TIDMOGN

RNS Number : 5961N

Origin Enterprises Plc

26 September 2023

Origin Enterprises plc

PRELIMINARY RESULTS STATEMENT

Strong operational delivery, robust cash generation; adjusted

EPS of 53.16 cent, at the top end of guidance

Dublin, London, 26 September 2023: Origin Enterprises plc

('Origin' or 'the Group'), the international Agronomy-Services

group, providing specialist advice, inputs and digital solutions to

promote sustainable land use, announces its results for the

financial year ended 31 July 2023 ('FY23').

Results highlights for FY23

-- Strong Group performance delivering operating profit(1) of EUR90.8 million

-- Increase in Group revenue of 4.9% to EUR2.5 billion

-- Adjusted diluted earnings per share(3) of 53.16 cent

-- Strong cash generation and conversion with free cash flow of

EUR104.4 million (free cash flow conversion of 178.2%)

-- Year end net cash(4) position of EUR53.2 million (FY22: EUR43.4 million)

-- Completion of four complementary acquisitions in the Group's

strategically important Amenity, Environmental and Ecology

business

-- Strong ESG progress with improved external ESG ratings

-- Proposed final dividend of 13.65 cent per share with total FY23 dividend of 16.8 cent

-- Completion of EUR20.0 million share buyback

Commenting on FY23 performance, Origin's Chief Executive

Officer, Sean Coyle said:

"Origin delivered a strong overall performance in declining

commodity markets. The Group delivered an operating profit of

EUR90.8 million resulting in adjusted diluted earnings per share of

53.16 cent, at the top end of our guidance.

Effective operational execution helped deliver a robust cash

performance with a net cash position of EUR53.2 million at year

end. This result was driven by a strong free cash flow of EUR104.4

million which included a working capital inflow of EUR43.9 million,

as fertiliser raw materials and feed prices decreased globally,

combined with favourable timing impacts of purchases and sales.

We continue to pursue a disciplined approach to capital

allocation to drive shareholder returns. We made strong progress

against a number of our strategic objectives with four

acquisitions, totalling EUR30.1 million, in our Amenity,

Environmental and Ecology business. These acquisitions complement

our organic growth strategy and broaden our expertise and

capabilities in the growing market for ecological and environmental

products and services. From our strong cash flow, we also returned

EUR38.0 million to shareholders this year through a combination of

share buybacks and dividends.

We have, however, taken the difficult decision to close our

Ukraine business at the end of September. This decision was taken

after much deliberation, given the reduced activity levels and the

market dynamics over recent years which have resulted in the

business being loss making, with little evidence that the trading

environment will improve.

Thanks to the continued dedication of all our staff, we continue

to drive sustainable growth and are on track to deliver our

strategic ambitions as set out in our 2022 Capital Markets Day. We

delivered a return on capital employed in FY23 within our targeted

range at 12.6% and we will continue to invest for growth across our

existing operations and strengthen our earnings potential through

margin accretive acquisitions."

Constant

2023 2022 Change Currency

Results Summary EUR'000 EUR'000 % %

Group revenue 2,456,168 2,342,102 4.9% 6.5%

Operating profit(1) 90,791 119,740 (24.2%) (24.4%)

Associates and joint venture(2) 4,040 6,845 (41.0%) (40.4%)

Total group operating profit(1) 94,831 126,585 (25.1%) (25.2%)

Finance expense, net (12,963) (11,057) (17.2%) (18.6%)

Profit before tax(1) 81,868 115,528 (29.1%) (29.4%)

Basic EPS (cent) 45.24 65.40 (30.8%) (31.1%)

Adjusted diluted EPS (cent)(3) 53.16 71.53c (25.7%) (25.9%)

Return on capital employed

(%) 12.6% 18.3% (570bps)

Group net cash(4) 53,175 43,434 9,741

Operating margin(1) (%) 3.7% 5.1% (140bps)

Free cash flow (EUR'000) 104,418 108,489 (4,071)

Dividend per ordinary share

(cent) 16.80c 16.00c 5.0%

Consistent with previous years, the Group will issue a Q1

Trading Update for FY24 on the date of the AGM, 16 November

2023.

(1) Before amortisation of non-ERP intangible assets and

exceptional items

(2) Profit after interest and tax before exceptional items

(3) Before amortisation of non-ERP intangible assets, net

of related deferred tax (2023: EUR11.0m, 2022: EUR13.0m)

and exceptional items, net of tax (2023: charge of EUR0.6m,

2022: credit of EUR2.8m)

(4) Group net cash/(bank debt) before impact of IFRS 16 Leases

Conference Call and Webcast details:

The management team will host a live conference call and

webcast, for analysts and institutional investors today, 26

September 2023, at 08:30 (Irish/UK time). Registration details for

the Conference Call and Webcast can be accessed at:

www.originenterprises.com

Alternatively, please contact FTI Consulting by email at

originenterprises@fticonsulting.com

Participants are requested to dial in 5 to 10 minutes prior to

the scheduled start time.

Enquiries:

Origin Enterprises plc

TJ Kelly

Chief Financial Officer Tel: +353 (0)1 563 4900

Brendan Corcoran

Head of Investor Relations Tel: +353 (0)1 563 4900

Goodbody (Euronext Growth (Dublin)

Adviser) Tel: +353 (0)1 641 9449

Joe Gill

Davy (Nominated Adviser)

Anthony Farrell Tel: +353 (0)1 614 9993

Numis Securities (Stockbroker)

Stuart Skinner Tel: +44 (0)20 7260 1314

FTI Consulting (Financial Communications

Advisers)

Jonathan Neilan / Patrick Berkery Tel: +353 (86) 602 5988

About Origin Enterprises plc

Origin Enterprises plc is an international Agronomy-Services

group, providing specialist advice, inputs and digital solutions

to promote sustainable land use. The Group has leading market

positions in Ireland, the United Kingdom, Brazil, Poland, Romania

and Ukraine. Origin's ordinary shares are listed on the Euronext

Growth (Dublin) market of Euronext Dublin and the AIM market

of the London Stock Exchange.

Euronext Growth (Dublin) ticker symbol: OIZ

AIM ticker symbol: OGN

Website: www.originenterprises.com

Financial Review - Summary

2023 2022

EUR'000 EUR'000

Group revenue 2,456,168 2,342,102

Operating profit(1) 90,791 119,740

Associates and joint venture, net(2) 4,040 6,845

Group operating profit(1) 94,831 126,585

Finance costs, net (12,963) (11,057)

Profit before tax(1) 81,868 115,528

Income tax (19,230) (25,509)

Adjusted net profit 62,638 90,019

Adjusted diluted EPS (cent)(3) 53.16c 71.53c

Adjusted net profit reconciliation

Reported net profit 51,032 79,899

Amortisation of non-ERP intangible

assets 13,435 15,236

Tax on amortisation of non-ERP related

intangible assets (2,460) (2,269)

Exceptional items (net of tax) 631 (2,847)

Adjusted net profit 62,638 90,019

Adjusted diluted EPS (cent)(3) 53.16c 71.53c

Operating margin(1) 3.7% 5.1%

Return on capital employed 12.6% 18.3%

Free cash flow EUR104.4m EUR108.5m

Group revenue

Group revenue increased by 4.9% to EUR2,456.2 million on a

reported basis and 6.5% on a constant currency basis. Excluding

crop marketing, revenue in the Agronomy and Inputs businesses

delivered constant currency growth of 5.2%, with price growth of

12.5%, reflecting global commodity prices, and an increase of 1.1%

from acquisitions set against reduced volumes of 8.4%, driven

primarily by a combination of reduced Ukraine activity and lower

fertiliser volumes.

Operating profit(1)

Operating profit(1) amounted to EUR90.8 million compared to the

unique contribution in FY22 of EUR119.7 million, which was impacted

by strong commodity prices and highly volatile trading conditions.

Excluding FY22's result, the operating profit delivered in FY23 of

EUR90.8m exceeds the previous best of the Group with increases

recorded in Continental Europe and Latin America set against the

expected reduced contribution from Ireland and the UK.

Group operating margin reduced from 5.1% to 3.7% in FY23,

principally driven by the Ireland and UK segment, which saw its

operating margin reduce from 5.9% in FY22 to 3.5% in FY23.

Associates and joint venture(2)

Origin's share of the profit after taxation from associates and

joint venture amounted to EUR4.0 million in the period (FY22:

EUR6.8 million). The FY23 performance reflects a weaker feed

commodity market in the second half of the year compared to the

stronger operating and trading conditions experienced in FY22.

Finance costs and net bank debt(4)

Net cash(4) at 31 July 2023 was EUR53.2 million (net debt(4) of

EUR1.7 million including IFRS 16 lease debt) compared to net

cash(4) of EUR43.4 million (net debt(4) EUR5.1 million including

IFRS 16 lease debt) at the end of the prior year, an increase of

EUR9.8 million. The movement is primarily driven by the strong FY23

operating performance and a net working capital inflow during the

year, as described below.

Net finance costs amounted to EUR13.0 million, which represents

an increase of EUR1.9 million on the prior year. Excluding the

impact of IFRS 16, there was an increase in net finance costs of

EUR1.8 million reflecting increased interest rates, year-on-year,

across the Group.

At 31 July 2023, the Group had unsecured committed banking

facilities of EUR400.0 million (2022: EUR400.0 million), with

pricing linked to ESG performance, of which EUR33.8 million will

expire in 2024 and EUR366.2 million in 2026.

At year end the Group's key banking covenants were as

follows:

Banking Covenant 2023 2022

Net debt to EBITDA Maximum 3.5 - -

EBITDA to net

interest Minimum 3.0 8.57 13.83

Working capital

For the year ended 31 July 2023, there was a working capital

inflow of EUR43.9 million reflecting the continued focus on working

capital optimisation across the Group. While the year-end

represents the low point in the working capital cycle for the Group

reflecting the seasonality of the business, working capital

performance was positively impacted by lower fertiliser raw

material and feed pricing, the favourable timing impact of

purchases and sales offtakes during H2 and the net benefit of trade

payables which have been suspended in accordance with international

sanctions imposed in response to the Russian invasion of Ukraine in

2022. We continue to monitor the situation regarding sanctions and

work very closely with the relevant National Competent Authorities

and will continue to act in accordance with their guidance.

Adjusted diluted earnings per share ('EPS')(3)

Adjusted diluted EPS(3) amounted to 53.16 cent per share (FY22:

71.53 cent), a decrease of 25.7% on a reported basis and 25.9% on a

constant currency basis.

Free cash flow

2023 2022

EUR'm EUR'm

Free cash flow 104.4 108.5

Free cash flow conversion ratio 178.2% 130.5%

The Group generated free cash flow in the year of EUR104.4

million (2022: EUR108.5 million). This strong cash flow performance

delivered a net cash position of EUR53.2 million at year end. This

was due to a continued focus on working capital optimisation,

falling feed and fertiliser raw material prices and disciplined

cash management across the Group.

Free cash flow means the total of earnings before interest, tax,

depreciation (excluding depreciation of IFRS 16 Right of Use leased

assets), amortisation of non-ERP related intangible assets and

exceptional items of wholly owned businesses ('EBITDA') adjusted to

take account of interest, tax, routine capital expenditure, working

capital cash flows and dividends received.

Free cash flow conversion ratio means free cash flow as a

percentage of profit after tax of wholly owned businesses,

excluding exceptional items and amortisation of non-ERP related

intangible assets.

Return on capital employed

2023 2022

Return on capital employed ('ROCE') 12.6% 18.3%

The Group's strong operating performance delivered a ROCE of

12.6%, within our targeted range. Return on capital employed is a

key performance indicator for the Group and represents Group

earnings before interest, tax and amortisation of non-ERP related

intangible assets from continuing operations ('EBITA') taken as a

percentage of the Group Net Assets. For the purposes of this

calculation:

(i) EBITA includes the net profit contribution from associates

and joint venture (after interest and tax) and excludes

the impact of exceptional and non-recurring items; and

(ii) Group Net Assets means total assets less total liabilities

as shown in the annual report excluding net debt, derivative

financial instruments, put option liabilities, accumulated

amortisation of non-ERP related intangible assets and taxation

related balances. Net Assets are also adjusted to reflect

the average level of acquisition investment spend and the

average level of working capital for the accounting period.

Exceptional items

Exceptional items net of tax amounted to a charge of EUR0.6

million in the year (FY22: credit of EUR2.8 million), and are

summarised in the table below:

2023 2022

EUR'm EUR'm

Acquisition and disposal related costs 2.3 -

Ukraine related costs 2.0 -

Arising in associates and joint venture (3.7) -

Gain on the disposal of investment properties - (2.7)

Other - (0.1)

Total exceptional items, net of tax 0.6 (2.8)

Dividends

The Directors are proposing a final dividend of 13.65 cent per

ordinary share for approval at the AGM in November 2023, bringing

the total dividend payment for FY23 to 16.80 cent, an increase of

5.0%. Subject to shareholder approval at the AGM, this final

dividend will be paid on 9 February 2024 to shareholders on the

register on 19 January 2024.

Board changes

Rose Hynes resigned as a Director of the Company with effect

from the conclusion of the 2022 AGM in November 2022 and was

succeeded by Gary Britton as Chairman as planned. Also during the

year Mr. Alan Ralph and Ms. Pam Powell were appointed as

independent Non-Executive Directors.

Share buyback programme

On 28 September 2022 the Group commenced a share buyback

programme to repurchase up to EUR20 million of ordinary shares. The

programme was completed on 29 March 2023, with the average price

paid per share of EUR4.0583.

Sustainability

Origin made significant progress on its Environmental, Social

and Governance ("ESG") agenda in FY23. During the year the Group

continued the implementation of its environmental sustainability

strategy, 'Nurturing Growth' and its associated targets. Origin is

focused on actions in the areas that are most important to

stakeholders and has prioritised work in the evolution of a more

sustainable product portfolio.

The Group also implemented its carbon transition plan and has

committed to a 54.9% reduction in Scope 1 and 2 emissions, and a

32.5% reduction in Scope 3 emissions by 2032 from a 2019 base.

These targets have been submitted for validation to the Science

Based Target initiative ("SBTi").

The Group's efforts have been acknowledged with improved ESG

ratings: Sustainalytics (Low Risk), MSCI (A rating), and CDP (B

rating). This achievement has resulted in Origin attaining the top

end of its ESG targets within its sustainability-linked revolving

credit facility.

On the social agenda, Origin has also made progress on Diversity

and Inclusion during the year with good engagement across the

organisation culminating in achieving a 25% female representation

in leadership and management positions (7% increase since 2018) and

33% female representation on the Origin Board. The Group also

increased resourcing within its environmental compliance team and

launched a series of actions across education, talent acquisition

and engagement to further embed our progress.

Corporate development

During the year, the Group continued to strengthen its offering

in its Amenity, Environmental and Ecology business with the

acquisitions of Keystone Environmental, Neo Environmental, Agrigem

and British Hardwood Tree Nursery. Subsequent to the year end, the

Group acquired the business and operating assets of Suregreen

Limited ('Suregreen'), a UK based landscape and gardening products

supplier for trade professionals and DIY customers from its

Administrators. These acquisitions complement the Group's organic

growth strategy, are EPS enhancing and broaden its expertise and

capabilities in the growing market for ecological and environmental

products and services which will continue to play an important role

in sustainable land use to help tackle climate change, restore

biodiversity, and create recreational spaces to promote social

wellbeing.

The Group also continues the rollout of Dynamics 365 ERP

solution across its UK and Ireland businesses, with the solution

being deployed to the remaining key business units over FY24.

Investor relations

Our strategy aims to create long-term shareholder value and we

support this strategy through regular and open communication with

all capital market participants. Contact with institutional

shareholders is the responsibility of the executive management team

including the Chief Executive Officer, the Chief Financial Officer

and the Head of Investor Relations.

We engage with institutional investors in numerous one-on-one

meetings, as well as at roadshows and equity conferences. During

FY23, meetings were held with 142 institutional investors.

Engagement was facilitated through a combination of in-person

meetings and remotely using virtual conferences and video

calls.

Annual General Meeting (AGM)

The AGM is scheduled to be held on 16 November 2023 at 11.00am

(UK/Ireland time) in the Merrion Hotel, Upper Merrion Street,

Dublin 2.

Cautionary statement

This Preliminary Results Statement contains forward looking

statements. These statements have been made by the Directors in

good faith based on the information available to them up to the

time of the preparation of this document. Due to the inherent

uncertainties, including both economic and business risk factors

underlying such forward-looking information, actual results may

differ materially from those expressed or implied by these

forward-looking statements.

The Directors undertake no obligation to update any

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise.

Review of Operations

Group Overview

Change on prior year

Constant

2023 2022 Change Underlying(3) Currency(4)

EUR'm EUR'm % % %

---------------------- --------- -------- --------- --------------- -----------------

Revenue 2,456.2 2,342.1 4.9% 5.5% 6.5%

Operating profit(1) 90.8 119.7 (24.2%) (27.4%) (24.4%)

Operating margin(1) 3.7% 5.1% (140bps) (160bps) (150bps)

Adjusted diluted EPS

(cent)(2) 53.16 71.53 (25.7%) (28.6%) (25.9%)

(1) Before amortisation of non-ERP intangible assets and exceptional

items

(2) Before amortisation of non-ERP intangible assets, net of related

deferred tax (2023: EUR11.0m, 2022: EUR13.0m) and exceptional

items, net of tax (2023: charge of EUR0.6m, 2022: credit of

EUR2.8m)

(3) Excluding currency movements and the impact of acquisitions

and disposals

(4) Excluding currency movements

---- -----------------------------------------------------------------

The Group delivered a strong overall performance in FY23,

despite significant price and volume volatility across all our

markets. As previously noted, the FY23 performance is set against a

strong comparable period in FY22 due to the unique backdrop of

strong commodity prices and highly volatile trading conditions.

Group revenue increased by 4.9% on a reported basis, while Group

operating profit and adjusted fully diluted earnings per share

reduced by 24.2% and 25.7% respectively.

There was an underlying decrease in agronomy services and crop

input volumes, primarily driven by a combination of reduced Ukraine

activity and lower fertiliser volumes, excluding crop marketing

volumes, of 8.4% for FY23.

Ireland and the United Kingdom

Change on prior year

Constant

2023 2022 Change Underlying(3) Currency(4)

EUR'm EUR'm % % %

Revenue 1,641.8 1,614.4 1.7% 2.6% 4.0%

Operating profit(1) 57.8 94.5 (38.8%) (41.1%) (37.2%)

Operating margin(1) 3.5% 5.9% (240bps) (250bps) (230bps)

Associates and joint

venture(2) 4.0 6.8 (41.0%) (40.4%) (40.4%)

(1) Before amortisation of non-ERP intangible assets and exceptional

items

(2) Profit after interest and tax before exceptional items

(3) Excluding currency movements and the impact of acquisitions

and disposals

(4) Excluding currency movements

---- -----------------------------------------------------------------

Ireland and the UK delivered a good performance in FY23,

reflective of a return to more normalised trading conditions as the

year progressed, including some recovery in Q4 from what was a wet

and cold Q3 period. As previously stated, FY23 is set against a

unique prior year comparative, and while reported revenue increased

by 1.7%, operating profit decreased by 38.8%.

While FY23 continued to be characterised by significant price

and volume volatility, these challenges were successfully managed

across the Group. Agronomy Services and Agri-inputs experienced an

underlying volume reduction of 7.4% for the period, primarily

fertiliser driven.

Operating margin decreased to 3.5% from 5.9% in the prior year.

This again reflects the exceptional nature of FY22's result.

Agronomy Services

Integrated Agronomy and On-Farm Services delivered a strong

result for the year.

The result was supported by a robust planted area across the UK,

despite the impact of some weather related challenges. Strong

volume performance across our seed portfolio was set against

reductions in fertiliser and crop protection volumes, as

anticipated. The FY23 harvest is progressing well, after a slow

start, and yields to-date are as expected.

Agri-inputs

Our Business-to-Business Agri-Inputs division delivered a solid

performance, despite experiencing reduced demand as a result of

higher global raw material prices, which have fallen towards the

end of the year.

Fertiliser

Fertiliser delivered a solid financial and operating

performance, while navigating ongoing pricing uncertainties and

supply chain challenges. The global fertiliser market experienced

significant raw material price volatility throughout the year, and

this negatively impacted FY23 volumes.

Despite the challenges faced in global markets, the Group

continues to execute strongly across the business. Sustainable land

use and soil health are a core focus for the Group, and Origin will

continue to invest in innovative products to meet evolving

customer's needs.

Feed Ingredients

Origin's Feed Ingredients division delivered a satisfactory

performance in FY23, again set against stronger FY22 operating and

trading conditions.

The Group's animal feed manufacturing associate, John Thompson

& Sons Limited, in which the Group has a 50% shareholding,

delivered a satisfactory performance in the period.

Amenity, Environmental and Ecology

As part of the strategy outlined at the Group's 2022 Capital

Markets Day, Origin committed to accelerating its participation in

the amenity, environmental and ecology markets. In FY23, the

Group's Amenity, Environmental and Ecology business delivered a

good performance supported by the impact of acquisitions completed

during the year.

During the year, the Group completed four acquisitions in this

space, totalling EUR30.1 million, with a further acquisition post

year end. The five acquisitions are: Agrigem; British Hardwood Tree

Nursery; Keystone Environmental; Neo Environmental; and

Suregreen.

These newly acquired businesses provide a diverse range of

ecological and environmental products and services , in areas such

as forestry, landscaping and habitat conservation. They primarily

cater for the growing demand from customers seeking sustainable

nature based solutions.

These acquisitions complement Origin's organic growth strategy

and broaden its offering in the emerging nature economy through

sustainable land use.

Continental Europe (1)

Change on prior year

Constant

2023 2022 Change Underlying(3) Currency(4)

EUR'm EUR'm % % %

Revenue 464.6 461.8 0.6% 2.4% 2.4%

Operating profit(2) 15.8 14.8 6.6% 5.1% 5.1%

Operating margin(2) 3.4% 3.2% 20bps 10bps 10bps

(1) Excluding crop marketing. While crop marketing has a significant

impact on revenue, its impact on operating profit is less

significant. For the year ending 31 July 2023 crop marketing

revenues and profits attributable to Continental Europe amounted

to EUR231.7 million and EUR1.5 million respectively (2022:

EUR192.7 million and EUR0.8 million respectively). An analysis

of revenues, profits and margins attributable to agronomy

services and inputs more accurately reflects the underlying

drivers of business performance

(2) Before amortisation of non-ERP intangible assets and exceptional

items

(3) Excluding currency movements and the impact of acquisitions

(4) Excluding currency movements

---- ------------------------------------------------------------------

Continental Europe ('CE') delivered a solid performance in FY23,

with an overall increase in operating profit to EUR15.8 million, an

increase of 6.6% on FY22.

Overall volumes were back in each geography in CE, with

underlying business volumes reducing by 18.2% in the period,

primarily driven by Ukraine and the impact of higher product

pricing.

Poland

Poland delivered a good performance in FY23, with the cropping

area largely in line with FY22.

The performance was characterised by a continued focus on

working capital optimisation, with a reduction in net working

capital delivered year-on-year. Across Poland, the harvest is

progressing as planned with good yields reported across most

regions. Farm sentiment remains cautious, with input price

volatility delaying purchasing decisions. The construction of the

expanded 'Foliq'-branded liquid foliar fertiliser facility is

progressing to plan, with commissioning expected during first half

of calendar 2024.

Romania

Romania reported a strong performance in FY23, supported by a

robust planted area, satisfactory crop establishment and generally

favourable soil moisture levels.

The harvest of winter crops is largely complete across Romania,

with record oilseed rape yields recorded in some regions set

against lower than average yields for other winter cereals. Farm

sentiment is cautious with some early purchasing of oilseed rape

noted, however purchasing decisions for other winter cereals are

expected to be delayed. The Group will commence its investment

programme to expand our micropack production facility and

fertiliser coating facilities in early FY24.

Ukraine

Activity levels in Ukraine have continued to reduce

significantly as a result of the war. In recent years the Group has

undertaken a significant de-risking of the balance sheet through a

sustained focus on working capital reduction. Subsequent to year

end, the Group took the difficult decision to wind down operations

in Ukraine, and it will cease trading at the end of September 2023.

The Group's Ukraine business has experienced a number of

challenges, most recently as a result of the war with reduced

activity levels in relation to on-farm liquidity, however, a

volatile trading environment and challenging market dynamics have

resulted in the business being loss making over a number of years,

with little evidence that the trading environment will improve post

war.

Latin America

Change on prior period

Constant

2023 2022 Change Underlying(2) Currency(3)

EUR'm EUR'm % % %

---------------------- --------- -------- -------- --------------- -------------

Revenue 118.1 73.2 61.3% 48.5% 48.5%

Operating profit(1) 15.7 9.7 62.1% 47.3% 47.3%

Operating margin(1) 13.3% 13.2% 10bps (10bps) (10bps)

(1) Before amortisation of non-ERP intangible assets and exceptional

items

(2) Excluding currency movements and the impact of acquisitions

(3) Excluding currency movements

---- -----------------------------------------------------------------

The Latin American ('LATAM') reporting segment incorporates the

Group's operations in Brazil.

Latin America delivered another strong performance in FY23, with

operating profit increasing to EUR15.7 million from EUR9.7 million

in FY22, with an underlying increase of EUR4.6 million.

There was an underlying increase in volumes of 30.1%. The strong

volume development and underlying growth was enabled by the

broadening of our product range, following additional investment to

increase capacity of liquid, dry and Controlled Release Fertiliser

('CRF'). The Group's CRF operations reached maximum capacity, ahead

of targets, in FY23. Further investment will be required in FY24 to

address current production related constraints. The establishment

of F1rst Agbiotech, a dedicated biological business unit supporting

research and development of bio-solutions, continued in line with

expectations, with initial sales volumes delivered through Q4

FY23.

The overall result was supported by the total cropping area

dedicated to soya, Brazil's principal crop, increasing by 5.1% on

the prior year to 43.6 million hectares, with the expected soya

harvest increasing to 153.3 million tonnes from 125.5 million

tonnes last year. The total production for Brazil's secondary crop,

maize, is forecasted to increase by 10.6% to 125.1 million

tonnes.

S

Origin Enterprises plc

Consolidated Income Statement

For the financial year ended 31 July 2023

Pre- Pre-

exceptional Exceptional Total exceptional Exceptional Total

2023 2023 2023 2022 2022 2022

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Notes (Note 3) (Note 3)

Revenue 2 2,456,168 - 2,456,168 2,342,102 - 2,342,102

Cost of sales (2,122,029) - (2,122,029) (1,972,937) - (1,972,937)

Gross profit 334,139 - 334,139 369,165 - 369,165

Operating (costs)

/ income (256,783) (4,489) (261,272) (264,661) 3,919 (260,742)

Share of profit

of associates

and joint

venture 4,040 3,692 7,732 6,845 - 6,845

Operating profit 81,396 (797) 80,599 111,349 3,919 115,268

Finance income 2,080 - 2,080 1,127 - 1,127

Finance expense (15,043) - (15,043) (12,184) - (12,184)

Profit before

income tax 68,433 (797) 67,636 100,292 3,919 104,211

Income tax

(expense)/credit (16,770) 166 (16,604) (23,240) (1,072) (24,312)

Profit for the

year 51,663 (631) 51,032 77,052 2,847 79,899

Earnings per share for the year 2023 2022

Basic earnings per share 4 45.24c 65.40c

------------ ------------

Diluted earnings per

share 4 43.31c 63.49c

------------ ------------

Origin Enterprises plc

Consolidated Statement of Comprehensive Income

For the financial year ended 31 July 2023

2023 2022

EUR'000 EUR'000

Profit for the year 51,032 79,899

Other comprehensive (expense) / income

Items that are not reclassified subsequently to the Consolidated Income Statement:

Group/Associate defined benefit pension obligations

-remeasurements on Group's defined benefit pension schemes (6,103) 909

-deferred tax effect of remeasurements 1,506 (176)

-share of remeasurements on associate's defined benefit pension schemes (53) (2,386)

-share of deferred tax effect of remeasurements - associates 13 596

Items that may be reclassified subsequently to the Consolidated Income Statement:

Group foreign exchange translation details

-exchange difference on translation of foreign operations (1,580) 9,588

Group/Associate cash flow hedges

-effective portion of changes in fair value of cash flow hedges 7,387 9,186

-fair value of cash flow hedges transferred to operating costs and other income (7,801) (3,751)

-deferred tax effect of cash flow hedges 394 (840)

-share of associates and joint venture cash flow hedges (1,960) 2,134

-deferred tax effect of share of associates and joint venture cash flow hedges 245 (267)

Other comprehensive (expense) / income for the year, net of tax (7,952) 14,993

Total comprehensive income for the year attributable to equity shareholders 43,080 94,892

------- -------

Origin Enterprises plc

Consolidated Statement of Financial Position

As at 31 July 2023

2023 2022

Notes EUR'000 EUR'000

ASSETS

Non-current assets

Property, plant and equipment 5 118,107 107,906

Right of use asset 54,037 47,705

Investment properties 2,270 2,270

Goodwill and intangible assets 6 299,906 251,999

Investments in associates and joint venture 7 52,387 47,053

Other financial assets 898 561

Deferred tax assets 8,737 6,363

Post employment benefit surplus 9 2,579 7,767

Derivative financial instruments 6,960 4,241

Total non-current asset 545,881 475,865

-------------------- ---------

Current assets

Properties held for sale 5,800 5,800

Inventory 232,167 380,412

Trade and other receivables 440,398 455,110

Derivative financial instruments 118 2,162

Cash and cash equivalents 11 151,237 193,059

Total current assets 829,720 1,036,543

-------------------- ---------

TOTAL ASSETS 1,375,601 1,512,408

Origin Enterprises plc

Consolidated Statement of Financial Position (continued)

As at 31 July 2023

2023 2022

Notes EUR'000 EUR'000

EQUITY

Called up share capital presented as equity 12 1,253 1,253

Share premium 160,526 160,521

Retained earnings and other reserves 248,814 241,003

TOTAL EQUITY 410,593 402,777

---------- ----------

LIABILITIES

Non-current liabilities

Interest-bearing borrowings 11 96,964 132,936

Lease liabilities 42,835 38,753

Deferred tax liabilities 20,720 20,854

Provision for liabilities 8 11,331 4,002

Derivative financial instruments 25 -

Total non-current liabilities 171,875 196,545

---------- ----------

Current liabilities

Interest-bearing borrowings 11 1,098 16,689

Lease liabilities 12,081 9,803

Trade and other payables 722,605 841,085

Corporation tax payable 11,937 12,290

Put option liability 32,382 29,695

Provision for liabilities 8 11,987 1,610

Derivative financial instruments 1,043 1,914

Total current liabilities 793,133 913,086

---------- ----------

TOTAL LIABILITIES 965,008 1,109,631

TOTAL EQUITY AND LIABILITIES 1,375,601 1,512,408

---------- ----------

Origin Enterprises plc

Consolidated Statement of Changes in Equity

For the financial year ended 31 July 2023

Share- Foreign

Capital Cash based currency

flow

Share Share Treasury redemption hedge Revaluation payment Re-organisation translation Retained

capital Premium shares reserve reserve reserve reserve reserve reserve earnings Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

At 1 August 2022 1,253 160,521 (36,005) 145 4,604 12,843 4,194 (196,884) (43,748) 495,854 402,777

Profit for the year - - - - - - - - - 51,032 51,032

Other comprehensive expense

for the year - - - - (1,735) - - - (1,580) (4,637) (7,952)

------- ------- --------- ---------- ------- ----------- ------- -------------------------- ----------- -------- ---------

Total comprehensive (expense)

/ income for the year - - - - (1,735) - - - (1,580) 46,395 43,080

Share-based payment charge - - - - - - 2,550 - - - 2,550

Shares issued - 5 - - - - - - - - 5

Share buyback - - (20,000) - - - - - - - (20,000)

Re-issue of treasury shares - - 4,316 - - - - - - (2,024) 2,292

Change in fair value of put

option - - - - - - - - - (2,121) (2,121)

Dividend paid to shareholders

Transfer of share based - - - - - - - - - (17,990) (17,990)

payment reserve

to retained earnings - - - - - - (518) - - 518 -

At 31 July 2023 1,253 160,526 (51,689) 145 2,869 12,843 6,226 (196,884) (45,328) 520,632 410,593

Origin Enterprises plc

Consolidated Statement of Cash Flows

For the financial year ended 31 July 2023

2023 2022

EUR'000 EUR'000

Cash flows from operating activities

Profit before tax 67,636 104,211

Exceptional items 797 (3,919)

Finance income (2,080) (1,127)

Finance expense 15,043 12,184

Loss on disposal of property, plant and equipment 718 650

Share of profit of associates and joint venture (4,040) (6,845)

Depreciation of property, plant and equipment 8,678 10,696

Depreciation of right of use assets 12,810 11,482

Amortisation of intangible assets 14,218 17,112

Employee share-based payment charge 2,550 2,285

Pension contributions in excess of service costs (834) (762)

Payment of exceptional Ukraine related costs (1,918) -

Payment of exceptional acquisition and disposal related costs (1,537) (206)

Operating cash flow before changes in working capital 112,041 145,761

Movement in inventory 146,884 (161,914)

Movement in trade and other receivables 19,845 (18,464)

Movement in trade and other payables (122,835) 196,531

Cash generated from operating activities 155,935 161,914

Interest paid (11,526) (8,040)

Income tax paid (19,631) (26,213)

Cash inflow from operating activities 124,778 127,661

Origin Enterprises plc

Consolidated Statement of Cash Flows (continued)

For the financial year ended 31 July 2023

2023 2022

EUR'000 EUR'000

Cash flows from investing activities

Proceeds from disposal of held for sale properties - 19,500

Proceeds from sale of property, plant and equipment 235 1,083

Purchase of property, plant and equipment (18,567) (13,128)

Additions to intangible assets (17,683) (10,998)

Consideration relating to acquisitions (net of cash acquired) (30,112) (1,457)

Payment of contingent acquisition consideration (115) (106)

Net proceeds from disposal of subsidiary 705 -

Purchase of other financial assets (345) -

Repayment of loans - 2,898

Dividends received from associates 144 3,042

Cash (outflow) / inflow from investing activities (65,738) 834

Cash flows from financing activities

Drawdown of bank loans 334,599 295,365

Repayment of bank loans (369,244) (334,465)

Lease liability payments (14,810) (13,499)

Share buyback (20,000) (39,997)

Issue of share capital 5 -

Proceeds from re-issue of treasury shares 1,654 -

Payment of dividends to equity shareholders (17,990) (13,449)

Cash outflow from financing activities (85,786) (106,045)

Net (decrease) / increase in cash and cash equivalents (26,746) 22,450

Translation adjustment 515 (1,858)

Cash and cash equivalents at start of year 176,370 155,778

Cash and cash equivalents at end of year (Note 11) 150,139 176,370

Origin Enterprises plc

Notes to the preliminary results statement

For the financial year ended 31 July 2023

1 Basis of preparation

The financial information included on pages 12 to 32 of this

preliminary results statement has been extracted from the Group

financial statements for the year ended 31 July 2023 on which the

auditor has issued an unqualified audit opinion.

The financial information has been prepared in accordance with

the accounting policies set out in the Group's consolidated

financial statements for the year ended 31 July 2023, which were

prepared in accordance with International Financial Reporting

Standards as adopted by the EU.

The consolidated financial information is presented in Euro,

rounded to the nearest thousand, which is the functional currency

of the parent.

2 Segment information

IFRS 8, 'Operating Segments' requires operating segments to be

identified on the basis of internal reports that are regularly

reviewed by the Chief Operating Decision Maker ('CODM') in order to

allocate resources to the segments and to assess their

performance.

The Group has three operating segments as follows:

Ireland and the United Kingdom

This segment includes the Group's wholly owned Irish and UK

based Business-to-Business Agri-Inputs operations, Integrated

Agronomy and On-Farm Services operations and Amenity, Environmental

and Ecology operations. In addition, this segment includes the

Group's associates and joint venture undertakings.

Continental Europe

This segment includes the Group's Business-to-Business

Agri-Inputs operations, Integrated Agronomy and On-Farm Services

operations in Poland, Romania and Ukraine.

Latin America

This segment includes the Group's 65% controlling interest in

Fortgreen Commercial Agricola Ltda ("Fortgreen"), a business which

is focused on the development and marketing of value added crop

nutrition and speciality inputs and which is headquartered in

Paraná State in southern Brazil.

Information regarding the results of each reportable segment is

included below. Performance is measured based on segment operating

profit as included in the internal management reports that are

reviewed by the Group's CODM, being the Origin Executive Directors.

Segment operating profit is used to measure performance, as this

information is the most relevant in evaluating the results of the

Group's segments. Segment results include all items directly

attributable to a segment.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

2 Segment information (continued)

(i) Segment revenue and results

Ireland & Continental Latin America Total

the UK Europe Group

---------- ------------- ---------------------- ----------

2023 2022 2023 2022 2023 2022 2023 2022

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Revenue 1,641,764 1,614,423 696,268 654,446 118,136 73,233 2,456,168 2,342,102

---------- ---------- ------------ -------- -------- -------- ---------- ----------

Segment

result 57,841 94,480 17,297 15,604 15,653 9,656 90,791 119,740

Profit from

associates

and joint

venture 4,040 6,845 - - - - 4,040 6,845

Amortisation

of non-ERP

intangible

assets (10,729) (7,967) (1,013) (5,354) (1,693) (1,915) (13,435) (15,236)

---------- ---------- ------------ -------- -------- -------- ---------- ----------

Total

operating

profit

before

exceptional

items 51,152 93,358 16,284 10,250 13,960 7,741 81,396 111,349

Exceptional

items (128) 3,919 (669) - - - (797) 3,919

Operating

profit 51,024 97,277 15,615 10,250 13,960 7,741 80,599 115,268

---------- ---------- ------------ -------- -------- -------- ---------- ----------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

2 Segment information (continued)

(ii) Segment earnings before financing costs and tax is

reconciled to reported profit before tax and profit after tax as

follows:

2023 2022

EUR'000 EUR'000

Segment earnings before financing costs and tax 80,599 115,268

Finance income 2,080 1,127

Finance expense (15,043) (12,184)

Reported profit before tax 67,636 104,211

Income tax expense (16,604) (24,312)

Reported profit after tax 51,032 79,899

3 Exceptional items

Exceptional items are those that, in management's judgement,

should be separately presented and disclosed by virtue of their

nature or amount. Such items are included within the Consolidated

Income Statement caption to which they relate. The following

exceptional items arose during the year:

2023 2022

EUR'000 EUR'000

Ukraine Related costs (i) 2,226 -

Acquisition, disposal and other related costs / (credit) (ii) 2,263 (125)

Gain on disposal of properties held for sale (iii) - (3,794)

Total exceptional costs / (credit) before tax and before associates and joint venture 4,489 (3,919)

Arising in associates and joint venture, net of tax (iv) (3,692) -

------- -------

Total exceptional costs / (credit) before tax including associates and joint venture 797 (3,919)

Tax (credit) / charge on exceptional items (166) 1,072

------- -------

Total exceptional costs / (credit) after tax 631 (2,847)

------- -------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

3 Exceptional items (continued)

(i) Ukraine related costs

Ukraine related costs comprise of rationalisation costs

attributable to termination payments from restructuring programmes

in Ukraine along with costs associated with international sanctions

imposed by authorities in response to the Russian invasion of

Ukraine. The tax impact of this exceptional item in the year was a

tax credit of EUR0.2 million

(ii) Acquisition, disposal and other related costs /

(credit)

Acquisition, disposal and other related costs principally

comprised of costs incurred in relation to the acquisitions

completed during the current year and a loss on sale of a

subsidiary. The tax impact of this exceptional item in the current

year was a charge of EURnil. The costs in the prior year

principally comprised of a dilapidation credit.

(iii) Gain on disposal of properties held for sale

During the prior year, held for sale properties were sold,

resulting in an exceptional gain of EUR3.8 million. Also included

were costs relating to the disposal of the properties. The tax

impact of this exceptional item in the prior year was a charge of

EUR1.1 million.

(iv) Arising in associates and joint venture

During 2021 the R&H Hall storage facility in Ringaskiddy

suffered fire damage. Contingency plans were implemented and the

impact on customers and operations was minimised. The gain

represents the excess of the insurance claim proceeds over the net

book value of the assets destroyed and other restructuring costs

incurred. The net tax impact of this exceptional item was EUR0.7

million .

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

4 Earnings per share

Basic earnings per share

2023 2022

EUR'000 EUR'000

Profit for the financial year attributable to equity shareholders 51,032 79,899

------- -------

'000 '000

Weighted average number of ordinary shares for the year 112,791 122,164

------- -------

Cent Cent

Basic earnings per share 45.24 65.40

------- -------

Diluted earnings per share

2023 2022

EUR'000 EUR'000

Profit for the financial year attributable to equity shareholders 51,032 78,899

------- -------

'000 '000

Weighted average number of ordinary shares used in basic calculation 112,791 122,164

Impact of shares with a dilutive effect 2,671 1,928

Impact of the SAYE scheme 2,379 1,759

Weighted average number of ordinary shares (diluted) for the year 117,841 125,851

------- -------

Cent Cent

Diluted earnings per share 43.31 63.49

------- -------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

4 Earnings per share (continued)

2023 2022

'000 '000

Adjusted basic earnings per share

Weighted average number of ordinary shares for the year 112,791 122,164

------- -------

2023 2022

EUR'000 EUR'000

Profit for the financial year 51,032 79,899

Adjustments:

Amortisation of non-ERP related intangible assets (Note 6) 13,435 15,236

Tax on amortisation of non-ERP related intangible assets (2,460) (2,269)

Exceptional items, net of tax 631 (2,847)

------- -------

Adjusted earnings 62,638 90,019

------- -------

Cent Cent

Adjusted basic earnings per share 55.53 73.69

------- -------

Adjusted diluted earnings per share

2023 2022

'000 '000

Weighted average number of ordinary shares used in basic calculation 112,791 122,164

Impact of shares with a dilutive effect 2,671 1,928

Impact of the SAYE scheme 2,379 1,759

Weighted average number of ordinary shares (diluted) for the year 117,841 125,851

------- -------

2023 2022

EUR'000 EUR'000

Adjusted earnings (as above) 62,638 90,019

------- -------

Cent Cent

Adjusted diluted earnings per share 53.16 71.53

------- -------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

5 Property, plant and equipment

2023 2022

EUR'000 EUR'000

At 1 August 107,906 104,528

Arising on acquisition (Note 10) 1,459 874

Additions 18,891 13,477

Disposals (1,014) (1,733)

Depreciation charge for the year (8,678) (10,696)

Translation adjustments (457) 1,456

--------- ----------

At 31 July 118,107 107,906

--------- ----------

6 Goodwill and intangible assets

2023 2022

EUR'000 EUR'000

At 1 August 251,999 248,445

Arising on acquisition (Note 10) 46,650 2,314

Additions 17,683 10,998

Disposals (886) (848)

Purchase adjustment (58) -

Amortisation of non-ERP intangible assets (13,435) (15,236)

ERP intangible amortisation (783) (1,876)

Translation adjustments (1,264) 8,202

-------- --------

At 31 July 299,906 251,999

-------- --------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

7 Investments in associates and joint venture

2023 2022

EUR'000 EUR'000

At 1 August 47,053 42,774

Share of profits after tax, before exceptional items 4,040 6,845

Share of exceptional items, net of tax (Note 3) 3,692 -

Dividends received (144) (3,042)

Share of other comprehensive income (1,755) 77

Translation adjustment (499) 399

At 31 July 52,387 47,053

------- -------

Split as follows:

Total associates 27,219 24,580

Total joint venture 25,168 22,473

------- -------

52,387 47,053

------- -------

8 Provision for liabilities

The estimate of provisions is a key judgement in the preparation

of the financial statements.

2023 2022

EUR'000 EUR'000

At 1 August 5,612 3,459

Arising on acquisition (Note 10) 15,199 1,460

Provided in year 2,738 1,045

Paid in year (115) (384)

Released in the year (290) -

Currency translation adjustment 174 32

---------------------------------- ----------------------------------

At 31 July 23,318 5,612

---------------------------------- ----------------------------------

Split as follows:

Current liabilities 11,987 1,610

Non-current liabilities 11,331 4,002

---------------------------------- ----------------------------------

23,318 5,612

---------------------------------- ----------------------------------

Provisions primarily relate to contingent acquisition

consideration arising on a number of acquisitions completed during

the current and prior years.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

9 Post employment benefit obligations

The Group operates a number of defined benefit pension schemes

and defined contribution schemes with assets held in separate

trustee administered funds. All of the defined benefit schemes are

closed to new members.

The valuations of the defined benefit schemes used for the

purposes of the following disclosures are those of the most recent

actuarial valuations carried out at 31 July 2023 by an independent,

qualified actuary. The valuations have been performed using the

projected unit method.

Movement in net asset recognised in the Consolidated Statement

of Financial Position

2023 2022

EUR'000 EUR'000

At 1 August 7,767 5,939

Current service cost (414) (590)

Employer contributions 1,248 1,352

Other finance income 255 93

Remeasurements (6,103) 909

Translation adjustments (174) 64

At 31 July 2,579 7,767

------- -------

10 Acquisition of subsidiary undertakings

On 6 October 2022, the Group acquired 100% of the share capital

of Keystone Environmental Limited in the UK, an independent ecology

solutions provider specialising in the design, planning and

delivery of complete ecological solutions.

On 17 February 2023, the Group acquired 100% of the share

capital of Agrigem Limited in the UK, the largest independent

specialist supplier and advisor of ground care products throughout

the UK and Ireland.

On 31 March 2023, the Group acquired 100% of the share capital

of Neo Environmental Limited in the UK, a multi-disciplinary

consultancy business that provides market-leading planning,

environmental and technical advice.

On 2 June 2023, the Group acquired 100% of the share capital of

British Hardwood Tree Nursery Limited in the UK, one of the UK's

leading specialist wholesale suppliers of bare root plants, shrubs,

hedgerow plants and planting accessories for the forestry, farming,

estate management, corporate and landscaping sectors.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

10 Acquisition of subsidiary undertakings - continued

Details of the net assets acquired and goodwill arising from the

business combinations are as follows:

Fair

value

EUR'000

Assets

Non-current

Property, plant & equipment 1,459

Intangible assets 9,514

--------

Total non-current assets 10,973

--------

Current assets

Inventory 2,417

Trade receivables (i) 3,060

Other receivables 104

Cash and cash equivalents 5,081

--------

Total current assets 10,662

--------

Liabilities

Trade and other payables (5,322)

Corporation tax (575)

Deferred tax liability (2,482)

--------

Total liabilities (8,379)

--------

Total identifiable net assets at fair value 13,256

Goodwill arising on acquisition 37,136

--------

Total net assets acquired 50,392

--------

Consideration satisfied by:

Cash consideration 35,193

Contingent consideration arising from acquisition 15,199

--------

Total consideration related to acquisitions 50,392

--------

Net cash outflow - arising on acquisitions

Cash consideration 35,193

Less cash and cash equivalents acquired (5,081)

--------

Total cash outflow related to acquisitions 30,112

--------

(i) Trade Receivables acquired were EUR3.1 million. All amounts deemed recoverable.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

11 Analysis of net cash / (debt)

Non-cash Translation

2022 Cash flow movements adjustment 2023

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Cash 193,059 (42,113) - 291 151,237

Overdrafts (16,689) 15,367 - 224 (1,098)

Cash and cash equivalents 176,370 (26,746) - 515 150,139

Loans (132,936) 34,645 (875) 2,202 (96,964)

Net cash 43,434 7,899 (875) 2,717 53,175

Lease liabilities (48,556) 14,810 (21,838) 668 (54,916)

Net debt including

lease liabilities (5,122) 22,709 (22,713) 3,385 (1,741)

---------- ---------- ---------- ------------ ---------

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

12 Share capital

2023 2022

EUR'000 EUR'000

Authorised

250,000,000 ordinary shares of EUR0.01 each (i) 2,500 2,500

Allotted, called up and fully paid

125,320,375 (2023: 125,317,865) ordinary shares of EUR0.01 each (i) (ii) 1,253 1,253

Number of ordinary shares Nominal value of shares

EUR'000

Allotted, called up and

fully paid

At 1 August 2022 125,317,865 1,253

Share options exercised

(ii) 2,510 -

At 31 July 2023 125,320,375 1,253

Number of treasury shares Nominal value of shares Carrying value of shares

EUR'000 EUR'000

Treasury shares in issue

At 1 August 2022 (9,763,176) (98) (36,005)

Share buyback (iii) (4,928,216) (49) (20,000)

Re-issue of treasury shares

(iv) 1,132,908 11 4,316

(13,558,484) (136) (51,689)

(i) Ordinary shareholders are entitled to dividends as declared

and each ordinary share carries equal voting rights at meetings of

the Company.

(ii) In the current financial year, the issued ordinary share

capital was increased by the issue of 2,510 ordinary shares of

nominal value EUR0.01 each, at an issue price of EUR2.02 each

pursuant to the terms of the Origin Save As You Earn Scheme.

(iii) During the financial year, the Group completed a share

buyback programme. The total number of ordinary shares purchased by

the Group was 4,928,216 for a total consideration before expenses

of EUR20 million. The re-purchased shares are held as treasury

shares.

(iv) During the financial year, the Group re-issued 1,132,908

treasury shares to satisfy the exercise of share options granted

under the Group's UK and ROI Savings Related Share Option

Schemes.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

13 Return on capital employed

Return on capital employed is a key performance indicator for

the Group and represents Group earnings before interest, tax and

amortisation of non-ERP related intangible assets taken as a

percentage of Group net assets and is consistent with the

definition approved as part of the 2015 Long Term Incentive

Plan.

2023 2022

EUR'000 EUR'000

Total assets 1,375,601 1,512,408

Total liabilities (965,008) (1,109,631)

Adjusted for:

Net debt 1,741 5,122

Tax, put option and derivative financial

instruments, net 50,292 51,987

Accumulated amortisation of non-ERP

related intangible assets 84,557 72,793

---------- ------------

Capital employed 547,183 532,679

---------- ------------

Average capital employed 754,287 691,369

========== ============

Operating profit (excluding exceptional

items) 77,356 104,504

Amortisation of non-ERP intangible

assets 13,435 15,236

Share of profit of associates and

joint venture 4,040 6,845

---------- ------------

Return 94,831 126,585

========== ============

Return on capital employed 12.6% 18.3%

In years where the Group makes significant acquisitions or

disposals, the return on invested capital calculation is adjusted

accordingly to ensure that the impact of the acquisition or

disposal is time apportioned appropriately.

14 Related party transactions

Related party transactions occurring in the year were similar in

nature to those described in the 2022 Annual Report.

15 Dividend

The Board is recommending a final dividend of 13.65 cent per

ordinary share (2022: 12.85) which when combined with the interim

dividend of 3.15 cent per ordinary share brings the total dividend

for the year to 16.80 cent per share (2022: 16.00 cent per share).

Subject to shareholders' approval at the Annual General Meeting,

the dividend will be paid on 9 February 2024 to shareholders on the

register on 19 January 2024. In accordance with IFRS, this dividend

has not been provided for in the Consolidated Statement of

Financial Position as at 31 July 2023.

Origin Enterprises plc

Notes to the preliminary results statement (continued)

For the financial year ended 31 July 2023

16 Financial commitments

The Group has a financial commitment of EUR2.2 million

attributable to a strategic partnership with University College

Dublin ('UCD'). The commitment is over a five year period and was

extended until January 2024.

17 Subsequent events

In August 2023, the Group exercised the option to acquire the

remaining 35 per cent interest in FortGreen Comercial Agrícola

Ltda.

In addition, the Group acquired the business and operating

assets of Suregreen Limited, a UK based landscape and gardening

products supplier for trade professionals and DIY customers from

its Administrators.

Subsequent to year end, the Group took the difficult decision to

wind down operations in Ukraine, and it will cease trading

effective 29 September 2023.

There have been no other material events subsequent to 31 July

2023 that would require adjustment to or disclosure in this

report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UVARRORUKUUR

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

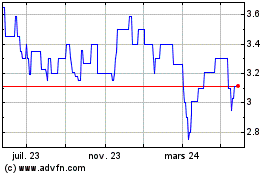

Origin Enterprises (LSE:OGN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

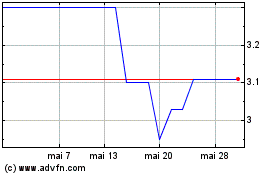

Origin Enterprises (LSE:OGN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024