TIDMCML

RNS Number : 4850S

CML Microsystems PLC

22 November 2011

CML Microsystems Plc

INTERIM RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductor products, primarily for the

global communication and data storage markets, announces Interim

Results for the six months ended 30 September 2011.

Financial Highlights:

-- Revenues up 9% to GBP12.29m (2010 H1: GBP11.21m)

-- Gross profit up 8% to GBP8.51m (2010 H1: GBP7.83m)

-- Profit before tax up 59% to GBP2.02m (2010 H1: GBP1.27m)

-- Basic EPS up 63% of 9.87p (2010 H1: 6.05p)

-- Net cash position of GBP4.37m (2010 H1: GBP553k) - with bank

borrowings reduced by GBP1.5m to GBP3m

Operational Highlights:

-- Strong revenue growth globally

-- Stable cost base and margins within targets

-- Solid cash flow, improved net cash position

-- Maintained investment levels for key new product development programs

Regarding Outlook, Chris Gurry, Managing Director of CML,

said:

"Trading performance through the first half year was encouraging

and reflected the Group's established multi-year strategy for

sustainable growth.

"Within our three major market areas of wireless, storage and

wireline telecom, we continue to see growth opportunities within

existing customer product portfolios in addition to general

expansion of the overall customer base.

"Following the period end, overall order book levels have

remained healthy although it is possible that the general economic

climate in some regions may affect customer buying patterns or

investment decisions. Despite this, the Board currently anticipates

positive trading conditions to prevail through what is

traditionally a slightly weaker second half."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Managing Director Tel: 01621 875 500

Nigel Clark, Financial

Director

Cenkos Securities plc

Jeremy Warner Allen (Sales) Tel: 020 7397 8900

Stephen Keys (Corporate

Finance)

Walbrook PR Ltd Tel: 020 7933 8780

Paul McManus Mob: 07980 541 893 or paul.mcmanus@walbrookpr.com

Helen Westaway Mob: 07841 917 679 or helen.westaway@walbrookpr.com

Chairman's Statement

I am pleased to report that your Company continued to improve

its performance through the opening six-month period of the present

trading year, with increased sales revenue, pre-tax profit and

earnings-per-share the outcome for that period.

Group sales rose to GBP12.29m (2010: GBP11.21m), with gains

posted for each of the principal product market areas, while a

gross profit of GBP8.51m (2010: GBP7.83m) reflects a materially

unchanged gross profit margin.

Profit before tax grew to GBP2.02m (2010: GBP1.27m), while

diluted EPS show an increase to 9.78p per share on the enlarged

share capital (2010: 5.99p).

The Company has continued with steps to re-balance its

debt/asset cash position, resulting in net cash of GBP4.37m (2010:

GBP553k) at the end of the period and a reduction in the

outstanding bank loan to GBP3m (2010: GBP4.5m).

In the period post 30 September the Company sold one of the USA

based properties held for sale for approximately $1m. The proceeds

will be subject to appropriate taxes.

The uncertainties and negative factors that presently affect

many business areas are not helpful to near-term growth, but I

nevertheless believe that subject to unforeseen circumstances, your

Company's results for the current full trading year will meet

present market expectations.

On behalf of your Directors I once again express our

appreciation and thanks to the Group's employees for their efforts

and commitment towards its success.

G W Gurry

Chairman

21 November 2011

Operating and Financial Review

Group revenues for the six months to 30 September 2011 rose to

GBP12.29m representing a 9% increase over the comparable half year

period (2010: GBP11.21m). Semiconductor shipments increased in each

of the three major geographical regions, with the Americas showing

the highest percentage growth, the Far East maintaining its

position as the single largest region and Europe contributing solid

growth.

Group products for use within wireless and storage applications

contributed approximately 83% of overall Group revenues whilst

products sold into wireline telecom markets accounted for close to

12%.

Within the target wireless markets, dominant end applications

continued to include voice and/or data transmission within two-way

radio products, control and data acquisition systems, regional

transport and infrastructure systems, and marine safety

systems.

Flash memory controller chips for use within removable and

embedded solid state storage media dominated revenues from the

storage sector. The Group benefited from the combined effects of

increased shipment volumes to established customers along with a

higher contribution from more recent customer design wins.

Group semiconductor products for telecom applications

experienced high single-digit percentage sales growth across a

range of end applications including point-of-payment terminals,

security alarm panels and medical monitoring devices.

Sales at the Group's equipment division, RDT, increased 17% to

GBP415k (2010: GBP354k) largely as a result of higher export sales

of telemetry and control products for transport applications. Entry

into the M2M market was initiated with the launch of a GPRS modem

and router for industrial users.

The gross margin was maintained at 69% delivering a reported

gross profit of GBP8.51m (2010: GBP7.83m). Distribution and

administration costs of GBP6.52m were very slightly down (2010:

6.64m) and this helped to deliver an operational profit (before

other income, share-based payments and finance costs) of GBP1.99m

against a comparable period figure of GBP1.19m.

Income from other operating activities, principally rental

proceeds from group owned industrial properties fell from GBP169k

to GBP89k due to a lower occupancy rate through the period.

Net finance costs amounted to GBP37k (2009: GBP68k) and a profit

before tax of GBP2.02m was recorded (2010: GBP1.27m).

A combination of improved revenue levels, static gross margin

and tight cost control resulted in positive cash flow of GBP2.04m

through the six months under review. At the period end the Group

had cash reserves of GBP7.38m and reduced bank borrowings of

GBP3.01m.

Summary and outlook

Trading performance through the first half year was encouraging

and reflected the Group's established multi-year strategy for

sustainable growth.

Within our three major market areas of wireless, storage and

wireline telecom, we continue to see growth opportunities within

existing customer product portfolios in addition to general

expansion of the overall customer base.

Important new engineering development activities and partnership

programs, some of which were announced in the prior financial year,

will be sampled through the remainder of the current trading year.

These products are expected to commence meaningful revenue

contributions starting next financial year.

Following the period end, overall order book levels have

remained healthy although it is possible that the general economic

climate in some regions may affect customer buying patterns or

investment decisions. Despite this, the Board currently anticipates

positive trading conditions to prevail through what is

traditionally a slightly weaker second half.

C A Gurry

Managing Director

21 November 2011

Condensed Consolidated Income Statement

Unaudited Unaudited Audited

six months six months Year end

end end

30/09/11 30/09/10 31/03/11

GBP'000 GBP'000 GBP'000

------------------------------------- ---------- ---------- --------

Continuing operations

Revenue 12,293 11,209 22,122

Cost of sales (3,785) (3,380) (6,754)

------------------------------------- ---------- ---------- --------

Gross profit 8,508 7,829 15,368

Distribution and administration

costs (6,521) (6,641) (12,729)

------------------------------------- ---------- ---------- --------

1,987 1,188 2,639

Other operating income 89 169 389

------------------------------------- ---------- ---------- --------

Profit before share-based payments 2,076 1,357 3,028

Share-based payments (24) (22) (43)

------------------------------------- ---------- ---------- --------

Profit after share-based payments 2,052 1,335 2,985

Revaluation of investment properties - - (400)

Finance costs (41) (74) (271)

Finance income 4 6 11

------------------------------------- ---------- ---------- --------

Profit before taxation 2,015 1,267 2,325

Income tax (expense)/credit (489) (363) 360

------------------------------------- ---------- ---------- --------

Profit for period attributable

to equity owners of the parent 1,526 904 2,685

------------------------------------- ---------- ---------- --------

Earnings per share

Basic 9.87p 6.05p 17.87p

------------------------------------- ---------- ---------- --------

Diluted 9.78p 5.99p 17.64p

------------------------------------- ---------- ---------- --------

Condensed Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

six months six months Year end

end end

30/09/11 30/09/10 31/03/10

GBP'000 GBP'000 GBP'000

------------------------------------ ---------- ---------- --------

Profit for the period 1,526 904 2,685

Other comprehensive income:

Foreign exchange differences 56 (11) (48)

Actuarial gain on retirement

benefit obligations - - 2,811

Income tax on actuarial loss - - (800)

------------------------------------ ---------- ---------- --------

Other comprehensive income for

the period net of tax 56 (11) 1,963

------------------------------------ ---------- ---------- --------

Total comprehensive income for

the period net of tax attributable

to equity owners of the business 1,582 893 4,648

------------------------------------ ---------- ---------- --------

Condensed Consolidated Statement of Financial Position

Unaudited Unaudited Audited

30/09/11 30/09/10 31/03/11

GBP'000 GBP'000 GBP'000

---------------------------------- --------- --------- --------

Assets

Non-current assets

Property, plant and equipment 5,165 5,266 5,231

Investment properties 3,450 3,850 3,450

Development costs 4,385 3,820 3,624

Goodwill 3,512 3,512 3,512

Deferred tax asset 2,608 2,920 2,534

---------------------------------- --------- --------- --------

19,120 19,368 18,351

---------------------------------- --------- --------- --------

Current assets

Inventories 1,686 1,689 1,666

Trade receivables and prepayments 1,104 2,833 1,513

Current tax assets - 5 5

Cash and cash equivalents 7,383 5,101 6,246

---------------------------------- --------- --------- --------

10,173 9,628 9,430

---------------------------------- --------- --------- --------

Non-current assets classified

as held for

sale - properties 430 426 420

---------------------------------- --------- --------- --------

Total assets 29,723 29,422 28,201

---------------------------------- --------- --------- --------

Liabilities

Current liabilities

Bank loans and overdrafts 3,014 4,548 3,919

Trade and other payables 3,375 3,799 2,525

Current tax liabilities 276 149 49

---------------------------------- --------- --------- --------

6,665 8,496 6,493

---------------------------------- --------- --------- --------

Non-current liabilities

Deferred tax liabilities 1,816 2,160 1,577

Retirement benefit obligation 2,607 5,728 2,607

---------------------------------- --------- --------- --------

4,423 7,888 4,184

---------------------------------- --------- --------- --------

Total liabilities 11,088 16,384 10,677

---------------------------------- --------- --------- --------

Net assets 18,635 13,038 17,524

---------------------------------- --------- --------- --------

Capital and reserves attributable

to equity owners of the parent

Share capital 788 747 785

Share premium 4,872 4,148 4,820

Share-based payments reserve 69 277 298

Foreign exchange reserve 382 363 326

Accumulated profits 12,524 7,503 11,295

---------------------------------- --------- --------- --------

Shareholders' equity 18,635 13,038 17,524

---------------------------------- --------- --------- --------

Condensed Consolidated Cash Flow Statement

Unaudited Unaudited Audited

six months six months Year end

end end

30/09/11 30/09/10 31/03/11

GBP'000 GBP'000 GBP'000

--------------------------------------- ---------- ---------- --------

Operating activities

Profit for the period before

income taxes 2,015 1,267 2,325

Adjustments for:

Depreciation 94 101 321

Amortisation of development costs 1,460 1,557 3,276

Revaluation of investment properties - - 400

Movement in pensions deficit - - (437)

Share-based payments 24 22 43

Interest expense 41 74 144

Interest income (4) (6) (11)

Decrease in working capital 1,239 1,049 926

--------------------------------------- ---------- ---------- --------

Cash flows from operating activities 4,869 4,064 6,987

Income tax (paid)/refunded (118) 43 (328)

--------------------------------------- ---------- ---------- --------

Net cash flows from operating

activities 4,751 4,107 6,659

--------------------------------------- ---------- ---------- --------

Investing activities

Purchase of property, plant and

equipment (33) (69) (253)

Investment in development costs (2,247) (1,253) (2,786)

Disposals of property, plant

and equipment 2 30 32

Interest income 4 6 11

--------------------------------------- ---------- ---------- --------

Net cash flows from investing

activities (2,274) (1,286) (2,996)

--------------------------------------- ---------- ---------- --------

Financing activities

Issue of ordinary shares 55 - 710

Decrease in bank loans and short-term

borrowings (905) (1,273) (2,049)

Dividend paid to Group shareholders (550) - -

Finance cost (41) (74) (144)

--------------------------------------- ---------- ---------- --------

Net cash flows from financing

activities (1,441) (1,347) (1,483)

---------- ---------- --------

Increase in cash and cash equivalents 1,036 1,474 2,180

--------------------------------------- ---------- ---------- --------

Movement in cash and cash equivalents:

At start of year 6,246 3,883 3,883

Increase in cash and cash equivalents 1,036 1,474 2,180

Effects of exchange rate changes 101 (256) 183

--------------------------------------- ---------- ---------- --------

At end of year 7,383 5,101 6,246

--------------------------------------- ---------- ---------- --------

Condensed Consolidated Statement of Changes in Equity

Foreign

Share premium Share-based exchange Accumulated

Share payments reserve profits Total

capital

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------------- ------------ --------- ------------ -------

At 1 April 2010 747 4,148 255 374 6,599 12,123

----------------------------- -------- -------------- ------------ --------- ------------ -------

Profit for period 904 904

Other comprehensive

income:

Foreign exchange differences (11) (11)

----------------------------- -------- -------------- ------------ --------- ------------ -------

Total comprehensive

income for the period - - - (11) 904 893

----------------------------- -------- -------------- ------------ --------- ------------ -------

Transactions with

owners in their capacity

as owners:

Share-based payments 22 22

----------------------------- -------- -------------- ------------ --------- ------------ -------

At 30 September 2010 747 4,148 277 363 7,503 13,038

----------------------------- -------- -------------- ------------ --------- ------------ -------

Profit for period 1,781 1,781

Other comprehensive

income:

Foreign exchange differences (37) (37)

Net actuarial profits

recognised directly

to equity 2,811 2,811

Deferred tax on actuarial

losses (800) (800)

----------------------------- -------- -------------- ------------ --------- ------------ -------

Total comprehensive

income for the period - - - (37) 3,792 3,755

----------------------------- -------- -------------- ------------ --------- ------------ -------

Transactions with

owners in their capacity

as owners:

Issue of ordinary

shares 38 672 710

Share-based payments 21 21

----------------------------- -------- -------------- ------------ --------- ------------ -------

At 31 March 2011 785 4,820 298 326 11,295 17,524

----------------------------- -------- -------------- ------------ --------- ------------ -------

Profit for period 1,526 1,526

Other comprehensive

income:

Foreign exchange differences 56 56

----------------------------- -------- -------------- ------------ --------- ------------ -------

Total comprehensive

income for the period - - - 56 1,526 1,582

----------------------------- -------- -------------- ------------ --------- ------------ -------

Transactions with

owners in their capacity

as owners:

Dividend paid (550) (550)

Issue of ordinary

shares 3 52 55

Share-based payments

transferred on cancellation (253) 253 -

Share-based payments 24 24

----------------------------- -------- -------------- ------------ --------- ------------ -------

At 30 September 2011 788 4,872 69 382 12,524 18,635

----------------------------- -------- -------------- ------------ --------- ------------ -------

Notes to the Condensed Financial Statements

1. Segmental analysis

Business segments

Unaudited Unaudited Audited

six months end six months end Year End

30/09/11 30/09/10 31/03/11

Semi-conductor Semi-conductor Semi-conductor

Equipment components Group Equipment components Group Equipment components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

By origination 415 21,444 21,859 354 18,141 18,495 769 34,998 35,767

Inter-segmental

revenue - (9,566) (9,566) - (7,286) (7,286) - (13,645) (13,645)

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Segmental revenue 415 11,878 12,293 354 10,855 11,209 769 21,353 22,122

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Profit/(loss)

Segmental result 4 2,048 2,052 (12) 1,347 1,335 7 2,978 2,985

------------------ --------- -------------- --------- -------------- --------- --------------

Revaluation of

investment

properties - - (400)

Net financial

income (37) (68) (260)

Income tax (489) (363) 360

------- ------- --------

Profit after

taxation 1,526 904 2,685

------- ------- --------

Assets and

liabilities

Segmental assets 22,629 606 23,235 626 21,595 22,221 687 21,105 21,792

------------------ --------- -------------- --------- -------------- --------- --------------

Unallocated

corporate

assets

Investment

property

(Including held

for sale) 3,880 4,276 3,870

Deferred taxation 2,608 2,920 2,534

Current tax

receivable - 5 5

------- ------- --------

Consolidated

total assets 29,723 29,422 28,201

------- ------- --------

Segmental

liabilities 3,284 91 3,375 39 3,760 3,799 113 2,412 2,525

------------------ --------- -------------- --------- -------------- --------- --------------

Unallocated

corporate

assets

Deferred taxation 1,816 2,160 1,577

Current tax

liability 276 149 49

Bank loans and

overdrafts 3,014 4,548 3,919

Retirement benefit

obligation 2,607 5,728 2,607

------- ------- --------

Consolidated

total liabilities 11,088 16,384 10,677

------- ------- --------

Other segmental

information

Property, plant

and equipment

additions 32 1 33 - 69 69 - 253 253

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Development cost

additions 2,206 41 2,247 33 1,220 1,253 71 2,715 2,786

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Depreciation 90 4 94 4 97 101 8 313 321

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Amortisation 1,427 33 1,460 32 1,525 1,557 72 3,204 3,276

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Other significant

non-cash

(income)/expenses - - - - - - - (37) (37)

------------------ --------- -------------- ------- --------- -------------- ------- --------- -------------- --------

Geographical segments

UK Germany Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------------------ ------- -------- -------- --------

Unaudited

6 month ended 30 September

2011

Revenue by origination 7,182 6,275 2,887 5,515 21,859

Inter-segmental revenue (4,244) (5,295) - (27) (9,566)

-------------------------------- ------------------ ------- -------- -------- --------

Revenue to third parties 2,938 980 2,887 5,488 12,293

-------------------------------- ------------------ ------- -------- -------- --------

Property, plant and equipment 5,062 67 16 20 5,165

-------------------------------- ------------------ ------- -------- -------- --------

Investment properties including

held for sale 3,450 - 430 - 3,880

-------------------------------- ------------------ ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

-------------------------------- ------------------ ------- -------- -------- --------

Development cost 2,321 2,064 - - 4,385

-------------------------------- ------------------ ------- -------- -------- --------

Total assets 21,495 4,920 1,770 1,538 29,723

-------------------------------- ------------------ ------- -------- -------- --------

Unaudited

6 month ended 30 September

2010

Revenue by origination 6,878 4,514 2,657 4,446 18,495

Inter-segmental revenue (3,271) (4,014) - (1) (7,286)

-------------------------------- ------------------ ------- -------- -------- --------

Revenue to third parties 3,607 500 2,657 4,445 11,209

-------------------------------- ------------------ ------- -------- -------- --------

Property, plant and equipment 5,103 84 52 27 5,266

-------------------------------- ------------------ ------- -------- -------- --------

Investment properties including

held for sale 3,850 - 426 - 4,276

-------------------------------- ------------------ ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

-------------------------------- ------------------ ------- -------- -------- --------

Development cost 2,390 1,430 - - 3,820

-------------------------------- ------------------ ------- -------- -------- --------

Total assets 20,764 4,950 1,835 1,873 29,422

-------------------------------- ------------------ ------- -------- -------- --------

Audited

Year ended 31 March 2011

Revenue by origination 13,089 8,481 5,089 9,108 35,767

Inter-segmental revenue (6,263) (7,374) - (8) (13,645)

-------------------------------- ------------------ ------- -------- -------- --------

Revenue to third parties 6,826 1,107 5,089 9,100 22,122

-------------------------------- ------------------ ------- -------- -------- --------

Property, plant and equipment 5,110 81 21 19 5,231

-------------------------------- ------------------ ------- -------- -------- --------

Investment properties including

held for sale 3,450 - 420 - 3,870

-------------------------------- ------------------ ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

-------------------------------- ------------------ ------- -------- -------- --------

Development cost 2,029 1,595 - - 3,624

-------------------------------- ------------------ ------- -------- -------- --------

Total assets 21,027 4,364 1,573 1,237 28,201

-------------------------------- ------------------ ------- -------- -------- --------

Reported segments and their results in accordance with IFRS 8,

is based on internal management reporting information that is

regularly reviewed by the chief operating decision maker. The

measurement policies the Group uses for segmental reporting under

IFRS 8 are the same as those used in its financial statements.

2. Dividend paid and proposed

A dividend of 3.5p per 5p ordinary share in respect of the year

end 31 March 2011 was paid on 5 August 2011 (2010: GBPNil per

ordinary share of 5p in respect of the year ended 31 March 2010).

No dividend is proposed in respect of the six months period ended

30 September 2011(2010: GBPNil per ordinary share of 5p in respect

of the period end 30 September 2010).

3. Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary and

have provided on that basis.

Unaudited Unaudited Audited

six months six months Year end

end end

30/09/11 30/09/10 31/03/11

GBP'000 GBP'000 GBP'000

------------------------------------ ---------- ---------- --------

UK income tax charge 170 83 294

Overseas income tax charge 175 140 186

------------------------------------ ---------- ---------- --------

Total current tax charge 345 223 480

Deferred tax charge/(credit) 144 140 (840)

------------------------------------ ---------- ---------- --------

Reported income tax charge/(credit) 489 363 (360)

------------------------------------ ---------- ---------- --------

4. Earnings per share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

Ordinary 5p shares

Weighted average Diluted

number number

---------------------------- ------------------------------ ------------------

Six months end 30 September

2011 15,467,789 15,600,977

---------------------------- ------------------------------ ------------------

Six months end 30 September

2010 14,947,626 15,091,370

---------------------------- ------------------------------ ------------------

Year end 31 March 2011 15,023,279 15,217,456

---------------------------- ------------------------------ ------------------

5. Investment properties

Investment properties are revalued at each discrete period end

by the Directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At 31 March 2009 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis.

6. Analysis of cash flow movement in net debt

Net debt 6m end Net cash 6m end Net cash 6m end Net cash

at at at at

01/04/10 30/09/10 30/09/10 31/03/11 31/03/11 30/09/11 30/09/11

Cash flow Cash flow Cash flow

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- --------- -------- --------- -------- --------- --------

Cash and cash equivalents 3,883 1,218 5,101 1,145 6,246 1,137 7,383

Bank loans and overdrafts (5,968) 1,420 (4,548) 629 (3,919) 905 (3,014)

-------------------------- -------- --------- -------- --------- -------- --------- --------

(2,085) 2,638 553 1,774 2,327 2,042 4,369

-------------------------- -------- --------- -------- --------- -------- --------- --------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

7. Retirement benefit obligations

The directors have not obtained an actuarial report in respect

of the defined benefit pension scheme for the purpose of this Half

Yearly Report.

8. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency would have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly-competitive

global market, which is undergoing continual and geographical

change. The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

9. Directors' statement pursuant to the Disclosure and Transparency Rules

The Directors confirm that, to the best of their knowledge:

a. the condensed financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position and profit of the Company

and the undertakings included in the consolidation taken as a

whole; and

b. the condensed set of financial statements have been prepared

in accordance with IAS 34 "Interim Financial Reporting"; and

c. the Chairman's statement and operating and financial review

includes a fair review of the development and performance of the

business and the position of the company and the undertakings

included in the consolidation taken as a whole together with a

description of the principal risks and uncertainties that they

face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

10. Basis of preparation

The basis of preparation and accounting policies used in

preparation of the Half Yearly Financial Report are the same

accounting policies set out in the year ended 31 March 2011

financial statements.

11. General

Other than already stated within the Chairman's statement and

the operating and financial review there have been no important

events during the first six months of the financial year that have

impacted this Half Yearly Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 8 above.

In the segmental analysis (note 1) inter-segmental transfers or

transactions are entered into under commercial terms and conditions

appropriate to the location of the entity whilst considering that

the parties are related.

This interim management report includes a fair review of the

information required by DTR 4.2.7 (indication of important events

and their impact, and description of principal risks and

uncertainties for the remaining six months of the financial

year).

This Half Yearly Report does not include all the information and

disclosures required in the Annual Report, and should be read in

conjunction with the consolidated Annual Report for the year ended

31 March 2011.

The financial information contained in this Half Yearly Report

has been prepared using International Financial Reporting Standards

as adopted by the European Union. This Half Yearly Report does not

constitute statutory accounts as defined by Section 434 of the

Companies Act 2006. The financial information for the year ended 31

March 2011 is based on the statutory accounts for the financial

year ended 31 March 2011 that have been filed with the Registrar of

Companies and on which the auditors gave an unqualified audit

opinion. The auditors' report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Report has not been audited or reviewed by the

Group Auditors.

A copy of this Half Yearly Report can be viewed on the company

website www.cmlmicroplc.com.

12. Approval

The Directors approved this Half Yearly Report on 21 November

2011.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGGBGGUPGGQG

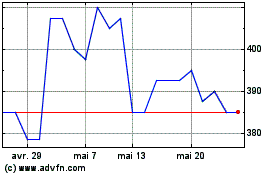

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024