Diversified Energy Company PLC (LSE: DEC; NYSE: DEC)

(“

Diversified” or the "

Company"),

an independent energy company focused on natural gas and liquids

production, transportation, marketing and well retirement, today

announces the pricing of its previously announced underwritten

public offering (the “

Offering”) of 8,500,000

ordinary shares (the “

Shares”) at a public

offering price of $14.50 per Share for total gross proceeds of

approximately $123.3 million. The Offering is expected to settle on

February 21, 2025, subject to customary closing conditions. In

addition, Diversified has granted the underwriters a 30-day option

to purchase up to an additional 850,000 ordinary shares at the

public offering price, less underwriting discount.

Citigroup and Mizuho are acting as joint

book-running managers and underwriters for the Offering. KeyBanc

Capital Markets, Truist Securities, Jefferies and Raymond James are

also acting as joint book-running managers and underwriters for the

Offering. Johnson Rice & Company, Pickering Energy Partners,

Stephens Inc. and Stifel are acting as co-managers and underwriters

for the Offering.

The Company intends to use the net proceeds from

the Offering to repay a portion of the debt expected to be incurred

by the Company in connection with the proposed acquisition of

Maverick Natural Resources, LLC, as announced on January 27, 2025

(the “Acquisition”). In the event that the

Acquisition does not close, the Company intends to use the net

proceeds from the Offering to repay debt and for general corporate

purposes. The consummation of the Offering is not conditioned upon

the completion of the Acquisition, and the completion of the

Acquisition is not conditioned upon the consummation of the

Offering.

A shelf registration statement relating to these

securities was filed with the U.S. Securities and Exchange

Commission (the "SEC") on February 11, 2025 and

became effective upon filing. Copies of the registration statement

can be accessed through the SEC's website free of charge at

www.sec.gov. A preliminary prospectus supplement and an

accompanying prospectus relating to and describing the terms of the

Offering were filed with the SEC and are available free of charge

by visiting EDGAR on the SEC's website at www.sec.gov. When

available, copies of the final prospectus supplement and the

accompanying prospectus related to the Offering can be accessed

through the SEC's website free of charge at www.sec.gov or obtained

free of charge from either of the joint book-running managers for

the Offering: Citigroup, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717 (Tel: 800-831-9146); or

Mizuho Securities USA LLC, Attention: Equity Capital Markets Desk,

at 1271 Avenue of the Americas, New York, NY 10020, or by email at

US-ECM@mizuhogroup.com.

This announcement does not constitute an offer

to sell or the solicitation of an offer to buy our ordinary shares

nor shall there be any sale of securities, and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of that

jurisdiction.

In connection with the admission of the Shares

to listing on the equity shares (commercial companies) category of

the Official List of the Financial Conduct Authority and to trading

on the main market for listed securities of the London Stock

Exchange (“Admission”), the Company intends to

publish a prospectus as required under the UK version of Regulation

(EU) 2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018. Applications will be made to the FCA

and LSE for Admission, and Admission is expected to become

effective at 8:00 am (London time) on February 24, 2025.

Post Transaction Report

In accordance with the Statement of Principles

(November 2022) published by the Pre-Emption

Group, Diversified announces the following post transaction

report in connection with the Offering.

|

Name of Issuer |

Diversified Energy Company PLC |

|

Transaction Details |

The Company issued 8,500,000 new Ordinary Shares (the

“Shares”), representing 16.6% of the Company's

ordinary share capital as of 14 February 2025.Admission of the

Shares representing 16.6% of the Company's ordinary share capital

as of 14 February 2024 is expected to occur at 8.00

am (London time) on 24 February 2024. |

|

Use of Proceeds |

The directors of the Company intend to use the net proceeds from

the Offering to repay a portion of the debt expected to be incurred

by the Company in connection with the proposed acquisition of

Maverick Natural Resources, LLC, as announced on 27 January 2025

(the “Acquisition”). In the event that the

Acquisition does not close, the Company intends to use the net

proceeds from the Offering to repay debt and for general corporate

purposes. |

|

Quantum of Proceeds |

Total gross proceeds from the Offering, amounted to US$123.3

million (approximately £97.9 million), approximately

US$118.3 million net of expenses (approximately £93.9

million net of expenses). |

|

Discount |

The Offering was completed at a price of US$14.50 per Share,

representing a 3.4% percent discount from the NYSE closing price of

US$15.01 per Share on 19 February 2025 (being the last business day

prior to the pricing of the Offering). |

|

Allocations |

Soft pre-emption has been adhered to in the allocations process,

where possible. Management was involved in the allocations process,

which has been carried out in compliance with the MIFID II

Allocation requirements. |

|

Consultation |

The Underwriters undertook a pre-launch wall-crossing process,

including consultation with major shareholders, to the extent

reasonably practicable and permitted by law. |

|

U.K. Retail Investors |

Following discussions between the Underwriters and the Company, it

was decided that a retail offer would not be included in the

Offering. The Offering structure was chosen to minimize cost, time

to completion and complexity. |

CONTACTS

|

Diversified Energy Company PLC |

+1 973 856 2757 |

| Doug Kris |

dkris@dgoc.com |

| Senior Vice President, Investor

Relations & Corporate Communications |

|

| |

|

| FTI

Consulting |

dec@fticonsulting.com |

| U.S. & UK Financial Media

Relations |

|

About Diversified

Diversified is a leading publicly traded energy

company focused on natural gas and liquids production, transport,

marketing, and well retirement. Through our unique differentiated

strategy, we acquire existing, long-life assets and invest in them

to improve environmental and operational performance until retiring

those assets in a safe and environmentally secure manner.

Recognized by ratings agencies and organizations for our

sustainability leadership, this solutions-oriented, stewardship

approach makes Diversified the Right Company at the Right Time to

responsibly produce energy, deliver reliable free cash flow, and

generate shareholder value.

Forward-Looking Statements

This press release includes forward-looking

statements. Forward-looking statements are sometimes identified by

the use of forward-looking terminology such as "believe",

"expects", "targets", "may", "will", "could", "should", "shall",

"risk", "intends", "estimates", "aims", "plans", "predicts",

"continues", "assumes", “projects”, "positioned" or "anticipates"

or the negative thereof, other variations thereon or comparable

terminology. These forward-looking statements include all matters

that are not historical facts. They appear in a number of places

throughout this announcement and include statements regarding the

intentions, beliefs or current expectations of management or the

Company concerning, among other things, expectations regarding the

proposed Offering of securities and the Acquisition. These

forward-looking statements involve known and unknown risks and

uncertainties, many of which are beyond the Company's control and

all of which are based on management's current beliefs and

expectations about future events, including market conditions,

failure of customary closing conditions and the risk factors and

other matters set forth in the Company’s filings with the SEC and

other important factors that could cause actual results to differ

materially from those projected.

Important Notice to UK and EU

Investors

This announcement contains inside information

for the purposes of Regulation (EU) No. 596/2014 on market

abuse and the UK Version of Regulation (EU) No. 596/2014 on

market abuse, as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018 (together,

“MAR”). In addition, market soundings (as defined

in MAR) were taken in respect of the matters contained in this

announcement, with the result that certain persons became aware of

such inside information as permitted by MAR. Upon the publication

of this announcement, the inside information is now considered to

be in the public domain and such persons shall therefore cease to

be in possession of inside information in relation to the Company

and its securities.

Members of the public are not eligible to take

part in the Offering. This announcement is directed at and is only

being distributed to persons: (a) if in member states of the

European Economic Area, "qualified investors" within the meaning of

Article 2(e) of Regulation (EU) 2017/1129 (the "Prospectus

Regulation") ("Qualified Investors"); or

(b) if in the United Kingdom, “qualified investors” within the

meaning of Article 2(e) of the UK version of Regulation (EU)

2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018, who are (i) persons who fall within

the definition of "investment professionals" in Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005, as amended (the "Order"), or (ii)

persons who fall within Article 49(2)(a) to (d) of the Order; or

(c) persons to whom they may otherwise lawfully be communicated

(each such person above, a "Relevant Person"). No

other person should act or rely on this announcement and persons

distributing this announcement must satisfy themselves that it is

lawful to do so. This announcement must not be acted on or relied

on by persons who are not Relevant Persons, if in the United

Kingdom, or Qualified Investors, if in a member state of the EEA.

Any investment or investment activity to which this announcement or

the Offering relates is available only to Relevant Persons, if in

the United Kingdom, and Qualified Investors, if in a member state

of the EEA, and will be engaged in only with Relevant Persons, if

in the United Kingdom, and Qualified Investors, if in a member

state of the EEA.

No offering document or prospectus will be

available in any jurisdiction in connection with the matters

contained or referred to in this announcement in the United Kingdom

and no such offering document or prospectus is required (in

accordance with the Prospectus Regulation or UK Prospectus

Regulation) to be published. The Company will publish a prospectus

in connection with Admission as required under the UK Prospectus

Regulation in due course.

Neither the content of the Company's website (or

any other website) nor the content of any website accessible from

hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

The Company has consulted with a number of

existing shareholders and other investors ahead of the release of

this announcement, including regarding the rationale for the

offering. Consistent with each of its prior offerings, the Company

will respect the principles of pre-emption, so far as is possible,

through the allocation process, in the Offering.

In connection with the Offering, Citigroup or

any of its agents, may (but will be under no obligation to), to the

extent permitted by applicable law, over-allot Shares or effect

other transactions with a view to supporting the market price of

the Shares at a higher level than that which might otherwise

prevail in the open market. Citigroup may, for stabilization

purposes, over-allot Shares up to a maximum of 10 per cent. of the

total number of Shares comprised in the Offering. Citigroup will

not be required to enter into such transactions and such

transactions may be effected on any stock market, over-the-counter

market, stock exchange or otherwise and may be undertaken at any

time during the period commencing on the date of adequate public

disclosure of the final price of the securities and ending no later

than 30 calendar days thereafter. However, there will be no

obligation on Citigroup or any of its agents to effect stabilizing

transactions and there is no assurance that stabilizing

transactions will be undertaken. Such stabilizing measures, if

commenced, may be discontinued at any time without prior notice. In

no event will measures be taken to stabilize the market price of

the Shares above the offer price. Save as required by law or

regulation, neither Citigroup nor any of its agents intends to

disclose the extent of any over-allotments made and/or

stabilization transactions conducted in relation to the

Offering.

Citigroup and Mizuho are acting exclusively for

the Company and no one else in connection with the Offering and

will not regard any other person as their respective clients in

relation to the Offering and will not be responsible to anyone

other than the Company for providing the protections afforded to

their respective clients or for giving advice in relation to the

Offering or the contents of this announcement or any transaction,

arrangement or other matter referred to herein.

In connection with the Offering, Citigroup and

Mizuho or any of their respective affiliates, acting as investors

for their own accounts, may subscribe for or purchase Shares and in

that capacity may retain, purchase, sell, offer to sell or

otherwise deal for their own accounts in such Shares and other

securities of the Company or related investments in connection with

the Offering or otherwise. Accordingly, references in the US

prospectus, once published, to the Shares being issued, offered,

subscribed, acquired, placed or otherwise dealt in should be read

as including any issue or offer to, or subscription, acquisition,

placing or dealing by, Citigroup and Mizuho or any of their

respective affiliates acting as investors for their own accounts.

Citigroup and Mizuho or any of their respective affiliates do not

intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligations to do so.

Neither Citigroup nor Mizuho, nor any of their

respective subsidiary undertakings, affiliates or any of their

respective directors, officers, employees, advisers, agents or any

other person accepts any responsibility or liability whatsoever

for, or makes any representation or warranty, express or implied,

as to the truth, accuracy, completeness or fairness of the

information or opinions in this announcement (or whether any

information has been omitted from the announcement) or any other

information relating to the Company, its subsidiaries or associated

companies, whether written, oral or in a visual or electronic form,

and howsoever transmitted or made available or for any loss

howsoever arising from any use of this announcement or its contents

or otherwise arising in connection therewith.

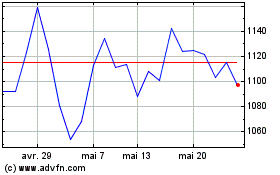

Diversified Energy (LSE:DEC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

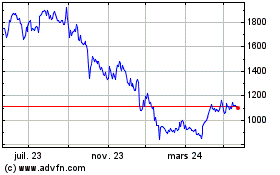

Diversified Energy (LSE:DEC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025