TIDMVENN

RNS Number : 3521O

Venn Life Sciences Holdings PLC

17 May 2018

17 May 2018

Venn Life Sciences Holdings Plc

("Venn", "Venn Life Sciences" or the "Company")

Preliminary Final Results for the year ended 31 December

2017

Venn Life Sciences (AIM: VENN), an Integrated Drug Development

Partner offering a combination of drug development expertise and

clinical trial design and management to pharmaceutical,

biotechnology and medical device clients, announces its audited

results for the year ended 31 December 2017.

Financial Highlights

-- Total income was EUR17.8m (2016: EUR18.2m)

-- EBITDA (before exceptional items) of EUR1.0m (2016: EUR0.4m)

-- Operating profit of EUR0.1m (2016: Loss EUR0.6m)

-- Loss for the year after tax of EUR1.5m (2016: profit of

EUR0.6m) after a charge of EUR1.7m (2016: EUR0.4m) being share of

losses and investment write-down on Integumen PLC in 2017

-- Cash and cash equivalents of EUR1.2m as at 31 December 2017 (2016: EUR3.5m)

Operational Highlights

-- Continued progress on key systems infrastructure

implementation and operational efficiency delivering improvements

in operating margins

-- Strategic review concluded that following a period of

investment and operational consolidation, the Company would look to

identify both organic and in-organic growth opportunities

-- Key project milestones achieved leading to client endorsements and increased repeat business

-- Strengthening of the Board and operations with the

appointment of Christian Milla as Chief Operating Officer as well

as new leadership hires in Information Technology and Quality

Assurance

-- Finalisation of Kinesis acquisition with no further consideration payable

Post period-end

-- Retirement of Jonathan Hartshorn as Chief Financial Officer

-- Acquisition of minority interest in VLS France

-- Dilution of stake in Integumen PLC to below associate threshold

Commenting on the Group's outlook, Tony Richardson, CEO of Venn,

said: "During 2017 our focus has been on the delivered improved

underlying EBITDA in the business through improved operational

efficiencies. Additional investment in systems means that we now

have both the expertise and infrastructure to profitably execute

new business in scale and our focus is now on the generation of new

business opportunities. We have invested significantly in business

development and engaged creatively with clients to develop deeper,

longer lasting partnerships and our pipeline of opportunities is

healthy. We continue to see an increasing number of opportunities

that require the full range of services now on offer in Venn.

Continued strong investment in the biotech sector and the clear

emergence of virtual drug companies both represent a significant

opportunity for Venn. Our size, flexibility, deep expertise and

breadth of service capability leaves us well positioned to benefit

from this shift in the drug development landscape."

Enquiries:

Venn Life Sciences Holdings Tel: +353 1 5499341

Plc

Allan Wood, Non-Executive

Chairman

Tony Richardson, Chief

Executive Officer

Cenkos (Nominated adviser Tel: +44 (0) 20 7397 8900

and joint broker)

Mark Connolly/Steve Cox

(Corporate Finance)

Davy (Nominated adviser Tel: +353 (1) 679 6363

and broker)

Fergal Meegan/Matthew de Vere

White (Corporate Finance)

Hybridan (Joint broker) Tel: +44 (0) 20 3764 2341

Claire Louise Noyce

Walbrook PR

Paul McManus/Anna Dunphy Tel: +44 (0) 20 7933 8780

Chairman's Statement

For the year ended 31 December 2017

Dear Fellow Shareholder,

I am pleased to report that 2017 has been another year of

progress for Venn, delivering improved EBITDA and a differentiated

positioning for the business that we believe will drive sustainable

order book growth. The completion of certain key integration

initiatives during 2017 has delivered a strong common identity

across all service lines and facilitated the generation of new

opportunities utilising the full spectrum of services on offer in

Venn. We continue to invest in knowledge development in order to

increase our value-add for clients and secure longer lasting

relationships.

We have underpinned our initiatives on integration and business

positioning with a significant investment in business development

and marketing, adding experienced new business professionals with

proven track records and supporting them with additional lead

generation resources. Our plan includes the broadening of our

revenue base and delivering a better balanced book of business. I

am pleased to report that we are making progress in this regard

with the progression of certain smaller accounts to key account

status.

During the year we completed a strategic review of growth

options for the business and concluded that it makes sense to

better leverage the infrastructure we have, through delivering both

organic and inorganic business growth. We will look at inorganic

opportunities that extend both our footprint and service lines,

consistent with our objective of positioning the business as full

service and full coverage in Europe.

Allan Wood

Chairman

17 May 2018

Chief Executive's Statement

For the year ended 31 December 2017

Dear Fellow Shareholder,

Results and Commentary

Total income for the full year was EUR17.8m (2016: EUR18.2m).

The revenue mix remained similar year on year across the two

principal service lines in the business. Early Development Services

(EDS) delivered revenues of EUR6m and Clinical Research Services

(CRS) delivered revenues of EUR11.8m. EBITDA before exceptional

charges was EUR1.0m (2016: EUR0.4m). Improved EDBITDA was driven

principally by greater operational efficiency resulting in improved

project margins. We expect that increased billable resources and

continued improvements in operational efficiency will drive further

growth in EBITDA during 2018. Exceptional charges have been

minimised at EUR0.03m (2016: EUR0.1m). The consolidated balance

sheet as at 31 December 2017 had gross assets of EUR12.2m (2016:

EUR14.7m), EUR1.2m (2016: EUR3.5m) of which was represented by cash

and cash equivalents.

Group operating profit for the year was EUR0.1m (2016: loss

EUR0.6m). Loss after tax was EUR1.5m (2016: Loss EUR0.7m) accounted

for by our share of losses in Integumen plc and a write down to

market value in the carrying value of our investment. The combined

share of losses and investment write down was EUR1.7m (2016:

EUR0.36m). In future periods we will mark this investment to

market.

We continue to see benefits and opportunities from the

integration of EDS and CRS and have secured projects spanning all

service areas of the business. We have strengthened our business

development team and now have a fully integrated offering with a

common Venn identity.

We are focussed on deepening our connections and engagement with

our clients offering higher value adding consulting in the early

days of the engagement resulting in committed, longer lasting

relationships. There are clear opportunities with a number of

clients to develop a genuine partner relationship. In recent months

we have participated in consortia focussed on collaborative drug

development initiatives. This approach supports an innovative

business model moving from transactional relations with our clients

to R&D partnerships supported by our unique drug development

capabilities.

Anthony Richardson

Chief Executive Officer

17 May 2017

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2017

2017 2016

EUR'000 EUR'000

--------------------------------------- --------- ---------

Continuing operations

Revenue 17,405 17,909

Direct Project and Administrative

Costs (17,763) (18,805)

Other operating income 410 335

Operating profit/(loss) 52 (561)

--------- ---------

Depreciation (99) (133)

Amortisation (792) (689)

Exceptional items (25) (125)

EBITDA before exceptional items 968 386

---------

Finance income - 12

Finance costs - -

Share of loss of investments

accounted for using the equity

method (923)

Impairment of fixed asset investments (794) (364)

---------------------------------------- --------- ---------

Profit/(loss) before income

tax (1,665) (913)

Income tax credit 127 169

---------------------------------------- --------- ---------

Profit/(loss) for the year from

continuing operations (1,538) (744)

---------------------------------------- --------- ---------

Discontinued operations

Profit for the year from discontinued

operations - 1,295

---------------------------------------- --------- ---------

Profit/(loss) for the year (1,538) 551

---------------------------------------- --------- ---------

Profit for the year is attributable

to:

Owners of the parent (1,538) 532

Non-controlling interests - 19

---------------------------------------- --------- ---------

(1,538) 551

--------------------------------------- --------- ---------

Other comprehensive income

--------------------------------------- --------- ---------

Currency translation differences 60 (36)

---------------------------------------- --------- ---------

Total comprehensive gain/(loss)

for the year (1,478) 515

---------------------------------------- --------- ---------

Total comprehensive gain/(loss)

for the year is attributable

to:

Owners of the parent (1,478) 496

Non-controlling interests - 19

---------------------------------------- --------- ---------

(1,478) 515

--------------------------------------- --------- ---------

Total comprehensive gain/(loss)

for the year attributable to

owners of the parent arises

from:

Continuing operations (1,478) (799)

Discontinued operations - 1,295

---------------------------------------- --------- ---------

(1,478) 496

--------------------------------------- --------- ---------

Earnings per share from continuing

and discontinued operations

attributable to owners of the

parent during the year

Basic profit/(loss) per ordinary

share

From continuing operations (2.55c) (1.26c)

From discontinued operations - 2.14c

---------------------------------------- --------- ---------

From profit/(loss) for the year (2.55c) 0.88c

---------------------------------------- --------- ---------

Diluted profit/(loss) per ordinary

share

From continuing operations (2.35c) (1.14)

From discontinued operations - 1.93c

---------------------------------------- --------- ---------

From profit/(loss) for the year (2.35c) 0.79c

---------------------------------------- --------- ---------

Consolidated and Company's Statement of Financial Position

As at 31 December 2017

Group Group Company Company

2017 2016 2017 2016

EUR'000 EUR'000 EUR'000 EUR'000

------------------------------- -------- -------- -------- --------

Assets

Non-current assets

Property, plant and

equipment 312 191 - -

Intangible assets 4,034 4,499 - -

Investments in subsidiaries - - 7,778 7,908

Assets held for sale 680

Investments 31 2,038 31 31

Total non-current assets 5,057 6,728 7,809 7,939

-------------------------------- -------- -------- -------- --------

Current assets

Trade and other receivables 5,874 4,402 8,960 8,664

Income tax recoverable 107 43 - -

Cash and cash equivalents 1,175 3,541 15 206

-------------------------------- -------- -------- -------- --------

Total current assets 7,156 7,986 8,975 8,870

-------------------------------- -------- -------- -------- --------

Total assets 12,213 14,714 16,784 16,809

-------------------------------- -------- -------- -------- --------

Equity attributable

to owners

Share capital 155 155 155 155

Share premium account 14,026 14,026 14,026 14,026

Group re-organisation

reserve (541) (541) - -

Merger relief reserve - - 3,531 3,531

Reverse acquisition

reserve 45 45 - -

Foreign currency reserves (48) 13 - -

Share option reserve - 28 - 28

Retained earnings (4,882) (3,294) (1,312) (1,824)

-------------------------------- -------- -------- -------- --------

8,755 10,432 16,400 15,916

Non-controlling interest - - - -

------------------------------- -------- -------- -------- --------

Total equity 8,755 10,432 16,400 15,916

-------------------------------- -------- -------- -------- --------

Liabilities

Non-current liabilities

Borrowings - 25 - -

Total non-current liabilities - 25 - -

------------------------------- -------- -------- -------- --------

Current liabilities

Trade and other payables 2,999 3,661 384 893

Deferred taxation 434 561 - -

Deferred consideration - - - -

Borrowings 25 35 - -

Total current liabilities 3,458 4,257 384 893

-------------------------------- -------- -------- -------- --------

Total liabilities 3,458 4,282 384 893

-------------------------------- -------- -------- -------- --------

Total equity and liabilities 12,213 14,714 16,784 16,809

-------------------------------- -------- -------- -------- --------

Consolidated and Company's Statement of Cash Flows

For the year ended 31 December 2017

Group Group Company Company

2017 2016 2017 2016

Notes EUR'000 EUR'000 EUR'000 EUR'000

Cash Flow from operating activities

Continuing operations

Cash used in operations (1,255) (219) (321) (377)

Income tax received/(paid) (64) 38 - -

---------------------------------------------------------------- -------- -------- -------- --------

Net cash used in operating activities (1,319) 181 (321) (377)

---------------------------------------------------------------- -------- -------- -------- --------

Cash flow from investing activities

Investment in associate (465) - - -

Purchase of intellectual property (327) (79) (7) -

Purchase of property, plant and equipment (220) - - -

Refund of Escrow - - 137 -

Interest received - 12 - -

------------------------------------------------------- ------- -------- -------- -------- --------

Net cash used in investing activities (1,012) (67) 130 -

---------------------------------------------------------------- -------- -------- -------- --------

Cash flow from financing activities

Proceeds from issuance of ordinary shares - 15 - 30

Repayments on borrowings (35) (27) - -

Net cash generated by financing activities (35) (12) - 30

---------------------------------------------------------------- -------- -------- -------- --------

Net increase/ (decrease) in cash and cash equivalents (2,366) (260) (191) (347)

Cash and cash equivalents at beginning of year 3,541 3,798 206 554

Exchange losses on cash and cash equivalents - 3 - 1

---------------------------------------------------------------- -------- -------- -------- --------

Cash and cash equivalents at end of year 1,175 3,541 15 206

---------------------------------------------------------------- -------- -------- -------- --------

Consolidated and Company's Statement of Changes in Shareholders'

Equity

Group

Re-organisation

& Reverse Share Foreign

Share Share acquisition Option currency Retained Non-controlling

capital premium reserve reserve reserve earnings Total interests Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

At 1 January

2016 155 14,011 (496) 13 49 (3,826) 9,906 327 10,233

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Changes in

equity for the

year

ended 31

December 2016

Profit/ (Loss)

for the year - - - - - 532 532 (327) 205

Currency

translation

differences - - - - (36) - (36) - (36)

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Total

comprehensive

profit

/(loss) for

the year - - - - (36) 532 496 (327) 169

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Transactions

with the

owners

Shares issued - 15 - - - - 15 - 15

Options issued - - - 15 - - 15 - 15

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Total

contributions

by and

distributions

to owners - 15 - 15 - - 30 - 30

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

At 31 December

2016 155 14,026 (496) 28 13 (3,294) 10,432 - 10,432

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Changes in

equity for the

year

ended 31

December 2017

Profit/ (Loss)

for the year - - - - - (1,538) (1,538) (-) (1,538)

Prior year

adjustment (78) (78) (78)

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Currency

translation

differences - - - - (61) - (61) - (61)

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Total

comprehensive

profit

/(loss) for

the year - - - - (61) (1,616) (1,677) (-) (1,677)

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Transactions

with the

owners

Shares issued - - - - - - - - -

Share option

provision

reversed - - - (28) - 28 (-) - (-)

Total - - - - - - - - -

contributions

by and

distributions

to owners

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

At 31 December

2017 155 14,026 (496) - (48) (4,882) 8,755 (-) 8,755

--------------- --------- --------- ---------------- -------- ---------- ---------- --------- ----------------- --------

Company Merger

Share Share relief Retained

Share capital premium Option reserve reserve earnings Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

---------------- -------------------- ---------------- -------------------- ---------- --------- ---------------------------

As at 1 January

2016 155 14,011 13 3,531 (2,351) 15,359

---------------- -------------------- ---------------- -------------------- ---------- --------- ---------------------------

Changes in

equity for the

year ended

31 December

2015

Total

comprehensive

loss for the

year - - - - 527 527

Issued in year - 15 15 - - 30

At 31 December

2016 155 14,026 28 3,531 (1,824) 15,916

---------------- -------------------- ---------------- -------------------- ---------- --------- ---------------------------

Changes in

equity for the

year ended

31 December

2017

Total

comprehensive

gain for the

year - - (28) - 512 484

Issued in year - - - - - -

At 31 December

2017 155 14,026 - 3,531 (1,340) 16,372

---------------- -------------------- ---------------- -------------------- ---------- --------- ---------------------------

1. General information

Venn Life Sciences Holdings Plc is a company incorporated in

England and Wales. The Company is a public limited company listed

on the AIM market of the London Stock Exchange. On 18 January 2016,

the company also listed on the ESM market of the Irish Stock

Exchange. The address of the registered office is 1 Berkeley

Street, London, W1J 8DJ.

The principal activity of the Group is that of a Clinical

Research Organisation providing a suite of consulting and clinical

trial services to pharmaceutical, biotechnology and medical device

organisations. The Group has a presence in the UK, Ireland, France,

Netherlands, Germany and Singapore.

The financial statements are presented in Euros, the currency of

the primary economic environment in which the Group's trading

companies operate. The Group comprises Venn Life Sciences Holdings

Plc and its subsidiary companies.

The registered number of the Company is 07514939.

2. Exceptional items

Included within Administrative expenses are exceptional items as

shown below:

2017 2016

EUR'000 EUR'000

----------------------------------------- -------- --------

Exceptional items includes:

- Transaction costs relating to

business combinations and acquisitions 25 79

- office relocation - 46

Total exceptional items 25 125

------------------------------------------ -------- --------

3. Finance income and costs

2017 2016

EUR'000 EUR'000

------------------------------------------ -------- --------

Interest expense:

- Bank borrowings - -

- Interest on other loans - -

------------------------------------------ -------- --------

Finance costs - -

------------------------------------------ -------- --------

Finance income

- Interest income on cash and short-term

deposits - 12

------------------------------------------ -------- --------

Finance income - 12

------------------------------------------ -------- --------

Net finance costs - 12

------------------------------------------ -------- --------

4. Income tax expense

2017 2016

Group EUR'000 EUR'000

--------------------------------------------------- -------- --------

Current tax:

Current tax for the year - (38)

Overprovision of prior year tax charge (127)

Total current tax (credit)/charge (127) (38)

--------------------------------------------------- -------- --------

Deferred tax:

Origination and reversal of temporary differences - (131)

--------------------------------------------------- -------- --------

Total deferred tax - (131)

--------------------------------------------------- -------- --------

Income tax (credit)/charge (127) (169)

--------------------------------------------------- -------- --------

The tax on the Group's results before tax differs from the

theoretical amount that would arise using the standard tax rate

applicable to the profits of the consolidated entities as

follows:

2017 2016

EUR'000 EUR'000

------------------------------------------------- -------------- --------

Loss before tax (1,665) (913)

------------------------------------------------- -------------- --------

Tax calculated at domestic tax rates applicable

to UK standard rate of tax of 19% (2016

- 20%) (316) (183)

Tax effects of:

- Expenses not deductible for tax purposes 28 26

- Temporary timing differences (127) (131)

- Losses carried forward/(utilised) 288 118

Tax (credit)/charge (127) (169)

------------------------------------------------- -------------- --------

There are no tax effects on the items in the statement of

comprehensive income.

5. Loss per share

(a) Basic

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year.

2017 2016

EUR'000 EUR'000

Profit/(loss) from continuing operations

attributable to equity holders of

the Company (1,538) (763)

Profit from discontinued operations

attributable to equity holders of

the Company - 1,295

Total (1,538) 532

Weighted average number of Ordinary

Shares in issue 60,284,263 60,264,907

Basic profit/ (loss) per share (2.55c) 0.88c

(b) Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares.

Weighted average number of shares used as the denominator

2017 2016

Weighted average number of ordinary

shares used as the denominator in

calculating basic earnings per share 60,284,263 60,264,907

Adjustments for calculation of diluted

earnings per share:

Options 4,985,288 3,675,000

Warrants 166,000 166,000

Total 65,436,117 64,106,573

6. Intangible fixed assets

Group Customer Intellectual

relationships Trade secrets Goodwill Property Rights Workforce Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Cost

At 1 January 2016 1,639 712 1,400 740 1,449 5,940

Addition - 29 440 - - 469

Exchange differences (5) (6) (22) (57) - (90)

On Disposal - - - (683) - (683)

At 31 December 2016 1,634 735 1,818 - 1,449 5,636

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Amortisation

At 1 January 2016 258 104 54 86 502

Charge for year 328 71 - - 290 689

Disposal of

subsidiary - - - (54) - (54)

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

At 31 December 2016 586 175 - - 376 1,137

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Net book value

At 31 December 2016 1,048 560 1,818 - 1,073 4,499

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Cost

At 1 January 2017 1,634 735 1,818 - 1,449 5,636

Addition - - - 360 360

Exchange differences 2 (2) (3) - 1 (2)

On disposal - (28) - - - (28)

At 31 December 2017 1,636 705 1,815 360 1,450 5,966

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Amortisation

At 1 January 2016 586 175 - - 376 1,137

Charge for the year 327 71 - 105 292 792

On disposal of - - - - - -

subsidiary

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

At 31 December 2017 913 246 - 105 668 1,932

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Net book value

At 31 December 2017 723 459 1,815 255 782 4,034

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

No amortisation charge has been charged on the goodwill in the

income statement (2016 - EURnil).

Goodwill is allocated to the Group's cash-generating units

(CGU's) identified according to operating segment. An operating

segment-level summary of the goodwill allocation is presented

below.

2017 2016

EUR'000 EUR'000

------- -------- --------

CRO 1,815 1,818

Total 1,815 1,818

------- -------- --------

Goodwill is tested for impairment at the balance sheet date. The

recoverable amount of goodwill at 31 December 2017 was assessed on

the basis of value in use. As this exceeded carrying value no

impairment loss was recognised.

The key assumptions in the calculation to assess value in use

are the future revenues and the ability to generate future cash

flows. The most recent financial results and forecast approved by

management for the next three years were used followed by an

extrapolation of expected cash flows at a constant growth rate for

a further two years. The projected results were discounted at a

rate which is a prudent evaluation of the pre-tax rate that

reflects current market assessments of the time value of money and

the risks specific to the cash-generating units.

The key assumptions used for value in use calculations in 2017

were as follows:

%

-------------------------------------- ---

Longer-term growth rate (after 2019) 5

Discount rate 20

--------------------------------------- ---

The Group has been loss making for the last 6 years and in 2014

the Directors transformed the infrastructure and capabilities of

the Group in order to work as a Group in providing services to

clinical research and development markets as one unit rather than

separate units. This meant that the impairment review is prepared

on the group basis rather than a single unit basis. The Directors

have made significant estimates on future revenues and EBITDA

growth over the next three years based on the Group's budgeted

investment in recruiting key employees and marketing the

services.

The Directors have performed a sensitivity analysis to assess

the impact of downside risk of the key assumptions underpinning the

projected results of the Group. The projections and associated

headroom used for the group is sensitive to the EBITDA growth

assumptions that have been applied. A 50% reduction in EBITDA

growth; in the first five years of the management projections would

not result in any impairment at the group level.

The Company has no intangible assets.

7. Investments in associates

Company 2017 2016

Shares in associated undertakings EUR'000 EUR'000

----------------------------------- -------- -------------

At 1 January 2,007 -

Additions 465 2,371

Share of losses (923) (364)

Impairment (869) -

----------------------------------- -------- -------------

At 31 December 2017 680 2,007

----------------------------------- -------- -------------

On 24 October 2016 the Company's wholly owned subsidiary Venn

Life Sciences Limited acquired a 41.51% holding in Integumen

Limited, as consideration for the disposal of its holding in

Innovenn UK Limited.

After the IPO of Integumen Plc on 5(th) April 2017, Venn Life

Sciences invested an additional EUR465k to offset dilution of the

original stake post IPO down to 25.59%. The stake was further

diluted to 22.19% after a round 2 investment in which Venn Life

Sciences did not participate .

The final valuation of the Integument Plc investment of EUR680k

was determined based on the market price as at 31 December

2017.

The group has no other associates.

Name of Company Note Proportion Held Class of Shareholding

Nature of Business

Integumen Limited 1 22.19% (indirect) Ordinary Human Surface

Science

Notes

1. Incorporated and registered in England and Wales.

8. Cash used in operations

Group Group Company Company

2017 2016 2017 2016

EUR'000 EUR'000 EUR'000 EUR'000

--------------------------------- -------- -------- -------- --------

(Loss)/Profit before

income tax (1,665) (913) 484 565

Discontinued operations - 1,295 - -

Adjustments for:

- Depreciation and amortisation 891 822 - -

- Foreign currency translation

of net assets (61) 134 - (38)

- Exceptional Item 25 79 - 137

- Net finance costs - (12) - -

- Share options charge (28) 15 - -

- Share in associated

undertakings 923 (364) - -

Changes in working capital

- Financial assets 794 (2,007) - -

- Trade and other receivables (1,424) 1,289 (296) (967)

- Trade and other payables (662) (557) (509) (74)

--------------------------------- -------- -------- -------- --------

Net cash used in operations (1,255) (219) (321) (377)

--------------------------------- -------- -------- -------- --------

9. Post balance sheet events

An additional 11.0% of the shares in Venn Life Sciences (France)

S.A.S were purchased with effect from 1 January 2018, bringing the

total proportion of shares held in that company to 100%. 277,550

Shares in Venn Life Sciences Holdings Plc were issued in

consideration for the purchase

The percentage holding in Integumen PLC fell from 22.19% to

18.89% on 6 January 2018 as a result of Integumen PLC issuing new

shares.

10. Annual Report and Accounts

Copies of the audited Annual Report and Accounts for the year

ended 31 December 2017 will be posted to shareholders shortly and

may also be obtained from the Company's head office at 19 Railway

Road, Dalkey, Dublin, Ireland

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UNRURWSAVAUR

(END) Dow Jones Newswires

May 17, 2018 02:01 ET (06:01 GMT)

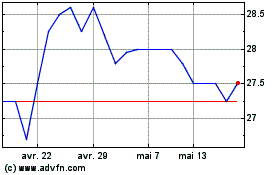

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024