TIDMFSF

Foresight Sustain. Forestry Co PLC

14 June 2023

Foresight Sustainable Forestry (FSF)

14/06/2023

Results analysis from Kepler Trust Intelligence

-- Foresight Sustainable Forestry (FSF) has reported its results

for the six months ending 31/03/2023. Despite numerous

macroeconomic headwinds, the trust proved resilient, with its net

asset value (NAV) increasing from GBP180.6m to 186.6m. The trust's

shares also rose by 1.9% over the period.

-- The increase in NAV was mainly driven by revaluations of the

trust's afforestation sites - plots of land that are converted into

forestry. Completion of planting at four sites that had been

acquired by the trust was a key driver of returns. This provides

validation of the argument managers Robert Guest and Richard Kelly

of Foresight Group have made since IPO in November 2021, namely

that converting plots of land into forestry should prove accretive

to NAV.

-- In December, FSF also became the first investment company to

receive the Voluntary Carbon Market designation from the London

Stock Exchange. The VCM accreditation shows that FSF's carbon

credits are subject to high quality oversight and verification.

FSF's Board plan to allow shareholders the choice to either receive

carbon credits from 2030 onwards as in specie dividends to offset

their unavoidable emissions, or to receive an equivalent dividend

in cash.

-- FSF Chair Richard Davidson said: "The long-term demand

outlook for sustainable timber in both the UK and Europe remains

positive and underpinned by the prevailing decarbonisation agenda.

As we embark on the next six months, [FSF] is well positioned to

leverage a range of environmental tailwinds whilst it continues to

deliver on its business objectives."

Kepler View

Foresight Sustainable Forestry (FSF) is the only investment

trust listed today that provides investors with exposure to the

UK's natural capital and sustainable forestry sector. The

Investment Manager, Foresight Group LLP, drives returns by

investing in afforestation projects. This takes relatively lower

grade agricultural land and transforms it into more valuable

forestry once fully planted and the trees are established. Returns

are also generated by investing in and upgrading existing forestry

sites, with the intention of harvesting and selling the timber they

produce, and by tapping into the nascent market for carbon credits,

which afforestation sites generate.

FSF only launched in November 2021 but these latest half-year

performance figures are positive and build on prior results that

suggest the trust's strategy is working. The Company has delivered

a total NAV per Ordinary Share return of 10.6% since IPO and

increased its NAV to GBP186.6 million (30/09/2022: GBP180.6

million) during the period. As noted, a key driver of returns has

been the upward revaluation of land that has been converted into

forestry. So far, these revaluations have been stark. For example,

one FSF site - Mountmill Burn in Scotland - saw a 97% uplift to its

acquisition value when planting was complete.

That uplifts to NAV continued in the most recent half-year

period whilst timber prices were relatively muted also illustrates

the resilience of UK forestry assets to interest rate hikes.

Acquisitions in the sector are not typically reliant on large

amounts of debt, meaning rate hikes are less impactful than on

other property investments. FSF has also traded with lower

volatility and at a premium to NAV for several prolonged periods.

We think this illustrates the trust is relatively resilient to

wider macroeconomic headwinds, such as inflation, as well as

offering strong portfolio diversification benefits, given its low

correlation to other asset classes, like bonds and equities.

CLICK HERE TO READ THE FULL REPORT

Visit Kepler Trust Intelligence for more high quality

independent investment trust research.

Important information

This report has been issued by Kepler Partners LLP. The analyst

who has prepared this report is aware that Kepler Partners LLP has

a relationship with the company covered in this report and/or a

conflict of interest which may impair the objectivity of the

research.

Past performance is not a reliable indicator of future results.

The value of investments can fall as well as rise and you may get

back less than you invested when you decide to sell your

investments. It is strongly recommended that if you are a private

investor independent financial advice should be taken before making

any investment or financial decision.

Kepler Partners is not authorised to make recommendations to

retail clients. This report has been issued by Kepler Partners LLP,

is based on factual information only, is solely for information

purposes only and any views contained in it must not be construed

as investment or tax advice or a recommendation to buy, sell or

take any action in relation to any investment.

The information provided on this website is not intended for

distribution to, or use by, any person or entity in any

jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject Kepler

Partners LLP to any registration requirement within such

jurisdiction or country. In particular, this website is exclusively

for non-US Persons. Persons who access this information are

required to inform themselves and to comply with any such

restrictions.

The information contained in this website is not intended to

constitute, and should not be construed as, investment advice. No

representation or warranty, express or implied, is given by any

person as to the accuracy or completeness of the information and no

responsibility or liability is accepted for the accuracy or

sufficiency of any of the information, for any errors, omissions or

misstatements, negligent or otherwise. Any views and opinions,

whilst given in good faith, are subject to change without

notice.

This is not an official confirmation of terms and is not a

recommendation, offer or solicitation to buy or sell or take any

action in relation to any investment mentioned herein. Any prices

or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and

representatives) or a connected person may have positions in or

options on the securities detailed in this report, and may buy,

sell or offer to purchase or sell such securities from time to

time, but will at all times be subject to restrictions imposed by

the firm's internal rules. A copy of the firm's Conflict of

Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial

Conduct Authority (FRN 480590), registered in England and Wales at

70 Conduit Street, London W1S 2GF with registered number

OC334771.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAXXLFFXQLZBBF

(END) Dow Jones Newswires

June 14, 2023 02:12 ET (06:12 GMT)

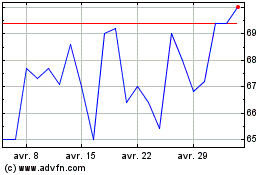

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024