TIDMPYC

RNS Number : 9704D

Physiomics PLC

27 June 2023

27 June 2023

Physiomics plc

("Physiomics" or "the Company")

Physiomics completes fundraise to fund growth opportunities

Physiomics plc (AIM: PYC), a leading mathematical modelling

company supporting oncology drug development and personalised

medicine solutions , is pleased to announce that it has completed a

fundraise, conditional on Admission, of in aggregate GBP335,000

(gross) from the issue of 33,500,000 new ordinary shares of 0.4

pence each (" Ordinary Shares ") at an issue price of 1 penny per

Ordinary Share (the " Fundraise ").

The Fundraise will comprise the issue of 32,500,000 new Ordinary

Shares via a placing through the Company's broker, Hybridan LLP

(the " Placing "), and 1,000,000 new Ordinary Shares expected to be

issued via a direct subscription to certain Directors of the

Company (the " Subscription "). The Company will also shortly be

launching a retail offering to the Company's existing shareholders,

to raise up to an additional maximum number of 15,000,000 shares or

GBP150,000 at the Placing price of 1 penny per new Ordinary

Share.

The Company has made significant progress since its last placing

in May 2020, including:

-- New clients including: Numab Tx, Ankyra Tx, Ducentis

BioTherapeutics, Servier, Aleta Biotherapeutics/ CRUK, and Arjuna

Therapeutics;

-- Hiring of team members: Creation of Business Development

function and recruitment of a Head of Business Development,

recruitment of three new scientific team members and the addition

of two Independent Non-Executive Directors;

-- Collaboration Agreements: Completion of PARTNER Study,

re-engagement with DoseMeRx and engagement with Inaphaea Biolabs

Ltd;

-- Less Concentration Risk: Significant diversification of the

pipeline away from single large client; 48% compound annual growth

of non-Merck revenues between financial years ended 30 June 2019

and 2022; and

-- Pipeline: Discussions ongoing with over 25 largely new

potential clients regarding projects with an estimated total value

of over GBP1.5m which could be commenced in financial year

2024.

In order to further develop its business and accelerate growth,

the Company is raising funds to carry out activities including:

-- Further expansion and diversification of its client base;

-- Expansion of its consulting business into the adjacent area

of pharmaceutical biostatistics services; and

-- Exploration of opportunities around its personalised oncology software offering.

Director Subscriptions

Dr Jim Millen (Executive Chairman and CEO) and Dr Christophe

Chassagnole (COO) intend to participate in the Fundraise via direct

subscriptions of GBP5,000 each at the Placing price and,

accordingly, are expected to be issued 500,000 new Ordinary Shares

each. A further announcement will be made in due course following

completion of the intended Subscription.

Retail Offering

The Company is also pleased to announce that a retail offer to

existing shareholders will be shortly launched via the Winterflood

Retail Access Platform ("WRAP"), to raise up to a maximum of

GBP150,000 (the "WRAP Retail Offer"), through the issue of up to

15,000,000 new Ordinary Shares, at a price of 1 penny per new

Ordinary Share.

The proceeds of the WRAP Retail Offer will be utilised in the

same way as the proceeds of the Placing. For the avoidance of

doubt, the WRAP Retail Offer is not part of the Placing or

Subscription. Completion of the WRAP Retail Offer is conditional,

inter alia, upon the completion of the Placing, but completion of

the Placing is not conditional on the completion of the WRAP Retail

Offer. The WRAP Retail Offer is conditional on the any shares

subscribed for under the WRAP Retail Offer (the "WRAP Retail Offer

Shares") being admitted to trading.

The Company values its shareholder base and believes that it is

appropriate to provide its existing retail shareholders in the

United Kingdom the opportunity to participate in the WRAP Retail

Offer.

The WRAP Retail Offer is expected to close at 4.30 p.m. on 28

June 2023.

Admission and Total Voting Rights

Application will be made for the new Ordinary Shares to be

issued pursuant to the Fundraise and the WRAP Retail Offer Shares

to be admitted to trading on AIM and dealing is expected to

commence on 3 July 2023 (" Admission "). A further announcement

regarding the enlarged issued share capital for the purposes of the

Financial Services Authority's Disclosure Guidance and Transparency

Rules will be made following completion of the WRAP Retail Offer

and the Subscription.

Dr Jim Millen, Executive Chairman and CEO, commented :

"I am pleased with the response we have had to this latest

fundraising and hope that our existing shareholders will also

consider participating through the WRAP scheme. I believe

Physiomics remains well positioned to expand its current consulting

business and I'm excited at both the opportunity to expand into

adjacent fields of pharmaceutical consulting and the possibilities

in the personalised medicine space."

Enquiries:

Physiomics plc

Dr Jim Millen, CEO

+44 (0)1865 784 980

Hybridan LLP (Broker)

Claire Louise Noyce

+44 (0) 203 764 2341

Strand Hanson Ltd (NOMAD)

James Dance & James Bellman

+44 (0)20 7409 3494

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

Notes to Editor

About Physiomics

Physiomics plc (AIM: PYC) is an oncology consultancy using

mathematical models to support the development of cancer treatment

regimens and personalised medicine solutions. The Company's Virtual

Tumour(TM) technology uses computer modelling to predict the

effects of cancer drugs and treatments to improve the success rate

of drug discovery and development projects while reducing time and

cost. The predictive capability of Physiomics' technologies have

been confirmed by over 100 projects, involving over 50 targets and

75 drugs, and has worked with clients such as Merck KGaA, Astellas,

Merck & Co and Bicycle Therapeutics.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFFFFFRSIRFIV

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

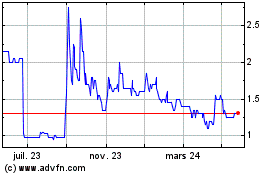

Physiomics (LSE:PYC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

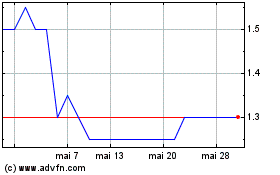

Physiomics (LSE:PYC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025