TIDMRVG

RNS Number : 0909P

Retroscreen Virology Group PLC

14 August 2014

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, JAPAN

OR THE REPUBLIC OF SOUTH AFRICA OR ANY JURISDICTION IN WHICH SUCH

PUBLICATION OR DISTRIBUTION IS PROHIBITED.

For immediate release 7.00am: 14 August 2014

RETROSCREEN VIROLOGY GROUP PLC

("Retroscreen" or "the Company")

CONDITIONAL PLACING TO RAISE GBP33.6 MILLION

Retroscreen Virology Group plc (AIM: RVG), the pioneer of hVIVO

Human Challenge Models ("HCMs") of disease, announces today that it

has raised, subject to certain conditions, GBP33.6 million (before

expenses) by way of a placing of 12,923,077 new Ordinary Shares

(the "New Ordinary Shares") with both new and existing

institutional shareholders at a price of 260 pence per Ordinary

Share.

The Placing Price is at a discount of 18.8 per cent. to the

closing middle market price of 320 pence per Ordinary Share on 13

August 2014, the latest date prior to this Announcement.

The New Ordinary Shares will, upon Admission, rank pari passu in

all respects with the Ordinary Shares in issue as at the date of

this Announcement, including as regards the right to receive all

dividends or other distributions declared, made or paid after

Admission. The New Ordinary Shares will represent 19.1 per cent. of

the Company's enlarged issued ordinary share capital immediately

following completion of the Placing.

The net proceeds of the Placing are expected to be approximately

GBP32.8 million and will be principally used by the Company to

accelerate its biomarker discovery programme in flu and asthma,

refine the asthma model for product validation use, initiate COPD

model development as the second airways disease opportunity and

broaden the Company's challenge agent repertoire.

The Company also announces that, in line with its expanded

vision for the business, it will be changing its name to hVIVO plc

which is currently the Company's proprietary name for its

technology platform. The name change is expected to be implemented

in Q4 2014.

A general meeting of Retroscreen to approve the Placing will be

held at the Group's registered office at Queen Mary Bio

Enterprises, Innovation Centre, 42 New Road, London E1 2AX at 10.00

a.m. on 1 September 2014.

Kym Denny, Chief Executive Officer, commented: "We are delighted

to have raised these funds through both existing and new

shareholders, together with the tremendous support and

encouragement we have received. We are at an exciting inflection

point for Retroscreen where having established and proven the hVIVO

Human Challenge Model with our clients over the past couple of

years, we now have the capability, capacity and funds to build on

this and accelerate Retroscreen's own R&D programme, leveraging

our hVIVO platform as a powerful tool in biomarker discovery and in

the development of new disease models."

Further details of the Placing are below.

For further information:

Retroscreen Virology Group plc Tel: +44 (0) 207 756

Kym Denny, Chief Executive Officer 1300

Graham Yeatman, Finance Director

----------------------------------------------- ---------------------

Numis Securities Limited Tel: +44 (0) 207 260

Michael Meade / Freddie Barnfield - Nominated 1000

Adviser

James Black / Michael Burke - Corporate

Broking

----------------------------------------------- ---------------------

1. Background to the Placing

Retroscreen is a rapidly growing life sciences company based in

the UK pioneering a technology platform called hVIVO which uses

human disease models to discover and study new drugs and diagnostic

products.

The Retroscreen business was established in 1989 and over the

last 25 years it has established itself as a market leader in

providing clinical services to third party study sponsors using

human disease models involving volunteers. To date, Retroscreen has

conducted 37 clinical studies, involving more than 1,800 volunteers

for a range of leading industry, government and academic clients.

The Directors' consider Retroscreen to be the only business built

to deliver a range of human disease models on an industrial scale.

The Group is now expanding the use of its platform to include the

discovery and development of its own proprietary therapeutic and

diagnostic products.

Drug discovery and development: a process that is fundamentally

flawed

Many industry commentators have highlighted the failings of the

pharmaceutical R&D process. It typically takes more than a

decade and often hundreds of millions of dollars to bring a

pharmaceutical drug to market. In addition, it is estimated that

only one in every fifty preclinical compounds enter clinical

testing, while less than one in five investigational new drugs in

clinical development succeed in reaching the market. A primary

reason for the high attrition rate is a fundamental lack of

efficacy, or at least the lack of demonstration of clinical

efficacy in late stage development. This high failure rate is

compounded by the fact that it can take more than five years for a

new drug candidate to progress to clinical testing, where it is

evaluated in human subjects for the first time.

The Directors' believe there are three main reasons behind this

high failure rate:

(a) The mechanisms of many diseases are insufficiently understood to choose valid drug targets

It is generally accepted by the industry that selection of the

wrong drug target is usually the main reason behind a failure to

demonstrate clinical efficacy. This is a result of the fundamental

lack of understanding of human biology, despite many technological

advances over the last few decades. The pharmaceutical industry

continues to use published literature in its search for new drug

targets. However, a publication in the Nature Reviews Drug

Discovery in 2011 indicated that there were inconsistencies in 65

per cent. of the published experimental data that were repeated,

with only 21 per cent. proving to be reproducible.

(b) In vitro and in vivo preclinical models often poorly predict clinical efficacy

The industry relies on non-human preclinical models to discover

and validate new drug candidates before they enter clinical

testing. These models act as key gate points in the decision making

process for progressing a new drug candidate through early stage

development. However, the relevance of preclinical models to the

complex human biological system is limited such that drugs that

show preclinical promise are more likely than not to fail in

humans. Leading industry commentators, including the FDA, believe

that the majority of these preclinical models have low predictive

ability and the results from such models do not translate to the

humans. In particular, one report has claimed that the mouse model

has been totally misleading and years and billions of dollars have

been wasted following false leads as a result.

(c) Failure to identify the correct target patient population for drug treatment

A third common reason for drugs failing to show efficacy in

clinical studies is in the design of the studies themselves,

including inappropriate patient selection. In most disease areas,

patients are recruited for clinical studies based on a phenotypic

classification of disease, which often includes a range of criteria

including symptom type and severity. However, because these

selection criteria do not differentiate patient types at the

molecular level, a range of inappropriate patient types can be

included in a clinical study due to the lack of appropriate

stratification of the disease. For a drug that targets a specific

subset of patients, this is likely to mean that a clinical study

will be underpowered and therefore unlikely to detect an efficacy

signal on an all-comers basis. This is commonly described as the

one-size fits all approach to drug development although diseases

are increasingly being recognised as syndromes, consisting of a

range of disease types. For drugs that fail to hit efficacy

endpoints, a retrospective analysis may identify a specific subset

of patients that responded in the study and this can help guide its

future development but for some drugs, this is too late in the

process.

hVIVO has the potential to transform pharmaceutical R&D

productivity

The Directors believe that the best way to address this high

attrition rate and to shorten product development time is to (a)

accelerate the demonstration of proof of concept for new drugs and

diagnostics and (b) identify more appropriate biomarkers to enable

next generation drug and diagnostic products to be developed. In

the Directors' opinion, hVIVO is ideally placed to address both of

these fundamental challenges.

Retroscreen'shVIVO platform puts humans at the heart of the

modelling of disease. The platform functions in the following way:

volunteers are recruited for research studies in which a safe

challenge agent is administered to elicit a self-limiting

infection, such as 'flu', or to trigger a disease episode or

exacerbation, such as in asthmatic subjects. The studies are

conducted under tightly controlled, quarantine conditions with full

medical supervision. The benefits of this approach, compared to

field-based studies where patients are only recruited when they

become symptomatic, are that (a) the healthy or pre-challenge

subject acts as an internal control by providing a pre-disease

baseline; (b) the laboratory like conditions means the presentation

of symptoms together with cellular and molecular changes in

response to the challenge agent can be tightly correlated; and (c)

multiple, high quality samples can be taken from a range of body

compartments throughout the course of the disease, or disease

episode. The Directors believe that combining these benefits in one

platform creates a powerful R&D tool for product discovery and

development.

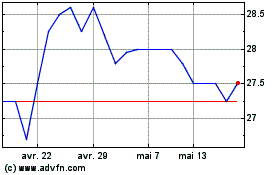

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024