K3 Business Technology Group PLC PDMR Announcement (2989A)

01 Février 2022 - 10:03AM

UK Regulatory

TIDMKBT

RNS Number : 2989A

K3 Business Technology Group PLC

01 February 2022

AIM: KBT

K3 Business Technology Group plc

("K3", "Company" or "Group")

PDMR Announcement

K3, which provides mission -- critical business software and

cloud solutions, has received notification from Kestrel Partners

LLP ("Kestrel") that on 28 January 2022 it acquired, on behalf of

its discretionary clients, 21,497 ordinary shares of 25p each in

the Company at an average price of GBP1.559304 per share. In

addition, on the 27 January 2022 it transferred, on behalf of its

discretionary clients, an aggregate of 53,572 ordinary shares at an

average price of GBP1.52 per share between accounts managed by

Kestrel.

Mr Scott, a non-executive director of K3, is a partner of, and

holds a beneficial interest in Kestrel. Mr Scott is also a

shareholder in one of Kestrel's clients ("Kestrel Opportunities")

and is therefore deemed to have a beneficial interest in Kestrel

Opportunities' entire legal holding in the Company.

Following these transactions, Kestrel Opportunities holds (and

consequently Mr Scott is deemed to have a beneficial interest in)

8,515,879 ordinary shares in the Company, and other clients of

Kestrel, in which Mr Scott has no beneficial interest, hold

2,653,427 ordinary shares in the Company.

On a combined basis, Kestrel indirectly holds voting rights over

11,169,306 ordinary shares in the Company, which represents 24.97%

per cent of the Company's issued share capital.

Kestrel's interest in the ordinary shares in the Company is held

through the following nominees:

Holding Nominee No. of shares % of issued share

type capital

Bank of New York Nominees

Indirect Ltd 8,515,879 19.04%

Indirect JIM Nominees Limited 140,080 0.31%

Bank of New York Nominees

Indirect Ltd 2,513,347 5.62%

Further details in respect of the purchase are provided below,

in accordance with the EU Market Abuse Regulation (No

596/2014).

For further information contact:

+44 (0) 161 876

K3 Business Technology Group plc 4498

Marco Vergani, CEO

Rob Price, CFO

+44 (0) 207 220

finnCap Ltd 0500

Nominated Adviser and Broker

Julian Blunt/James Thompson (Corporate finance)

Richard Chambers/ Sunila de Silva (Corporate

Broking)

+44 (0) 20 3178

KTZ Communications 6378

Katie Tzouliadis/Dan Mahoney

ANNEX

Template for notification and public disclosure of transactions

by persons discharging managerial responsibilities and persons

closely associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Kestrel Partners LLP ('Kestrel')

----------------------- ------------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status PCA - Oliver Rupert Andrew Scott (non-executive

director of K3 Business Technology Group plc

and Partner in Kestrel)

----------------------- ------------------------------------------------

b) Initial notification Initial

/Amendment

----------------------- ------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name K3 Business Technology Group plc

----------------------- ------------------------------------------------

b) LEI 213800QOJ9OF2AV81748

----------------------- ------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------

a) Description 25p Ordinary Shares

of the financial

instrument,

type of instrument ISIN: GB00B00P6061

Identification

code

----------------------- ------------------------------------------------

b) Nature of the Purchase / Transfer

transaction

----------------------- ------------------------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) GBP1.52 53,572 - Transfer

------------------

GBP1.54 10,000 - Purchase

------------------

1,497 - Purchase

GBP1.55

------------------

10,000 - Purchase

GBP1.58

------------------

----------------------- ------------------------------------------------

d) Aggregated information Total purchase of 21,497 at an average of

- Aggregated GBP1.559304 for value GBP33,520.35.

volume Total transfer of 53,572 at a price of GBP1.52

for value GBP81,429.44

- Price

----------------------- ------------------------------------------------

e) Date of the 27/01/2022 - Transfer

transaction 28/01/2022 - Purchase

----------------------- ------------------------------------------------

f) Place of the London Stock Exchange, AIM Market (XLON)

transaction

----------------------- ------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHGIGDDCUGDGDB

(END) Dow Jones Newswires

February 01, 2022 04:03 ET (09:03 GMT)

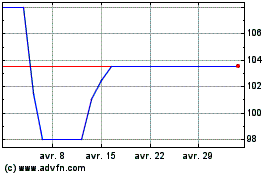

K3 Business Technology (LSE:KBT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

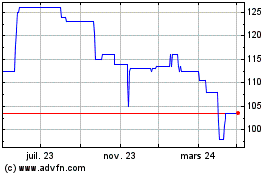

K3 Business Technology (LSE:KBT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024