Once new predictive and prognostic biomarkers and drug targets

have been identified, the Directors believe that a range of

commercialisation and partnering options are available to

Retroscreen to realise shareholder value. These include research

collaborations, co-development agreements and out-licensing deals,

at different stages of development. The hVIVO platform provides an

ideal opportunity for the Group to demonstrate proof of concept for

a new product, and to build-out a licensing package with additional

supportive data on dose selection and mechanism of action, prior to

partnering and subsequent commercialisation to drive deal value.

However, the Directors believe that the preferred partnering

strategy will depend both on the disease area, the product

development and expertise requirements and the probability, costs

and timelines involved.

The Group could expect to receive a combination of upfront,

milestone, and sales performance payments from a licensing and

commercialisation partner, together with royalties on product

sales. Market research indicates that the average headline deal

value for a therapeutic product out-licensed at Phase II of a

clinical trial is $170 million, excluding royalties, while for

breakthrough products, the Directors' point to industry precedents

for headline deals of even higher value for both biomarker and

product based licensing deals.

2. Current trading and outlook

Increasing industry adoption of the hVIVO platform has resulted

in Retroscreen being able to achieve two and a half years of

exceptional growth. As a result, the majority of Retroscreen's

workload to-date, reflected in utilisation of staff and quarantine

facilities, has been employed for external client engagements,

generating revenue and gross profit. The Directors expect to report

revenue for the six months ended 30 June 2014 in excess of GBP14.0

million (H1'13, GBP12.0 million; 2013, GBP27.5 million) when the

Company announces its half-year results in September 2014. This

strong performance is due to a busy schedule of client engagements

across two quarantine facilities, with the Group continuing to

achieve improvements in gross profit margin (H1'13, 28.3 per cent;

2013, 30.2 per cent). The Company will also report an increased

R&D expense as the Group continues to build its in-house

R&D capability and preparations are made to implement the

Group's R&D plan. Cash as at 30 June 2014 was GBP31.6 million

(H1'13, GBP13.2 million; 2013, GBP35.8 million).

Retroscreen has reached an inflection point where it now needs

to achieve a balance of external client revenue engagements with

internal R&D studies. In order to accelerate the R&D

programme the Directors are targeting a 70:30 balance of external

client revenue engagements to internal R&D studies, which in

time is expected to become an equal 50:50 balance as overall

workload increases. This will be a significant transition for

Retroscreen, such that in the next twelve months there may be

lumpiness in balancing the prioritisation and timing of client

revenue engagements and internal R&D studies. Accordingly, in

the short term this is expected to lead to lower revenue for the

second half of 2014. However, longer term as the Company

diversifies its workload and expands its capacity, including the

introduction of Chesterford Research Park in summer 2015, the

Directors believe that the balancing of client revenue engagements

and internal R&D studies should increase Retroscreen's overall

utilisation of staff and facilities. The Directors believe this

will drive cost efficiencies and gross profit margin improvement,

which will in part contribute to the Company's increasing

investment in R&D expense and requirement for cash.

In July 2014, Kym Denny and members of the senior management

team completed an extensive client roadshow to announce the Group's

broadening strategy and begin to explore potential collaborations

with existing and new customers. The Company is delighted to report

that it received very positive feedback on the client roadshow,

particularly regarding the development of the new disease

models.

The Directors anticipate strong progress with the new model

development programme and in-house R&D programmes over the next

24 months. The Group plans to calibrate hVIVO in both asthma and

COPD models, while elucidating a circuit plan for at least one

target disease with the subsequent discovery of a first candidate

biomarker. Once identified, the Group intends to meet with the

regulators including the FDA to determine the most appropriate

development pathway. This will allow the Group to start the

clinical validation of the biomarker while seeking a collaboration

or partnership for product development and commercialisation.

3. Use of proceeds

The Placing is intended to allow Retroscreen to further utilise

the skills, resources and expertise that it has developed over the

last two years, to accelerate sample generation and subsequent

bioinformatics work in the race to identify novel biomarkers and

drug targets in areas of high unmet medical need.

The Directors intend that the net proceeds of the Placing, being

approximately GBP32.8 million, will be used by the Group

principally for the following:

-- Accelerate biomarker discovery programme in 'flu' and asthma;

-- Refine asthma model for product validation use;

-- Initiate COPD model development as the second airways disease opportunity; and

-- Broaden the Group's Challenge Agent repertoire.

The Company anticipates that the proceeds will be invested in

these R&D programmes over the next 24 months.

4. Details of the Placing

The Group proposes to raise GBP33.6 million, approximately

GBP32.8 million net of expenses, by way of a conditional,

non-pre-emptive placing of 12,923,077 New Ordinary Shares at the

Placing Price. The New Ordinary Shares have been placed by Numis as

agent for the Company pursuant to the Placing Agreement with

institutional and other professional investors. The Directors had

considered whether the Company would be able to extend the offer of

new Ordinary Shares to all existing Shareholders but, having

discussed this with its professional advisers, decided that the

expense of doing so could not be justified and would not be in the

best interests of the Company.

The Placing Price represents a discount of approximately 18.8

per cent. to the closing mid-market price of the Ordinary Shares of

320 pence on 13 August 2014 (being the last practicable dealing day

prior to the date of this document). The New Ordinary Shares will

represent approximately 19.1 per cent. of the Ordinary Share

capital as enlarged by the Placing and will, when issued, rank pari

passu in all respects with the other Ordinary Shares then in issue,

including all rights to all dividends and other distributions

declared, made or paid following Admission.

The Placing Agreement is conditional upon (amongst other things)

it not having been terminated, the passing of the Resolutions at

the General Meeting and Admission occurring on or before 8.00 a.m.

on 2 September 2014 (or such later date as Numis and the Company

may agree, being not later than 8.30 a.m. on 16 September

2014).

The Placing Agreement contains warranties from the Company in

favour of Numis in relation to (amongst other things) the Group and

its business. In addition, the Company has agreed to indemnify

Numis in relation to certain liabilities it may incur in

undertaking the Placing. Numis has the right to terminate the

Placing Agreement in certain circumstances prior to Admission, in

particular, it may terminate in the event that there has been a

material breach of any of the warranties or for force majeure.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM. It is expected that dealings in the New

Ordinary Shares will commence on AIM on 2 September 2014.

5. Change of name

The Directors consider that the company name, Retroscreen

Virology Group, which is a legacy of the Group's origins in the

field of retroviruses, along with the strap line 'Conquering Viral

Disease' is no longer appropriate to describe the business.

The Directors' expanded vision for the Group provides an ideal

opportunity to change the company name and introduce more

appropriate, forward looking branding. The Directors intend to

adopt the name hVIVO, which is currently the Group's proprietary

name for its technology platform, as the new company name. The new

name will be implemented in the last quarter of 2014 and

shareholder approval is not required for this name change under the

Company's articles of association.

hVIVO provides the Company with a bold new name which

encapsulates its pioneering vision of fundamentally understanding

human biology and disease by working in partnership with human

volunteers. In essence, hVIVO enables human biology to be studied

in human volunteers, with the aim of conquering human disease, not

just viral disease.

6. Related party transaction

As part of the Placing, Invesco, which is a related party for

the purpose of the AIM Rules by virtue of being a "substantial

shareholder", has agreed to subscribe for 4,230,769 New Ordinary

Shares.

As at 13 August 2014 (being the last practicable date prior to

the release of the Announcement), Invesco holds approximately 24.4

per cent. of the voting rights attached to the issued share capital

of the Company. Immediately upon Admission, Invesco is expected to

hold 17,569,338 Ordinary Shares representing 26.0 per cent. of the

issued share capital as enlarged by the Placing.

The Directors consider, having consulted with the Company's

nominated adviser, Numis, that the participation by Invesco is fair

and reasonable in so far as its Shareholders are concerned.

The AIM Rules do not prohibit Invesco from exercising the voting

rights attached to its holding of Ordinary Shares at the General

Meeting.

7. Resolutions

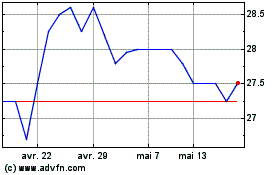

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024