TIDMFEN

RNS Number : 6728A

Frenkel Topping Group PLC

24 January 2024

The information contained within this announcement was deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 as amended. With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

Frenkel Topping Group plc

("Frenkel Topping", the "Company" or the "Group")

Trading Update for the year ended 31 December 2023

&

New Debt Facility

Frenkel Topping (AIM: FEN), a specialist financial and

professional services firm operating within the personal injury and

clinical negligence marketplace, provides the following trading

update for the financial year ended 31 December 2023 ("FY2023") and

an outlook for the current financial year ("FY2024").

-- Revenue increased by 32% in FY2023, driven by acquisition and organic growth

-- In light of the challenging market conditions during the

year, revenue is expected to be GBP32.8m in FY2023 and adjusted

EBITDA is expected to be GBP8.0m*

-- Assets Under Management (AUM) up 12% to GBP1,335m (2022: GBP1,187m)

-- Assets on a discretionary mandate up 15% to GBP820m (2022: GBP715m)

-- New Money Market Solution launched in June 2023 attracting investment of GBP39m

-- Acquisition strategy continues to deliver with non-recurring revenue up in excess of 50%

-- Two new Major Trauma Centres and three Working-in-Partnership JVs added during the year

-- Cash generation from operations continues to improve, up over 150% from 2022

-- The Company had GBP2.4m of net cash at the year end

-- Client retention rate remains high at 99%

-- FY2024 has started strongly with a number of AUM opportunities in the pipeline

-- Post period end the Company has signed a new GBP7.5m Revolving Credit Facility with Santander

Richard Fraser, Chief Executive Officer of Frenkel Topping Group

plc, said:

"Volatile market conditions have seen clients channelling funds

into high interest savings accounts and led to a general reluctance

to invest in equities which unsurprisingly has meant high margin

recurring revenue being impacted, with a consequential impact on

both revenue and EBITDA for FY2023 being slightly below

expectations by c6-7%.

However, we have grown our AUM, in no small part thanks to

Ascencia, which has again beaten its benchmark and shown agility in

launching the new Money Market Solution in response to market

dynamics and client demand and overall demonstrated resilience in a

challenging environment.

We are seeing the benefits of our acquisition strategy coming to

fruition. We continue our focus on data and are seeing the growth

in transactional revenue channelling into future growth

opportunities in AUM.

We continue to be optimistic about our long-term goal to grow to

15% market share in each of our business units. "

Non-recurring revenue

The strong growth of 50% in non-recurring revenue has been very

pleasing, demonstrating the success of the Company's acquisition

strategy over recent years, and with a better than expected gross

margin profile, especially for Bidwell Henderson and Forths.

Forth Associates Ltd (acquired 2020) and Bidwell Henderson

(acquired 2021) closed the year with record numbers of active

files. Meanwhile Somek & Associates (acquired 2022) has grown

their number of expert witnesses by 19% during the year which

further increases capacity to accept new instructions. The

onboarding of expert witnesses remains a key area of focus for 2024

and we expect to achieve similar levels of growth throughout the

year ahead.

Recurring Revenue

It is reassuring that our recurring revenue has continued to

grow, and that the year-end AUM has increased. However, growth in

AUM was moderately impacted by market conditions, which remained

challenging and the Company has not been entirely immune from

it.

The performance of our discretionary fund management business

Ascencia Investment Management has again been strong. With global

economic uncertainty, Ascencia's conservative multi-asset

investment approach continues to deliver a smoother client

investment experience and has continued to outperform its key

benchmarks.

High interest rates have meant many potential new Court of

Protection clients were inclined to hold funds within the

Government's Court Funds Office accounts rather than to invest. In

June 2023 and in response to this, Ascencia launched a 'Money

Market Solution' which provides clients with an investment solution

that benefits from the higher interest rate environment. This

product, assisted by the hard work and tenacity of our sales team,

has attracted investment from both new and existing clients with

GBP39m of assets added by the year end. Whilst funds in this Money

Market Solution' product do earn a lower fee than those invested in

our other investment solutions, which has moderately impacted the

overall full year outturn, we are confident that they will be

redeployed to higher fee products across our proposition as

financial markets turn.

Outlook

The Company continues to deliver on its growth strategy, in

particular the transactional businesses are thriving, a clear

indicator that the Group is adding value through its acquisition

strategy. We remain committed to continuing our acquisition path

and are advancing further opportunities.

For the recurring revenue businesses, the market backdrop

continues to be uncertain. The success of the Money Market Solution

means that funds are waiting to be deployed into higher yield

funds, however the timing is unclear and prudently we anticipate a

similar impact on this current financial year from this headwind

and revise our expectations accordingly.

January 2024 has been positive with a strong pipeline of new AUM

opportunities being pursued which provides confidence for the start

of the new financial year.

We remain focused on our strategic course and the Board's view

on the longer term is unchanged notwithstanding the tough market

conditions which are impacting AUM and our recurring revenues. The

growth strategy continues to mature, and we are seeing an increase

in opportunities across the Group. Consequently, we are confident

that we can continue to deliver growth in shareholder value in the

years ahead.

New Debt Facility

The Company is pleased to have entered into a GBP7.5m revolving

credit facility (RCF) at 2.95% over SONIA with high street lender

Santander on standard commercial terms to support its growth and

acquisition strategy.

* The financial expectations noted above are preliminary, and

subject to year-end financial close and audit review processes.

Adj. EBITDA defined as before share based compensation, M&A

strategy and re-organisation costs.

For further information:

Frenkel Topping Group plc www.frenkeltoppinggroup.co.uk

Richard Fraser, Chief Executive Officer Tel: 0161 886 8000

Cavendish Capital Markets Ltd (Nominated Tel: 020 7220 0500

Advisor & Broker)

Carl Holmes/Abigail Kelly/Fergus Sullivan

(Corporate Finance)

Tim Redfern (ECM)

About Frenkel Topping Group

The Frenkel Topping Group of companies specialises in providing

financial advice and asset protection services to clients at times

of financial vulnerability, with particular expertise in the field

of personal injury (PI) and clinical negligence (CN).

For more than 30 years the Group has worked with legal

professionals and injured clients themselves to provide

pre-settlement, at-settlement and post-settlement services to help

achieve the best long-term outcomes for clients after injury. It

boasts a client retention rate of 99%.

Frenkel Topping Group is focused on consolidating the fragmented

PI and CN space in order to provide the most comprehensive suite of

services to clients and deliver a best-in-class service offering

from immediately after injury or illness and for the rest of their

lives.

The Group's services include the Major Trauma Signposting

Partnership service inside NHS Major Trauma Centres, expert

witness, costs, tax and forensic accountancy, independent financial

advice, investment management, and care and case management.

The Group's discretionary fund manager, Ascencia, manages

financial portfolios for clients in unique circumstances, often who

have received a financial settlement after litigation. In recent

years Ascencia has diversified its portfolios to include a

Sharia-law-compliant portfolio and a number of ESG portfolios in

response to increased interest in socially responsible investing

(SRI).

Frenkel Topping has earned a reputation for commercial

astuteness underpinned by a strong moral obligation to its clients,

employees and wider society, with a continued focus on its

Environmental, Social and Governance (ESG) impact.

For more information visit: www.frenkeltoppinggroup.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEEFWDELSEEF

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

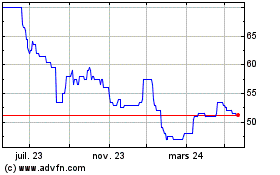

Frenkel Topping (LSE:FEN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

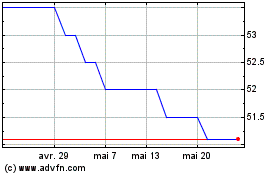

Frenkel Topping (LSE:FEN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024