TIDMHBR

RNS Number : 6502X

Harbour Energy PLC

21 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION.

THIS IS AN ANNOUNCEMENT AND NOT A CIRCULAR OR PROSPECTUS OR

EQUIVALENT DOCUMENT AND INVESTORS AND PROSPECTIVE INVESTORS SHOULD

NOT MAKE ANY INVESTMENT DECISION ON THE BASIS OF ITS CONTENTS. A

CIRCULAR AND PROSPECTUS IN RELATION TO THE ACQUISITION DESCRIBED IN

THIS ANNOUNCEMENT WILL EACH BE PUBLISHED IN DUE COURSE.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Harbour Energy plc

( " Harbour " )

Transformational acquisition of Wintershall Dea asset

portfolio

21 December 2023

-- Transforms scale and geographic diversification

-- Materially enhances production, reserve life and margins

-- Increases exposure to natural gas and lowers emissions

intensity

-- Delivers significant financial synergies

-- Immediately accretive to free cash flow

-- Enhanced and sustainable shareholder returns

Harbour is pleased to announce that it has reached an agreement

with BASF and LetterOne, the shareholders of Wintershall Dea AG

("Wintershall Dea"), for the acquisition of substantially all of

Wintershall Dea's upstream assets (the "Target Portfolio") for

$11.2 billion (the "Acquisition").

The Target Portfolio includes all of Wintershall Dea's upstream

assets in Norway, Germany, Denmark [1] , Argentina, Mexico, Egypt,

Libya [2] and Algeria as well as Wintershall Dea's CO(2) Capture

and Storage ("CCS") licences in Europe. Wintershall Dea's Russian

assets are excluded. The Acquisition will add 1.1 bnboe of 2P

reserves at c.$10/boe and more than 300 kboepd of production at

c.$35,000/boepd [3] .

The Acquisition is expected to transform Harbour into one of the

world's largest and most geographically diverse independent oil and

gas companies, adding material gas-weighted portfolios in Norway

and Argentina and complementary growth projects in Mexico. Harbour

will also benefit from an increased reserve life and improved

margins with lower operating costs and greenhouse gas (" GHG ")

intensity.

Harbour is expected to receive investment grade credit ratings

and to benefit from a significantly lower cost of financing

resulting from the porting of existing euro denominated Wintershall

Dea bonds with a nominal value of c.$4.9 billion [4] (the "

Wintershall Dea Bonds ") and a weighted average coupon of c.1.8 per

cent. The Acquisition is also accretive to Harbour's free cash

flow, supporting enhanced and sustainable shareholder returns.

Acquisition benefits

The Board of Directors of Harbour believe the Acquisition is a

strong strategic fit, in line with its stated M&A objectives,

and offers a transformational value-creating opportunity for

Harbour's shareholders.

The Acquisition:

* Transforms Harbour's scale and geographic

diversification

* Combined production of over 500 kboepd [5] and 2P

reserves of 1.5 bnboe [6]

* Significant production of c.170 kboepd [7] in Norway

with additional material positions in Argentina,

Egypt and Germany

* Combined revenue of $5.1 billion and EBITDAX of $3.7

billion for six months to end June 2023

* Adds high quality assets which are accretive to

Harbour's reserve life and margins

* Increases Harbour's 2P reserve life [8] to c.8 years

with organic reserve replacement opportunities from

c.1.5 bnboe [9] of combined 2C resources

* Enhances Harbour's natural gas-weighting with

combined natural gas production of over 300 kboepd

[10] (c.60 per cent of total production)

* Materially accretive to margins with lower combined

opex [11] of c.$11/boe and exposure to advantaged

markets (Brent for oil and TTF for European gas)

* Supports Harbour's energy transition goals

* Step change in Harbour's GHG emissions intensity,

with lower combined GHG emissions intensity of c.15

kgCO(2) e/boe [12]

* Strong pipeline of European CCS projects with

potential to store more than 10 mtpa of CO(2) (net

equity share)

* Harbour's 2035 Net Zero commitment reaffirmed [13]

* Significantly enhances Harbour's financial strength

* Material financial synergies with porting of existing

Wintershall Dea Bonds with a nominal value of c.$4.9

billion, a weighted average coupon of c.1.8 per cent

and weighted average maturity of c.4.5 years

* Post completion, Harbour expects to receive

investment grade credit ratings, increasing its

access to low cost, diverse sources of capital

* Significantly increases Harbour's per share free cash

flow [14]

* Enables enhanced and sustainable shareholder returns

framework

* Supports an increase in Harbour's annual dividend

from $200 million to c.$455 million, of which c.$380

million will be paid to holders of ordinary shares in

Harbour (" Ordinary Shares "). This reflects a 5 per

cent increase in dividend per Ordinary Share to 26.25

cents [15]

* High quality portfolio, free cash flow accretion and

significantly enhanced financial strength underpin a

sustainable increase in the dividend

* Potential for additional returns in line with

Harbour's existing policy

Consideration structure

Under the terms of the business combination agreement entered

into between Harbour, BASF and LetterOne (the " BCA " ), Harbour

will acquire the Target Portfolio for $11.2 billion comprising:

* The porting of existing Wintershall Dea Bonds with a

nominal value of c.$4.9 billion and a weighted

average coupon of c.1.8 per cent to Harbour

* Approximately 921.2 million new Harbour shares issued

to Wintershall Dea's shareholders (the "

Consideration Shares ") at an agreed value of $4.15

billion or 360 pence per Harbour share, representing

a premium of c.60 per cent to Harbour's 30-day volume

weighted average share price of c.227 pence [16] ,

such that on completion:

* BASF, a 72.7 per cent shareholder in Wintershall Dea,

will own 46.5 per cent of Harbour's listed Ordinary

Shares with Harbour's current shareholders owning

53.5 per cent [17]

* LetterOne, a 27.3 per cent shareholder in Wintershall

Dea, will own 251.5 million non--voting, non--listed

convertible ordinary shares with preferential rights

(the " Non-Voting Shares"). If the Non-Voting Shares

were to be converted into Ordinary Shares, Harbour's

current shareholders would own 45.5 per cent of

Harbour; BASF and LetterOne would own 39.6 per cent

and 14.9 per cent, respectively

* $2.15 billion of cash consideration to be funded

through cash flow generated from the Target Portfolio

between the effective date of 30 June 2023 and

completion, and an underwritten bridge facility

Other key details of the Acquisition

* Post completion, Harbour will continue to be Chaired

by R. Blair Thomas, with Linda Z. Cook and Alexander

Krane remaining as Chief Executive Officer and Chief

Financial Officer, respectively

* All Target Portfolio employees will be transferred to

Harbour on completion. In addition, Harbour intends

to take on some employees from Wintershall Dea's

corporate headquarters

* BASF will be entitled to nominate two Non-Executive

Directors to the Board of Harbour provided BASF holds

at least 25 per cent of the Ordinary Shares, and one

Non-Executive Director in the event BASF holds

between 10 and 25 per cent

* BASF's Ordinary Shares will be subject to a six month

lock-up following completion (subject to customary

exceptions). The lock-up arrangements will also apply

to any Ordinary Shares held by LetterOne in the event

LetterOne converts its Non-Voting Shares into

Ordinary Shares within the period of six months from

completion

* LetterOne's Non-Voting Shares are convertible (on a

one-for-one basis) into Ordinary Shares on the

satisfaction of certain conditions, including receipt

of relevant regulatory approvals (if applicable). In

the event of conversion, LetterOne will be entitled

to equivalent rights as BASF regarding the nomination

of Non-Executive Directors

* The dividend payable on each Non-Voting Share will be

at a 13 per cent premium to any dividend payable in

respect of each Ordinary Share, reflecting its

unlisted nature and limited voting rights

* LetterOne will not be permitted to acquire any

Ordinary Shares for a period of six months following

completion and, until such date as the conversion

conditions in respect of the Non-Voting Shares have

been satisfied, LetterOne will not be able to own

more than 19.99 per cent of Harbour's issued share

capital

* While LetterOne itself is not a sanctioned entity,

certain of LetterOne's minority owners are subject to

sanctions in the UK, EU and US. As such, LetterOne's

Non-Voting Shares have no governance rights and, for

so long as those sanctions remain in place, LetterOne

will have no representation on the Harbour Board

* All of Wintershall Dea's assets located in Russia or

held in joint ventures with Russian companies are

excluded from the Acquisition as is Wintershall Dea's

stake in WIGA Transport Beteiligungs-GmbH & Co. KG

Board recommendation and Undertakings

The directors of Harbour have determined that the Acquisition is

in the best interests of Harbour based on a number of factors and

intend unanimously to recommend that shareholders vote in favour of

the relevant resolutions at the shareholder meeting to be held to

approve the Acquisition.

The directors of Harbour and certain of their connected persons

have irrevocably undertaken that they will vote in favour of the

relevant resolutions required to implement the Acquisition at the

shareholder meeting in respect of their own beneficial holdings of

Harbour shares, representing approximately 1.7 per cent of the

existing share capital of Harbour as at 20 December 2023, being the

last practicable date prior to publication of this

announcement.

EIG Asset Management LLC, EIG Separate Investments (Cayman) LP

and Potomac View Investments, LP have each irrevocably undertaken

to vote in favour of the relevant resolutions required to implement

the Acquisition at the Harbour shareholder meeting in respect of

their holdings of Harbour shares, representing 16.8 per cent of the

existing share capital of Harbour as at 20 December 2023, being the

last practicable date prior to publication of this

announcement.

Conditions to closing

The Acquisition constitutes a reverse takeover for the purposes

of the Listing Rules for Harbour, with the intention that Harbour

applies to retain its premium London listing on completion. Harbour

will seek shareholder approval and re-admission of its Ordinary

Shares and admission of the new Ordinary Shares upon completion to

the premium listing segment of the Official List of the Financial

Conduct Authority (the "FCA") (or a listing on the single category

for equity shares in commercial companies if such new listing

category, as contemplated in FCA Consultation Paper CP23/31, has

been implemented by the FCA and taken effect at the relevant time)

and to trading on the main market for listed securities of the

London Stock Exchange. Harbour will, in due course, issue a

circular to its shareholders to convene a general meeting to seek

approval of the Acquisition and publish a prospectus.

The Acquisition is subject to, amongst other things, regulatory,

antitrust and foreign direct investment approvals, as well as

Harbour shareholder approval. Completion of the Acquisition is

expected to occur in Q4 2024.

Linda Z Cook, CEO of Harbour, commented:

" Today's announcement marks Harbour's fourth major acquisition

and the most transformational step yet in our journey to build a

uniquely positioned, large-scale, geographically diverse

independent oil and gas company.

" The addition of Wintershall Dea's assets will increase our

production to over 500 kboepd, extend our reserves life, and

enhance our margins and cash flow, all supporting enhanced

shareholder returns over the longer run. Importantly, the

acquisition also advances our energy transition objectives by

shifting our portfolio towards natural gas, lowering our GHG

emissions intensity and expanding our CCS interests into new

European markets.

" I am proud of what we have achieved so far - a testament to

the skill, hard work and commitment of our people - including our

track record of safe and responsible operations and disciplined

capital allocation, which have made this acquisition possible.

" We look forward to completion of the acquisition and welcoming

Wintershall Dea employees to Harbour, and to our further growth as

we continue to build a global independent oil and gas company of

the future. "

Alexander Krane, CFO of Harbour, commented:

" The acquisition of Wintershall Dea's large scale, high quality

portfolio will transform our asset base as well as our capital

structure. The funding structure we have put together - including

the porting of $4.9 billion of low-cost investment grade bonds with

a coupon of 1.8 per cent and the issuance of $4.15 billion of

equity at a significant premium - will significantly improve our

credit rating and deliver a transaction which is accretive on a per

share basis across all key metrics. This will materially improve

our cost of capital and enable access to broader and lower cost

sources of funding, supporting further growth and additional

shareholder returns.

The increase to our ordinary dividend per share is a first step

in this direction. "

Harbour enquiries:

Harbour plc +44 (0) 203

Elizabeth Brooks, Head of Investor Relations 833 2421

Brunswick (PR Advisers)

Patrick Handley +44 (0) 207

Will Medvei 404 5959

Financial Advisors on the transaction:

Barclays (Joint Financial Adviser and Sole

Sponsor)

Michael Powell +44 (0) 207

Ben Plant 623 2323

J.P. Morgan Cazenove (Joint Financial Adviser)

James Janoskey +44 (0) 203

Daniele Apa 493 8000

Harbour Energy corporate brokers:

Barclays

Robert Mayhew +44 (0) 207

Tom Macdonald 623 2323

Jefferies

Sam Barnett +44 (0) 207

Will Soutar 029 8000

A live audio webcast and conference call for analysts and

investors will be held today at 4.30pm London time. The conference

call details can be found on Harbour's website:

www.harbourenergy.com

FURTHER INFORMATION ABOUT THE ACQUISITION

Additional funding details

* The Wintershall Dea Bonds form part of the Target

Portfolio to be acquired by Harbour and the

liabilities in respect of the Wintershall Dea Bonds

will be assumed by Harbour at completion. Completion

of the Acquisition will not trigger a change of

control (as defined in the relevant terms and

conditions) or a bond investor put right given

Harbour's expected investment grade credit rating

status.

* In addition to the underwritten $1.5 billion bridge

facility, Harbour has secured a new underwritten $3.0

billion unsecured Revolving Credit and Letter of

Credit Facility to cover its Letter of Credit

requirements and to provide additional liquidity.

This will replace its existing RBL facility.

* Following completion and conditional upon the average

price of Brent oil in certain agreed test periods,

potential contingent payments of up to a maximum of

$300 million may be made by Harbour to BASF and

LetterOne over the four years following completion.

Key Conditions to the Acquisition

The Acquisition constitutes a reverse takeover for the purposes

of the Listing Rules for Harbour, with the intention that Harbour

will apply to readmit its Ordinary Shares, and admit the new

Ordinary Shares, to listing in London on completion.

The Acquisition is conditional therefore on, among other

things:

* Harbour shareholder approval at a general meeting

convened pursuant to an FCA approved circular (the

"Circular")

* Publication of an FCA approved prospectus (the

"Prospectus")

* A Rule 9 Waiver (as defined below) having been

granted in respect of BASF by the UK Panel on

Takeovers and Mergers ("Takeover Panel"), subject to

the approval of the waiver by the independent

shareholders of Harbour

* FCA and LSE approval of the admission of all new

Ordinary Shares ("Admission") and re-admission of all

existing Ordinary Shares to listing on the premium

segment of the Official List of the FCA (or a listing

on the single category for equity shares in

commercial companies if such new listing category as

contemplated in FCA Consultation Paper CP23/31 has

been implemented by the FCA and taken effect at the

relevant time) and to trading on the main market of

the London Stock Exchange

* Satisfaction of regulatory, anti-trust and foreign

direct investment approvals in relevant jurisdictions

Shareholder approval

As indicated above, the Acquisition will be conditional on,

amongst other things, approval by Harbour's shareholders. Harbour

currently anticipates posting a shareholder circular to convene a

shareholder meeting to approve the Acquisition in H1 2024. At that

shareholder meeting, it is expected that shareholders will be asked

to approve ordinary resolutions (i) consenting to the issuance of

more than 30 per cent of the Ordinary Shares in Harbour to BASF

without triggering a mandatory offer for the purposes of the

Takeover Code (a Takeover Code "Rule 9 Waiver"); (ii) approving the

Acquisition for the purposes of the Listing Rules; (iii) approving

the issuance of new Harbour shares to BASF and LetterOne, as

described above; and (iv) certain other matters required to effect

the Acquisition.

Rule 9 Waiver

It is anticipated that BASF, as the largest shareholder of

Wintershall Dea, will hold 46.5 per cent ([18]) of the Ordinary

Shares of Harbour post completion. As a result, BASF would

ordinarily be required to make a mandatory offer under Rule 9,

however a Rule 9 Waiver will be sought from the Takeover Panel in

order to disapply mandatory offer requirements. This Rule 9 Waiver

will require approval by Harbour's independent shareholders at the

general meeting to be convened pursuant to the Circular which will

be sent to shareholders in due course.

Relationship agreements

At completion, Harbour will enter into separate relationship

agreements (the form of which has already been agreed) with BASF

and LetterOne governing the relationship between Harbour and each

of BASF and LetterOne which will be effective at Admission (the

"BASF Relationship Agreement" and the "LetterOne Relationship

Agreement" respectively and, together, the "Relationship

Agreements"). The principal terms of the Relationship Agreements

are referred to below.

BASF Relationship Agreement

In addition to the mandatory undertakings given by BASF required

under the UK Listing Rules and other customary provisions, the BASF

Relationship Agreement will provide that BASF will be entitled to

appoint following Admission up to two Non-Executive Directors and

reasonable cooperation and assistance from Harbour in relation to

any offering of Ordinary Shares by BASF.

LetterOne Relationship Agreement

The LetterOne Relationship Agreement contains similar provisions

to the BASF Relationship Agreement, except, among other things,

certain rights and obligations of LetterOne, including in relation

to the appointment of any Non-Executive Director, which will only

be triggered from the date on which LetterOne holds 10 per cent or

more of the Ordinary Shares.

Lock-Up Agreements

At completion, Harbour will enter into separate lock-up

agreements with BASF and LetterOne governing the disposal of shares

in Harbour held by BASF and LetterOne (the "BASF Lock-Up Agreement"

and the "LetterOne Lock-Up Agreement").

BASF Lock-Up Agreement

Pursuant to the BASF Lock-Up Agreement, BASF's Ordinary Shares

will be subject to a lock-up for the first six months following

completion during which time, subject to customary exceptions, BASF

will not be permitted to sell its Ordinary Shares.

LetterOne Lock-Up Agreement

The LetterOne Lock-Up Agreement contains similar provisions to

the "BASF Lock-Up Agreement". In the event that LetterOne is able

to convert its Non-Voting Shares into Ordinary Shares, such

Ordinary Shares will be subject to a lock-up for the first six

months following completion.

LetterOne Standstill Agreement

LetterOne will also enter into a standstill agreement (the

"LetterOne Standstill Agreement") with Harbour to be effective on

completion pursuant to which it will undertake:

* Not, subject to customary exceptions, to acquire any

Ordinary Shares for a period of six months following

completion

* Until such time as the conversion conditions in

respect of the Non-Voting Shares have been satisfied,

not to own more than 19.99 per cent of Harbour's

issued share capital in total

LetterOne may transfer its Non-Voting Shares to certain

permitted transferees, in certain cases only with the consent of

Harbour and in accordance with the terms of the Non-Voting

Shares.

Key indicative financial Information on Wintershall Dea

Summary IFRS financial information

The unaudited Target Portfolio historical financial information

for the year ended 31 December 2022 and the six months ended 30

June 2023 (together the "Unaudited Target Portfolio Historical

Financial Information") included in this announcement reflects the

historical results of operations and financial position of the

Target Portfolio as if the Target Portfolio had been run during the

relevant periods as a stand-alone business, in conformity with IFRS

and the accounting policies adopted by Wintershall Dea in its own

consolidated Annual Report and Accounts. The Unaudited Target

Portfolio Historical Financial Information does not include the

cost of services historically provided by the headquarters of

Wintershall Dea to the Target Portfolio, however such costs will be

reflected in the Prospectus Historical Financial information (as

defined below).

Following closing of the Acquisition Wintershall Dea may provide

services to Harbour in connection with the Target Portfolio under a

number of service agreements.

The Unaudited Target Portfolio Historical Financial Information

has been prepared in accordance with Wintershall Dea IFRS

accounting policies and no adjustments have been made to align the

accounting policies of Wintershall Dea to those of Harbour. The

Unaudited Target Portfolio Historical Financial Information has

been extracted without material adjustments from the accounting

records that underpin Wintershall Dea's 31 December 2022

consolidated Annual Report and Accounts and 30 June 2023 Half Year

Results.

The accounting records referred to above are presented in EUR,

which have been converted to USD using the Harbour foreign exchange

(FX) rates in the tables below:

IFRS Six months EUR to Six months Twelve EUR to Twelve

ended USD FX ended months USD FX months

30 June rates 30 June ended rates ended

2023 [19] 2023 31 December (19) 31 December

2022 2022

---------------- ------------ -------- ----------- ------------- -------- -------------

2,878 3,116 7,651 8,030

million million million million

Revenue [20] EUR 1.08 USD EUR 1.05 USD

------------ -------- ----------- -------- -------------

2,069 2,240 6,002 6,300

million million million million

EBITDAX [21] EUR 1.08 USD EUR 1.05 USD

------------ -------- ----------- -------- -------------

Operating

costs per 7.9 8.6 7.6 8.0

barrel ([22]) EUR/boe 1.08 USD/boe EUR/boe 1.05 USD/boe

------------ -------- ----------- -------- -------------

Oil and gas n/a n/a n/a n/a n/a 1,129

reserves million

[23] boe

------------ -------- ----------- -------- -------------

Production n/a n/a 317 n/a n/a 318

kboepd kboepd

------------ -------- ----------- -------- -------------

In accordance with the Listing Rules, the Circular and

Prospectus will contain Historical Financial Information on the

Target Portfolio covering the latest three financial years

(expected to be the years ended 31 December 2023, 2022 and 2021)

(the " Prospectus Historical Financial Information ") prepared in

accordance with IFRS and will be consistent with Harbour's

accounting policies, adopted in Harbour's Annual Report and

Accounts for the year ended 2023, expected to be latest annual

consolidated accounts prior to the publication of the Circular and

Prospectus. Such Prospectus Historical Financial Information on the

Target Portfolio contained in the Circular and Prospectus may

therefore differ from the Unaudited Target Portfolio Historical

Financial Information set out above.

Harbour has undertaken an initial review to compare Wintershall

Dea's accounting policies to those of Harbour. The following areas

are expected to require alignment when preparing the Prospectus

Historical Financial Information to be included in the Circular and

Prospectus but have not been adjusted in the summary financial

information included in this announcement:

a) Presentational currency - Harbour's presentational currency

is the US Dollar while Wintershall Dea's presentational currency

is the Euro

b) Exploration and evaluation expenditure ( " E&E " ) capitalisation

- There is a difference in some of the E&E costs capitalised

by Harbour and Wintershall Dea, primarily those relating to

seismic survey costs.

Once the technical feasibility and commercial viability of

a well are demonstrable, Wintershall Dea's license acquisition

costs are transferred to intangibles and the cost of successful

exploration drilling is transferred to Property, Plant and

Equipment ("PPE"); in Harbour, both cost categories are transferred

to PPE

c) Over-/under-lift positions - Harbour measures over-/under-lift

at net realisable value using an observable year-end oil or

gas market price and included within receivables, whereas

Wintershall Dea values over-/under-lift based on actual production

cost. Harbour and Wintershall Dea both measure overlift at

net realisable value using an observable year-end oil or gas

market price and is included in payables

d) Inventory valuation - Harbour measures all inventories,

except for petroleum products, at the lower of cost and net

realisable value. The cost of materials is the purchase cost,

determined on a first-in, first-out basis. Wintershall Dea

uses weighted average cost. Harbour petroleum products are

measured at net realisable value using an observable year-end

oil or gas market price, and are included in inventory whereas

Wintershall Dea petroleum products are measured using weighted

average cost and included in inventory

e) Finance income and finance cost - Wintershall Dea reports

FX gains/ losses net under finance income or expense whereas

Harbour reports them gross as income and expense. Wintershall

Dea reports derivative gains/losses net under finance income

or expense whereas Harbour reports them gross as income and

expense

On the basis of Harbour's initial review, and noting that both

Wintershall Dea and Harbour report under IFRS, the accounting

policy differences set out above are unlikely to have a material

impact on Wintershall Dea's Unaudited Target Portfolio Historical

Financial Information. Further differences may be identified upon

finalisation of the accounting policy difference exercise in

relation to which Harbour has been unable to assess materiality at

this stage . The Prospectus Historical Financial Information will

differ from the Unaudited Target Portfolio Historical Financial

Information in respect of the accounting policy differences

identified above, any other accounting policy differences

identified and the central allocation of historical costs for

services provided by Wintershall Dea to the Target Portfolio.

Illustrative post completion unaudited financial information for

Harbour

The following sets out the illustrative post completion

unaudited historical financial information for Harbour for the

periods stated. The historical financial information below in

relation to Harbour has been extracted from Harbour's Half Year

Results for the six months ended 30 June 2023 and Annual Report and

Accounts for the year ended 31 December 2022. The financial

information below in relation to the Target Portfolio has been

extracted from the above table in the Summary IFRS financial

information section of this announcement. The post completion

financial information below is a summation of the Harbour and

Wintershall Dea financial information.

Six months ended 30 June Twelve months ended 31

2023 December 2022

---------------- ------------------------------------------- -------------------------------------------

Harbour Wintershall Harbour Harbour Wintershall Harbour

Dea post completion Dea post completion

IFRS IFRS IFRS IFRS IFRS IFRS

[24] [25] [26] (25)

(A) (B) (A+B) (C) (D) (C+D)

--------- ------------- ----------------- --------- ------------- -----------------

Revenue

(USD million) 2,016 3,116 5,132 5,431 8,030 13,461

--------- ------------- ----------------- --------- ------------- -----------------

EBITDAX

(USD million) 1,428 2,240 3,668 4,011 6,300 10,311

--------- ------------- ----------------- --------- ------------- -----------------

Oil and

gas reserves

(mmboe) n/a n/a n/a 410 1,129 1,539

--------- ------------- ----------------- --------- ------------- -----------------

Operating

cost per

barrel

(USD/boe) 15.4 8.6 11.2 13.9 8 10.3

--------- ------------- ----------------- --------- ------------- -----------------

Production

(kboepd) 196 317 513 208 318 526

--------- ------------- ----------------- --------- ------------- -----------------

In the above table Revenue, EBITDAX and oil and gas reserves are

shown under the respective company's definitions but for Operating

cost per barrel the Harbour definition has been used for both

Harbour and Wintershall Dea (as summarised in note 21).

In accordance with the Listing Rules, the Circular and

Prospectus when published will include Harbour pro forma financial

information prepared in accordance with the requirements of the

Prospectus Regulation Rules. Such information may differ from the

illustrative post completion Harbour financial information set out

above.

NOTES TO EDITORS

About Harbour

Harbour started as a private company in 2014 and has grown

through M&A to c.200 kboepd. Harbour publicly listed in the UK

through a reverse merger with Premier Oil in 2021.

Today, Harbour is the UK's largest oil and gas producer with

over 90 per cent of its production coming from the UK and the

balance from its assets in South East Asia. In addition, Harbour

has a portfolio of international growth opportunities including in

Indonesia and Mexico and is progressing two CCS projects in the UK,

including the Harbour-led Viking project, one of the largest

planned CCS projects in the world.

Harbour is a premium-listed, FTSE 250 company headquartered in

London with approximately 2,000 staff and contractors across its

offshore platforms and offices. In 2022, Harbour delivered free

cash flow of $2.1 billion (post-tax, pre shareholder distributions)

with production of 208 kboepd, split approximately 50 per cent

liquids, 50 per cent gas. Harbour had combined 2P reserves and 2C

resources of 865 mmboe as of December 2022.

Further information on Harbour can be found at

www.Harbourenergy.com. The Group's ticker symbol is HBR-GB.

About Wintershall Dea

Wintershall Dea is a leading European independent gas and oil

company, headquartered in Kassel and Hamburg, Germany.

Wintershall Dea has more than 120 years of experience as an

operator and project partner across the entire E&P value chain.

The company with German roots explores for and produces gas and oil

in 11 countries worldwide in an efficient and responsible manner.

With activities in Europe, Latin America and the MENA region

(Middle East & North Africa), Wintershall Dea has a global

upstream portfolio and, with its participation in natural gas

transport, is also active in the midstream business. Furthermore,

the company develops carbon management and low carbon hydrogen

projects to contribute to climate goals and secure energy

supplies.

As at 30 June 2023, Wintershall Dea had gross assets of $20,156

[27] million. This does not reflect the gross assets of the defined

perimeter of the Acquisition.

BASF

BASF creates chemistry for a sustainable future and combines

economic success with environmental protection and social

responsibility. More than 111,000 employees in the BASF Group

contribute to the success of customers in nearly all sectors and

almost every country in the world. Its portfolio comprises six

segments: Chemicals, Materials, Industrial Solutions, Surface

Technologies, Nutrition & Care and Agricultural Solutions.

BASF generated sales of EUR87.3 billion in 2022. BASF shares are

traded on the Frankfurt stock exchange (BAS) and as American

Depositary Receipts (BASFY) in the United States.

LetterOne

LetterOne is a GBP20 billion long-term investment business

headquartered in Luxembourg. It supports 125,000 jobs globally in

sectors including health, energy, technology and retail.

Target Portfolio

The Target Portfolio consists of Wintershall Dea's non-Russia

connected upstream assets, including producing and development

assets as well as exploration rights in Norway, Argentina, Germany

(excluding midstream), Mexico, Algeria, offshore Libya, Egypt and

Denmark (excluding the Ravn field) as well as Wintershall Dea's CCS

licences in Europe.

The excluded assets are those located in Russia and those held

through joint ventures with Russian majority state-owned energy

corporation Gazprom: Wintershall Dea Noordzee B.V. (50 per cent

Wintershall Dea / 50 per cent Gazprom ([28]) , registered in

Rijswijk, The Netherlands), Wintershall Dea AG (51 per cent

Wintershall Dea / 49 per cent Gazprom, registered in Celle,

Germany) and Nord Stream AG (15.5 per cent Wintershall Dea / 51 per

cent Gazprom, registered in Zug, Schweiz). WIGA Transport

Beteiligungs-GmbH & Co. KG (50.02 per cent Wintershall Dea /

49.98 per cent SEFE, registered in Kassel, Germany) is also not

part of the asset perimeter.

The Target Portfolio comprises:

Production of 317 kboepd (65 per cent gas) in H1 2023

Operating costs of c.$9/boe in H1 2023

IMPORTANT NOTICE

The information contained in this announcement is for

information purposes only and does not purport to be complete. The

information in this announcement is subject to change.

This announcement has been prepared in accordance with English

law, the UK Market Abuse Regulation and the Disclosure Guidance and

Transparency Rules and Listing Rules of the FCA and information

disclosed may not be the same as that which would have been

prepared in accordance with the laws of jurisdictions outside

England.

No person has been authorised to give any information or make

any representations to shareholders with respect to the Acquisition

other than the information contained in this announcement and, if

given or made, such information or representations must not be

relied upon as having been authorised by or on behalf of Harbour,

the Harbour directors, or any other person involved in the

Acquisition. None of the above take any responsibility or liability

for, and can provide no assurance as to the reliability of, other

information that you may be given. Subject to the UK Market Abuse

Regulation and the FCA's Disclosure Guidance and Transparency Rules

and Listing Rules, the delivery of this announcement shall not

create any implication that there has been no change in the affairs

of Harbour since the date of this announcement or that the

information in this announcement is correct as at any time

subsequent to its date.

Barclays Bank PLC, acting through its Investment Bank

("Barclays"), which is authorised by the Prudential Regulation

Authority and regulated in the UK by the Financial Conduct

Authority and the Prudential Regulation Authority, is acting

exclusively as joint financial adviser and sponsor for Harbour and

no one else in connection with the Acquisition and shall not be

responsible to anyone other than Harbour for providing the

protections afforded to clients of Barclays nor for providing

advice in connection with the Acquisition or any other matter

referred to herein.

J.P. Morgan Securities plc, which conducts its UK investment

banking activities as J.P. Morgan Cazenove ("J.P. Morgan

Cazenove"), and which is authorised in the United Kingdom by the

Prudential Regulation Authority and regulated in the United Kingdom

by the Financial Conduct Authority and the Prudential Regulation

Authority, is acting exclusively as joint financial adviser for

Harbour and no one else in connection with the Acquisition and

shall not be responsible to anyone other than Harbour for providing

the protections afforded to clients of J.P. Morgan Cazenove or its

affiliates, nor for providing advice in connection with the

Acquisition or any other matter referred to herein.

The contents of this announcement are not to be construed as

legal, business or tax advice. Each shareholder should consult its

own legal adviser, financial adviser or tax adviser for legal,

financial or tax advice respectively.

Percentages in tables have been rounded and accordingly may not

add up to 100 per cent. Certain financial data have also been

rounded. As a result of this rounding, the totals of data presented

in this press release may vary slightly from the actual arithmetic

totals of such data.

Forward-looking statements

Certain statements in this announcement are forward-looking

statements. In some cases, these forward looking statements can be

identified by the use of forward looking terminology including the

terms "believes", "expects", "estimates", "anticipates", "intends",

"may", "will" or "should" or in each case, their negative, or other

variations or comparable terminology. These forward looking

statements reflect Harbour's current expectations concerning future

events and speak only as of the date of this announcement. They

involve various risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Harbour Group, the post-completion Harbour Group, third parties or

the industry to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Such risks, uncertainties and other factors

include, amongst other things, general economic and business

conditions, industry trends, competition, changes in regulation,

currency and commodity price fluctuations, the Harbour Group's or

the post-completion Harbour Group's ability to recover its reserves

or develop new reserves and to implement expansion plans and

achieve cost reductions and efficiency measures, changes in

business strategy or development and political and economic

uncertainty. There can be no assurance that the results and events

contemplated by these forward looking statements will in fact

occur.

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings, earnings

per share or income, cash flow from operations or free cash flow

for the Harbour Group or the post-completion Harbour Group, as

appropriate, for the current or future years would necessarily

match or exceed the amount set out in any forward-looking statement

or historical published earnings, earnings per share or income,

cash flow from operations or free cash flow for the Harbour Group

or the post-completion Harbour Group, as appropriate.

This announcement and the documents required to be published

pursuant to Rule 26.1 of the UK Code on Takeovers and Mergers (the

"Takeover Code") will be made available at the relevant time for

inspection on Harbour's website at www.Harbour.com . Neither the

content of Harbour's (or any other website) nor the content of any

website accessible from hyperlinks on Harbour's website (or any

other website) is incorporated into, or forms part of, this

announcement.

The information contained within this announcement is deemed by

Harbour to constitute inside information for the purposes of

Article 7 of Market Abuse Regulation (EU) No 596/2014 (as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018). By the publication of this announcement via

a Regulatory Information Service, this inside information is now

considered to be in the public domain. The person responsible for

arranging for the release of this announcement on behalf of Harbour

is Howard Landes, General Counsel.

LEI: 213800YPC42DYBKVPF97

[1] Excluding the Ravn field.

[2] Excluding Wintershall AG.

[3] Production is for the six months to 30 June 2023, as per

management estimates. 2P reserves is based on verified year end

2022 2P reserves.

[4] Average exchange rate of $1.08 over H1 2023.

[5] Based on H1 2023 production, as per management

estimates.

[6] Based on verified year end 2022 2P reserves.

[7] Based on H1 2023 production, as per management

estimates.

[8] Based on year end 2022 2P reserves and average H1 2023

production, as per management estimates.

[9] Based on verified year end 2022 2C resources.

[10] Based on H1 2023 production, as per management

estimates.

[11] Direct operating costs (excluding over/under-lift),

including insurance costs, mark to market movements on

emissions hedges and tariff expense, less tariff income, divided

by working interest production.

[12] Scope 1 and Scope 2 emissions on a net equity share

basis.

[13] Scope 1 and 2 emissions on a gross operated basis.

[14] Free cash flow is post tax and before distributions.

[15] Based on a total expected dividend for 2023 of 25

cents/share (12 cents interim and expected 13 cents final) and

1,440.1 million Ordinary Shares post-completion.

[16] Based on 30 calendar days, as at 20 December 2023.

[17] Prior to conversion of the Non-Voting Shares.

[18] Prior to conversion of the Non-Voting Shares.

[19] Harbour's monthly average exchange rate has been used to

convert Revenue, EBITDAX and Operating costs per barrel.

[20] Revenue includes i) oil and gas revenues; ii) other

revenues (including tariff income); and iii) other operating

income.

[21] EBITDAX comprises earnings before interest, taxes,

depreciation, amortisation and exploration expenses adjusted for

special items. Wintershall and Harbour EBITDAX definitions are not

materially different.

[22] Direct operating costs (excluding over/under-lift) for the

period, including insurance costs, mark to market movements on

emissions hedges and tariff expense, less tariff income, divided by

working interest production.

[23] Reserves are those quantities of oil and natural gas

anticipated to be commercially recoverable from known accumulations

of hydrocarbons. Wintershall Dea presents proved reserves plus

reserves that are deemed probable to be commercially

recoverable.

[24] As per Harbour's Half Year Results 2023.

[25] As per table on page 8.

[26] As per Harbour Annual Report and Accounts 2022.

[27] EUR18,389, using Harbour's 30 June exchange rate of

1.10.

[28] As per Wintershall Dea Annual report 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQLFLFLXLLFFBK

(END) Dow Jones Newswires

December 21, 2023 09:05 ET (14:05 GMT)

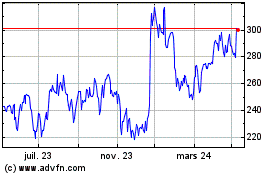

Harbour Energy (LSE:HBR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

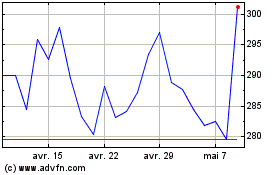

Harbour Energy (LSE:HBR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024