CML Microsystems PLC - Interim Results

25 Novembre 1997 - 8:33AM

UK Regulatory

RNS No 8427h

CML MICROSYSTEMS PLC

25th November 1997

CML Microsystems Plc

Interim Results

for the six months ended

30th September 1997

Chairman's Statement

The results for the six months ending 30th September 1997 show

an improvement on the interim figures for last year.

Group turnover increased by 11% to #9.379M (1996 #8.392M) and

pre-tax profits were more than doubled at #0.319M (1996

#0.117M). An operating profit of #0.102M compares with the

operating loss posted for the earlier period.

Earnings per share show a 45% rise to 1.96p (1996 1.35p) on a

virtually unchanged number of shares. A reduction in net cash

reserves at the interim stage reflects principally cash flow

timing.

The Group's semiconductor businesses turned in improved

results on the back of steady gains in product sales.

Expenditure in support of product marketing and new products

development reached expected higher levels during the period.

The Traffic business began to see benefits anticipated by the

re-organisation of its operations. The equipment markets

remained very difficult and a delay was encountered in the

contribution by systems contracts, but the operating loss,

usual for this business in the first half, was broadly in-line

with projections for the period.

Overall, the interim results are very much in accordance with

my expectations when I indicated the outlook for the current

year in my year end Statement.

I am encouraged by the positive progress your Company is

making towards its future growth, and I remain optimistic that

the results for the present year will post a further advance.

G. W. Gurry

Chairman

For further information:

Nigel Clark Lulu Bridges/Peter Willetts

CML Microsystems Plc Tavistock Communications

Tel: 01376 513833 Tel: 0171 600 2288

Group Profit and Loss Account

Unaudited Unaudited Audited

6 Months End 6 Months End 12 Months End

30/09/97 30/09/96 31/03/97

#'000 #'000 #'000

Turnover 9,379 8,392 18,233

===== ===== =====

Operating Profit/(Loss) 102 (79) 1,535

Interest Receivable 236 202 421

Interest Payable (19) (6) (22)

----- ----- -----

Profit on Ordinary Activities

Before Taxation 319 117 1,934

Taxation (112) (41) (679)

----- ----- -----

207 76 1,255

Minority Interest 105 138 81

----- ----- -----

Profit attributable to

Shareholders 312 214 1,336

===== ===== =====

Earnings per share 1.96p 1.35p 8.40p

===== ===== =====

Summary Group Balance Sheet

6 Months End 6 Months End 12 Months End

30/09/97 30/09/96 31/03/97

#'000 #'000 #'000

Fixed Assets

Tangible Assets 7,273 7,245 6,967

----- ----- -----

7,273 7,245 6,967

----- ----- -----

Current Assets

Stocks 2,747 2,365 2,346

Debtors 4,120 3,631 4,711

Investments 7,503 5,237 5,963

Cash at Bank & in hand 49 2,806 2,069

----- ----- -----

14,419 14,039 15,089

Creditors: Amounts falling due

within one year 3,746 3,626 4,381

----- ----- -----

Net Current Assets 10,673 10,413 10,708

----- ----- -----

Deferred Taxation 13 12 13

----- ----- -----

17,933 17,646 17,662

===== ===== =====

Capital & Reserves

Called up Share Capital 796 796 796

Share Premium Account 2,349 2,347 2,347

Capital Redemption Reserve 155 155 155

Profit & Loss Account 14,633 14,300 14,259

----- ----- -----

17,933 17,598 17,557

Minority Interests 0 48 105

----- ----- -----

17,933 17,646 17,662

===== ===== =====

Summary Group Cash Flow Statement

Unaudited Unaudited Audited

6 Months End 6 Months End 12 Months End

30/09/97 30/09/96 31/03/97

#'000 #'000 #'000

Net cash in flow from

operating activities 656 817 1,494

Returns on investments

and servicing of finance 250 204 400

Taxation 136 770 169

Capital expenditure and

financial investment (602) (692) (752)

Equity dividends paid (971) (971) (971)

----- ----- -----

Net cash (out)/in flow

before financing (531) 128 340

Financing 2 0 0

----- ----- -----

(Decrease)/Increase in

cash (529) 128 340

===== ===== =====

Notes

Comparative Results

The actual results for the year to 31st March 1997 as shown in

this statement, are an abridged version of the company's 1997

accounts which have been filed with the Registrar of

Companies. The report of the auditors on the 1997 accounts

was unqualified. Results for the six months ending 30/09/96

are the unaudited figures published in the Interim Statement

dated 20th November 1996.

Taxation

The Directors consider that tax will be payable at varying

rates according to the country of incorporation of a

subsidiary and have provided on that basis.

Earnings Per Share

The calculation of earnings per share is based on the profit

attributable to shareholders for the period, and on a weighted

average of 15,917,831 shares (1996 - 15,917,338 shares).

The calculation of earnings per share for the year ended 31st

March 1997 was based on 15,917,338 shares.

This statement will be sent to shareholders and will be

available from the Company's registered office: Wheaton Road,

Industrial Estate East, Witham, Essex CM8 3TD.

This statement will also be available via CML Microsystem's

Worldwide Web Home Page - http://www.cmlmicro.com.

END

IR DZFFLDFKZFKF

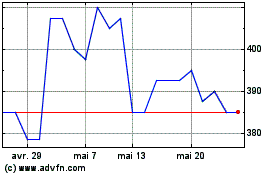

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024