Open Orphan PLC Schedule One Update (0696A)

16 Janvier 2020 - 3:00PM

UK Regulatory

TIDMORPH

RNS Number : 0696A

Open Orphan PLC

16 January 2020

Pre-Admission Announcement

Euronext Growth Schedule 1

Announcement to be made by the Applicant prior to admission

in accordance with the Euronext Growth Markets Rule Book

----------------------------------------------------------------------

All Applicants must complete the following

Company name

Open Orphan plc ("Open Orphan" or the

"Company", and together with its subsidiaries

the "Group")

-------------------------------------------------------------------

Company registered address and if different, company trading

address (including postcodes)

Registered Office:

PO Box W1J 6BD, Berkley Square House, 2nd Floor, Mayfair,

London, W1J 8DJ

Trading Offices:

19 Railway Road, Dalkey, Dublin, Ireland

Queen Mary BioEnterprises (QMB) Innovation Centre, 42 New

Road, London, E1 2AX

----------------------------------------------------------------------

Country of incorporation

England and Wales

----------------------------------------------------------------- ---

Company website address containing all information required

by rule 26 (5.26) of the Euronext Growth Markets Rule Books

www.openorphan.com

----------------------------------------------------------------------

Company business (including main country of operation) or,

in the case of an investing company, details of its investing

strategy. If the admission is sought as a result of a reverse

takeover under rule 5.19 of the Euronext Growth Markets

Rule Books, this should be stated

This is a reverse takeover under Rule 14.

Open Orphan is a Clinical Research Organisation that specialises

in rare and orphan drugs. The headquarters are in Dublin,

Ireland and the company also has offices in the UK, France,

the Netherlands and Germany.

Details of securities to be admitted including any restrictions

as to transfer of securities (i.e. where known, number of

shares, nominal value and issue price to which it seeks

admission and the number and type to be held as treasury

shares):

Number of ordinary shares of 0.1 pence each in nominal value

("Ordinary Shares") for which Admission will be sought:

445,622,374

There are no restrictions as to the transferability of the

Ordinary Shares and no Ordinary Shares will be held in treasury.

Capital to be raised on admission (if applicable) and anticipated

market capitalisation on admission:

Expected Market Capitalisation: GBP29.6 million (based on

an enlarged share capital of 445,622,374 and closing price

per Open Orphan Shares of GBP[0.0665] on 15 January 2020)

No capital to be raised on admission

Percentage of Euronext Growth securities not in public hands

on admission

22.8%

---------------------------------------------------------------------------------

Details of any other exchange or trading platform to which

the ex securities (or other securities of the company) are

or will be admitted or traded:

AIM

---------------------------------------------------------------------------------

Full names and functions of directors and proposed directors

(underlining the first name by which each is known or including

any other name by which each is known):

Directors:

Cathal Friel, Executive Chairman

Brendan Buckley, Non-executive Director

Proposed Directors:

Dr Trevor Phillips, Chief Executive Officer

Dr Mark Warne, Non-executive Director

Michael Meade, Non-executive Director

---------------------------------------------------------------------------------

Full names and holdings of significant shareholders, expressed

as a percentage of the issued share capital, before or after

admission (underlining the first name by which each is known

or including any other name by which each is known):

Before Admission:

Name Number of Ordinary Percentage of issued

Shares share capital

Cathal Friel 41,046,981 16.1%

------------------- ---------------------

Anthony (Tony) Richardson 16,313,388 6.4%

------------------- ---------------------

Gresham House Asset Management 13,081,337 5.1%

------------------- ---------------------

Crux Asset Management 11,928,571 4.7%

------------------- ---------------------

Brendan Buckley 7,845,860 3.1%

------------------- ---------------------

After Admission:

Cathal Friel 41,046,981 9.2%

Anthony (Tony) Richardson 16,313,388 3.7%

----------- ------

Gresham House Asset Management 13,081,337 2.9%

----------- ------

Crux Asset Management 11,928,571 2.7%

----------- ------

Brendan Buckley 7,845,860 1.8%

----------- ------

Invesco Ltd 52,485,973 11.8%

----------- ------

Link Fund Solutions Ltd 38,618,608 8.7%

----------- ------

IP Group plc 32,267,791 7.2%

----------- ------

Jupiter Asset Management

Ltd 22,819,579 5.1%

----------- ------

-------------------------------------------------------------------------------------

Names of all persons to be disclosed in accordance with

Chapter 5: Schedule Two, paragraph (h) of the Euronext Growth

Markets Rule Book:

n/a

-------------------------------------------------------------------------------------

i anticipated accounting reference date: 31

December

ii date to which the main financial information

in the admission document has been prepared:

31 December 2019

iii. dates by which it must publish its first

three reports pursuant to Rules 5.14 and 5.15

in the Euronext Growth Markets Rule Book:

31 December 2019 due 30 June 2020, 30 June

2020 due September 2020, 31 December 2020

due 30 June 2021

------------------------------------------------------------------------------- ----

Expected admission date: 20

January 2020

----------------------------------------------------------------------------- ------

Name and address of Euronext

Growth Advisor

Davy Corporate Finance, Davy

House, 49 Dawson Street, Dublin

2, Ireland

Name and address of broker

Arden Partners plc., 125 Old Broad Street, London, EC2N

1AR

-------------------------------------------------------------------------------------

Other than in the case of a Quoted Applicant, details of

where (postal or internet address) the admission document

will be available from, with a statement that this will

contain full details about the Applicant and the admission

of its securities

A copy of the admission document containing full details

about the applicant and the admission of its securities

is available on the Company's website, www.openorphan.com

-------------------------------------------------------------------------------------

Date of notification

16 January 2020

----------------------------------------------------------------------------- ------

New/update: Update

----------------------------------------------------------------------------- ------

This announcement has been issued through the Companies

Announcement Service of Euronext Dublin.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ISEFLFEVLTIRLII

(END) Dow Jones Newswires

January 16, 2020 09:00 ET (14:00 GMT)

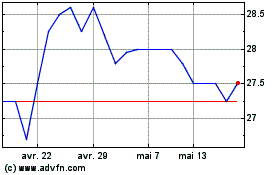

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024