TIDMFSF

RNS Number : 3684G

Foresight Sustain. Forestry Co PLC

15 November 2022

15 November 2022

Foresight Sustainable Forestry Company Plc

("FSF" or "the Company")

30 September 2022 Net Asset Value ("NAV") and Notice of Full

Year Results

Foresight Sustainable Forestry Company Plc, an investment

company that invests in UK forestry and afforestation assets,

announces that as at 30 September 2022 its unaudited NAV was

GBP180.6 million (31 March 2022: GBP135.5 million), resulting in a

NAV per Ordinary Share of 105.0 pence, up 0.8 pence from 104.2

pence as at 31 March 2022. The Company also announces the

publication date of its audited Full Year Results for the period to

30 September 2022.

Highlights

- NAV per Share over the full period increased to 105.0 pence, a total

NAV return since IPO of 5.0%.

- Overall NAV increase of GBP50.6 million between IPO and 30 September

2022, a material proportion of which was due to the successful GBP45

million equity raise in June 2022

- Total fixed asset portfolio valuation increase of GBP12.1 million

(up 9.1%) from inception to 30 September 2022

- Voluntary carbon credits recognised within valuations for the first

time, resulting in a GBP0.6 million increase in the value of the portfolio

from two planted afforestation assets

NAV Update

In aggregate, the Company's NAV increased by GBP50.6 million

between IPO on 24 November 2021 and 30 September 2022. This was due

to FSF's successful GBP45 million equity raise in June 2022, 16

acquisition transactions, increases in portfolio valuations and,

for the first time, the recognition of voluntary carbon credits in

valuations.

The NAV per share increase in the six-month period to 30

September 2022 has been impacted by transaction costs from the high

volume of afforestation acquisitions, the commencement of

development activities on multiple afforestation properties, and

costs related to securing new equity and debt capital. The benefits

of investing in development projects and increasing the Company's

available capital base for deployment are becoming apparent in the

very strong valuation uplifts delivered by the first two

afforestation assets where planting has been completed. Successful

afforestation development and the securing of the related voluntary

carbon credits is a core part of the Company's business model and

the value recognition received on the first two afforestation

properties validates this strategy.

Summary of NAV key drivers from 31 March 2022 to 30 September

2022:

Item p/share

movement

NAV at 31 March 2022 104.2

----------

Equity increase (share issue) 0.3

----------

Operational expenditure (0.8)

----------

Acquisitions & due diligence (0.7)

----------

Afforestation & restock (0.4)

----------

Forest operational costs (0.1)

----------

Portfolio revaluation 2.1

----------

Voluntary carbon credit valuation 0.4

----------

NAV at 30 September 2022 105.0

----------

Portfolio Valuations

Within the total portfolio, the property revaluation delivered a

gain of GBP12.1 million (up 9.1%) from IPO to 30 September 2022.

Following this increase, FSF's split of afforestation properties

(by value) now stands at 41% of the total portfolio. The remaining

59% of the portfolio by value is split between established forestry

assets (56%) and non-core assets (3%).

During the period, the largest property valuation increases were

from two planted afforestation properties, Mountmill Burn and Banc

Farm. Of the combined GBP2.6 million uplift since acquisition, an

increase of 89%, GBP0.6 million was the result of 36,000 voluntary

carbon credits being recognised in the valuations. These properties

demonstrate the capital appreciation potential of afforestation

sites once development milestones are met. The Company has a

further 25 afforestation properties as part of a series of

development activities which is estimated to see 6.4 million trees

planted over 2023 and 2024, and the creation of approximately

800,000 voluntary carbon credits, after the verifier's 20% buffer

has been catered for to ensure that the number of units offset or

traded is conservative versus the estimated carbon actually

sequestered. Afforestation properties remain the engine room of

performance and the Company is looking to increase the portfolio

allocation to this asset type in the coming year.

Afforestation properties also bring significant Sustainability

and ESG ("S & ESG") benefits. For example, FSF's Banc Farm

afforestation scheme saw 229,320 trees planted, 75% of which were

conifers that are forecast to deliver 48,153 tonnes of sustainable

timber production for each c.35-year rotation. 25% of trees planted

were non-commercial broadleaves and includes 350 Black Poplar trees

which are recognised by the Forestry Commission as one of the UK's

rarest native species. FSF's planting is expected to increase the

total UK population of this tree species by approximately 5%. The

rare and endangered tree planting at the property also includes

1,500 Holm Oak and 300 Juniper trees, both of which are on the

International Union for Conservation of Nature's 'Red List'. As a

result of this, using DEFRA's Biodiversity Metric 3.0, the scheme

will improve the property's baseline biodiversity habitat unit

value by 60%. Finally, the scheme will see the introduction of

mountain biking trails, the construction of a car park for visitors

and the creation of 25-30 jobs for the local community during the

first year from planting commencing. Whilst each scheme is

different and tailored to the specific site and region in question,

the potential for these types of benefits is explored during the

design process across all of FSF's afforestation portfolio.

FSF will release the inaugural standalone S & ESG report in

February 2023 and it will act as a supplement to the information

presented in the Full-year Annual Report. The Company will detail

several achievements since IPO and is particularly looking forward

to sharing information regarding its Forestry Skills Training

Programme.

As a result of mark-to-market gains, afforestation properties

acquired since 31 March 2022 saw gains of GBP1.0 million, a 6.6%

increase. The uplifts demonstrate the value of the Company's

proprietary direct origination campaign. Afforestation properties

in the portfolio that continued to be developed but which have not

yet reached development milestones remained stable in their

valuations.

Standing forestry properties delivered gains of GBP1.2 million,

a 1.6% gain from acquisition to 30 September 2022. Valuations for

established forest properties have remained comparatively stable,

in line with the timber market and the softening timber prices seen

in the second half of the reporting period.

Mixed forestry and afforestation properties, a category

dominated by Fordie Estate, delivered a 17.4% gain from acquisition

to 30 September 2022, a GBP2.2m of uplift. The development project

at Fordie, which includes an afforestation scheme of material

scale, continues to progress well.

Valuations were performed on a property-by-property basis by an

independent third-party in accordance with the Royal Institute of

Chartered Surveyors (RICS) Red Book Fair Value methodology.

Notice of Results

FSF will publish its Full Results for the period to 30 September

2022 on Wednesday, 14 December 2022.

The Company will host a virtual SparkLive presentation at 9:00

a.m. (UK time) on Wednesday, 14 December 2022. To register your

interest in attending the presentation, please register at:

https://www.lsegissuerservices.com/spark/FORESIGHTSUSTAINABLEFORESTRYCOMPANY/events/b6793ad3-27a1-498e-9859-4e2282c53d6b

Richard Davidson, Chair of Foresight Sustainable Forestry

Company, commented:

"Foresight Sustainable Forestry continues to apply its

investment strategy diligently and the NAV uplift announced

demonstrates the success of the Company's approach. It is

particularly pleasing to see voluntary carbon credits recognised

for the first time as a source of additional value to our

properties and the Company will continue to generate these as we

develop our afforestation properties. The recent launch of the

London Stock Exchange Voluntary Carbon Market is further evidence

of growing demand for these credits and the need for a

sophisticated market in which to trade them. We have an exciting

series of afforestation development opportunities within the

portfolio, and Mountmill Burn and Banc Farm have clearly

demonstrated the benefits of a well executed development plan. In

just under a year since listing on the LSE, FSF has achieved a huge

amount and established a strong platform for further growth."

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5%, the Company provides investors

with the opportunity for real returns and capital appreciation

driven by the prevailing global imbalance between supply and demand

for timber; the inflation-protection qualities of UK land

freeholds; and biological tree growth of 3% to 4% not correlated to

financial markets. It also offers outstanding sustainability and

ESG attributes and access to carbon units related to carbon

sequestration from new afforestation planting. The Company targets

value creation as the afforestation projects successfully achieve

development milestones in the process of converting open ground

into established commercial forest and woodland areas. The Company

is seeking to make a direct contribution in the fight against

climate change through forestry and afforestation carbon

sequestration initiatives and to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

managed by Foresight Group LLP.

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

Email: fsfc@foresightgroup.eu +44 20 3667 8100

Website: https://fsfc.foresightgroup.eu/

Jefferies International Limited

Neil Winward

Will Soutar +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore ( toby.moore@citigatedewerogerson.com

) +44 7768 981763

This announcement does not constitute, and may not be construed

as, an offer to sell or an invitation to purchase investments of

any description, or the provision of investment advice by any

party. No information set out in this announcement is intended to

form the basis of any contract of sale, investment decision or any

decision to purchase securities in the Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will", "targeting" or

"should" or, in each case, their negative or other variations or

comparable terminology. All statements other than statements of

historical facts included in this announcement, including, without

limitation, those regarding the Company's financial position,

strategy, plans, proposed acquisitions and objectives, are

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBKQBBFBDDFDD

(END) Dow Jones Newswires

November 15, 2022 02:00 ET (07:00 GMT)

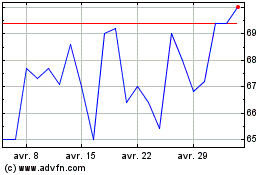

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024