TIDMCML

RNS Number : 2788R

CML Microsystems PLC

05 July 2022

05 July 2022

CML Microsystems Plc

("CML", the "Company" or the "Group")

Full Year Results

CML Microsystems plc (AIM: CML), which develops mixed-signal, RF

and microwave semiconductors for global communications markets ,

announces its Full Year Results for the year ended 31 March

2022.

Financial Highlights

-- Revenue increase to GBP16.96m (2021: GBP13.10m) with growth

driven by a recovery in the voice-centric markets

-- Gross profit of GBP12.80m (2021: GBP9.46m) with a slightly

improved margin due to product mix delivered

-- Net cash of GBP25.04m (2021: GBP31.9m) after a GBP9.0m dividend to shareholders

-- Profit before tax of GBP1.74m (2021: GBP0.01m) after

accounting for share-based payments and net finance income

-- Recommended final dividend of 5p per ordinary 5p share

Operational Highlights

-- Recovery from existing markets

-- Expanded product range - increasing addressable market

-- Strong investment in research and development

-- Completed move from Main Market to AIM

Chris Gurry, Group Managing Director of CML Microsystems

commented on the results :

"This has been an encouraging year of growth for the business.

The strength and resilience of CML has been shown in the fact that

despite having to navigate a number of sector-wide headwinds, the

Company has delivered sustained levels of growth with key financial

metrics increasing year-on-year.

Operationally, the Group is well positioned to take advantage of

the opportunity in both the traditional wireless voice and data

market alongside wider higher-frequency semiconductor markets which

we have targeted as key future growth areas. Our continued

investment in research and development will drive future progress

and increase our addressable market through an expanded product

range. While the sector-wide challenges remain, we are very well

placed to continue executing on our growth strategy and to cement

our position as one of the first-choice semiconductor partners to

technology innovators across the globe."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Director Tel: +44 (0) 1621 875 500

Nigel Clark, Executive Chairman

Shore Capital (Nominated Adviser Tel: +44 (0) 20 7408 4090

and Sole Broker)

Toby Gibbs

James Thomas

John More

Alma PR Tel: +44 (0) 20 3405 0212

Josh Royston

Andy Bryant

Matthew Young

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

CHAIRMAN'S STATEMENT

Introduction

I must apologise for the delay in publishing this year's

results, but this was due to the Group's auditor, BDO LLP (BDO),

requesting additional time to finalise their audit process and

internal review procedures.

The world is clearly going through very unsettled times, with

geopolitical trade conditions persisting, the COVID-19 pandemic

still impacting supply chains and the conflict in Ukraine. Despite

this backdrop and understanding that we are not immune from these

factors, we have delivered robust growth this year. General

inflationary pressure, a significant rise in energy costs and

ongoing supply problems present all of us with challenging times to

navigate. Notwithstanding that, the recovery within our markets

continued throughout the year. In what has been our first full

financial year as a pure play semiconductor business focused solely

on the Communications Market, we also ended the year with another

record order book.

Last year was transformational for CML following the disposal of

the Storage Division and as a result we needed to address the

composition of the Group and its structure going forward. The move

to the AIM, completed in early September, was another important

change. Finally, we remain in the process of relocating certain

operating companies to more appropriate premises and are in a

recruitment phase that will continue through the current year.

To execute our strategy, we are focused on simultaneously

securing the existing markets addressed whilst additionally

identifying other areas within the global communications sector

where we see material potential. The traditional markets have

returned to growth and the newer markets, addressed in part by our

SuRF product range, are a step change larger, providing

opportunities of significant magnitude.

Results (1)

Despite the further substantial returns to shareholders and the

investment in new product development this year, we have ensured

the balance sheet has remained strong with relatively high levels

of cash.

The business is now fully focused on communications

semiconductor markets, although this year's results do contain an

element of rental income (classified under "Other income") which

will not be present in future years following the disposal of one

of the investment properties and the holding for sale of the other.

Additionally, this year, other income was bolstered by a COVID loan

subsequently forgiven in the USA, which is a one-off.

Revenues were GBP16.96m up 29% (2021: GBP13.10m), reflecting the

recovery in our existing end markets. The revenue increase, coupled

with tight cost control, yielded a considerable improvement in

profit from operations. Profit before tax grew to GBP1.74m (2021:

GBP0.01m) and a resulting tax charge of GBP0.50m delivered profit

after tax of GBP1.24m (2021: GBP0.80m). During the comparable

period, profit attributable to shareholders was substantially

boosted by the disposal of the Storage Division and so this has

consequently reduced to GBP1.24m (2021: GBP23.56m). Net cash, cash

equivalent and fixed term deposits levels reduced to GBP25.0m

(2021: GBP31.9m) after a final dividend payment of GBP8.3m in

August 2021 and an interim dividend of GBP0.7m paid in December

2021.

Property

Historically the Group has owned two investment properties from

which it previously traded. Changes in our business requirements

led to them becoming surplus to our operational needs and they were

commercially rented to third parties. At 31 March 2021, these

properties were professionally revalued and, with tenancies ending

through the year under review, were put on the market for sale. The

property located in Witham, Essex was sold in January 2022 and

although we expected to sell the Fareham, Hampshire based property

by the financial year end, the sale did not materialise.

Accordingly, the property is now shown in the balance sheet as held

for sale. The total rental income from these two investment

properties for the year to 31 March 2022 reduced to GBP0.22m (2021:

GBP0.34m) and will reduce to zero for the year ahead.

The Group headquarters at Oval Park, Maldon (circa 28-acre site)

was acquired in 1993 and the business relocated from Witham to the

current facility during the year ended 31 March 2000. The Oval Park

site is designated employment land in the Maldon District Plan and

is excess to our trading requirements. Through the year, we have

worked to encourage other companies to join us here at Oval Park

and have signed sale contracts with two separate parties, subject

to them gaining appropriate planning permission for development on

approximately 13 acres of land. We anticipate submission of a

planning application in the coming weeks which will include an

outline planning application for a business park development on the

remaining excess land (circa 6 acres). This project is not without

cost, regardless of success or failure, and additionally will

involve an element of construction work around the Group's existing

buildings. However, if objectives are met, all excess land and

property will be disposed of during the financial year ahead.

Share Buyback Programme and Dividend

In April 2022, a GBP3.0m Share Buyback Programme was put in

place for the principal purpose of reducing the share capital of

the Company and returning funds to shareholders who sold their

ordinary shares in the Company. During April, the GBP3.0m was used

in its entirety to repurchase 748,188 ordinary shares and these

shares were taken into treasury.

The Board strives to maintain a progressive dividend policy,

with the dividend level debated and set by the Board twice yearly,

where all relevant factors such as cash needs for the business,

confidence in the future and overall cash levels can be

considered.

For the year-ended March 2020, following the onset of COVID-19,

the full year dividend was reduced to 4p (2019: 7.8p) as a measure

of caution. For the year ended March 2021, the Company returned

excess cash to shareholders following the sale of its Storage

Division. As well as a one-off repayment of capital of 50p,

shareholders then received a bumper final dividend of 50p, taking

the year's dividend total to 52p (interim 2p).

We have seen good progress this year and the confidence of the

Board was demonstrated at the half-year stage with a decision to

increase the interim dividend to 4p, which was subsequently paid in

December 2021. Clearly the years ended March 2020 and March 2021

were somewhat abnormal and current global issues dictate an element

of prudence, but the Board feels it should continue to reflect the

return of the Company to meaningful growth and its confidence in

the strategy being followed. After due consideration, the Board has

decided to recommend a 5p, final dividend taking the full year's

dividend to 9p. Subject to shareholder approval, the dividend will

be paid to shareholders on 19 August 2022 whose names appear on the

register at close of business on 5 August 2022, the shares will go

ex-dividend on 4 August 2022.

ESG

CML takes its responsibilities for the environment and the wider

stakeholder community very seriously. For some years we have

reviewed our greenhouse gas emissions with the long-term objective

of reducing them substantially by following a practical and

pragmatic approach, not simply a box-ticking route.

Through this year, apart from reviewing our consumption of

energy and considering what reductions in demand can be made by

changing working practices and methods, a number of initiatives

have been completed. We now have electric vehicle charging points

for employees to use and over 40% of Company-owned vehicles are

hybrid or electric. This is coupled with a vehicle replacement

policy to encourage a move away from fossil fuels. Solar panels

have been installed to the roof of our Global Headquarters in Essex

to provide renewable energy during daylight hours and, where

possible, lighting throughout the facility has been switched to LED

to reduce energy consumption.

CML has a diverse employee base from a multitude of

nationalities and ethnicities, and we actively promote the values

of diversity and inclusion. Incredibly important is employee

development and throughout the pandemic we have been especially

mindful of this. Additionally, CML's position in the local

community is and always has been key and today we provide work

experience placements and sponsor local sports clubs.

Currently CML has a well-balanced Board between Executives and

Independent Non-Executive Directors, thus ensuring objectivity in

decision-making. The Directors are committed to high standards of

corporate governance and following the decision to move to AIM

decided to apply the QCA Code, details of which are set out on our

website in the investor relations section.

Employees

The Board is very mindful that the success of any company is

down to its employees and at CML we have a team of talented and

hard-working staff. We have just finished another year of lockdowns

and adjusted work routines coupled with global travel restrictions

meaning a reduction in face-to-face meetings and efficiency, which

tests the resilience of everyone. The Board wishes to extend its

thanks to each and every employee for the dedication, enthusiasm

and loyalty shown through this year, it is much appreciated.

Outlook

Our foundation for sustainable growth, which has been a key

cornerstone of our strategy for years, continues. The sustainable

growth path needs not just be organic; selected acquisitions at the

right time and price could enhance and accelerate our growth along

with assisting the long-term sustainability of the business.

Potential opportunities fitting these criteria are constantly under

consideration and the ability to move quicky if opportunities

materialise is essential. To aid this, the substantial number of

shares in treasury, coupled with our relatively strong cash

balance, provides the flexibility needed to meet these goals.

The conflict in Ukraine, geopolitical instability, further

disruption from the pandemic, supply chain issues, inflation and

energy problems are all closely monitored and the Group's strategy

and operational execution demonstrates our resilience. These are

tough times to navigate, but CML has solid foundations and is

pursuing numerous growth opportunities. We have a well-established

global market reach and a growing product portfolio addressing RF,

Microwave and Millimetre-wave application areas coupled with a

strong product roadmap defining our direction of travel. I can only

reiterate what I said at the interim stage, which is that the

future has never been brighter for CML, and we are confident in

growth for both the full year ahead and in the longer term.

1. (2021 comparatives relate only to continuing operations)

Nigel Clark

Executive Chairman

OPERATIONAL AND FINANCIAL REVIEW

Introduction

For the year to 31 March 2022, the Group made tangible progress

with its growth strategy based around a singular focus on providing

our customers with class-leading semiconductor products for global

Communications markets.

Fiscally, we started the trading year in a strong position,

notwithstanding the major return to shareholders that had already

been made. The underlying feeling was one of opportunity and

optimism. The financial progress recorded at the halfway stage was

augmented by positive trading through the second six-month period

and, in terms of future growth prospects, the value and quality of

new business opportunities being actively managed improved.

The recovery of existing markets drove a strong new order

intake, assisted by new customer design-wins moving into the

production phase and concerns around supply chain constraints

within the semiconductor market generally.

The improvement demonstrated within these results follows a

multi-year period of enduring headwinds. During this time, the

Group has invested heavily in research and development activities

targeted at products and application areas that are expected to

drive growth over the coming years. The business optimisation that

took place prior to this year commencing, coupled with the enhanced

strategy now being followed, positions the Group well to deliver

significant, sustainable growth.

Global pandemic

The welfare and safety of our employees has been of paramount

importance throughout the pandemic and remains a priority. Our

operations remain fully functional, supported by prior IT

investments and the ongoing utilisation of partial work from home

practices, where applicable.

Travel restrictions persist in some regions and have affected

our ability to mobilise and physically meet with customers,

particularly where international travel is required. However, our

sales partners located within those regions have helped minimise

the impact on our customer base by continuing to offer a level of

domestic support. China's well publicised zero-COVID policy has

recently led to further lockdowns which has resulted in factory

closures and a reduced level of business activity.

On a global basis, there are several customers who are not yet

allowing face to face visits and ultimately, the conclusion drawn

is that the situation will remain fluid for some time.

The CML teams throughout the world continue to demonstrate a

resilience and dedication for which the Board are extremely

thankful. They have continued to work tirelessly under challenging

circumstances and their commitment both to CML and our customers

has not wavered. As we continue to face the challenges of COVID-19,

including the ongoing risk of further rolling lockdowns, we do so

with the support of a dedicated, talented team around the

world.

Russian conflict in Ukraine

Following Russia's invasion of Ukraine on 24 February 2022 and

the sanctions subsequently imposed, CML ceased sales into the

Russian market. The impact of that action resulted in an immaterial

bad debt being recorded for the first time in many years. The Group

continues to adhere to applicable UK government sanctions in force

at any one time and future business plans take those restrictions

into account.

Strategy

The Group's vision is to be the first-choice semiconductor

partner to technology innovators, together transforming how the

world communicates.

The focus is on our customers' success by delivering advantages

through the improved functionality and performance of class leading

IC solutions. R&D activity is targeted at developing the

product portfolio to support emerging and evolving customer

requirements for size, cost and performance whilst striving to

remain our customer's first choice supplier within their advanced

communication platforms.

During the prior financial year, our strategy evolved to include

the development and market launch of the SuRF product portfolio to

address higher frequency (microwave/millimetre wave) and wider

bandwidth wireless applications. Added to the existing elements of

the Group's expansion objectives, the growth strategy currently

consists of four key areas for R&D investment:

1. "Defend and grow" revenues in core CML markets.

2. Develop a portfolio of new products to expand the addressable

market (SuRF).

3. Selected "other" product initiatives to expand into new high

growth markets.

4. Internal research and innovation to maintain product

superiority and suitability.

In today's world, "connected everything" is propelling

exponential increases in data consumption, driving growth across

wireless communications markets globally. We are expanding our

total addressable market having enlarged our market focus to

include applications within the so-called mega trend areas of

Industrial Internet of Things (IIoT), 5G and Industry 4.0. This

complements the historic market areas of public safety, maritime

and mission critical wireless voice and data communications,

leveraging our systems knowledge, engineering capabilities and

routes to market.

Markets and operations

For the comparable period, revenues from voice-centric wireless

applications were heavily impacted by the pandemic, with the

situation across a wide range of data-centric customers somewhat

mixed. As the year progressed, conditions improved within the

Group's established end markets for both professional voice and

industrial data communications products, supported by initial

revenues from the introduction of the SuRF product range.

The Communications market is demonstrating a number of growth

areas including the transition to higher-capacity digital networks

within voice-centric markets and, in data-centric markets, the

increasing data throughput requirements from terrestrial and

satellite communications applications. The latter is required to

meet the needs of the growing machine -- to -- machine (M2M) and

IIoT sectors. Ancillary markets continue to develop which serves to

maintain the very fragmented nature of the Group's communications

markets. New product releases in recent years are expected to

capture a higher share of a growing market over time.

In addition to the traditional wireless voice and data market

areas served, our plan to significantly widen the product portfolio

and address broader application areas is being achieved through a

combination of resource blend and new customer engagements.

Under our established growth strategy, the addressable

semiconductor market includes a number of key future growth areas,

including critical infrastructure (public utilities, smart grid,

RFID), 5G (repeaters, small/pico cells, fixed wireless access) and

satellite communications (terminals, broadband access). The Group's

total addressable market (TAM) has recently expanded to a value

exceeding $1bn through an enlarged product portfolio.

Through the year under review, a number of new integrated

circuits (ICs) were released or priority sampled to market. As an

example, to deal with the future needs of 5G networks that will

operate on millimetre wave radio frequencies, the Group sampled a

suitable Power Amplifier solution to selected customers that

addresses the need to meet demanding technical specifications but

with better efficiency leading to reduced heat generation. The

higher frequencies that future 5G products will utilise offer

higher data rates, greater capacity, better quality and lower

latency.

For satellite communication applications in the form of

ground-based terminals and reception equipment, engineering

activities have been underway for some time that are expected to

lead to meaningful revenue generation in the years ahead. Aside

from technical performance and commercial competitiveness, the

focus on our customers' success and our inherent partnership

capabilities are key factors that are setting CML aside from our

competition and this bodes well for the future growth of the

business.

Customer adoption of the Group's products marketed under the

SuRF brand continues to gather pace. First orders received from

early-stage adopters were shipped during the second half of the

year, as planned and an acceleration in the number of new product

releases is expected as we move forward. In addition to the SuRF

product range, we continue to actively invest in new platform

technology and differentiated wireless/baseband products to gain

market share in a combination of existing and new end application

areas. These new releases build upon prior year investments and

product introductions that also serve to increase the number of

market opportunities we can service.

Operationally, it has been challenging to address the increased

demands placed upon the team through what is a rapid expansion of

the product range. It is once again essential to acknowledge the

efforts being expended in that regard and its importance towards

maximising our chances of success in the future. Following

corporate acquisition and disposal events over the last two years,

the Group has now rebalanced its internal design skills and

operational capabilities to be in tune with its current growth

strategy. One of our guiding principles is to foster a culture of

quality with a sense of urgency and that principle is key to future

success.

The Group continues to invest significant effort in ensuring

global sales channels are appropriate for the direction of travel

that the business is taking. Where possible, those channels are

being exploited to good effect as the release of new products

gathers pace, although the process is one of evolution and

refinement. As reported at the interim stage, customer reach has

been extended further through a widening of the existing agreement

with RFMW to become a global partner, along with the addition of

several new manufacturers' representatives in the Americas

region.

Extended delivery lead times from raw material suppliers and

third-party manufacturing services companies continue to be a

factor across the semiconductor industry. The Group has navigated

that situation comparatively well so far and we remain well placed

for this to continue, supported by the prior decision to maintain

higher levels of raw material inventory. Notwithstanding that, it

is important to recognise that our semiconductor solutions are a

sub-set of the electronic components that customers need in order

to successfully produce their own products. Their failure to secure

the other components required could have an impact on Group sales.

Capacity constraints in the supply chain could well continue beyond

the end of this calendar year.

Outlook

Financially, the current trading year has started well, backed

by a strong order book stretching beyond twelve months. The Group's

traditional voice markets have recovered nicely and demand from our

data-centric customer base is at a healthy level. The expansion

into wider markets through microwave/millimetre wave product

developments is well underway. Operationally, the efforts being

made towards capturing the growth opportunities already identified

are expected to bear fruit and the pipeline of opportunity

continues to grow.

Clearly headwinds and risks remain, including potential pandemic

lockdowns, the current economic outlook and geopolitical

uncertainties. That said, relatively similar conditions have been

in place across each of the last two financial years and they are

again factored into growth expectations for the year ahead. The

Group is making good advances and has a well-seasoned team

navigating the business.

Subject to unforeseen circumstances, the Board remains confident

that the year ahead will deliver a firm improvement in results,

both financially and operationally.

Financial review (1)

The change in Auditor, ratified through the year under review,

has resulted in a restatement of some of the prior year's figures.

The changes include the treatment of other income and the movement

of share-based payments within the income statement, along with the

reclassification of certain cash balances that are on deposit and a

change to the capital redemption reserve within the consolidated

statement of financial position. The changes have no effect on the

profit before tax or the value of net assets previously

reported.

Group turnover for the year to 31 March 2022 was GBP16.96m

representing an increase of 29% against the prior full year period

(2021: GBP13.10m), with the second half slightly stronger than the

first. Revenue growth was driven by a recovery in the voice-centric

markets coupled with a strong contribution from those customers

active within M2M/IIoT market areas. Geographically, shipments

improved in each major region, namely Asia, Europe and the Americas

although it is important to note that annual revenue comparisons by

region can be misleading because customers can and do alter their

manufacturing locations periodically.

Higher sales and a slightly improved margin due to product mix

delivered a Gross Profit of GBP12.80m, representing an increase of

35% year-on-year (2021: GBP9.46m). This is a pleasing outcome given

the raw material price increases encountered over the past 18

months and the need to impose price increases across the Group's

product range on more than one occasion. The year ahead will

encounter higher inventory costs if the current strength of the US

dollar is maintained, and an element of allowance has been made

within the Group's growth expectations.

Customer dependency for the year reflected the strength in depth

of the very fragmented markets being addressed, with only one

customer accounting for between 10 and 15% of Group revenues and

only two customers in the 5% to 7% range.

Distribution and administration costs rose to GBP11.56m (2021:

GBP10.57m) with the majority of the increase attributable to a

number of non-recurring expenses. These included the move across to

an AIM listing from the standard segment of the Main Market,

property-related activities associated with a Planning application

on the Group's 28-acre Essex site and various legal costs

associated with an investment property sale and operating company

leases. These costs, when combined with an impairment and write off

of GBP0.39m following a review of engineering projects, exceeded

the overall increase in distribution and administration expenses

year-on-year.

Research and development expenditure for the year was steady at

GBP4.79m (2021: GBP4.90m). Of this amount, GBP1.26m was expensed

(2021: GBP0.93m) and GBP3.53m was capitalised under the Group's

research and development policy.

An expense of GBP0.10m was recognised for share-based payments

(2021: GBP0.14m).

Strong revenue growth coupled with a relatively stable cost base

led to a significant swing in operational profitability, moving

from a loss of GBP0.98m for FY21 to a profit of GBP1.21m for FY22.

This was a very pleasing outcome for what is a key performance

measurement.

Not to be confused with the previously referenced other

operating income, the Group also receives other income from the

rental of two commercial property assets that have been surplus to

operational requirements for some years. Rental income for the year

amounted to GBP0.22m in comparison with a prior year figure of

GBP0.34m. The reduction in rental income was due to one of the two

property assets being disposed of through the period, generating a

cash inflow of GBP1.75m. The remaining commercial property asset

has been reclassified as held for sale with a market valuation of

GBP1.98m.

In addition to rental income, the Group benefited from

forgiveness of a US government grant previously received under the

COVID-19 Paycheck Protection Program amounting to GBP0.29m. The

total sum recorded under other income was GBP0.50m (2021:

GBP0.37m).

Net finance income of GBP0.07m (2021: GBP0.04m) along with a

small loss of GBP0.05m upon sale of the investment property led to

profit before taxation advancing to GBP1.74m against what was

essentially a break-even year for the continuing business for the

previous financial year.

The Group continued to benefit from UK tax credits associated

with some of its research and development activities, albeit at a

lower level than the prior year. Additionally, the need to provide

for the expected increase in corporation tax from 19% to 25%

through to 2025 led to a deferred tax charge (non-cash) of GBP0.45m

(2021: GBP0.09m). Overall, an income tax charge of GBP0.50m was

recorded against a prior year credit of GBP0.79m.

Profit after tax amounted to GBP1.24m (2021: GBP0.80m), an

improvement of 54%, with basic EPS rising 55% to 7.45p (2021:

4.81p).

The Group's cash reserves as at 31 March 2022 stood at

GBP25.04m, representing a reduction of GBP7.86m when compared to

one year earlier (31 March 2021: GBP32.20m). The balance reported

arises after a research and development spend of GBP4.79m, dividend

payments totalling GBP8.96m and a GBP1.10m investment in plant and

equipment, including the ongoing expansion of the Group's

capabilities to incorporate the evaluation and testing of microwave

and millimetre wave semiconductor products and installation of

solar panels at the Group's headquarters in Essex. Cash inflows

included the sale of an investment property for GBP1.75m along with

early repayment of a GBP0.29m loan note associated with a potential

acquisition that did not materialise.

Inventory levels continue to be maintained at relatively high

levels, helping to reduce the impact of ongoing capacity issues

within the semiconductor market generally and also in support of an

expanding product range. At 31 March 2022, inventories were valued

at GBP2.26m (2021: GBP1.45m) with the increases attributable across

raw materials, work in progress and finished goods

collectively.

The Group has a historic final pension scheme that has been

closed to new members and future accrual for many years. Along with

the Company, the Trustees and their professional advisors have

worked diligently in recent years to achieve the right balance

between adequate scheme funding and business growth objectives. As

a result, the scheme funding position has improved and for the year

under review a deficit of GBP2.44m has been recorded under IAS 19

(2021: GBP5.57m).

Separately, the most recent actuarial report carried out by an

independent professionally qualified actuary, as at 31 March 2022,

resulted in a net pension surplus estimate of GBP1.09m (estimate 31

March 2021: GBP0.47m). The market value of the assets of the scheme

were sufficient to cover 105% of the benefits accrued to members,

after allowing for future increases in these benefits.

The GBP1.09m pension surplus calculated under the funding

valuation basis above is different to the accounting valuation

presented in the Group consolidated balance sheet, which shows a

net pension liability of GBP2.44m. Differences arise between the

funding valuation and accounting valuation, mainly due to the use

of different assumptions in valuing the liabilities in accordance

with the accounting standard IAS 19 Retirement Benefits.

All administrative expenses of running the pension scheme are

met directly by the scheme along with pension protection fund

levies.

1. (2021 comparatives relate only to continuing operations)

Chris Gurry

Group Managing Director

Consolidated income statement for the year ended 31 March

2022

2021

2022 Restated

Notes GBP'000 GBP'000

--------------------------------------------- ----- -------- ---------

Continuing operations

Revenue 1,2 16,964 13,101

Cost of sales (4,169) (3,646)

--------------------------------------------- ----- -------- ---------

Gross profit 12,795 9,455

Distribution and administration costs (11,562) (10,567)

Share -- based payments (98) (143)

--------------------------------------------- ----- -------- ---------

1,135 (1,255)

Other operating income 79 278

--------------------------------------------- ----- -------- ---------

Profit / (Loss) from operations 1,214 (977)

Other income 500 370

Revaluation of investment properties 8 - 579

Loss on sale of investment properties (50) -

Finance income 106 75

Finance expense (33) (37)

Profit before taxation 1,737 10

Income tax (charge) / credit 4 (499) 792

--------------------------------------------- ----- -------- ---------

Profit from continuing operations 1,238 802

Profit from discontinued operations 7 - 22,762

--------------------------------------------- ----- -------- ---------

Profit after taxation attributable to equity

owners of the parent 1,238 23,564

--------------------------------------------- ----- -------- ---------

The Consolidated Income Statement has been restated for year

ended 31 March 2021. See note 12 for further details.

Earnings per share for profit from continuing

operations attributable to the ordinary

equity holders of the Company:

Basic earnings per share 57.45p 4.81p

Diluted earnings per share 57.35p 4.79p

Earnings per share for profit attributable

to the ordinary equity holders of the Company:

Basic earnings per share 57.45p 141.13p

Diluted earnings per share 57.35p 140.56p

The following measure is considered an alternative performance

measure not a generally accepted accounting principle. This ratio

is useful to ensure that the level of borrowings in the business

can be supported by the cashflow in the business. For definition

and reconciliation see note 6.

Adjusted EBITDA 64,308 2,731

Consolidated statement of total comprehensive income for the

year ended 31 March 2022

2022 2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------- ------- ------- -------

Profit for the year 1,238 23,564

Other comprehensive (expense)/income:

Items that will not be reclassified

subsequently to profit or loss:

Re-measurement of defined benefit

obligation 3,307 (897)

Deferred tax on actuarial loss (827) 170

Change in deferred tax rate on

defined benefit obligation 345 -

----------------------------------------- ------- ------- ------- -------

Items reclassified subsequently

to profit or loss upon derecognition:

Foreign exchange differences 880 (312)

Reclassification of foreign exchange

differences on discontinued operations - (1,100)

----------------------------------------- ------- ------- ------- -------

Other comprehensive expense for

the year net of taxation attributable

to equity owners of the parent 3,705 (2,139)

----------------------------------------- ------- ------- ------- -------

Total comprehensive income for

the year attributable to the equity

owners of the parent 4,943 21,425

----------------------------------------- ------- ------- ------- -------

Total comprehensive income

for the year attributable to

the equity owners of the parent

Continuing operations 4,943 (237)

Discontinued operations - 21,662

----------------------------------- ----- ------

4,943 21,425

--------------------------------- ----- ------

Consolidated statement of financial position as at 31 March

2022

2021 2021

2022 2022 Restated Restated

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- ------- --------- ---------

Assets

Non -- current assets

Goodwill 7,531 7,072

Other intangible assets 1,119 1,276

Development costs 11,197 9,191

Property, plant and equipment 5,593 4,864

Right-of-use assets 458 409

Investment properties - 3,775

Deferred tax assets 1,550 1,531

--------------------------------------- -------- ------- --------- ---------

27,448 28,118

Current assets

Investment properties - held

for sale 1,975 -

Inventories 2,258 1,450

Trade receivables and prepayments 2,199 2,434

Current tax assets 409 1,046

Cash and cash equivalents 19,084 22,046

Short term cash deposits 5,958 10,150

--------------------------------------- -------- ------- --------- ---------

31,883 37,126

-------------------------------------- -------- ------- --------- ---------

Total assets 59,331 65,244

--------------------------------------- -------- ------- --------- ---------

Liabilities

Current liabilities

Bank loans and overdrafts - 282

Trade and other payables 2,827 3,081

Lease liabilities 230 183

Current tax liabilities 42 80

--------------------------------------- -------- ------- --------- ---------

3,099 3,626

-------------------------------------- -------- ------- --------- ---------

Non -- current liabilities

Deferred tax liabilities 3,702 2,339

Lease liabilities 238 262

Retirement benefit obligation 2,439 5,570

--------------------------------------- -------- ------- --------- ---------

6,379 8,171

-------------------------------------- -------- ------- --------- ---------

Total liabilities 9,478 11,797

--------------------------------------- -------- ------- --------- ---------

Net assets 49,853 53,447

--------------------------------------- -------- ------- --------- ---------

Capital and reserves attributable to equity owners

of the parent

Share capital 865 859

Share premium 1,362 1,039

Capital redemption reserve 8,285 8,285

Treasury shares - own share

reserve (1,670) (1,670)

Share -- based payments reserve 490 570

Foreign exchange reserve 1,182 302

Accumulated profits reserve 39,339 44,062

--------------------------------------- -------- ------- --------- ---------

Total shareholders' equity 49,853 53,447

--------------------------------------- -------- ------- --------- ---------

The Consolidated Statement of Financial Position has been

restated for year ended 31 March 2021. See note 12 for further

details.

Consolidated cash flow statement for the year ended 31 March

2022

2021

2022 Restated

GBP'000 GBP'000

------------------------------------------ -------------------- ----------

Operating activities

Profit for the year before taxation

- continuing operations 1,737 10

Profit for the year after taxation

- discontinued operations - 22,762

Adjustments for:

Depreciation - on property, plant

and equipment 375 370

Depreciation - on right-of-use assets 258 438

Impairment of development costs 123 701

Amortisation of development costs 1,507 3,789

Amortisation of intangibles recognised

on acquisition and purchased 283 212

Profit on disposal of property, plant

and equipment - 16

Loss on disposal of investment properties 50 -

Revaluation of investment properties - (579)

Gain on disposal of discontinued

operations - (21,740)

Rental income (215) (344)

Forgiveness US PPP loan (284) -

Movement in non-cash items (Retirement

benefit obligation) 176 201

Share -- based payments 98 143

Finance income (106) (75)

Finance expense 33 37

Movement in working capital (1,025) 1,388

------------------------------------------ -------------------- ----------

Cash flows from operating activities 3,010 7,329

Income tax received 905 494

------------------------------------------ -------------------- ----------

Net cash flows from operating activities 3,915 7,823

------------------------------------------ -------------------- ----------

Investing activities

Disposal of business (net of expenses) - 33,261

Acquisition of subsidiary, net of

cash acquired - (100)

Proceeds from sale of investment 1,750 -

Purchase of property, plant and equipment (1,105) (390)

Investment in development costs (3,532) (7,270)

Repayment / (Investment) in fixed

term deposits 4,192 (10,150)

Repayment of Investment loan note 293 -

Investment in intangibles - 25

Rental income 215 344

Finance income 106 75

Net cash flows from / (used in)

investing activities 1,919 15,795

------------------------------------------ -------------------- ----------

Financing activities

Lease liability repayments (287) (556)

Proceeds from borrowings - 282

Issue of ordinary shares 329 29

Purchase of own shares for treasury - (1,590)

Dividends paid to shareholders (8,964) (674)

Share capital redemption - (8,276)

Finance expense - (15)

------------------------------------------ -------------------- ----------

Net cash flows used in financing

activities (8,922) (10,800)

------------------------------------------ -------------------- ----------

Increase / (decrease) in cash and

cash equivalents (3,088) 12,818

------------------------------------------ -------------------- ----------

Movement in cash, cash equivalents

and fixed term deposits:

At start of year 22,046 8,479

(Decrease) / increase in cash, cash

equivalents and fixed term deposits (3,088) 12,818

Effects of exchange rate changes 126 749

------------------------------------------ -------------------- ----------

At end of year 19,084 22,046

------------------------------------------ -------------------- ----------

The Consolidated and Company cash flow statements have been

restated for year ended 31 March 2021. See note 12 for further

details

Cash flows presented exclude sales taxes.

Consolidated statement of changes in equity for the year ended

31 March 2022

Share- Foreign

Share Share Redemption Treasury based exchange Retained

capital premium reserve shares payments reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

At 31 March 2020 859 9,286 9 (80) 582 1,714 30,020 42,390

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Profit for year 23,564 23,564

Other comprehensive

income

Foreign exchange

differences (312) (312)

Foreign exchange

differences

discontinued

operations (1,100) (1,100)

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations (897) (897)

Deferred tax on

actuarial gain 170 170

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Total comprehensive

income for year

capacity as owners - - - - - (1,412) 22,837 21,425

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

859 9,286 9 (80) 582 302 52,857 63,815

Transactions with

owners in their

capacity as owners

Issue of ordinary

shares 29 29

Purchase of own shares

- treasury (1,590) (1,590)

Issue of B shares 8,276 (8,276) -

Share capital

redemption (8,276) 8,276 (8,276) (8,276)

Dividend paid (674) (674)

Total transactions

with owners in their

capacity as owners - (8,247) 8,276 (1,590) - - (8,950) (10,511)

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Share -- based

payments in year 143 143

Cancellation/transfer

of share -- based

payments (155) 155 -

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

At 31 March 2021

(restated) 859 1,039 8,285 (1,670) 570 302 44,062 53,447

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Profit for year 1,238 1,238

Other comprehensive

income

Foreign exchange

differences 880 880

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations 3,307 3,307

Deferred tax on

actuarial gain (827) (827)

Change in deferred tax

rate on defined

benefit obligation 345 345

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Total comprehensive

income for year

capacity as owners - - - - - 880 4,063 4,943

Transactions with

owners

in their capacity as

owners 859 1,039 8,285 (1,670) 570 1,182 48,125 58,390

Issue of ordinary

shares - exercise of

share options 6 323 329

Dividend paid (8,964) (8,964)

Total transactions

with owners in their

capacity as owners 6 323 - - - - (8,964) (8,635)

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

Share -- based payment

charge - - - - 98 98

Cancellation/transfer

of share -- based

payments - - - - (178) 178 --

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

At 31 March 2022 865 1,362 8,285 (1,670) 490 1,182 39,339 49,853

---------------------- ------- ------- ---------- --------- -------- -------- --------- ----------

The Consolidated Statement of Changes in Equity has been

restated for year ended 31 March 2021. See note 12 for further

details

1 Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

The Group is focused for management purposes on one operating

segment, which is reported as the semiconductor segment, with

similar economic characteristics, risks and returns, and the

Directors therefore consider there to be one single segment, being

semiconductor components for the communications industry.

Geographical information (by origin)

UK Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ -------- --------- ---------

Year ended 31 March 2022

------------------------------------------- -------- -------- --------- ---------

Revenue to third parties - by

origin 4,569 2,572 9,823 16,964

------------------------------------------- -------- -------- --------- ---------

Property, plant and equipment 5,504 12 77 5,593

------------------------------------------- -------- -------- --------- ---------

Right-of-use assets 227 60 171 458

------------------------------------------- -------- -------- --------- ---------

Investment properties - - - -

------------------------------------------- -------- -------- --------- ---------

Investment properties - held

for sale 1,975 - - 1,975

------------------------------------------- -------- -------- --------- ---------

Development costs 9,714 - 1,483 11,197

------------------------------------------- -------- -------- --------- ---------

Intangibles - software and intellectual

property 243 - 96 339

------------------------------------------- -------- -------- --------- ---------

Goodwill 1,531 - 6,000 7,531

------------------------------------------- -------- -------- --------- ---------

Other intangible assets arising

on acquisition 184 - 596 780

------------------------------------------- -------- -------- --------- ---------

Total assets 46,024 1,163 12,144 59,331

------------------------------------------- -------- -------- --------- ---------

Year ended 31 March 2021

Revenue to third parties - by

origin (restated) 5,867 1,624 5,610 13,101

------------------------------------------- -------- -------- --------- ---------

Property, plant and equipment 4,753 22 89 4,864

------------------------------------------- -------- -------- --------- ---------

Right-of-use assets 90 255 64 409

------------------------------------------- -------- -------- --------- ---------

Investment properties 3,775 - - 3,775

------------------------------------------- -------- -------- --------- ---------

Development costs 7,942 - 1,249 9,191

------------------------------------------- -------- -------- --------- ---------

Intangibles - software and intellectual

property 264 - 101 365

------------------------------------------- -------- -------- --------- ---------

Goodwill 1,531 - 5,541 7,072

------------------------------------------- -------- -------- --------- ---------

Other intangible assets arising

on acquisition 210 - 701 911

------------------------------------------- -------- -------- --------- ---------

Total assets 52,228 2,467 10,549 65,244

------------------------------------------- -------- -------- --------- ---------

2 Revenue

The geographical classification of business turnover

(by destination) is as follows:

2021

2022 Restated

Continuing business GBP'000 GBP'000

-------------------------------------------------- ---------- ---------

Europe 3,705 2,996

Far East 9,603 7,636

Americas 2,901 2,000

Others 755 469

-------------------------------------------------- ---------- ---------

16,964 13,101

-------------------------------------------------- ---------- ---------

3 Dividend - paid and proposed

During the year a final special dividend of 50.0p per ordinary

share of 5p was paid in respect of the year ended 31 March 2021. An

interim dividend of 4.0p per ordinary share was paid on 17 December

2021 to shareholders on the Register on 3 December 2021.

It is proposed to pay a final dividend of 5.0p per ordinary

share of 5p, taking the total dividend amount in respect of the

year ended 31 March 2022 to 9.0p. It is proposed to pay the final

dividend of 5.0p, if approved, on 19 August 2022 to shareholders

registered on 5 August 2022 (2021: paid 13 August 2021 to

shareholders registered on 30 July 2021).

4 Income tax expense

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

2022 2021

GBP'000 GBP'000

-------------------------------------------------------- -------- -------

Current tax

UK corporation tax on results of the year (415) (1,089)

Adjustment in respect of previous years (6) (37)

-------------------------------------------------------- -------- -------

(421) (1,126)

Foreign tax on results of the year 121 248

Total current tax (300) (878)

-------------------------------------------------------- -------- -------

Deferred tax

Deferred tax - Origination and reversal of temporary

differences 6 91

Change in deferred tax rate 833 -

Adjustments to deferred tax charge in respect of

previous years (40) (5)

-------------------------------------------------------- -------- -------

Total deferred tax 799 86

-------------------------------------------------------- -------- -------

Tax expense / (income) on profit on ordinary activities 499 (792)

-------------------------------------------------------- -------- -------

5 Earnings per share

2022 2021

----------------------------------------------------------- ----- -----

Earnings per share for profit from continuing operations

attributable to the ordinary equity holders of the

Company:

Basic earnings per share 7.45p 4.81p

Diluted earnings per share 7.35p 4.79p

The calculation of basic and diluted earnings per share is based

on the profit from continuing operations attributable to ordinary

shareholders, divided by the weighted average number of shares in

issue during the year, as shown below:

2022 2021

--------------------------------- -----------------------------------

Weighted Weighted

average average

number of Earnings number of Earnings

Profit shares per share Profit shares per share

Basic earnings per share GBP'000 Number p GBP'000 Number p

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Basic earnings per share

- from profit for year 1,238 16,628,301 7.45 802 16,696,060 4.81

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Diluted earnings per

share

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Basic earnings per share 1,238 16,628,301 7.45 802 16,696,060 4.81

Dilutive effect of share

options - 219,951 (0.10) - 67,886 (0.02)

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Diluted earnings per

share

* from profit for year 1,238 16,848,252 7.35 802 16,763,946 4.79

---------------------------- ------- ------------ ---------- ------- ------------ ------------

2022 2021

-------------------------------------------------- ----- -------

Earnings per share for profit attributable to the

ordinary equity holders of the Company:

Basic earnings per share 7.45p 141.13p

Diluted earnings per share 7.35p 140.56p

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year, as

shown below:

2022 2021

--------------------------------- ------------------------------------

Weighted Weighted

average average

number of Earnings number of Earnings

Profit shares per share Profit shares per share

Basic earnings per share GBP'000 Number p GBP'000 Number p

---------------------------- ------- ------------ ---------- -------- ------------ ------------

Basic earnings per share

- from profit for year 1,238 16,628,301 7.45 23,564 16,696,060 141.13

---------------------------- ------- ------------ ---------- -------- ------------ ------------

Diluted earnings per

share

---------------------------- ------- ------------ ---------- -------- ------------ ------------

Basic earnings per share 1,238 16,628,301 7.45 23,564 16,696,060 141.13

Dilutive effect of share

options - 219,951 (0.10) - 67,886 (0.57)

---------------------------- ------- ------------ ---------- -------- ------------ ------------

Diluted earnings per

share

* from profit for year 1,238 16,848,252 7.35 23,564 16,763,946 140.56

---------------------------- ------- ------------ ---------- -------- ------------ ------------

6 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ('Adjusted EBITDA') is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the years presented:

2022 2021

GBP'000 GBP'000

--------------------------------------------------- ------- -------

Profit before taxation (earnings) 1,737 10

Adjustments for:

Finance income (106) (75)

Finance expense 33 37

Depreciation 375 310

Depreciation - right-of-use assets 258 202

Impairment of development costs 123 701

Amortisation of development costs 1,507 1,191

Amortisation of acquired and purchased intangibles

recognised on acquisition 283 212

Share-based payments 98 143

--------------------------------------------------- ------- -------

Adjusted EBITDA 4,308 2,731

--------------------------------------------------- ------- -------

7 Cash, cash equivalents and fixed term deposits

2021

2022 Restated

GBP'000 GBP'000

-------------------------------------------------- ---------- ---------

Cash on deposit 10,275 10,288

Cash at bank 8,809 11,758

-------------------------------------------------- ---------- ---------

19,084 22,046

Short term cash deposits 5,958 10,150

-------------------------------------------------- ---------- ---------

25,042 32,196

-------------------------------------------------- ---------- ---------

8 Discontinued Operations

On 10 December 2020, the Group announced it had entered into a

definitive agreement to divest its Storage Division,

Hyperstone.

Hyperstone was sold on 4 February 2021 and is reported in the

prior year as a discontinued operation. The discontinued operations

generated a profit GBP22,762,000 and a total cash inflow of

GBP33,554,000 with a gain on sale after income tax of

GBP21,740,000. Full details can be found in the statutory accounts

for the year ended 31 March 2021 available at

www.cmlmicroplc.com.

9 Investment properties

During the year an investment property was sold with proceeds of

GBP1,750,000. This sale generated a loss on disposal of GBP50,000.

The remaining investment property has been reclassified and is now

held for sale.

Investment properties were measured at current market valuation.

No depreciation is provided on freehold investment properties or on

long leasehold investment properties. In accordance with IAS 40,

gains and losses arising on revaluation of investment properties

are shown in the income statement. The open market valuation value

of the investment properties recognised is GBPNil (2021:

GBP3,775,000).

The investment property was reclassified on 31 March 2022 as

held for sale as the property became vacant with no prospective

tenant in place and is held based upon the current market valuation

methodology. The property is currently expected to sell within the

next twelve months. Investment properties held for sale

GBP1,975,000 (2021: GBPNil).

10 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

sectors, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored; however,

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

COVID-19

Following the effect of the COVID-19 pandemic, the Group

followed the guidance of the World Health Organization and other

government health agencies in safeguarding the health and wellbeing

of its employees and continue to operate a hybrid working policy.

The Group did not make use of the government's staff retention

schemes in the UK, nor make any redundancies. In the United States,

the government provided support in the form of a loan under the

Paycheck Protection Program ($388,400) which was forgiven on 23 May

2021.

There continues to be localised COIVID outbreaks, and the Board

closely monitors the impact taking prudent steps to mitigate any

potential impacts to our employees, customers, suppliers and other

stakeholders. The Group remains prepared to implement appropriate

mitigating strategies to minimise any potential business

disruption.

Given the nature of the markets we operate within, we anticipate

our end customers being insulated from a consumer downturn to some

extent, although the roll-out of some of the new products may be

delayed, dampening demand for our semiconductors. Even in these

difficult times, we still maintain the belief that the Group is

well placed to move positively forward in the medium to long term.

This belief is underpinned by a strong balance sheet and no debt,

along with a product portfolio that addresses markets that have a

positive outlook.

Russia and Ukraine conflict

Following Russia's invasion of Ukraine, the Group took the

decision to cease all supplies to customers based in Russia,

resulting in the non-payment of a debt totalling GBP16,000

($20,000) which has been fully provided for.

Key risks of a non -- financial nature

The Group is a small player operating in a highly competitive

global market that is undergoing continual and geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to, pricing, technological innovations,

product quality, customer service, raw material availabilities,

manufacturing capabilities and employment of qualified personnel

will be key in the achievement of its objectives. The Group's

ultimate success will depend on the demand for its customers'

products, since the Group is a component supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements (including

the UK's withdrawal from the European Union, or "Brexit"),

political risk, the enforceability of laws and contracts, changes

in the tax laws, terrorist activities, natural disasters or health

epidemics.

11 Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2022 financial statements

12 Prior year restatement

The financial statements for year ending 31 March 2021 have been

restated as follows:

The Consolidated Statement of Comprehensive Income

Third-party product re-sales have been reclassified from other

operating income to revenue and presented on a gross basis to

correctly reflect the group's role as principal in a revenue

arrangement. In the prior year, Revenue of GBP631,000 and Cost of

sales of GBP449,000 were presented net as other operating income.

This has now been correctly classified as Revenue and Cost of sales

respectively on a gross basis in the restated statement of

comprehensive income. The reclassification of these items has had

no effect on the profit before taxation or net assets.

Rental income and government grants have been reclassified as

other income to be excluded from profit / (loss) from operations,

having previously been incorrectly classified as other operating

income before profit / (loss) from operations. The reclassification

has resulted in an increase in the loss on operations of

GBP370,000.

Share-based payment expense was incorrectly presented below

profit/(loss) from operations. They have been reclassified to be

included within profit/(loss) from operations to properly reflect

the nature of the expense. This has resulted in an increase in the

loss from operations of GBP143,000.

The reclassification of the rental income, government grants

income and share based payment expenditure provides a better

measure of operating profit/(loss) in the consolidated statement of

comprehensive income. The reclassification of these items has had

no effect on the profit before taxation or net assets.

The Consolidated statement of financial position

An omission of a transfer within the statement of changes in

equity in relation to the B shares that were issued, redeemed, and

subsequently cancelled has been corrected. The adjustment

recognises a transfer of GBP8,276,000 from retained earnings to the

capital redemption reserve as required by the Companies Act 2006

and has had no effect on the profit before taxation or net

assets.

Short term cash deposits with initial maturity of more than 3

months were incorrectly included within cash and cash equivalents.

Therefore, the short term cash deposits of GBP10,150,000 have been

reclassified as financial assets.

The Consolidated cash flow statements

Short term cash deposits totalling GBP10,150,000 with initial

maturity of more than 3 months were incorrectly included within

cash and cash equivalents. Cash flows from investing activities

have therefore been corrected to reflect the movements in the short

term cash deposits instead of reflecting these in cash and cash

equivalents. Cash flows from rental income have been reclassified

as investing activities from operating activities. The

reclassification of these items has had no effect on the profit

before taxation or net assets.

The Consolidated statement of changes in equity

An omission of a transfer within the statement of changes in

equity in relation to the B shares that were issued, redeemed, and

subsequently cancelled has been corrected. The adjustment

recognises a transfer of GBP8,276,000 from retained earnings to the

capital redemption reserve as required by the Companies Act 2006

and has had no effect on the profit before taxation or net

assets.

13 General

These Condensed Consolidated Financial Statements have been

prepared in accordance with UK adopted International Accounting

Standards and are in conformity with the requirements of the

Companies Act 2006. They do not include all of the information

required for full annual statements and should be read in

conjunction with the 2022 Annual Report.

The comparative figures for the financial year 31 March 2021

have been extracted from the Group's statutory accounts for that

financial year. The statutory accounts for the year ended 31 March

2021 have been filed with the registrar of Companies. The auditor

reported on those accounts: their report was (i) unqualified, (ii)

did not include references to any matters to which the auditor drew

attention by way of emphasis without qualifying the reports and

(iii) did not contain statements under section 498(2) or (3) of the

Companies Act 2006.

The statutory accounts for the year ended 31 March 2022 were

approved by the Board of Directors on 4 July 2022 and will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting on 10 August 2022.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2022

or 2021 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GZGGNNDNGZZM

(END) Dow Jones Newswires

July 05, 2022 02:00 ET (06:00 GMT)

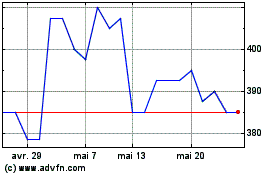

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024