TIDMNAVF

RNS Number : 1467L

Nippon Active Value Fund PLC

01 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO ANY MEMBER STATE OF THE EUROPEAN

ECONOMIC AREA, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE

REPUBLIC OF SOUTH AFRICA OR ANY JURISDICTION FOR WHICH THE SAME

COULD BE UNLAWFUL .

The information communicated in this announcement is deemed to

constitute inside information as stipulated under the UK Version of

Market Abuse Regulation (EU) No. 596/2014 (as incorporated into UK

Law by virtue of the European Union (Withdrawal) Act 2018, and as

subsequently amended ("MAR"). Upon the publication of this

announcement, this information is considered to be in the public

domain.

1 September 2023

Nippon Active Value Fund plc

LEI: 213800JOFEGZJYS21P75

Publication of Prospectus and Circular

Further to the Company announcements dated 18 May 2023 and 11

August 2023, the Board is today pleased to publish detailed

proposals relating to the rollover of assets of each of abrdn Japan

Investment Trust plc ("AJIT") and Atlantis Japan Growth Fund

Limited ("AJG") into the Company pursuant to schemes of

reconstruction of AJIT and AJG (respectively the "AJIT Scheme" and

the "AJG Scheme", and together the "Schemes"). Neither Scheme is

conditional on completion of the other.

Additionally, the prospectus of the Company dated 1 September

2023 relating to the Schemes and a 12-month placing programme to

issue up to 250 million new Ordinary Shares and/or C (the

"Prospectus") has been approved by the Financial Conduct

Authority.

A copy of the Prospectus has been submitted to the National

Storage Mechanism and will shortly be available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism , and is

available on the Company's website at

https://www.nipponactivevaluefund.com/shareholder-information/shareholder-documents/

.

Capitalised terms used and not otherwise defined in this

announcement shall have the same meaning as in the Prospectus.

In connection with the Schemes (but, in any event, whether or

not either Scheme proceeds) the Company intends to transfer its

listing from the Specialist Fund Segment and have its Existing

Shares and New Shares (whether issued pursuant to the Schemes or

the Placing Programme) be admitted to (i) the Official List; and

(ii) to trading on the premium segment of the Main Market (the

"Migration").

Summary of the AJIT Scheme

The AJIT Scheme

Subject to the passing of the resolutions to be proposed at the

AJIT General Meetings and to the satisfaction of the AJIT Scheme

Conditions, AJIT will be placed into members' voluntary liquidation

and the AJIT Scheme will take effect. It is expected that the AJIT

Scheme will become effective on the AJIT Scheme Effective Date,

whereupon the cash, undertaking and other assets of AJIT comprising

the AJIT Rollover Pool will be transferred to the Company pursuant

to the AJIT Transfer Agreement, in exchange for the allotment of

New Shares to the AJIT Liquidators (as nominees for AJIT

Shareholders entitled to them in accordance with the AJIT Scheme).

Thereafter, the AJIT Liquidators will renounce the allotments of

the New Shares in favour of AJIT Shareholders who have elected (or

are deemed to have elected) to receive New Shares, and such New

Shares will be issued by the Company to those AJIT Shareholders

pursuant to the AJIT Scheme.

The issue of New Shares under the AJIT Rollover Option will be

effected on a formula asset value ("FAV") for FAV basis as at the

AJIT Scheme Calculation Date. For the purposes of the AJIT Scheme,

the net asset values ("NAVs") of each of the Company and AJIT will

be adjusted to take account of (inter alia) all the costs

associated with the AJIT Scheme not already accrued, in order to

determine their respective FAVs. Further details of the relevant

FAV calculations of each company are set out in Part 2 (Additional

Information) of the Circular. The new Ordinary Shares issued

pursuant to the AJIT Scheme will rank pari passu with the existing

Ordinary Shares then in issue (save for any dividends or other

distributions declared, made or paid on the Ordinary Shares by

reference to a record date prior to the issue of the relevant new

Ordinary Shares).

AJIT Cash Option

As part of the AJIT Scheme, AJIT Shareholders may elect to

receive cash instead of New Shares in respect of some or all of

their holdings in AJIT at a discount of two per cent. to the AJIT

FAV per Share (the "AJIT Cash Option"). The maximum number of AJIT

Shares that can be elected for the AJIT Cash Option is 25 per cent.

of the total number of AJIT Shares in issue (excluding AJIT Shares

held in treasury) as at the AJIT Scheme Calculation Date.

AJIT Transfer Agreement

On the AJIT Scheme Effective Date, or as soon as practicable

thereafter, the Company and the AJIT Liquidators (in their personal

capacity and on behalf of AJIT) will enter into and implement the

AJIT Transfer Agreement (subject to such modifications as may be

agreed between the parties thereto), whereby the AJIT Liquidators

will procure the transfer of the cash, undertaking and other assets

of AJIT comprising the AJIT Rollover Pool to the Company (or its

nominee) in consideration for the allotment of New Shares to the

AJIT Liquidators (as nominees for the AJIT Shareholders entitled to

them), such shares to be renounced by the AJIT Liquidators in

favour of the holders of AJIT Rollover Shares.

The AJIT Transfer Agreement provides that the assets to be

transferred to the Company will be transferred with such rights and

title as AJIT may have in respect of the same or any part thereof

subject to (and with the benefit of) all and any rights,

restrictions, obligations, conditions and agreements affecting the

same or any part thereof. The AJIT Transfer Agreement further

provides that AJIT, acting by the AJIT Liquidators, insofar as they

are reasonably able to do so by law or otherwise, will comply with

all reasonable requests made by the Company (or its nominee) in

respect of the cash, undertaking and other assets of AJIT to be

acquired.

Costs and expenses of the AJIT Scheme

Any stamp duty, SDRT (or equivalent Japanese tax payable in

connection with the transfer of Japanese securities) or other

transaction tax, or investment costs incurred by the Company on the

acquisition of the AJIT Rollover Pool and listing fees in relation

to the listing of the Ordinary Shares will be borne by the Enlarged

Company. If the AJIT Scheme does not proceed on the terms agreed or

the required AJIT Scheme Conditions are not satisfied, then the

Company and AJIT will each bear their own costs. The Company's

costs in connection with the AJIT Scheme are estimated at

approximately GBP570,000. The Investment Adviser has agreed to pay

for AJIT's costs to implement the AJIT Scheme up to a cap of

GBP800,000.

Summary of the AJG Scheme

The AJG Scheme

Subject to the passing of the resolutions to be proposed at the

AJG EGM and to the satisfaction of the AJG Conditions, AJG will be

placed into members' voluntary winding up and the AJG Scheme will

take effect. It is expected that the AJG Scheme will become

effective on the AJG Scheme Effective Date, whereupon the cash,

undertaking and other assets of AJG comprising the AJG Rollover

Pool will be transferred to the Company pursuant to the AJG

Transfer Agreement, in exchange for the allotment of New Shares to

the AJG Liquidators (as nominees for AJG Shareholders entitled to

them in accordance with the AJG Scheme). Thereafter, the AJG

Liquidators will renounce the allotments of the New Shares in

favour of AJG Shareholders who have elected (or are deemed to have

elected) to receive New Shares, and such New Shares will be issued

by the Company to those AJG Shareholders pursuant to the AJG

Scheme.

The issue of New Shares under the AJG Rollover Option will be

effected on a formula asset value ("FAV") for FAV basis as at the

AJG Scheme Calculation Date. For the purposes of the AJG Scheme,

the NAVs of each of the Company and AJG will be adjusted to take

account of (among other matters) all of the costs associated with

the AJG Scheme not already accrued, in order to determine their

respective FAVs. Further details of the relevant FAV calculations

of each company are set out in Part 2 (Additional Information) of

the Circular. The new Ordinary Shares issued pursuant to the AJG

Scheme will rank pari passu with the existing Ordinary Shares then

in issue (save for any dividends or other distributions declared,

made or paid on the Ordinary Shares by reference to a record date

prior to the issue of the relevant new Ordinary Shares).

AJG Cash Option

As part of the AJG Scheme, AJG Shareholders may elect to receive

cash instead of New Shares in respect of some or all of their

holdings in AJG at a discount of two per cent. to the AJG FAV per

Share (the "AJG Cash Option"). The maximum number of AJG Shares

that can be elected for the AJG Cash Option is 25 per cent. of the

total number of AJG Shares in issue (excluding AJG Shares held in

treasury) as at the AJG Scheme Calculation Date.

AJG Scheme Transaction Agreement

Pending publication of the AJG Circular, the Company and AJG

have entered into the AJG Scheme Transaction Agreement. Pursuant to

the AJG Scheme Transaction Agreement, subject to receipt of

relevant tax clearances, AJG has undertaken to use all reasonable

endeavours to (i) publish the AJG Circular by 15 September 2023;

and (ii) to implement the AJG Scheme in accordance with the terms

of the AJG Scheme set out in the Prospectus.

AJG Transfer Agreement

On the AJG Scheme Effective Date, or as soon as practicable

thereafter, the Company and the AJG Liquidators (in their personal

capacity and on behalf of AJG) will enter into and implement the

AJG Transfer Agreement (subject to such modifications as may be

agreed between the parties thereto), whereby the AJG Liquidators

will procure the transfer of the cash, undertaking and other assets

of AJG comprising the AJG Rollover Pool to the Company (or its

nominee) in consideration for the allotment of New Shares to the

AJG Liquidators (as nominees for the AJG Shareholders entitled to

them), such shares to be renounced by the AJG Liquidators in favour

of the holders of AJG Rollover Shares.

The AJG Transfer Agreement provides that the assets to be

transferred to the Company will be transferred with such rights and

title as AJG may have in respect of the same or any part thereof

subject to (and with the benefit of) all and any rights,

restrictions, obligations, conditions and agreements affecting the

same or any part thereof. The AJG Transfer Agreement further

provides that AJG, acting by the AJG Liquidators, insofar as they

are reasonably able to do so by law or otherwise, will comply with

all reasonable requests made by the Company (or its nominee) in

respect of the cash, undertaking and other assets of AJG to be

acquired.

Costs and expenses of the AJG Scheme

Any stamp duty, SDRT (or equivalent Japanese tax payable in

connection with the transfer of Japanese securities) or other

transaction tax, or investment costs incurred by the Company on the

acquisition of the AJG Rollover Pool and listing fees in relation

to the listing of the New Shares will be borne by the Enlarged

Company. If the AJG Scheme does not proceed on the terms agreed or

the required AJG Scheme Conditions are not satisfied, then the

Company and AJG will each bear their own costs. The Company's costs

in connection with the AJG Scheme are estimated at approximately

GBP470,000. The Investment Adviser has agreed to pay for AJG's

costs to implement the AJG Scheme up to a cap of GBP800,000.

Bene ts of the Schemes

Your Board believes that the issue of New Shares pursuant to the

Schemes would have the following bene ts to Shareholders:

(a) Shareholders will immediately bene t from an enlarged capital base;

(b) the implementation of the Schemes will result in an enlarged

and more diverse portfolio of assets which the Investment Adviser

is well placed to manage (given its experience);

(c) it will result in a reduction of the estimated pro forma

ongoing charges ratio of the Company;

(d) the increase in the size of the Company should mean that the

Ordinary Shares have enhanced liquidity in the secondary

market;

(e) the Company will be able to deploy additional capital at an advantageous time;

(f) a larger capital base will allow the Investment Adviser to

pursue its activist strategy in opportunities involving companies

with larger capitalisations; and

(g) the Investment Adviser will be able to have more effective

conversations with investee companies (on the basis of the Company

having more firepower to build stakes in these companies).

The assets to be received by the Company pursuant to each

Scheme, which in each case will consist of shares in listed

Japanese companies, will be managed in accordance with the

Investment Policy and may be realised over time and redeployed into

more activist opportunities. Any proceeds of any such realisation

are expected to be redeployed into more activist opportunities

within six months of receipt.

AJIT Scheme Conditions

The AJIT Scheme is conditional upon:

(a) completion of the Migration;

(b) the recommendation of the boards of the Company and AJIT to

proceed with the AJIT Scheme, which may be withdrawn at any time

(including, without limit, for material adverse change

reasons);

(c) the Share Allotment Authorities relating to the AJIT Scheme

being approved by Shareholders and not having been revoked or

superseded;

(d) the passing of the resolutions to be proposed at the First

AJIT General Meeting and the resolution to be proposed at the

Second AJIT General Meeting or any adjournment of those meetings

and upon any conditions of such resolutions being fulfilled;

and

(e) Admission occurring in respect of the New Shares to be

issued pursuant to the AJIT Scheme.

Any AJIT Scheme condition may, subject to compliance with legal

requirements, be waived with the mutual agreement of each of the

Company, the Investment Adviser and AJIT at any time up to

completion of the AJIT Scheme.

AJG Scheme Conditions

The AJG Scheme is conditional upon:

(a) completion of the Migration;

(b) the recommendation of the boards of the Company and AJG to

proceed with the AJG Scheme, which may be withdrawn at any time

(including, without limit, for material adverse change

reasons);

(c) the Share Allotment Authorities relating to the AJG Scheme

being approved by Shareholders and not having been revoked or

superseded;

(d) the passing of the resolutions to be proposed at the AJG EGM

or any adjournment of that meeting and upon any conditions of such

resolutions being fulfilled; and

(e) Admission occurring in respect of the New Shares to be

issued pursuant to the AJG Scheme.

Any AJG Scheme condition may, subject to compliance with legal

requirements, be waived with the mutual agreement of each of the

Company, the Investment Adviser and AJG at any time up to

completion of the AJG Scheme.

Prop osed Directors

If the Schemes are implemented, for continuity purposes for the

AJIT and AJG shareholders, it is intended that Claire Boyle and

Noel Lamb will join the Board of the Company on the completion

dates for the respective Schemes. Both will be

non-executive-Directors and be considered to be independent of the

AIFM and the Investment Adviser.

Summary of the Placing Programme

The Directors intend to implement the Placing Programme to

enable the Company to raise additional capital in the 12 month

period from the publication of the Prospectus. Subject to the

passing of the relevant Resolutions, the Directors will have

discretion to issue Ordinary and/or C Shares, provided that such

number of Ordinary Shares and C Shares to be issued pursuant to the

Placing Programme may not exceed 250 million Shares in aggregate.

The Placing Programme is intended to be exible and may have a

number of closing dates in order to provide the Company with the

ability to issue Ordinary Shares and/or C Shares over a period of

time. The Placing Programme is intended to satisfy market demand

for New Shares and to raise further money for investment in

accordance with the Investment Policy.

Proposed change to the Investment Policy

In connection with the Schemes and in contemplation of the

Company's Migration, the Board has proposed amending the Investment

Policy of the Company to increase the diversification contained

within the Company's portfolio. Further details on the proposed New

Investment Policy are set out in the Company's Circular to be sent

to shareholders. The Board considers that these adjustments

represent a material change to the Company's published investment

policy, and therefore the Company's Shareholders should vote to

approve such a change. A resolution will be put at the General

Meeting seeking such approval.

General Meeting

The Circular containing a notice convening the General Meeting

at which Shareholders will be asked to consider and, if thought t,

approve the Resolutions, has been published on the Company's

website at

https://www.nipponactivevaluefund.com/shareholder-information/shareholder-documents/

and will be sent to shareholders shortly. The Resolutions to be

considered by Shareholders are to (i) adopt the New Investment

Policy; and (ii) authorise the Directors to issue the New Shares

pursuant to the Schemes and the Placing Programme on a

non-pre-emptive basis.

Recommendation

The Board considers the proposals described in the Circular to

be in the best interests of Shareholders as a whole. Accordingly,

the Board recommends unanimously that Shareholders vote in favour

of the Resolutions. The Directors intend to vote in favour of the

Resolutions in respect of their own bene cial holdings which total

247,791 Ordinary Shares (representing 0.23 per cent. of the total

voting rights in the Company exercisable at the General

Meeting).

In addition, the Board understands that the AJIT Directors who

hold shares in AJIT, and the AJG Directors who hold shares in AJG,

all intend to roll over their entire bene cial holdings of AJIT

Shares and AJG Shares into New Shares.

The Board greatly appreciates the support it receives from

Shareholders, and the Board and/or the Investment Adviser will

endeavour to address any questions received on the proposals or the

Circular.

Timetable

General Meeting Timetable

Latest time and date for receipt of Forms 9.30 a.m. on 18 September

of Proxy 2023

-----------------------------

General Meeting 9.30 a.m. on 20 September

2023

-----------------------------

Migration

Expected admission of the Existing Shares 8.00 a.m. on 21 September

to the Official List and to trading on 2023

the premium segment of the Main Market

-----------------------------

AJIT Scheme Timetable

First AJIT General Meeting 4.00 p.m. on 28 September

2023

-----------------------------

AJIT Scheme Calculation Date 5.00 p.m. on 5 October

2023

-----------------------------

Second AJIT General Meeting 3.00 p.m. on 10 October

2023

-----------------------------

Announcement of results of the AJIT 10 October 2023

Scheme and respective FAVs per share

-----------------------------

Effective Date for the AJIT Scheme 10 October 2023

-----------------------------

Admission of the Ordinary Shares pursuant 8.00 a.m. on 11 October

to the AJIT Scheme 2023

-----------------------------

CREST accounts credited in respect of 8.00 a.m. on 11 October

Ordinary Shares issued in uncertificated 2023

form

-----------------------------

Certificates despatched in respect of Week commencing 16 October

Ordinary Shares issued in certificated 2023

form

-----------------------------

Placing Programme Timetable

Prospectus published and Placing Programme 1 September 2023

opens

-----------------------------

Publication of the Placing Programme As soon as reasonably

Price in respect of each Placing undertaken practicable following

the closing of each Placing

-----------------------------

Admission of the New Shares to be issued 8:00 a.m. on each day

pursuant to the Placing Programme to New Shares are issued

the Official List and dealings commence

-----------------------------

CREST accounts credited in respect of As soon as possible after

New Shares issued in uncertificated 8:00 a.m. on each day

form New Shares are issued

-----------------------------

Certificates despatched in respect of Approximately one week

New Shares issued in certificated form following Admission of

the relevant New Shares

-----------------------------

Placing Programme closes 30 August 2024*

-----------------------------

* or, if earlier, the date on which all of the New Shares

available for issue under the Placing Programme have been issued

(or such other date as may be agreed between the Company, the

Investment Adviser, Shore Capital and Berenberg (such agreed date

to be announced by way of an RIS announcement)).

Notes:

(1) References to times above and in the Circular generally are

to London times unless otherwise specified.

(2) All times and dates in the expected timetable and in the

Circular may be adjusted by the Company in consultation with Shore

Capital and Berenberg. Any material changes to the timetable will

be notified via an RIS.

(3) The timetable for implementation of the AJG Scheme will be

announced by way of an RIS announcement following the publication

the AJG Circular.

Enquiries

Berenberg Gillian Martin / Dan Gee-Summons / Natasha Ninkov

Tel: +44 (0)20 3207 7800

Company Secretary Sylvanus Cofie / Maria Matheou

Tel: +44 (0) 20 3327 9720

Important information relating to Sponsor and Financial

Adviser

Joh. Berenberg, Gossler & Co. KG, London Branch

("Berenberg") which is authorised and regulated by the German

Federal Financial Supervisory Authority and deemed authorised and

subject to limited regulation in the United Kingdom by the FCA, is

acting solely as sponsor and financial adviser to the Company and

for no one else in relation to the proposed transaction, and will

not be responsible to anyone other than the Company for providing

the protections afforded to the clients of Berenberg or for

providing advice in relation to the proposed transaction, the

contents of the document or any other matters described in this

announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed upon Berenberg by FSMA or the regulatory regime

established thereunder, Berenberg does not accept any

responsibility whatsoever or make any representation or warranty,

express or implied, concerning the contents of this announcement,

including as to its accuracy, completeness or verification, or for

any other statement made or purported to be made by it, or on its

behalf, in connection with the Company or the proposed transaction,

whether as to the past or future.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDIGZGGLMMMGFZM

(END) Dow Jones Newswires

September 01, 2023 07:30 ET (11:30 GMT)

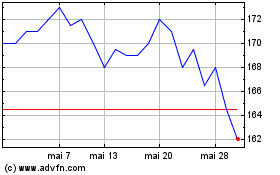

Nippon Active Value (LSE:NAVF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Nippon Active Value (LSE:NAVF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024