PayPoint announces investment in Aperidata

29 Mai 2024 - 10:00AM

UK Regulatory

PayPoint announces investment in Aperidata

PayPoint Plc

29 May 2024

PayPoint announces investment in

Aperidata

PayPoint has today announced a £1 million investment in

Aperidata Ltd, an innovative consumer and business credit reporting

and Open Banking platform. The deal will see the PayPoint Group

building on an existing commercial partnership between the two

companies delivering Open Banking solutions for clients across

multiple sectors, including government, local authorities,

charities and housing associations.

The investment enhances PayPoint’s multichannel payments

offering by adding Open Banking services, delivering improvements

to customer experience and making it easier for organisations to

access data for the benefit of their customers. Aperidata have been

instrumental in the Group’s recent work with Citizen’s Advice

Stevenage, launching an Open Banking driven Customer Support Tool

that has cut the time spent by Debt Advisor’s gathering and

reviewing financial information of individuals seeking help, from

an average of three weeks per case to just minutes.

Nick Wiles, CEO of PayPoint

said:

“We’re delighted to be investing in Aperidata, which will

further enhance our Open Banking solutions and multichannel

payments platform for clients in multiple sectors. This investment

will enable PayPoint to continue its diversification to digital and

enable further growth in Open Banking, which is one of our key

building blocks to delivering £100m EBITDA by the end of

FY26.”

Steve Ashworth, CEO of Aperidata

said:

“PayPoint was a natural partner for us as we expand our Open

Banking solutions and enable the next phase of growth. The UK

credit score model is over 50 years old with little innovation over

the years. Aperidata is solving tangible problems in 2024 with a

digital-first solution that gives any user a real time P&L on

consumers and businesses. Any time, any place – you’ll know the

financial position in real-time. We are super excited to be working

with the PayPoint teams and look forward to driving further success

into the market.”

|

Enquiries |

|

|

PayPoint plc |

FGS

Global |

| Nick Wiles,

Chief Executive (Mobile: 07442 968960) |

Rollo

Head |

| Rob Harding,

Chief Financial Officer (Mobile: 07525 707970) |

James

Thompson |

| |

(Telephone:

0207 251 3801) |

| |

(Email:

PayPoint-LON@fgsglobal.com)

|

ABOUT PAYPOINT GROUP

For tens of thousands of businesses and millions of consumers,

we deliver innovative technology and services that make life a

little easier.

The PayPoint Group serves a diverse range of organisations, from

SME and convenience retailer partners, to local authorities,

government, multinational service providers and e-commerce brands.

Our products are split across four core business divisions:

- In Shopping, we enhance retailer propositions and customer

experiences through EPoS services via PayPoint One, card payment

technology, Counter Cash, ATMs and home delivery technology

partnerships in over 60,000 SME and retailer partner locations

across multiple sectors. Our retail network of over 28,000

convenience stores is larger than all the banks, supermarkets and

Post Offices put together

- In E-commerce, we deliver best-in-class customer journeys

through Collect+, a tech-based delivery solution that allows

parcels to be picked up, dropped off and sent at thousands of local

stores

- In Payments and Banking, we give our clients and their

customers choice in how to make and receive payments quickly and

conveniently. This includes our channel-agnostic digital payments

platform, MultiPay, offering solutions to clients across cash, card

payments, direct debit and Open Banking. PayPoint also supports its

eMoney clients with purchase and redemption of eMoney across its

retail network.

- In Love2shop, we provide gifting, employee engagement, consumer

incentive and prepaid savings solutions to thousands of consumers

and businesses. Love2shop is the UK’s number one multi-retailer

gifting provider, offering consumers the choice to spend at more

than 140 high-street and online retail partners. Park Christmas

Savings is the UK’s biggest Christmas savings club, helping over

350,000 families manage the cost of Christmas, by offering a huge

range of gift cards and vouchers from some of the biggest high

street names, including Argos, Primark and B&M.

Together, these solutions enable the PayPoint Group to create

long-term value for all stakeholders, including customers,

communities and the world we live in.

ABOUT APERIDATA

Aperidata is an FCA authorised credit reference agency and Open

Banking Account Information Service Provider (AISP) that uses

financial data to transform credit scoring. Through connections to

UK banks, they use the power of Open Banking to make credit

assessments better, faster and fairer for consumers and financial

institutions alike. They go beyond traditional credit scoring,

providing a comprehensive real time view of a customers

creditworthiness and through the immense depth of data, they are

revolutionising credit scoring and lending processes that power

instant, responsible, and ethical credit decisions. What sets them

apart is their decades of global experience in the world of credit

risk management and data analytics, providing them with an in-depth

understanding of client needs, as well as an unparalleled insight

into the best services and processes that can be derived from the

Open Banking initiative. This experience is embedded in not only

their technology solutions but also in their delivery methodology,

which enables them to efficiently implement the right solution for

every client.

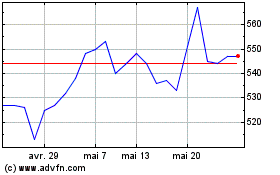

Paypoint (LSE:PAY)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Paypoint (LSE:PAY)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024