Ceiba Investments Limited Statement re Update from the Chairman

07 Octobre 2024 - 8:00AM

RNS Regulatory News

RNS Number : 0676H

Ceiba Investments Limited

07 October 2024

CEIBA INVESTMENTS

LIMITED

(the

"Company")

(TICKER: CBA, ISIN:

GG00BFMDJH11)

Legal

Entity Identifier:

213800XGY151JV5B1E88

UPDATE FROM THE

CHAIRMAN

On 27 September 2024, the Company

published its 30 June 2024 unaudited interim financial statements

-

https://ceibainvest.com/wp-content/uploads/2024/09/20240630-CBA-ICFS.pdf

At the latest Board meeting of the

Company, the Board instructed Management to enter into discussions

with Bondholders regarding the possibility of restructuring the €25

million 10% Convertible Bonds 2026 to change the payment schedule

from a single €25 million bullet payment due on 31 March 2026 to

five equal annual instalments of €5 million, to be made starting in

2025. If no agreement can be reached with Bondholders regarding a

restructuring, the Board will consider prepaying €10 million under

the Convertible Bonds prior to 31 March 2026, and attracting €15

million in new finance to pay the remainder of the Convertible

Bonds on 31 March 2026.

Once Management and the Board gain

additional confidence in the Company's cash flows and financial

position, and payments to Bondholders can be made according to the

new schedule, the Board would be in a position to review whether

the possibility exists of using part of the free cash-flow of

the Company to make distributions to shareholders and buy back

Shares in the Company, actions which - given the discount at which

Shares are presently trading - are both considered

attractive.

As per the annual general meeting

held on 18 June 2024, the Company has the authority to buy back

Shares, provided that: (i) the maximum number of Shares that may be

purchased is 10 per cent. of the aggregate number of Shares in

issue at the date of the annual general meeting; (ii) the minimum

price which may be paid for a Share is £0.01; and (iii) the maximum

price which may be paid for a Share is the higher of: (a) an amount

equal to 105 per cent. of the average of the mid-market values of a

Share taken from the London Stock Exchange Daily Official List for

the five business days before the purchase is made; and (b) the

higher of the price of the last independent trade or the highest

current independent bid for Shares on the London Stock Exchange at

the time the purchase is carried out.

John A. Herring

Chairman

For

further information, please contact:

|

Sebastiaan Berger

|

Via NSM Funds Limited

|

|

Singer Capital Markets

James Maxwell / Finn Gordon

(Corporate Finance)

James Waterlow (Sales)

|

Tel: +44 (0)20 7496 3000

|

|

NSM

Funds Limited

|

Tel: +44(0)1481 743030

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

STRDZMGGVDGGDZM

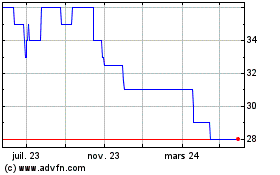

Ceiba Investments (LSE:CBA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

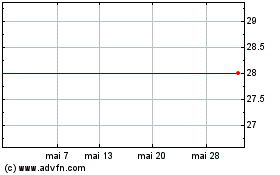

Ceiba Investments (LSE:CBA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025