CML Microsystems PLC - Final Results

14 Juin 2000 - 9:00AM

UK Regulatory

RNS Number:2070M

CML Microsystems PLC

14 June 2000

CML Microsystems Plc

Preliminary Results for the

Year ended 31st March 2000

CML Microsystems Plc, the group which designs, manufactures

and markets a range of semiconductors for use in the

communications industry, announces Preliminary results for

the year ended 31 March 2000.

* Turnover from continuing Businesses up 28%

* Pre-tax profits from continuing Businesses up 80%

* EPS up 115%

* Dividend up 21%

* Net cash reserves at year end increased to #6.85m

* George Gurry, Chairman, said "The opening months of the

current year are proving encouraging for the Group.

Trading indications point to a sustained market requirement

for the Group's products in the foreseeable near term, and

access to new opportunities are expected to result from the

Group's active focus on developing its position in the

markets that it can serve.

* "I feel that your Company is well placed to address its

future with confidence. Subject, as always, to unforeseen

circumstances, I believe that this current year will be

marked by a further increase in its results."

For further information:

Nigel Clark Lulu Bridges / Peter Willetts

CML Microsystems Plc Tavistock Communications

Tel: 01621 875 500 Tel: 020 7600 2288

Chairman's Statement

The gains posted in the first half by the Group's semiconductor

product businesses' saw further improvement in the second half,

and the overall Group results for the full year have moved ahead

in a satisfactory and encouraging manner.

For your consideration of these results, I believe it may be

helpful to have context for the events that took place during

the early half. The Profit and Loss account states a division

between discontinued and continuing activities on only the full

year basis.

As I reported at the interim stage, your Company has disposed

recently of its interests in the Group's traffic business, which

has contributed approximately #6.7m to the Group's turnover in

the previous year, but only some #2m towards these present

results by the time of disposal. As a result of the operating

loss incurred by the traffic business, and the exceptional cost

arising on its disposal, the Group recorded only a nominal pre-

tax profit at the half-year (#61k).

For the full 12-month trading period ending 31 March 2000, the

Group recorded a 92% rise in operating profit to #1.906m (1999

#0.989m), and a 60% increase in pre-tax profit to #2.135m (1999

#1.328m).

Group turnover amounted to #19.751m, some 4% down on the figure

for the year earlier (1999 #20.617m), influenced by the material

reduction in traffic sales. The Group's core continuing

business achieved sales growth of 28% in the period.

Interest earnings again formed a reduced element in arriving at

the pre-tax figure, but cash available for investment showed

improvement through the later months. The Group's net cash

reserves had risen to #6.85m by the year-end (1999 #4.42m).

Basic earnings per share shows a twofold increase to 10.73p

(1999 4.96p) and retained earnings have returned to a positive

figure. Following from the Group's investment in its UK

scientific facilities it is seeing the benefit of more

favourable UK taxation.

Your Directors believe that these results represent a

satisfactory outcome to the year for your Company, and they

consider that it would be appropriate to recommend the payment

of an increased dividend. They are recommending the payment of

a dividend of 8.5p per ordinary share, an increase of 21.4% on

the year earlier (1999 7p share). Subject to shareholder

approval, this dividend will be payable to all shareholders on

the register as on the 7th July 2000.

The Group's semiconductor businesses' were successful in

achieving increased sales for their products in the major market

territories. In addition to the gains recorded in

Western Europe and the Far East, an encouraging rate of growth

was evident for sales into the North American marketplace. Over

90% of turnover for the Group's semiconductor companies came

from customers outside the United Kingdom.

Sales of product for Telecoms applications continued their rise,

and displaced Private Mobile Radio (PMR) as the principal

semiconductor product area by turnover. The Group's low-power

wire-line embedded modems, signalling and interface devices

proved popular with telecom equipment producers, and the

prospects are encouraging for the emerging new ISDN products.

A further slight fall was registered in sales of devices aimed

at the world PMR markets. This area had yet to show material

benefit from the Group's new digital system products, or the

targeted benefit expected from "consumer" versions of 2-way

radios now in the market.

A healthy increase in sales was recorded of products for

handheld wireless data terminals, where the Group's wireless

base-band engines are gaining best solution market status. The

Group is actively joined with the development plans of the

Network operators and terminal producers for a number of digital

wireless services in operation in the Far East and elsewhere.

Radio Data Technology, the Group business producing wireless

telemetry and wireless video end-user products, saw selling

prices come under pressure in its principal UK/Europe

marketplace, and an increase in products sold did not materially

lift the turnover. Changes taking place to EU regulatory

procedures are expected to increasingly benefit RDT's access to

the markets in Europe for its new UHF products.

The Group spent approximately #1.6m on R&D in the period, which

saw new design projects progressing on several market

development fronts.

The new semiconductor facility constructed in the UK was fully

occupied and operational in the third quarter, which contributed

materially to the Group's ability to ship a record number of

products to its customers worldwide. Good progress was evident

with the Group's planned enhancement of its selling,

distribution and customer support systems.

The opening months of the current year are proving encouraging

for the Group. Trading indications point to a sustained market

requirement for the Group's products in the foreseeable near

term, and access to new opportunities are expected to result

from the Group's active focus on developing its position in the

markets that it can serve.

Your directors were pleased to welcome the appointment of Mr

Christopher Gurry to the Board as the current year commenced.

Chris Gurry will assist your Board with its objective of

developing the opportunities before the business.

I feel that your Company is well placed to address its future

with confidence. Subject, as always, to unforeseen

circumstances, I believe that this current year will be marked

by a further increase in its results.

The progress of a business will always be dependant on the

quality and dedication of the people it employs. Your directors

wish to record their thanks for the performance and commitment

that the Group receives from its employees worldwide.

G. W. Gurry

Group Profit and Loss Account

Discontinued Continued Unaudited Audited

2000 1999

#'000 #'000 #'000 #'000

Turnover 1,992 17,759 19,751 20,617

-------- -------- -------- --------

Operating Profit/(Loss) (689) 3,151 2,462 990

Exceptional item (556) - (556) -

-------- -------- -------- --------

(1,245) 3,151 1,906 990

Interest receivable - 247 247 381

Interest payable (18) - (18) (42)

-------- -------- -------- --------

Profit/(loss) on

ordinary activities

before taxation (1,263) 3,398 2,135 1,329

-------- --------

Taxation (617) (557)

-------- --------

Profit on ordinary

activities after taxation 1,518 772

Minority interests (14) 1

-------- --------

Profit for the financial year 1,504 773

Proposed dividend (1,217) (974)

-------- --------

Retained profit/(loss)

for the year 287 (201)

-------- --------

Earnings per Share

Basic 10.73p 4.96p

-------- --------

Diluted 10.71p 4.94p

-------- --------

Summary Group Balance Sheet

Unaudited Audited

2000 1999

#'000 #'000 #'000 #'000

Fixed Assets

Tangible assets 9,817 9,992

Current Assets

Stocks 1,681 2,250

Debtors 3,014 5,219

Investments 3,893 2,114

Cash at bank and in hand 2,958 2,309

-------- --------

11,546 11,892

Creditors:

Amounts falling due

within one year (3,856) (5,146)

-------- --------

7,690 6,746

-------- --------

17,507 16,738

Provisions for

liabilities and charges (6) (74)

-------- --------

Net Assets 17,501 16,664

-------- --------

Capital and Reserves

Called up share capital 716 696

Share premium account 2,802 2,349

Capital redemption reserve 255 255

Profit and loss account 13,704 13,355

-------- --------

Shareholder's funds 17,477 16,655

-------- --------

Minority interests 24 9

-------- --------

17,501 16,664

-------- --------

Summary Group Cash Flow Statement

Unaudited Audited

2000 1999

#'000 #'000

Net cash inflow from operating activities 3,782 2,782

Returns on investments and servicing of finance 229 357

Taxation (564) (747)

Capital expenditure and financial investment (573) (3,542)

Equity dividends paid (974) (1,114)

-------- ---------

Net cash inflow/(outflow) before financing 1,900 (2,264)

Financing 473 (1,410)

-------- --------

Increase/(Decreased) in cash 2,373 (3,674)

-------- --------

Notes

1. The profit and loss account, balance sheet and cash flow

statement are an abridge version of the Company's full accounts

which have not yet been filed with the Registrar of Companies

and which have not yet been reported on by the Company's

auditors.

2. A dividend of 8.5p per Ordinary Share (1999: 7p per

Ordinary Share) is recommended in respect of the year ended 31st

March 2000 and will be paid on 4th August 2000 to shareholders

on the register as at 7th July 2000.

3. The effective tax rate is significantly reduced by a prior

year corporation tax credit of #318,000 as a result of a claim

for scientific research allowances on the new semiconductor

operating facility at Langford, Essex.

4. The calculation of earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is

based on the basic earnings per share adjusted to

allow for the issue of shares on the assumed

conversion of all dilutive options.

5. The exceptional item is the net loss on the

disposal of the Group's interest in Microsense

Systems Limited, which was completed on 26th August

1999.

END

FR SFMFWDSSSEEM

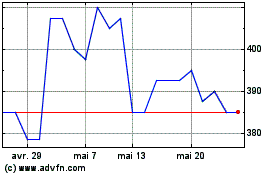

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024