Experian: Americans Are Embracing Gen AI to Make Smart Money Moves

31 Octobre 2024 - 11:00AM

Business Wire

New Experian research shows consumers are

turning to tech for smarter budgeting, investing and credit score

improvement

New Experian® research released today highlights a strong

interest among U.S. consumers in using generative AI for personal

financial management. The global technology and data company

surveyed consumers across the country to understand current

perceptions about generative AI and how frequently Americans are

tapping into the technology to manage their personal finances.

Key findings

- According to the research,1 63% of consumers are familiar with

generative AI, including 84% of Gen Zers and 79% of millennials,

and one-in-three say they’re using it to learn about a new topic or

finances.

- Nearly half (47%) have or are considering using generative

AI-powered tools to help with managing their personal finances — a

sentiment that rings especially true for America’s youngest

consumers, with 67% of Gen Zers and 62% of millennials stating they

use the technology to manage their personal finances.

- Notably, among those who have used generative AI for personal

financial management, an impressive 96% reported positive

experiences and 77% stated they use generative AI for personal

financial tasks at least once a week.

Why Gen AI?

In looking at why consumers are turning to generative AI for

personal financial management, 67% said it helps them feel more

productive or make decisions faster, and 38% stated they trust

generative AI as much or more than human advisors.

Consumers said generative AI is most helpful for the following

areas of their financial life:

- Saving and budgeting (60%)

- Investment planning (48%)

- Credit score improvement (48%)

“We know consumers are hungry for information and resources to

improve credit scores and overall financial health,” said Christina

Roman, Consumer Education and Advocacy Manager at Experian. “As we

look ahead, we believe the responsible use of AI can help create

new opportunities for consumers looking to improve their financial

literacy and overall financial health.”

Experian’s tech tips for generative AI users

For consumers currently leveraging, or who are considering

leveraging, generative AI to learn about or manage their finances

or credit scores, Experian’s consumer education and generative AI

experts recommend the following:

- Don’t forget the basics: While there’s no question

generative AI can be a helpful tool for managing your finances,

consumers shouldn’t lose sight of the “old school” ways to protect

their financial health and credit standing. This includes checking

your credit report and scores regularly. You can get a free copy of

your Experian credit report and FICO® Score2 updated daily at

www.experian.com or via Experian’s free mobile app. Consumers can

also get a free credit report from each of the three credit

reporting agencies once a week at www.annualcreditreport.com.

- Verify your findings: Generative AI tools are only as

good as the information they consume and there’s no shortage of

misinformation about managing your credit scores and finances that

exists online. Always cross-check AI-generated financial advice

with reputable sources. You can find answers to many personal

finance and credit-building questions on Ask Experian — Experian’s

free credit advice blog.

- Be safe and use generative AI responsibly. Many of the

generative AI tools that exist today collect and store user data.

Be mindful of the personal information you share with generative AI

tools to ensure your information is protected.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realise their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

_________________ 1 Experian commissioned Atomik Research to

conduct an online survey of 2,011 adults throughout the United

States. The margin of error is +/- 2 percentage points with a

confidence level of 95 percent. Fieldwork took place between August

30 and September 3, 2024. 2 Credit score calculated based on FICO

Score 8 model. Your lender or insurer may use a different FICO®

Score than FICO® Score 8, or another type of credit score

altogether. Learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031890350/en/

Amanda Garofalo Experian Public Relations 1 714 460 3739

amanda.garofalo@experian.com

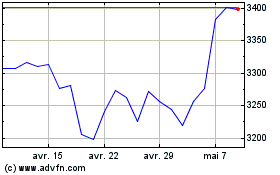

Experian (LSE:EXPN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Experian (LSE:EXPN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024