Form 8.3 - DataCash Group Plc

22 Septembre 2010 - 2:18PM

UK Regulatory

TIDMDATA

RNS Number : 1250T

Hurlstone Limited

22 September 2010

FORM 8.3

PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY

A PERSON WITH INTERESTS IN RELEVANT SECURITIES REPRESENTING 1% OR MORE

Rule 8.3 of the Takeover Code (the "Code")

1. KEY INFORMATION

+--------------------+------------+

| (a) | Hurlstone |

| Identity | Limited |

| of the | |

| person | |

| whose | |

| positions/dealings | |

| are being | |

| disclosed: | |

+--------------------+------------+

| (b) | Amber |

| Owner | Nominees |

| or | Limited |

| controller | (Indirect |

| of | Interest) |

| interests | |

| and short | Ridgeway |

| positions | Associates |

| disclosed, | Limited |

| if | (Indirect |

| different | Interest) |

| from 1(a): | |

| The | |

| naming of | |

| nominee or | |

| vehicle | |

| companies | |

| is | |

| insufficient | |

+--------------------+------------+

| (c) | DataCash |

| Name | Group |

| of | plc |

| offeror/offeree | |

| in relation to | |

| whose relevant | |

| securities this | |

| form relates: | |

| Use a | |

| separate form | |

| for each | |

| offeror/offeree | |

+--------------------+------------+

| (d) If | |

| an | |

| exempt | |

| fund | |

| manager | |

| connected | |

| with an | |

| offeror/offeree, | |

| state this and | |

| specify identity | |

| of | |

| offeror/offeree: | |

+--------------------+------------+

| (e) | 21 |

| Date | September |

| position | 2010 |

| held/dealing | |

| undertaken: | |

+--------------------+------------+

| (f) | NO |

| Has | |

| the | |

| discloser | |

| previously | |

| disclosed, | |

| or are | |

| they today | |

| disclosing, | |

| under the | |

| Code in | |

| respect of | |

| any other | |

| party to | |

| this offer? | |

+--------------------+------------+

2. POSITIONS OF THE PERSON MAKING THE DISCLOSURE

(a) Interests and short positions in the relevant securities of the

offeror or offeree to which the disclosure relates following the dealing (if

any)

+----------------+------------+--------+--------+--------+

| Class | |

| of | |

| relevant | |

| security: | |

| | |

+----------------+---------------------------------------+

| | Interests |Short positions |

| | | |

+ +---------------------+-----------------+

| | Number | % |Number | % |

+----------------+------------+--------+--------+--------+

| (1) | | | | |

| Relevant | | | | |

| securities | | | | |

| owned | | | | |

| and/or | | | | |

| controlled: | | | | |

+----------------+------------+--------+--------+--------+

| (2) | | | | |

| Derivatives | | | | |

| (other than | | | | |

| options): | | | | |

+----------------+------------+--------+--------+--------+

| (3) |27,708,338 | 29.9 | | |

| Options | | | | |

| and | | | | |

| agreements | | | | |

| to | | | | |

| purchase/sell: | | | | |

+----------------+------------+--------+--------+--------+

| |27,708,338 | 29.9 | | |

| | | | | |

| TOTAL: | | | | |

+----------------+------------+--------+--------+--------+

All interests and all short positions should be disclosed.

Details of any open derivative or option positions, or agreements to purchase or

sell relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

(b) Rights to subscribe for new securities (including directors' and

other executive options)

+--------------+--------+

| Class | |

| of | |

| relevant | |

| security | |

| in | |

| relation | |

| to which | |

| subscription | |

| right | |

| exists: | |

+--------------+--------+

| Details, | |

| including | |

| nature of | |

| the | |

| rights | |

| concerned | |

| and | |

| relevant | |

| percentages: | |

+--------------+--------+

If there are positions or rights to subscribe to disclose in more than one class

of relevant securities of the offeror or offeree named in 1(c), copy table 2(a)

or (b) (as appropriate) for each additional class of relevant security.

3. DEALINGS (IF ANY) BY THE PERSON MAKING THE DISCLOSURE

(a) Purchases and sales

+----------+---------------+------------+--------+

| Class |Purchase/sale | Number | Price |

| of | | of | per |

|relevant | |securities | unit |

|security | | | |

+----------+---------------+------------+--------+

| | | | |

| | | | |

+----------+---------------+------------+--------+

(b) Derivatives transactions (other than options)

+----------+-------------+---------------------+------------+--------+

| Class | Product | Nature | Number | Price |

| of |description | of | of | per |

|relevant | e.g. CFD | dealing | reference | unit |

|security | | e.g. |securities | |

| | | opening/closing | | |

| | | a long/short | | |

| | | position, | | |

| | |increasing/reducing | | |

| | | a long/short | | |

| | | position | | |

+----------+-------------+---------------------+------------+--------+

| | | | | |

| | | | | |

+----------+-------------+---------------------+------------+--------+

(c) Options transactions in respect of existing securities

(i) Writing, selling, purchasing or varying

+----------+-------------+-------------+------------+----------+-----------+----------+----------+

| Class | Product | Writing, | Number |Exercise | Type | Expiry | Option |

| of |description |purchasing, | of | price | e.g. | date | money |

|relevant | e.g. call | selling, |securities |per unit |American, | | paid/ |

|security | option | varying | to which | | European | |received |

| | | etc. | option | | etc. | |per unit |

| | | | relates | | | | |

+----------+-------------+-------------+------------+----------+-----------+----------+----------+

| Ordinary | Call | Varying | 27,708,338 | GBP1.27 | | 31 | |

| Shares | Option | | | | | December | |

| of | | | | | | 2016 | |

| GBP0.01 | | | | | | | |

+----------+-------------+-------------+------------+----------+-----------+----------+----------+

(ii) Exercising

+----------+-------------+------------+----------+

| Class | Product | Number |Exercise |

| of |description | of | price |

|relevant | e.g. call |securities |per unit |

|security | option | | |

+----------+-------------+------------+----------+

| | | | |

| | | | |

+----------+-------------+------------+----------+

(d) Other dealings (including subscribing for new securities)

+----------+---------------+---------+-------------+

| Class | Nature |Details | Price |

| of | of | | per |

|relevant | dealing | | unit |

|security | e.g. | | (if |

| |subscription, | |applicable) |

| | conversion | | |

+----------+---------------+---------+-------------+

| | | | |

| | | | |

+----------+---------------+---------+-------------+

The currency of all prices and other monetary amounts should be stated.

Where there have been dealings in more than one class of relevant securities of

the offeror or offeree named in 1(c), copy table 3(a), (b), (c) or (d) (as

appropriate) for each additional class of relevant security dealt in.

4. OTHER INFORMATION

(a) Indemnity and other dealing arrangements

+--------------------+

| Details |

| of any |

| indemnity |

| or option |

| arrangement, |

| or any |

| agreement or |

| understanding, |

| formal or |

| informal, |

| relating to |

| relevant |

| securities |

| which may be |

| an inducement |

| to deal or |

| refrain from |

| dealing |

| entered into |

| by the person |

| making the |

| disclosure and |

| any party to |

| the offer or |

| any person |

| acting in |

| concert with a |

| party to the |

| offer: |

| If there are |

| no such |

| agreements, |

| arrangements |

| or |

| understandings, |

| state "none" |

+--------------------+

| |

| Hurlstone |

| Limited |

| and |

| Ridgeway |

| Associates |

| Limited |

| have given |

| an |

| irrevocable |

| undertaking |

| on the |

| terms set |

| out in |

| Appendix 3 |

| to the |

| Announcement |

| of a |

| Recommended |

| Cash |

| Acquisition |

| of DataCash |

| Group plc by |

| Mastercard/Europay |

| U.K. Limited and |

| dated 19 August |

| 2010. |

| |

+--------------------+

(b) Agreements, arrangements or understandings relating to options or

derivatives

+-----------------+

| Details |

| of any |

| agreement, |

| arrangement |

| or |

| understanding, |

| formal or |

| informal, |

| between the |

| person making |

| the disclosure |

| and any other |

| person |

| relating to: |

| (i) the |

| voting rights |

| of any |

| relevant |

| securities |

| under any |

| option; or |

| (ii) the |

| voting rights |

| or future |

| acquisition or |

| disposal of |

| any relevant |

| securities to |

| which any |

| derivative is |

| referenced: |

| If there are |

| no such |

| agreements, |

| arrangements |

| or |

| understandings, |

| state "none" |

+-----------------+

| |

| See |

| comment |

| in 4(a) |

| above. |

| |

| |

+-----------------+

(c) Attachments

+--------------+--------+

| Is a | YES |

| Supplemental | |

| Form 8 (Open | |

| Positions) | |

| attached? | |

+--------------+--------+

+-------------+------------------+

| Date | 22 |

| of | September |

| disclosure: | 2010 |

+-------------+------------------+

| Contact | Justin |

| name: | Stock, |

| | O'Melveny |

| | & Myers |

| | LLP |

+-------------+------------------+

| Telephone | +44 207 558 4864 |

| number: | |

+-------------+------------------+

Public disclosures under Rule 8 of the Code must be made to a Regulatory

Information Service and must also be emailed to the Takeover Panel at

monitoring@disclosure.org.uk. The Panel's Market Surveillance Unit is available

for consultation in relation to the Code's dealing disclosure requirements on

+44 (0)20 7638 0129.

The Code can be viewed on the Panel's website at www.thetakeoverpanel.org.uk.

SUPPLEMENTAL FORM 8 (OPEN POSITIONS)

DETAILS OF OPEN OPTION AND DERIVATIVE POSITIONS, AGREEMENTS TO PURCHASE OR SELL

ETC.

Note 5(i) on Rule 8 of the Takeover Code (the "Code")

1. KEY INFORMATION

+-----------------+------------+

| Identity | Hurlstone |

| of | Limited |

| person | |

| whose | Amber |

| open | Nominees |

| positions | Limited |

| are being | (Indirect |

| disclosed: | Interest) |

| | |

| | Ridgeway |

| | Associates |

| | Limited |

| | (Indirect |

| | Interest) |

| | |

+-----------------+------------+

| Name | DataCash |

| of | Group |

| offeror/offeree | plc |

| in relation to | |

| whose relevant | |

| securities the | |

| disclosure | |

| relates: | |

+-----------------+------------+

2. OPTIONS AND DERIVATIVES

+----------+-------------+-----------+------------+----------+-----------+----------+

| Class | Product | Written | Number |Exercise | Type | Expiry |

| of |description | or | of | price | e.g. | date |

|relevant | e.g. call |purchased |securities |per unit |American, | |

|security | option | | to which | | European | |

| | | | option or | | etc. | |

| | | |derivative | | | |

| | | | relates | | | |

+----------+-------------+-----------+------------+----------+-----------+----------+

| Ordinary | Call | Purchased | 27,708,338 | GBP1.27 | | 31 |

| Shares | option | | | | | December |

| of | | | | | | 2016 |

| GBP0.01 | | | | | | |

| each | | | | | | |

+----------+-------------+-----------+------------+----------+-----------+----------+

3. AGREEMENTS TO PURCHASE OR SELL ETC.

+--------------------------------------------------------------+

| Full details should be given so that the nature of the |

| interest or position can be fully understood: |

+--------------------------------------------------------------+

| On 5 May 2006, Ashley Head granted Hurlstone Limited an |

| option over such number of ordinary shares as is equal to |

| the lower of: (i) 29.9% of the Company's issued share |

| capital from time to time; and (ii) 82.5% of the Company's |

| shares held by Ashley Head, up to a fixed cap. Based on the |

| increase of the issued share capital of the Company from |

| 92,465,258 to 92,670,026, Hurlstone is now entitled to call |

| 27,708,338 Ordinary Shares, being 29.9% of the issued share |

| capital of the Company. |

| |

+--------------------------------------------------------------+

It is not necessary to provide details on a Supplemental Form (Open Positions)

with regard to contracts for differences ("CFDs") or spread bets.

The currency of all prices and other monetary amounts should be stated.

The Panel's Market Surveillance Unit is available for consultation in relation

to the Code's dealing disclosure requirements on +44 (0)20 7638 0129.

This information is provided by RNS

The company news service from the London Stock Exchange

END

RETBDGDCUBDBGGD

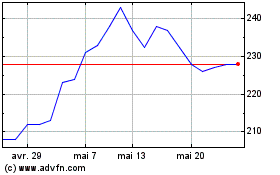

Globaldata (LSE:DATA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Globaldata (LSE:DATA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024