TIDMMTL

RNS Number : 4522Z

Metals Exploration PLC

12 January 2024

12 January 2024

METALS EXPLORATION PLC

("Metals Exploration", "MTL" or the "Company")

Acquisition of Prospective Philippine Exploration Project

Metals Exploration, a gold producer in the Philippines, is

pleased to announce that it has entered into a conditional share

purchase agreement (the "SPA"), which is subject (amongst other

things) to relevant lender and shareholder approvals, to acquire a

controlling interest in the YMC Group (as defined below), which

holds an extensive exploration tenement in the prospective Abra

area of the Philippines, for cash consideration of US$1.6 million

and the issue of options to subscribe for up to 41 million new

ordinary shares of GBP0.0001 each in the capital of the Company

("Ordinary Shares") (the "Transaction").

Summary

-- Acquisition of a majority and controlling interest in a

highly prospective exploration licence covering 16,200 hectares on

Luzon, Philippines, approximately 200km north of the Company's

Runruno mine, in the Cordillera region, which is a prolific gold

belt in the Philippines, with proven mineral endowment, having

produced over 40Moz of gold historically.

-- Acquisition consideration comprises US$1,600,000 cash plus

the issue of options to subscribe for up to 41,000,000 Ordinary

Shares (the "MTL Options") (further details of which are set out

below), to acquire:

-- 72.5% of the issued share capital of Yamang Mineral Corp., a

Philippine incorporated company ("YMCP") that holds the exploration

tenement EXPA-000129 (the "Abra Tenement"); and

-- the entire issued share capital of Yamang Mineral Corp Pte.

Ltd., a Singapore incorporated company ("YMCS" and together with

YMCP, the "YMC Group") that , subject to final documentation, will

be granted 100% of the rights to process any ore produced from

mining operations within the Abra Tenement area. Other assets

include cash of approx imately US$1,130,000, a purpose-renovated

drill rig and drill supplies with an initial cost of approx imately

US$125,000.

-- The issue of the Abra Tenement has been approved and the

licence is exploration ready, subject only to final agreement with

local communities within the Philippines' National Commission on

Indigenous Peoples ("NCIP") framework; with this requirement

expected to be satisfied in the near-term following positive

discussions with local stakeholders.

-- The Abra Tenement includes several drill ready target areas

(including within Lacub and Manikbel) and numerous areas of

historical artisanal mining operations.

-- Initial planned exploration work programmes will include

geochemistry, geophysics, mapping and review of historical data,

intended to lead to a drill programme which is currently expected

to commence during H2 2024.

-- It is intended that community and NCIP initiatives will also

be put in place concurrent with commencement of exploration

activities to ensure the Company's social licence to explore and

develop the Abra Tenements.

Steven Smith, Interim Chairman of Metals Exploration,

commented:

"Our strategy is to grow MTL within the Philippines and

ultimately the broader region, leveraging our established

in-country knowledge, experience, and strong technical team.

Our team at Runruno has set the bar for high performance,

locally-run and managed operations, and this gives us a significant

competitive advantage as we focus on the development of new

projects in the country.

The acquisition of the YMC Group is the first step in our

progress to a new future for the Company. The Abra Tenement has the

potential to provide an extensive project growth pipeline for MTL,

with multiple prospective targets in both gold and copper over a

significant area, in a geological region of scale and with

historical production. If we have the exploration success we are

targeting, we aim to focus on developing a high-grade,

smaller-scale gold production-ready project as soon as possible, in

addition to advancing our other targets.

YMC is the first of a number of targets within our purview and

we look forward to providing further updates on both our

exploration progress and project expansion efforts, as results are

obtained."

The Transaction

Under the terms of the SPA, Metals Exploration has agreed to

acquire 72.5% of the issued share capital of YMCP and 100% of the

issued share capital of YMCS for a total consideration of

US$1,600,000, plus the issue of up to 41,000,000 MTL Options.

The assets of the YMC Group include:

-- the Abra Tenement over an area of 16,200 hectares in the Abra region;

-- approximately US$1,130,000 cash; and

-- a purpose-renovated drill rig and drill consumables with an approximate cost of US$125,000.

The Transaction is subject (amongst other things) to approval of

the Company's lenders pursuant to its senior, mezzanine and

revolving credit facilities and approval of the Company's

shareholders at a general meeting, to be convened in the near term,

in order to seek:

-- approval of the Transaction in accordance with section 190 of

the Companies Act 2006 (the "Act");

-- approval of the terms of a long-term incentive plan proposed

to be adopted by the Company and, pursuant to which, the MTL

Options would be issued; and

-- the necessary shareholder authorities to issue the MTL Options.

Further announcements will be made in due course, including in

respect of the posting of a circular to convene the general

meeting.

The requisite lender approvals required in respect of the

Transaction have been received from MTL (Luxembourg) S. à r.l and

MTL (Guernsey) Limited and are being sought from Runruno Holdings

Limited and D & A Holdings Limited.

Whilst it does not constitute a related party transaction for

the purpose of Rule 13 of the AIM Rules for Companies due to its

relative size, the Transaction constitutes a substantial property

transaction for the purpose of section 190 of the Act, which

applies where a company is to acquire a non-cash asset with a value

exceeding GBP100,000 from a director. Darren Bowden, CEO of Metals

Exploration, holds 35% of the issued capital of YMCP, and will

receive consideration of 9.5 million MTL Options pursuant to the

SPA. Mike Langoulant, the Company's CFO (non-Board), is the

ultimate beneficial owner of Amber Harvest Investments Pte Ltd

("Amber"), the majority shareholder of YMCS, which will receive

approximately US$1.4 million cash consideration (reflecting its

cash investment into YMCS) and 3.5 million MTL Options pursuant to

the SPA. Further details will be included in the general meeting

circular and the Company's annual report, as required.

The YMC Group was established at a time when MTL's priority was

to pay down its significant group debt as quickly as possible and,

as a result, at that time MTL's lenders were not approached by the

Board to seek approval for the expenditure required for the

acquisition of new greenfield exploration projects. Accordingly, a

group of Filipino nationals and certain senior MTL management

independently formed the YMC Group, in order to seek to acquire the

Abra Tenement, following the Board of MTL deciding it was not of

interest to the Company at that time. Since its incorporation, YMCP

has applied for and been granted the Abra Tenement but has

otherwise not traded.

In addition, free incentive shares in both YMCS and YMCP (the "

Incentive Shares ") were issued to certain senior expats and local

Philippine MTL and YMC Group staff, provided that they remained

with the MTL group for at least a further 3-year period. The

Incentive Shares were issued as a quasi MTL-incentive scheme given

that, at that time, there was no MTL long-term incentive scheme put

in place for certain MTL senior employees. Further, a right of

first refusal was granted to the MTL group by Amber, as the

majority owner of YMCS, in respect of funding its mining

projects.

YMCP has now successfully applied for the Abra Tenement, subject

to a final clearance under the NCIP regulations being granted, as

noted above.

As a result of the subsequent strong financial performance of

the Runruno mine and the accelerated repayment of group debt, the

Company refined its strategy with regards to new projects. With

MTL's debt now below US$25 million and anticipated to be fully

repaid in H1 2024, and cognisant of the limited life of mine at

Runruno, MTL and its lenders believe it is now appropriate for the

Company to acquire new projects, including greenfield areas such as

the Abra Tenement, to seek to ensure the long-term viability of the

Company.

The US$1,600,000 cash consideration for the acquisition of the

YMC Group is equal to the amount of cash invested in the group to

date. In addition to the cash consideration payable under the SPA,

MTL will issue up to 41 million MTL Options as a replacement for

the Incentive Shares issued to certain MTL and YMC staff, on the

same or similar vesting terms, in exchange for such staff

transferring their Incentive Shares to MTL at nil cost.

As noted above, further details will be included in the circular

for the general meeting and the Company's annual report, as

required, but the key terms of the MTL Options will be:

Exercise price: GBP0.0001 per option

Exercise period: 7 years from issue

Employment hurdle: Requirement to remain an employee of the MTL group until 31 December 2025

The YMC Group structure has been established to comply with

Philippine mining law, should exploration lead to a mining

operation within the Abra Tenement area. Under Philippine mining

law, a mining company must be 60% owned by Philippine citizens,

however a foreign company can own 100% of a mineral processing

operation. With these rules in mind, YMCS (which is being 100%

acquired) will have the absolute right to process any minerals

mined from the Abra Project tenement area.

Following the completion of the Transaction, the MTL group will

own 72.5% of the issued share capital of YMCP, with the balance

held by three Filipino nationals, who will extend their support to

YMCP through the development of the Abra Tenement and any other

mining activities undertaken by YMCP. This 27.5% outside interest

in YMCP is free-carried and non-dilutive. Under Philippine mining

law, to enable a mining licence to be issued to YMCP in the future,

at least 32.5% of YMCP will be held by a qualifying Filipino MTL

group entity.

The Exploration Tenement

The Abra Tenement area, known as the "Abra Project", is located

on the Western belt of the highly endowed Central Cordillera region

in Abra, Luzon, approximately 200km north of MTL's existing

operations in Runruno. Bangued, the provincial capital, is

connected to Manila via the McArthur highway.

The Abra Project covers the Municipalities of Licuan-Baay and

Lacub. The terrain is moderate to rugged, with established forested

cover.

Water is readily available and main line power runs throughout

the area but may require additional infrastructure.

Figure 1: Abra Project Location Map

The Abra Project tenement area, with a strike length of

approximately 20km, covers an area of 16,200ha and is shown in

Figure 2.

The province is underlain extensively by volcaniclastics

intruded by quartz diorite and granodiorite.

Figure 2: Abra Project tenement area showing copper target

polygons.

Exploration Potential

The Central Cordillera of Luzon is formed of an uplifted and

tectonised magmatic arc associated with the Manila Trench

subduction zone.

The basement Oligo-Miocene arc succession of volcanoclastic

units is frequently intruded by diorites, and has been impacted by

a series of broadly North-South and Northeast-Southwest trending

structures associated with the dominant Philippines Fault.

Various phases of structural evolution with associated periods

of mineralisation have created a target rich domain for exploration

of copper and gold targets associated with porphyry and epithermal

systems.

The Cordillera region is a prolific gold belt in the Philippines

with proven endowment, having produced over 40Moz of gold

historically. Exploration in the Abra region was first conducted by

the Japanese International Cooperation Agency ("JICA") in the late

1970s and early 1980s and afterwards by various international

explorers, including the Philippine government in the late

1990s.

A geochemical map overlain with sampling data (Figure 3) shows

five main target areas. Of note in this image, the stars denote

copper values in excess of 65ppm.

Several significant structural intersection points appear to be

centres for higher grade copper anomalies, supporting the assumed

link between structure and mineralisation in this area.

Figure 3: Copper (Cu) Geochemical contour map.

From the results of historical work and recent sampling

programmes carried out by the YMC Group, there appear to be three

immediately interesting prospect areas:

Lacub

Northern most prospect, with 2 main targets:

o Copper/gold porphyry targets, as indicated by the surface

geochemistry.

o Epithermal gold targets, which have been sampled and accessed

via small scale mining tunnels with grades in excess of 100g/t

gold.

The geochemical data overlies the intersection of the regional

SW-NE trending structure and secondary structures. It also overlays

closely with the 1980 study conducted by the JICA which highlights

their focus on the area for porphyry copper targets, shown in

Figure 4.

Figure 4: Results from geochemical programmes, JICA survey, and

resultant target outline.

Further work conducted on the northern section of this target

area (M. Tuesley, 2008) showed high-grade epithermal vein systems,

with evidence of mining by small scale miners. Mineralisation is

from surface. Grab sampling from the ore and tailings of the

small-scale workings are shown in Table 1 below.

SAMPLE

NO Cu% Pb% Zn% Au,ppm Ag,ppm Details

L- 1 0.60 0.35 4.34 5.00 13.50 Kadadaunan Tails

-------- --------- --------- -------- -------- ------------------------------

L- 2 4.95 0.01 0.86 95.93 117.40 Bila Buneg Tails

-------- --------- --------- -------- -------- ------------------------------

L- 3 4.74 0.07 6.03 7.82 57.20 Saneng Tails

-------- --------- --------- -------- -------- ------------------------------

L- 4 1.3 0.00 0.03 0.34 10.20 Kadadaunan Copper Alteration

-------- --------- --------- -------- -------- ------------------------------

L- 5 0.01 0.00 0.02 29.36 23.10 Bila Buneg ore

-------- --------- --------- -------- -------- ------------------------------

L- 6 0.32 0.01 0.16 1.29 4.10 Saneng Ore (Unkles StockPile)

-------- --------- --------- -------- -------- ------------------------------

L- 7 2.76 0.00 0.49 131.57 108.70 Bila Buneg Ore

-------- --------- --------- -------- -------- ------------------------------

L- 8 0.02 0.04 0.06 0.25 2.10 Kadadaunan Wall Rock

-------- --------- --------- -------- -------- ------------------------------

L- 9 0.72 0.13 10.70 0.99 14.60 Saneng Ore (Mine)

-------- --------- --------- -------- -------- ------------------------------

L- 10 0.62 0.50 1.86 41.88 16.60 Kadadaunan Washed Ore

-------- --------- --------- -------- -------- ------------------------------

L- 11 0.44 0.01 0.55 3.42 6.60 Saneng Ore (2nd Sample)

-------- --------- --------- -------- -------- ------------------------------

Kadadaunan Unwashed

L- 12 0.30 0.43 2.12 16.11 9.70 Ore

-------- --------- --------- -------- -------- ------------------------------

L- 13 4.44 0.01 0.01 0.36 20.40 Bosawit

-------- --------- --------- -------- -------- ------------------------------

Table 1: Results of samples taken from small scale workings,

Lacub area.

Pervious exploration identified three types of

mineralisation:

1. Brecciated/stockwork copper-gold mineralisation.

2. Skarn mineralisation.

3. Vein and fracture fill mineralisation, marginal to diorite plutons .

There appear to be opportunities to identify smaller, high-grade

mineralised veins systems, which could provide low cost/fast start

mining projects, in addition to larger, lower grade porphyry copper

gold systems.

Manikbel

Copper targets, southern area:

o Large copper targets with evidence of anomalism from surface

mapping.

o Extensive outcrops over a 2km strike including grades of over

15% copper.

Manikbel has the highest intensity copper geochemical signature

of all the areas, coinciding with an area of major structural

intersection. The underlying geology is similar to Lacub, however,

in this case, the mineralisation from historical sampling seems to

be predominantly copper with little gold identified to date.

Outcrops mapped for over a 2km strike confirm copper values over

15%. It appears to represent a near-surface porphyry system. The

prospect is located close to the west coast which has port

infrastructure, accessible via national arterial roads.

Figure 5 shows the overlay of target areas by JICA (green

outline), with areas identified for further exploration of copper

porphyry targets, shown against follow-on field work previously

completed by the Mines and Geosciences Bureau (MGB). The target

areas appear to extend significantly beyond those initially

identified by JICA.

Figure 5: Surface exploration work completed in Manikbel.

Area 1 South Central region

o High-grade gold targets, with significant small-scale mining

activity.

o Additional extensive anomalism identified by large surface

sampling exercises conducted by the Philippine government.

Historical exploration in Area 1 has targeted high-grade gold

occurrences over several square kilometers and has identified

multiple mineralised vein systems. The area is north of MPSA 141, a

mining licence with a gold resource and south of MPSA 144, a mining

licence with a copper/gold resource. The images below (Figures 6

and 7) show results of sampling to date within the area.

Figure 6: Field work and sample results conducted by Yumol

1998.

Figure 7: Further work completed within MPSA 141 and Area 1

.

N.B: YMC does not hold either MPSA 141 or MSPA 144.

Initial 2024 exploration programme

The initial 2024 work programme is intended to commence in the

Lacub area, targeting previously identified high-grade gold systems

and regional analysis of the underlying porphyry systems. The

programme is envisaged to include the following tasks:

-- Finalising community and NCIP agreements and future community support programmes, Q1 2024

-- Field mapping and sampling, Q1 2024

-- Airborne geophysics covering the northern extent of the tenement area, Q1 2024

-- Survey and mapping of the small scall tunnels and veins, Q1 2024

-- Development of the geological data base and initial drill target Q1/2 2024

-- Commencement of drilling H2 2024

If the Company has the exploration success it is targeting, it

will focus on developing a high-grade, smaller-scale gold

production-ready project as soon as possible as well as advancing

its other exploration targets. This intention is based on both

historical and currently operating small scale mining activities in

the Lacub area.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

Glossary

Ag : means silver

Au : means gold

As : means arsenic

Cu : means copper

gm : means gramme

g/t : means grammes per tonne

Mo : means molybdenum

Moz : means million ounces

MT : means million tonnes

Pb : means lead

ppm : means parts per million

S : means sulphur

Zn : means zinc

- END -

For further information please visit or contact:

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

Nominated & Financial STRAND HANSON LIMITED

Adviser:

James Spinney, James

Dance, Rob Patrick +44 (0) 207 409 3494

Financial Adviser & HANNAM & PARTNERS

Broker:

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

Jos Simson, Nick Elwes +44 (0) 207 920 3150

Web: www.metalsexploration.com

Twitter: @MTLexploration

LinkedIn: Metals Exploration

Competent Persons' Statement

Mr Darren Bowden, a director of the Company, a Member of the

Australasian Institute of Mining and Metallurgy and who has been

involved in the mining industry for more than 25 years, has

compiled, read and approved the technical disclosure in this

regulatory announcement in accordance with the AIM Rules for

Companies - Note for Mining and Oil & Gas Companies.

Forward Looking Statements

Certain statements relating to the estimated or expected future

production, operating results, cash flows and costs and financial

condition of Metals Exploration, planned work at the Company's

projects and the expected results of such work contained herein are

forward-looking statements which are based on current expectations,

estimates and projections about the potential returns of the Group,

industry and markets in which the Group operates in, the Directors'

beliefs and assumptions made by the Directors . Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: "expects", "plans", "anticipates", "forecasts",

"believes", "intends", "estimates", "projects", "assumes",

"potential" or variations of such words and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results, mineral grades and

mineral reserve and resource estimates may also be deemed to be

forward-looking statements, as it constitutes a prediction of what

might be found to be present when and if a project is actually

developed.

These statements are not guarantees of future performance or the

ability to identify and consummate investments and involve certain

risks, uncertainties and assumptions that are difficult to predict,

qualify or quantify. Among the factors that could cause actual

results or projections to differ materially include, without

limitation: uncertainties related to raising sufficient financing

to fund the planned work in a timely manner and on acceptable

terms; changes in planned work resulting from logistical, technical

or other factors; the possibility that results of work will not

fulfil projections/expectations and realise the perceived potential

of the Company's projects; uncertainties involved in the

interpretation of drilling results and other tests and the

estimation of gold, copper or other relevant mineral reserves and

resources; risk of accidents, equipment breakdowns and labour

disputes or other unanticipated difficulties or interruptions; the

possibility of environmental issues at the Company's projects; the

possibility of cost overruns or unanticipated expenses in work

programs; the need to obtain permits and comply with environmental

laws and regulations and other government requirements;

fluctuations in the price of gold, copper and other relevant

minerals and other risks and uncertainties.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules for

Companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUWGGUPCGMG

(END) Dow Jones Newswires

January 12, 2024 02:00 ET (07:00 GMT)

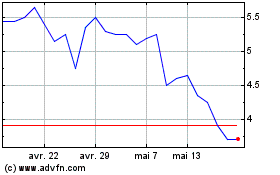

Metals Exploration (LSE:MTL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Metals Exploration (LSE:MTL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024