Diversified Energy Company PLC (LSE: DEC; NYSE: DEC)

(“

Diversified” or the "

Company"),

an independent energy company focused on natural gas and liquids

production, transportation, marketing and well retirement, today

announces the launch of an underwritten public offering (the

“

Offering”) in the United States of up to

8,500,000 ordinary shares (the “

Shares”).

Citigroup and Mizuho are acting as joint

book-running managers and underwriters for the proposed

Offering.

In addition, Diversified intends to grant the

underwriters an option to purchase up to an additional 850,000

ordinary shares at the public offering price, less underwriting

discount. The Offering is subject to market conditions and other

factors, and there can be no assurance as to whether or when the

Offering may be completed, or as to the actual size or terms of the

Offering.

The Company intends to use the net proceeds from

the Offering to repay a portion of the debt expected to be incurred

by the Company in connection with the proposed acquisition of

Maverick Natural Resources, LLC, as announced on January 27, 2025

(the “Acquisition”). In the event that the

Acquisition does not close, the Company intends to use the net

proceeds from the Offering to repay debt and for general corporate

purposes. The consummation of the Offering is not conditioned upon

the completion of the Acquisition, and the completion of the

Acquisition is not conditioned upon the consummation of the

Offering.

A shelf registration statement relating to these

securities was filed with the U.S. Securities and Exchange

Commission (the "SEC") on February 11, 2025 and

became effective upon filing. Copies of the registration statement

can be accessed through the SEC's website free of charge at

www.sec.gov. The Offering will be made only by means of a

prospectus supplement and an accompanying prospectus in the United

States. A preliminary prospectus supplement and the accompanying

prospectus related to the Offering will be filed with the SEC and

will be available free of charge by visiting EDGAR on the SEC’s

website at www.sec.gov. Copies of the preliminary prospectus

supplement and the accompanying prospectus can also be obtained,

when available, free of charge from either of the joint

book-running managers for the Offering: Citigroup, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717

(Tel: 800-831-9146); or Mizuho Securities USA LLC, Attention:

Equity Capital Markets Desk, at 1271 Avenue of the Americas, New

York, NY 10020, or by email at US-ECM@mizuhogroup.com.

This announcement does not constitute an offer

to sell or the solicitation of an offer to buy our ordinary shares

nor shall there be any sale of securities, and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of that

jurisdiction.

CONTACTS

|

Diversified Energy Company PLC |

+1 973 856 2757 |

| Doug Kris |

dkris@dgoc.com |

| Senior Vice President, Investor

Relations & Corporate Communications |

|

| |

|

| FTI

Consulting |

dec@fticonsulting.com |

| U.S. & UK Financial Media

Relations |

|

| |

|

About Diversified

Diversified is a leading publicly traded energy

company focused on natural gas and liquids production, transport,

marketing, and well retirement. Through our unique differentiated

strategy, we acquire existing, long-life assets and invest in them

to improve environmental and operational performance until retiring

those assets in a safe and environmentally secure manner.

Recognized by ratings agencies and organizations for our

sustainability leadership, this solutions-oriented, stewardship

approach makes Diversified the Right Company at the Right Time to

responsibly produce energy, deliver reliable free cash flow, and

generate shareholder value.

Forward-Looking Statements

This press release includes forward-looking

statements. Forward-looking statements are sometimes identified by

the use of forward-looking terminology such as "believe",

"expects", "targets", "may", "will", "could", "should", "shall",

"risk", "intends", "estimates", "aims", "plans", "predicts",

"continues", "assumes", “projects”, "positioned" or "anticipates"

or the negative thereof, other variations thereon or comparable

terminology. These forward-looking statements include all matters

that are not historical facts. They appear in a number of places

throughout this announcement and include statements regarding the

intentions, beliefs or current expectations of management or the

Company concerning, among other things, expectations regarding the

proposed Offering of securities and the Acquisition. These

forward-looking statements involve known and unknown risks and

uncertainties, many of which are beyond the Company's control and

all of which are based on management's current beliefs and

expectations about future events, including market conditions,

failure of customary closing conditions and the risk factors and

other matters set forth in the Company’s filings with the SEC and

other important factors that could cause actual results to differ

materially from those projected.

Important Notice to UK and EU

Investors

This announcement contains inside information

for the purposes of Regulation (EU) No. 596/2014 on market

abuse and the UK Version of Regulation (EU) No. 596/2014 on

market abuse, as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018 (together,

“MAR”). In addition, market soundings (as defined

in MAR) were taken in respect of the matters contained in this

announcement, with the result that certain persons became aware of

such inside information as permitted by MAR. Upon the publication

of this announcement, the inside information is now considered to

be in the public domain and such persons shall therefore cease to

be in possession of inside information in relation to the Company

and its securities.

Members of the public are not eligible to take

part in the Offering. This announcement is directed at and is only

being distributed to persons: (a) if in member states of the

European Economic Area, "qualified investors" within the meaning of

Article 2(e) of Regulation (EU) 2017/1129 (the "Prospectus

Regulation") ("Qualified Investors"); or

(b) if in the United Kingdom, “qualified investors” within the

meaning of Article 2(e) of the UK version of Regulation (EU)

2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018, who are (i) persons who fall within

the definition of "investment professionals" in Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005, as amended (the "Order"), or (ii)

persons who fall within Article 49(2)(a) to (d) of the Order; or

(c) persons to whom they may otherwise lawfully be communicated

(each such person above, a "Relevant Person"). No

other person should act or rely on this announcement and persons

distributing this announcement must satisfy themselves that it is

lawful to do so. This announcement must not be acted on or relied

on by persons who are not Relevant Persons, if in the United

Kingdom, or Qualified Investors, if in a member state of the EEA.

Any investment or investment activity to which this announcement or

the Offering relates is available only to Relevant Persons, if in

the United Kingdom, and Qualified Investors, if in a member state

of the EEA, and will be engaged in only with Relevant Persons, if

in the United Kingdom, and Qualified Investors, if in a member

state of the EEA.

No offering document or prospectus will be

available in any jurisdiction in connection with the matters

contained or referred to in this announcement in the United Kingdom

and no such offering document or prospectus is required (in

accordance with the Prospectus Regulation or UK Prospectus

Regulation) to be published. The Company will publish a prospectus

in connection with Admission as required under the UK Prospectus

Regulation in due course.

Neither the content of the Company's website (or

any other website) nor the content of any website accessible from

hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

The Company has consulted with a number of

existing shareholders and other investors ahead of the release of

this announcement, including regarding the rationale for the

offering. Consistent with each of its prior offerings, the Company

will respect the principles of pre-emption, so far as is possible,

through the allocation process, in the Offering.

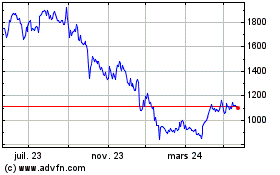

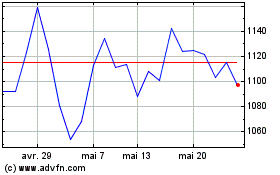

Diversified Energy (LSE:DEC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Diversified Energy (LSE:DEC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025