4. acknowledges that none of Numis, the Company, any of their

respective affiliates or any person acting on behalf of any of them

has provided it, and will not provide it, with any material

regarding the Placing Shares or the Company other than this

Announcement; nor has it requested any of Numis, the Company, their

respective affiliates or any person acting on behalf of any of them

to provide it with any such information and has read and understood

the Exchange Information;

5. acknowledges that the content of this Announcement is

exclusively the responsibility of the Company, and that none of

Numis, its affiliates or any person acting on its or their behalf

has or shall have any liability for any information, representation

or statement contained in this Announcement or any information

previously or concurrently published by or on behalf of the

Company, and will not be liable for any Placee's decision to

participate in the Placing based on any information, representation

or statement contained in this Announcement or otherwise. Each

Placee further represents, warrants and agrees that the only

information on which it is entitled to rely and on which such

Placee has relied in committing itself to acquire the Placing

Shares is contained in this Announcement and any Exchange

Information, such information being all that it deems necessary to

make an investment decision in respect of the Placing Shares and

that it has neither received nor relied on any other information

given or representations, warranties or statements made by Numis,

the Company or any of their respective directors, officers or

employees or any person acting on behalf of any of them, or, if

received, it has not relied upon any such information,

representations, warranties or statements (including any management

presentation that may have been received by any prospective Placee

or any material prepared by the Research Department of Numis (the

views of such Research Department not representing and being

independent from those of the Company and the Corporate Finance

Department of Numis and not being attributable to the same)), and

neither Numis nor the Company will be liable for any Placee's

decision to accept an invitation to participate in the Placing

based on any other information, representation, warranty or

statement. Each Placee further acknowledges and agrees that it may

not place the same degree of reliance on this Announcement as it

may otherwise place on a prospectus or admission document. Each

Placee further acknowledges and agrees that it has relied solely on

its own investigation of the business, financial or other position

of the Company in deciding to participate in the Placing and it

will not rely on any investigation that Numis, its affiliates or

any other person acting on its or their behalf has or may have

conducted;

6. represents and warrants that it has neither received nor

relied on any confidential price sensitive information concerning

the Company in accepting this invitation to participate in the

Placing;

7. acknowledges that Numis does not have any duties or

responsibilities to it, or its clients, similar or comparable to

the duties of "best execution" and "suitability" imposed by the

Conduct of Business Sourcebook in the FCA's Handbook of Rules and

Guidance and that Numis is not acting for it or its clients and

that Numis will not be responsible for providing protections to it

or its clients;

8. acknowledges that none of Numis, any of its affiliates or any

person acting on behalf of it or them has or shall have any

liability for the Exchange Information, any publicly available or

filed information or any representation relating to the Company,

provided that nothing in this paragraph excludes the liability of

any person for fraud or fraudulent misrepresentation made by that

person;

9. that, save in the event of fraud on the part of Numis (and to

the extent permitted by the Rules of the FCA), neither Numis, its

ultimate holding company nor any direct or indirect subsidiary

undertakings of that holding company, nor any of their respective

directors and employees shall be liable to Placees for any matter

arising out of Numis' role as placing agent or otherwise in

connection with the Placing and that where any such liability

nevertheless arises as a matter of law Placees will immediately

waive any claim against any of such persons which they may have in

respect thereof;

10. represents and warrants that (i) it is not in the United

States and (ii) it is not acting for the account or benefit of a

person in the United States;

11. acknowledges that the Placing Shares are being offered and

sold only pursuant to Regulation S under the Securities Act in a

transaction not involving a public offering of securities in the

United States and the Placing Shares have not been and will not be

registered under the Securities Act or with any state or other

jurisdiction of the United States, nor approved or disapproved by

the US Securities and Exchange Commission, any state securities

commission in the United States or any other United States

regulatory authority, and that the offer and sale of the Placing

Shares to it has been made outside of the United States in an

'offshore transaction' (as such term is defined in Regulation S

under the Securities Act) and agrees not to reoffer, resell, pledge

or otherwise transfer the Placing Shares except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and otherwise in

accordance with any applicable securities laws of any state or

jurisdiction of the United States;

12. unless otherwise specifically agreed in writing with Numis,

represents and warrants that neither it nor the beneficial owner of

such Placing Shares will be a resident of Canada, Australia, New

Zealand, Japan or the Republic of South Africa;

13. acknowledges that the Placing Shares have not been and will

not be registered under the securities legislation of Canada,

Australia, New Zealand, Japan or the Republic of South Africa and,

subject to certain exceptions, may not be offered, sold, taken up,

renounced or delivered or transferred, directly or indirectly,

within those jurisdictions;

14. represents and warrants that the issue to it, or the person

specified by it for registration as holder, of Placing Shares will

not give rise to a liability under any of sections 67, 70, 93 or 96

of the Finance Act 1986 (depositary receipts and clearance

services) and that the Placing Shares are not being acquired in

connection with arrangements to issue depositary receipts or to

transfer Placing Shares into a clearance system;

15. represents and warrants that: (i) it has complied with its

obligations under the Criminal Justice Act 1993 and Part VIII of

FSMA; (ii) in connection with money laundering and terrorist

financing, it has complied with its obligations under the Proceeds

of Crime Act 2002 (as amended), the Terrorism Act 2000 (as

amended), the Terrorism Act 2006 and the Money Laundering

Regulations 2007; and (iii) it is not a person: (a) with whom

transactions are prohibited under the Foreign Corrupt Practices Act

of 1977 or any economic sanction programmes administered by, or

regulations promulgated by, the Office of Foreign Assets Control of

the U.S. Department of the Treasury; (b) named on the Consolidated

List of Financial Sanctions Targets maintained by HM Treasury of

the United Kingdom; or (c) subject to financial sanctions imposed

pursuant to a regulation of the European Union or a regulation

adopted by the United Nations (together, the "Regulations"); and,

if making payment on behalf of a third party, that satisfactory

evidence has been obtained and recorded by it to verify the

identity of the third party as required by the Regulations and has

obtained all governmental and other consents (if any) which may be

required for the purpose of, or as a consequence of, such purchase,

and it will provide promptly to Numis such evidence, if any, as to

the identity or location or legal status of any person which Numis

may request from it in connection with the Placing (for the purpose

of complying with such Regulations or ascertaining the nationality

of any person or the jurisdiction(s) to which any person is subject

or otherwise) in the form and manner requested by Numis on the

basis that any failure by it to do so may result in the number of

Placing Shares that are to be purchased by it or at its direction

pursuant to the Placing being reduced to such number, or to nil, as

Numis may decide at its sole discretion;

16. if a financial intermediary, as that term is used in Article

3(2) of the Prospectus Directive, represents and warrants that the

Placing Shares purchased by it in the Placing will not be acquired

on a non-discretionary basis on behalf of, nor will they be

acquired with a view to their offer or resale to, persons in a

Member State of the European Economic Area which has implemented

the Prospectus Directive other than Qualified Investors, or in

circumstances in which the prior consent of Numis has been given to

the offer or resale;

17. represents and warrants that it has not offered or sold and

will not offer or sell any Placing Shares to persons in the

European Economic Area prior to Admission except to persons whose

ordinary activities involve them in acquiring, holding, managing or

disposing of investments (as principal or agent) for the purposes

of their business or otherwise in circumstances which have not

resulted in and which will not result in an offer to the public in

any member state of the European Economic Area within the meaning

of the Prospectus Directive (including any relevant implementing

measure in any member state);

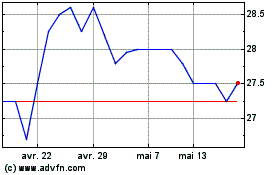

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024