Antipodean Currencies Rise Amid Risk Appetite

06 Juin 2024 - 6:57AM

RTTF2

The antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major counterparts in

the Asian session on Thursday amid risk appetite, following the

broadly positive cues from global markets overnight, amid optimism

about the outlook for U.S. interest rates after a report showed

U.S. private sector job growth slowed by more than expected in the

month of May. Treasury yields also extended the recent downward

trend.

Gains across most sectors led by gold miners and technology

stocks, also led to the upturn of the investor sentiment.

Crude oil prices bounced higher from four-month lows after OPEC

decided not to extend production cuts. West Texas Intermediate for

July delivery was up $1.04 or 1.42 percent to $74.29 per

barrel.

In the Asian trading today, the Australian dollar rose to a

14-month high of 0.9135 against the Canadian dollar, from

yesterday's closing value of 0.9103. The aussie may test resistance

near the 0.92 region.

Against the U.S. dollar and the euro, the aussie advanced to

2-day highs of 0.6683 and 1.6298 from Wednesday's closing quotes of

0.6647 and 1.6350, respectively. The aussie may test resistance

near 0.67 against the greenback and 1.62 against the euro.

The aussie edged up to 103.98 against the yen, from yesterday's

closing value of 103.77. On the upside, 105.00 is seen as the next

resistance level for the aussie.

The NZ dollar rose to nearly a 3-month high of 0.6215 against

the U.S. dollar, from yesterday's closing value of 0.6193. The next

resistance level for the kiwi is seen around the 0.63 region.

The kiwi edged up to 96.74 against the yen, from Wednesday's

closing value of 96.63. On the upside, 99.00 is seen as the next

resistance level for the kiwi.

Against the euro and the Australian dollar, the kiwi advanced to

nearly a 3-1/2-month high of 1.7525 and nearly a 2-1/2-month high

of 1.0734 from yesterday's closing quotes of 1.7525 and 1.0734,

respectively. If the kiwi extends its downtrend, it is likely to

find resistance around 1.73 against the euro and 1.06 against the

aussie.

Looking ahead, Eurozone retail sales data for April is due to be

released at 5:00 am ET in the European session.

At 8:15 am ET, the European Central Bank will announce its

monetary policy decision. The bank is widely expected to cut its

key interest rates, ending the rate hiking cycle that began in

mid-2022.

At the governing council meeting in Frankfurt, policymakers are

set to lower the main refinancing rate, the deposit facility rate

and the lending rate by 25 basis points each.

Following the meeting, ECB Chief Christine Lagarde holds press

conference at 8:45 am ET.

In the New York session, U.S. and Canada trade data for April,

U.S. weekly jobless claims data and Canada Ivey PMI for May are

slated for release.

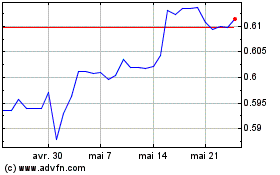

NZD vs US Dollar (FX:NZDUSD)

Graphique Historique de la Devise

De Mai 2024 à Juin 2024

NZD vs US Dollar (FX:NZDUSD)

Graphique Historique de la Devise

De Juin 2023 à Juin 2024