The calculation of the basic and diluted (Loss)/earnings per

share is based on the following data:

6 Months 6 Months Year

ended ended ended

30 Jun 30 Jun 31 Dec

14 13 Unaudited 13

Unaudited GBP'000 Audited

GBP'000 GBP'000

Earnings:

(Loss)/earnings for the

purposes of basic and diluted

(Loss)/ earnings per share

being net (Loss)/ profit

for the period (3,413) 572 1,512

=========== ============== ===========

Number of shares:

Weighted average number

of ordinary shares for

the purpose of basic (Loss)/earnings

per share 54,384,217 40,976,920 47,963,221

Effect of dilutive potential

ordinary shares:

* share options - 3,851,268 3,744,509

* warrants - - 143,449

----------- -------------- -----------

Weighted average number

of ordinary shares for

the purpose of diluted

(Loss)/earnings per share 54,384,217 44,828,188 51,851,179

=========== ============== ===========

In the 6 months ended 30 June 2014, potential dilutive ordinary

shares of 3,745,505 share options and 143,449 warrants were not

treated as dilutive as the Group was loss making.

5. Acquisition

On 4 March 2014, the Company announced the acquisition of 100%

of the share capital of Activiomics Limited ("Activiomics") for a

total consideration of up to GBP4.0 million in new ordinary shares

of 5 pence each in the Company ("Ordinary Shares"). Activiomics is

a private UK based proteomics company founded in 2010 and spun out

of Barts and the London Medical School, part of Queen Mary

University of London. Activiomics has a powerful technology for

protein identification which will help enable Retroscreen to mine

its biological samples for novel insights into target diseases.

The GBP4.0 million consideration is for the entire issued share

capital of Activiomics (on a fully diluted basis including all

outstanding options), split between a GBP3.08 million initial

consideration payable on the date of the transaction and GBP0.71

million of contingent consideration payable on the first

anniversary of the date of transaction subject to the satisfaction

of the successful transfer of technology to the Company. This

represents the fair value of the deferred consideration in line

with the expected payment based on the terms of the agreement.

Activiomics option holders rolled over their options into

Retroscreen options on similar terms, with options valued at

GBP171k in respect of the initial consideration and GBP40k in

respect of the contingent consideration.

The initial consideration was satisfied by the issue of 996,901

Ordinary shares in the Company. Following admission of the new

shares to trading on AIM, Retroscreen's total number of Ordinary

Shares with voting rights in issue was 54,723,821.

The amounts recognised in respect of the identifiable assets

acquired and liabilities assumed are as set out in the table

below:

GBP'000

Cash 108

Other receivables 16

Property, plant & equipment 24

Intangible assets 2,541

Financial liabilities (91)

Total identifiable assets 2,598

Goodwill 1,402

Total consideration 4,000

=============================================== ==================

Satisfied by:

Cash 41

Equity instruments (issue of ordinary shares) 3,037

Deferred consideration 922

Total consideration transferred 4,000

=============================================== ==================

The goodwill of GBP1.4m represents the premium paid in

anticipation of future profitability from assets that are not

capable of being separately identified and separately recognised

such as the expectation that the Company will be able to leverage

its wider market access and strong financial position to generate

sustainable financial growth beyond what Activiomics would have

potentially achieved as a stand-alone company.

None of the goodwill is expected to be deductible for tax

purposes. The impact of Activiomics results for the period are not

material to the Group as a whole.

The intangible assets acquired as part of the acquisition relate

to the proteomics technology, the fair value of which is dependent

on estimates of attributable cost savings, and are being amortised

over five years. The fair value of the acquired identifiable assets

and liabilities is provisional pending finalisation of the fair

value exercise.

6. Post Balance Sheet Event

On 14 August 2014, the Company announced that it had raised

GBP33.6 million (before expenses), subject to shareholder approval,

by way of a placing of 12,923,077 new Ordinary Shares of 25p each

with both new and existing institutional shareholders at a price of

260 pence per Ordinary Share. Following completion of the placing

on 1 September 2014 and subsequent admission of the 12,923,077 new

Ordinary Shares to trading on AIM, the total number of Ordinary

Shares with voting rights in issue was 67,646,898.

7. Financial Assets

Carrying value of financial assets:

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 9,149 13,194 13,310

Short-term deposits 22,500 - 22,500

Trade receivables 3,484 2,427 3,511

Research and development tax

credit receivable 1,818 1,615 2,425

Other receivables 2,428 1,305 1,838

Accrued income 664 479 502

----------------------------- --------- --------- -----------

Total financial assets 40,043 19,020 44,086

----------------------------- --------- --------- -----------

Carrying value of financial liabilities:

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Trade payables 2,881 2,268 2,083

Other taxes and social security 435 335 490

Accruals 2,256 1,318 2,705

Deferred income 2,235 3,644 2,892

Repayable lease incentive from

related parties 663 738 700

Other payables 197 60 111

-------------------------------- --------- --------- -----------

Total financial liabilities 8,667 8,363 8,981

-------------------------------- --------- --------- -----------

Retroscreen Virology Group plc

Independent review report to Retroscreen Virology Group plc

We have been engaged by the Company to review the condensed set

of financial statements in the interim financial report for the six

months ended 30 June 2014 which comprises the statement of

comprehensive income, the statement of financial position, the

statement of changes in equity, the statement of cash flows and

related notes 1 to 7. We have read the other information contained

in the interim financial report and considered whether it contains

any apparent misstatements or material inconsistencies with the

information in the condensed set of interim financial

statements.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

Company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The interim financial report is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the interim financial report in accordance with the AIM

Rules of the London Stock Exchange. As disclosed in note 1, the

annual financial statements of the Group are prepared in accordance

with IFRSs as adopted by the European Union. The condensed set of

financial statements included in this half-yearly financial report

has been prepared in accordance with International Accounting

Standard 34, "Interim Financial Reporting," as adopted by the

European Union.

Our responsibility

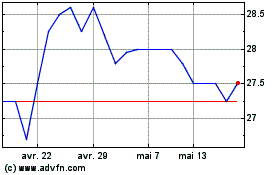

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024