Open Orphan PLC Exercise of Warrants and Issue of Shares (0565C)

05 Février 2020 - 12:00PM

UK Regulatory

TIDMORPH

RNS Number : 0565C

Open Orphan PLC

05 February 2020

5 February 2020

Open Orphan Plc

("Open Orphan" or the "Company")

Exercise of Warrants and Issue of Shares

Total Voting Rights

Open Orphan plc (ORPH), a rapidly growing specialist

pharmaceutical services company which has a focus on orphan drugs,

announces that the Company has received notices of exercise of

warrants over 539,654 ordinary shares of 0.1 pence each in the

capital of the Company ("Ordinary Shares") at a price of 0.1 pence

per share for 191,051 Ordinary Shares and at a price of 2.2 pence

per share for 348,603 Ordinary Shares. The gross proceeds of this

exercise received by the Company amounts to GBP7,860.33.

Following the warrant exercise, the outstanding warrants over

Ordinary Shares are as follows:

Number of Ordinary Shares Exercise Price per Expiry Date

share

-------------------------- ------------------- -----------------

166,666 30 pence 6 June 2021

1,568,701 0.1 pence 10 December 2023

2,862,337 2.2 pence 10 December 2023

1,607,142 5.6 pence 27 June 2024

The Company has made application for 539,654 new Ordinary

Shares, to be issued and allotted as a result of the warrant

exercise set out above, to be admitted to trading on AIM and

Euronext Growth. Admission is expected to occur at 8.00 a.m. on 11

February 2020.

Total Voting Rights

Following the admission of 86,885,253 new Ordinary Shares in

connection with the placing and subscription announced by the

Company on 31 January 2020, which is expected to occur at 8.00 a.m.

on 6 February 2020, and the admission of 539,654 new Ordinary

Shares issued and allotted as a result of the warrant exercise set

out above, which is expected to occur at 8.00 a.m. on 11 February

2020, the Company's total issued ordinary share capital will

consist of 533,047,281 Ordinary Shares. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Enquiries:

Open Orphan Plc Tel: +353 1 644 0007

Cathal Friel, Executive Chairman

Trevor Phillips, Chief Executive Officer Tel: +44 (0)20 7347

5350

Arden Partners (Nominated Adviser and Joint Broker) Tel: +44

(0)20 7614 5900

John Llewellyn-Lloyd / Ruari McGirr / Benjamin Cryer

Davy (Euronext Growth Adviser and Joint Broker) Tel: +353 (0)1

679 6363

Anthony Farrell (Corporate Finance)

Camarco (Financial PR) Tel: +44 (0)20 3757 4980

Tom Huddart / Billy Clegg / Dan Sherwen

Notes to Editors:

Open Orphan is a rapidly growing European full pharmaceutical

services company with a focus on orphan drug and specialist

services, comprising two commercial specialist CRO services

businesses (Venn and hVIVO) and a developing early stage orphan

drug genomics data platform business capturing valuable genetic

data from patient populations with specific diseases with

designated orphan drug status and incorporating AI tools. In June

2019, Open Orphan acquired AIM-listed Venn Life Sciences Holdings

plc in a reverse take-over and in January 2020 it completed the

Merger with hVIVO plc. Venn, as an integrated drug development

consultancy, offers CMC (chemistry, manufacturing and controls) ,

preclinical, phase I & II clinical trials design and execution

and hVIVO, as an industry leading services provider in viral

challenge studies and laboratory services, supports product

development for customers developing antivirals, vaccines and

respiratory therapeutics. The Merger with hVIVO created a European

full pharma services company broadening the Company's customer base

and with complementary specialist CRO services, widened the range

of the Company's service offerings. Open Orphan is a rapidly

growing European full pharmaceutical services company with a focus

on orphan drug and specialist services, comprising two commercial

specialist CRO services businesses (Venn and hVIVO) and a

developing early stage orphan drug genomics data platform business

capturing valuable genetic data from patient populations with

specific diseases with designated orphan drug status and

incorporating AI tools. In June 2019, Open Orphan acquired

AIM-listed Venn Life Sciences Holdings plc in a reverse take-over

and in January 2020 it completed the merger with hVIVO plc. Venn,

as an integrated drug development consultancy, offers CMC

(chemistry, manufacturing and controls) , preclinical, phase I

& II clinical trials design and execution and hVIVO, as an

industry leading services provider in viral challenge studies and

laboratory services, supports product development for customers

developing antivirals, vaccines and respiratory therapeutics. The

merger with hVIVO created a European full pharma services company

broadening the Company's customer base and with complementary

specialist CRO services, widened the range of the Company's service

offerings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TVRBELFBBLLLBBV

(END) Dow Jones Newswires

February 05, 2020 06:00 ET (11:00 GMT)

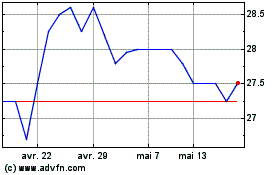

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024