- Buyout price 40% lower than under the 2022 agreement

- Transaction amount: €18.5m financed by borrowing

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241111446872/en/

Claranova: Simplified organization chart

of the PlanetArt division before and after the SCEP acquisition -

November 8, 2024 (Graphic: Business Wire)

Claranova (Euronext Paris: FR0013426004 - CLA) announces the

acquisition of Société Commune Européenne de Participation (SCEP)

by its subsidiary PlanetArt Holdings Inc., thereby enabling it to

own 100%1 of PlanetArt LLC.

This operation is in line with the new “One Claranova” strategy

for Claranova's which aims to make Claranova a more integrated

group, focused on operational excellence and profitability. With

this acquisition, the Group will hold 100%1 of its two strategic

divisions, Avanquest and PlanetArt, favoring synergies and

improving Claranova's profitability.

Buyout price per share 40% lower than the 2022

agreement2

In January 2022, Claranova signed an agreement for the phased

buyout of up to 65% of SCEP's stake in PlanetArt LLC at a price of

US$85,000 per preferred share. This agreement also gave SCEP a

right to require PlanetArt to be sold as from December 31, 2024,

which would have been contrary to the Group's strategic

orientations.

To this day, Claranova has already acquired 39% of SCEP's stake,

which now holds only 4.68%1 of PlanetArt's capital. This residual

stake represents 393 preferred shares.

The SCEP buyout enables Claranova to acquire these preferred

equity shares3, for a total amount of €18.5m, i.e. a price per

preferred share of €47,000 (i.e. US$51,000), representing a 40%

decrease compared with the agreement signed in January 2022.

Mr. Xavier Rojo will be appointed administrator of SCEP and Ms.

Beth Burkhart will represent SCEP on the PlanetArt LLC Board of

Directors. These appointments will help ensure a shared vision and

the successful implementation of the "One Claranova" strategy.

Upon completion of this buyout, the only dilutive elements

remaining at the level of these key subsidiaries4 will be the

conversion option held by PlanetArt's1 managers, Mr. Roger Bloxberg

and Mr. Todd Helfstein, exercisable in the event of the

subsidiary's sale or IPO, and the shares/stock options held by Mr.

Eric Gareau in the Avanquest5 subsidiary, which should be

transferred to Claranova in order to align his interests with those

of the Group6.

Mr. Eric Gareau, CEO of Claranova, commented: “This operation

marks a new step in the implementation of our new strategic plan,

‘One Claranova’. We will now hold the entirety of our strategic

activities, facilitating the alignment of our expertise and the

implementation of even more effective and innovative solutions for

our customers. I'm delighted that we can turn the page on these

past agreements and look to the future with a new perspective. I

would like to thank Cheyne Capital for its renewed support, which

demonstrates its confidence in Claranova's potential. By pursuing

our 'One Claranova' vision for a more integrated group that

generates operational synergies, we will create sustainable value

for all our stakeholders.”

Terms and conditions for the buyback

The €18.5m will be paid in three instalments:

- Initial payment on November 08, 2024, for €13.9m.

- 2nd instalment on December 15, 2025, for €2.3m.

- 3rd instalment on July 3, 2026, for €2.3m.

If PlanetArt is sold before June 30, 2026, at a value exceeding

US$275m, Claranova undertakes to pay contingent consideration

(earnout) of €2.3m.

New €20m loan from Cheyne Capital

The transaction is being financed by a €20m loan obtained by

Claranova Development SARL from Cheyne Capital on the same terms

(interest rates, guarantees, acceleration clauses, covenants) as

the €108m loan arranged in April 2024 when the Group refinanced

it’s debt7, and over the residual term of the latter, i.e. with

bullet repayment on April 4, 2028. A pledge of PlanetArt LLC shares

held by SCEP has also been granted.

This financing will be provided in two installments, €15m

payable on the day of the transaction, i.e. November 8, 2024, and

€5m within 30 days.

Pursuit of the “One Claranova” strategy

Strengthened by this agreement, the Group will pursue its new

“One Claranova” roadmap and confirms its objectives of achieving

total revenue of between €575m and €625m by 20278, with an EBITDA

margin9 of between 13% and 15%, and a ratio of net financial debt

to EBITDA of less than 1x.

Financial calendar: November 13, 2024:

Q1 2024-2025 revenue December 04, 2024: Annual General Meeting

About Claranova:

Claranova is a global leader in e-commerce for personalized

objects (photo prints, photo books, children's books, etc.),

software publishing (PDF, Photo and Security) and the Internet of

Things (IoT). As a truly international group, in 2024 it reported

revenue of nearly a half a billion euros, with 95% of this amount

originating from outside France.

Through its products and solutions sold in over 160 countries,

the Group's mission is to "Transform technological innovation into

user-centric solutions". By leveraging its digital marketing

expertise, AI and data from over 100 million active customers

worldwide, Claranova develops technological solutions, available

online, on mobile devices and tablets, for a wide range of private

and professional customers.

Operating in high-potential markets, the Group will pursue a

growth strategy focused on profitability and operational

excellence, in line with its "One Claranova" strategic roadmap.

Claranova is eligible for French “PEA-PME” tax-advantaged

savings accounts For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

APPENDIX

Simplified organization chart of the

PlanetArt division before and after the SCEP acquisition

November 8, 2024

(see illustration)

______________________________ 1 Ownership

interest (%) excluding dilutive effects: the executive officers of

PlanetArt LLC, Roger Bloxberg and Todd Helfstein, hold shares in

the capital of this company with financial and voting rights, as

well as a conversion option (FY 2023-2024 URD - Chapter 2 - Note

33). 2 Press release of January 5, 2022 3 Preferential value of 2.1

times the par value, plus a stake in the Company's capital

equivalent to their share as a percentage in the Company's capital

(FY 2023-2024 URD - Chapter 2 - Note 3) 4 PlanetArt and Avanquest 5

FY 2023-2024 URD – Chapter 2 – Note 25.2 6 Resolution 21 to be

submitted to the vote of the Annual General Meeting of December 4,

2024 7 The terms of the loan are described in detail in the press

release of April 2, 2024, and the FY 2023-204 URD - Chapter 2 -

Note 27. 8 FY 2026-2027 9 EBITDA as a percentage of sales. EBITDA

(earnings before interest, taxes, depreciation and amortization) is

a non-GAAP aggregate used to measure the operating performance of

the businesses. It equals Recurring Operating Income before the

impact of IFRS 2 (share-based payment expenses), depreciation and

amortization, and the IFRS 16 impact on the recognition of

leases.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111446872/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

contact@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 68

ir@claranova.com

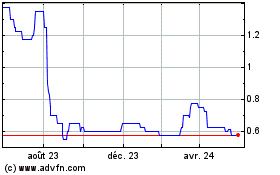

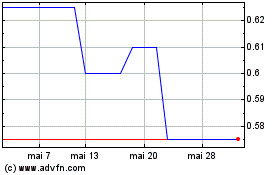

Celsius Resources (LSE:CLA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Celsius Resources (LSE:CLA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024