Canadian Dollar Advances Ahead Of Fed Decision

29 Juillet 2024 - 3:11PM

RTTF2

The Canadian dollar climbed against its most major counterparts

in the New York session on Monday, as investors awaited the U.S.

Federal Reserve's interest rate decision later this week for more

clues on the monetary policy outlook.

The Fed is widely expected to keep interest rates unchanged but

is likely to signal a rate reduction in September.

Monetary policy decisions in Japan and the U.K. are also due

this week.

The U.S. jobs report for July, closely watched surveys on U.S.

and global manufacturing, Eurozone gross domestic product and

inflation data, and Chinese factory activity data may influence

trading sentiment as the week progresses.

The Organization of Petroleum Exporting Countries and its

allies, known as OPEC+, plans to hold a virtual meeting on

Thursday, and it is uncertain whether there will be any changes in

production.

In its last meeting held in June, the oil cartel had decided to

extend its voluntary production cuts till 2025.

The loonie recovered to 0.9044 against the aussie and 111.38

against the yen, from an early low of 0.9076 and a 4-day low of

110.71, respectively. The currency is likely to locate resistance

around 0.86 against the aussie and 118.00 against the yen.

The loonie touched 1.4961 against the euro, setting a 4-day

high. Next key resistance for the currency is seen around the 1.46

level.

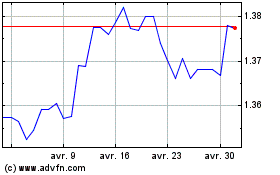

In contrast, the loonie fell to near a 9-month low of 1.3865

against the greenback. The loonie is seen finding support around

the 1.41 level.

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024