TIDMRNWH

RNS Number : 5111H

Renew Holdings PLC

20 May 2014

Renew Holdings plc

("Renew" or the "Group" or the "Company")

Interim Results

Renew (AIM: RNWH), the Engineering Services Group supporting UK

infrastructure, announces record interim results for the six months

ended 31 March 2014, achieving strong growth in both operating

profit and revenue and reporting a strong cash position.

In line with the Company's progressive dividend policy, the

interim dividend has increased by 36% to 1.50p (H1 2013:

1.10p).

Financial Highlights

H1 2014 H1 2013

------------------------ ---------- ---------- -----

Revenue GBP225.8m GBP152.4m +48%

------------------------ ---------- ---------- -----

Adjusted operating

profit* GBP7.8m GBP4.9m** +59%

------------------------ ---------- ---------- -----

Adjusted operating

margin* 3.4% 3.2%

------------------------ ---------- ---------- -----

Adjusted profit before

tax* GBP7.6m GBP4.6m** +65%

------------------------ ---------- ---------- -----

Adjusted earnings

per share* 9.80p 5.79p** +69%

------------------------ ---------- ---------- -----

Interim dividend

per share 1.50p 1.10p +36%

------------------------ ---------- ---------- -----

*Adjusted results are shown prior to amortisation charges

**Restated to reflect IAS 19 (2011)

Operational Highlights

-- Engineering Services revenue up 53% to GBP169.2m , (H1 2013: GBP110.4m)

-- Engineering Services operating profit prior to amortisation

up 59% to GBP7.8m (H1 2013 GBP4.9m)

-- GBP8.1m cash and no debt at 31 March 2014 (2013: net debt GBP3.2m)

-- Order book up 18% to GBP427m at 31 March 2014 (H1 2013: GBP361m)

-- 17% increase in Engineering Services order book to GBP306m (H1 2013: GBP261m)

-- Interim dividend increased by 36% to 1.50p (H1 2013: 1.10p)

Post Period End Highlights

-- Entry into the growing wireless telecoms infrastructure

market through successful acquisition of Clarke Telecom Limited

R J Harrison OBE, Chairman said: "I am pleased to announce

another record set of interim results for the Group. The Group has

achieved excellent underlying organic growth together with good

cash generation. Our strategy continues to deliver shareholder

value and we have built upon this robust financial performance with

the acquisition of Clarke Telecom. The strong order book justifies

the Board's confidence that the Group will meet market expectations

for the full financial year."

Enquiries:

Renew Holdings plc Tel: 0113 281 4200

Brian May, Chief Executive

John Samuel, Group Finance

Director

Numis Securities Limited Tel: 020 7260 1000

Stuart Skinner (Nominated

Adviser)

James Serjeant (Corporate

Broker)

Walbrook PR Tel: 020 7933 8780 or renew@walbrookpr.com

Paul McManus Mob: 07980 541 893

Bob Huxford Mob: 07747 635 908

Chairman's statement

The first half of 2014 has again seen the Group deliver record

interim results, achieving strong growth in both operating profit

and revenue. These results are a positive reflection on the Group's

long term strategy of providing engineering services in regulated

markets which benefit from established spending plans.

Results

Group operating profit, prior to amortisation charges, increased

by 59% to GBP7.8m (2013: GBP4.9m), on revenue up 48% to GBP225.8m

(2013: GBP152.4m). Operating margin improved to 3.4% (2013: 3.2%)

with adjusted earnings per share increasing by 69% to 9.80p (2013:

5.79p).

Engineering Services revenue grew by 53% to GBP169.2m (2013:

GBP110.4m), representing 75% of Group revenue. Operating profit

prior to amortisation charges increased by 59% to GBP7.8m (2013:

GBP4.9m) with an operating margin of 4.6% (2013: 4.4%).

Specialist Building maintained its operating profit at GBP1.0m

(2013: GBP1.0m) on increased revenue of GBP56.6m (2013: GBP42.0m).

In Specialist Building, the Board's emphasis is on maintaining its

level of operating profit and managing risk.

Dividend

In line with its progressive policy, the Board is increasing the

interim dividend by 36% to 1.50p per share (2013: 1.10p) which will

be paid on 7 July 2014 to shareholders on the register at 6 June

2014.

Order book

The Group's order book at 31 March 2014 was GBP427m (2013:

GBP361m), an increase of 18%. The Engineering Services order book

grew by 17% to GBP306m (2013: GBP261m). The Group's expected

revenue for the second half of the financial year is fully

secured.

Acquisition of Clarke Telecom Ltd

Subsequent to the period end, the Group announced the GBP17m

acquisition of Clarke Telecom Limited ("CTL"). CTL is a leader in

the wireless telecoms infrastructure delivery market, a field which

is enjoying strong structural growth. CTL will enhance the Group's

operating margin in Engineering Services as we progress towards our

target of 5%.

Cash

The Group had no bank debt at 31 March 2014 and a strong cash

position of GBP8.1m (31 March 2013: net debt GBP3.2m). On 28 April

2014, the Group deployed GBP5m of cash to part fund the acquisition

of CTL with the remaining GBP12m consideration being funded by a

four year term loan. The Board expects further strong cash

generation from operating activities in the second half of the

financial year.

Outlook

The regulated markets in which the Group operates provide good

visibility of opportunities and a strong pipeline of work. During

the first half of the financial year our Rail business experienced

very high levels of demand, partly due to the necessary emergency

repair works following the very bad weather conditions which caused

substantial damage to the rail network most notably in the South

West of England.

The consequence of this is that the Board considers that our

first half results may prove to be slightly higher than those we

will report in the second half, both in revenue and operating

profit. The excellent underlying organic growth achieved in the

first half, subsequent acquisitive growth and strong order book

gives the Board great confidence that the Group will meet market

expectations for the full financial year.

R J Harrison OBE

Chairman

20 May 2014

Chief Executive's review

Engineering Services

Renew delivers multidisciplinary Engineering Services supporting

critical infrastructure assets in the UK. Operating in the

regulated Energy, Environmental and Infrastructure markets our

services are delivered by our directly employed highly skilled

workforce through local, independently branded businesses. We have

strong client relationships built through responsiveness in our

target markets which have high barriers to entry. We focus on

providing essential asset support in markets which have long term

established spending plans. The majority of our work is within our

clients' ongoing operating expenditure budgets providing good

visibility of spending. Much of our work is undertaken through

asset renewal and maintenance framework agreements.

During the first half of the year, Engineering Services revenue

grew by 53% to GBP169.2m (2013: GBP110.4m), representing 75% of

Group revenue. Operating profit prior to amortisation charges

increased by 59% to GBP7.8m (2013: GBP4.9m) with an operating

margin of 4.6% (2013: 4.4%).

At 31 March 2014 the Engineering Services order book was GBP306m

(2013: GBP261m), an increase of 17%.

Energy

The majority of activity in Nuclear is undertaken on the

Sellafield site where we have seen record revenue in the period

with a number of work programmes accelerating spending together

with market share gains. We remain the largest mechanical and

electrical contractor at Sellafield, where our integrated offering

focuses on providing support for the care and maintenance of

operational plant associated with waste treatment or reprocessing,

decommissioning, demolition and clean-up of redundant

facilities.

Work under the current Multi Discipline Site Works framework,

which commenced in April 2013, has seen an increase in activity

over the period and provides good visibility of future

opportunities. The framework is expected to deliver work packages

of up to GBP280m over four years where our focus is on Production

Operations Support.

The Group is well positioned on eight additional nuclear

licensed sites. At Springfields, we have experienced substantial

activity growth and our recent appointment to lead the new waste

processing facility project has broadened our service offering at

this site which also continues to present a range of ongoing

decommissioning opportunities.

In renewables, we continue to provide maintenance services for

onshore wind turbine facilities and we have successfully broadened

this service offering into the offshore wind turbine maintenance

market.

Environmental

The Group works for a number of clients in the Water sector

providing infrastructure development and engineering services

including sewer maintenance, clean and wastewater rehabilitation,

strategic water mains maintenance, trunk mains cleaning and general

utility infrastructure services.

For Northumbrian Water, work continued under the AMP 5 Major

Waste Water project framework as well as on our non-discretionary

maintenance and trunk mains cleaning frameworks where we have seen

good progress and the award of a further framework during the

period. In addition to continued workload from our framework with

Wessex Water we have also been awarded two projects on their Water

Supply Grid Improvement scheme.

Recent weather events have seen flood protection and alleviation

schemes given higher priority with an increase in spending through

a number of established frameworks for the Environment Agency.

Our relationship with the Environment Agency was strengthened

with our appointment as sole supplier to the GBP10m four year MEICA

framework for the Northern Region.

Infrastructure

In Rail, the Group provides national off-track civil, mechanical

and electrical engineering services to Network Rail, where we

continue to focus on delivering planned and reactive infrastructure

maintenance, refurbishment and renewal services.

As the only national provider of engineering maintenance

services for Network Rail, we undertake the majority of our work

under the Buildings and Civils Delivery Partnership and Asset

Management frameworks where we experienced substantial increases in

activity during the period.

Working across all ten Network Rail routes, our national 24 hour

emergency response services saw substantial demand during the

period. Our business responded admirably to support our customer

and I would like to take this opportunity to congratulate and thank

all of our staff who were involved. Emergency works included the

high profile repairs to the Great Western Mainline railway

infrastructure at Dawlish following storm damage. The work was

completed on time and the line re-opened on schedule. That project

plus other emergency works have resulted in our Rail business

experiencing higher levels of activity than are likely to be

recorded in the second half of the financial year.

Our market leading capabilities in tunnel maintenance and

refurbishment for Network Rail saw the successful completion of

schemes at Holme Tunnel and Whiteball Tunnel during the period.

Specialist Building

Specialist Building revenue was 35% higher than a year ago at

GBP56.6m (2013: GBP42.0m) with operating profit maintained at

GBP1.0m (2013: GBP1.0m). The forward order book increased by 21% to

GBP121m (2013: GBP100m).

In High Quality Residential, we are experiencing increased

demand and the Group's expertise in the challenging temporary

structural works required by many projects provides a

differentiator in this market.

The New Build Affordable Housing market in the South East

remains strong and stable with our established relationships

providing access to an advertised spend of GBP700m per annum.

Strategy

In line with the Group's strategy, our range of services in the

infrastructure market has been extended since the period end with

the acquisition of Clarke Telecom Limited ("CTL"). CTL is a leading

provider in its market and delivers all aspects of wireless

telecoms infrastructure including site acquisition and design,

construction, installation and site optimisation. CTL also carries

out site maintenance and decommissioning and has relationships with

all of the UK's cellular network operators and major network

equipment manufacturers. The wireless telecoms market has excellent

growth opportunities with increasing demand for mobile internet

access, voice and data communications including the roll out of 4G

infrastructure.

Whilst continuing to develop organic growth in Engineering

Services, the Group continues to look for earnings enhancing,

complementary acquisitions to improve and expand our range of

services.

Brian May

Chief Executive

20 May 2014

Group income statement

for the six months ended 31 March 2014

Exceptional

items

and

Amortisation Before amortisation

of exceptional of

Before intangible items intangible

amortisation assets and assets

of (see Six months amortisation (see Year

intangible Note ended of intangible Note ended

assets 3) 31 March assets 3) 30 September

2014 2014 2014 2013* 2013 2013

(Restated**) (Restated**) 2013 (Restated**)

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Group revenue

from continuing

activities 2 225,795 - 225,795 152,411 334,649 15,412 350,061

Cost of sales (200,218) - (200,218) (131,159) (296,232) (14,408) (310,640)

-------------- -------------- ----------- -------------- -------------- ------------- --------------

Gross profit 25,577 - 25,577 21,252 38,417 1,004 39,421

Administrative

expenses (17,811) (750) (18,561) (16,583) (27,585) (968) (28,553)

-------------- -------------- ----------- -------------- -------------- ------------- --------------

Operating profit 2 7,766 (750) 7,016 4,669 10,832 36 10,868

Finance income 74 - 74 18 25 - 25

Finance costs (149) - (149) (193) (362) - (362)

Other finance

(expense)/income

- defined

benefit pension

schemes (61) - (61) (150) 42 - 42

-------------- -------------- ----------- -------------- -------------- ------------- --------------

Profit before

income

tax 2 7,630 (750) 6,880 4,344 10,537 36 10,573

Income tax

expense 4 (1,678) 188 (1,490) (1,062) (1,778) (9) (1,787)

-------------- -------------- ----------- -------------- -------------- ------------- --------------

Profit for the

period

from continuing

activities 5,952 (562) 5,390 3,282 8,759 27 8,786

Loss for the

period

from

discontinued

operation (18) (105) (315)

----------- -------------- --------------

Profit for the

period

attributable to

equity

holders of the

parent

company 5,372 3,177 8,471

----------- -------------- --------------

Basic earnings

per share

from continuing

activities 5 8.87p 5.48p 14.64p

Diluted earnings

per

share from

continuing

activities 5 8.75p 5.24p 14.49p

----------- -------------- --------------

Basic earnings

per share 5 8.84p 5.30p 14.12p

Diluted earnings

per

share 5 8.72p 5.08p 13.97p

----------- -------------- --------------

Proposed dividend 6 1.50p 1.10p 3.60p

----------- -------------- --------------

*Operating profit for the six months ended 31 March 2013 is

after charging GBP250,000 of amortisation cost. (See Note 3)

** Comparative figures have been restated to reflect IAS 19

(2011). Details are set out in Note 1.

Group statement of comprehensive income

for the six months ended 31 March 2014

Six months ended Year ended

31 March 30 September

2014 2013 2013

(Restated**) (Restated**)

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Profit for the period attributable

to equity holders of the parent company 5,372 3,177 8,471

Items that will not be reclassified

to profit or loss:

Movements in actuarial deficit - - (6,769)

Movement on deferred tax relating

to the defined benefit pension schemes - - 1,429

---------- ------------- -------------

Total items that will not be reclassified

to profit or loss - - (5,340)

---------- ------------- -------------

Items that are or may be reclassified

subsequently to profit or loss:

Exchange movement in reserves (246) 715 (24)

---------- ------------- -------------

Total items that are or may be reclassified

subsequently to profit or loss (246) 715 (24)

---------- ------------- -------------

Total comprehensive income for the

period attributable to equity holders

of the parent company 5,126 3,892 3,107

---------- ------------- -------------

Group statement of changes in equity

for the six months ended 31 March 2014

Called Share Capital Cumulative Share Retained Total

up based

share premium redemption translation payments earnings equity

capital account reserve adjustment reserve (Restated**) Unaudited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2012 5,990 5,893 3,896 775 289 (7,949) 8,894

Transfer from income

statement for the period 3,177 3,177

Dividends paid (1,258) (1,258)

Recognition of share

based payments 53 53

Exchange differences 715 715

-------- -------- ----------- ------------ --------- ------------- ----------

At 31 March 2013 5,990 5,893 3,896 1,490 342 (6,030) 11,581

Transfer from income

statement for the period 5,294 5,294

Dividends paid (659) (659)

New shares issued 150 150

Recognition of share

based payments 48 48

Exchange differences (739) (739)

Actuarial losses recognised

in pension schemes (6,769) (6,769)

Movement on deferred

tax relating to the pension

schemes 1,429 1,429

-------- -------- ----------- ------------ --------- ------------- ----------

At 30 September 2013 6,140 5,893 3,896 751 390 (6,735) 10,335

Transfer from income

statement for the period 5,372 5,372

Dividends paid (1,538) (1,538)

New shares issued 12 49 61

Recognition of share

based payments (187) (187)

Exchange differences (246) (246)

-------- -------- ----------- ------------ --------- ------------- ----------

At 31 March 2014 6,152 5,942 3,896 505 203 (2,901) 13,797

-------- -------- ----------- ------------ --------- ------------- ----------

Group balance sheet

at 31 March 2014

31 March 30 September

2014 2013 2013

(Restated**)

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-current assets

Intangible assets

- goodwill 33,060 26,918 33,060

- other 3,209 2,000 3,959

Property, plant and equipment 9,638 4,433 8,680

Retirement benefit assets 1,062 3,253 962

Deferred tax assets 2,819 2,535 3,051

---------- ------------- -------------

49,788 39,139 49,712

---------- ------------- -------------

Current assets

Inventories 2,920 9,449 3,195

Trade and other receivables 94,130 64,229 75,868

Current tax assets 1,243 834 1,007

Cash and cash equivalents 8,123 1,812 5,348

106,416 76,324 85,418

---------- ------------- -------------

Total assets 156,204 115,463 135,130

---------- ------------- -------------

Non-current liabilities

Obligations under finance

leases (1,779) (548) (1,984)

Retirement benefit obligations (2,172) (569) (3,545)

Deferred tax liabilities (1,036) (1,039) (1,036)

Provisions (628) (566) (628)

---------- ------------- -------------

(5,615) (2,722) (7,193)

---------- ------------- -------------

Current liabilities

Borrowings - (5,000) (2,500)

Trade and other payables (131,860) (94,483) (112,329)

Obligations under finance

leases (2,410) (577) (1,509)

Current tax liabilities (2,418) (934) (1,160)

Provisions (104) (166) (104)

(136,792) (101,160) (117,602)

---------- ------------- -------------

Total liabilities (142,407) (103,882) (124,795)

Net assets 13,797 11,581 10,335

---------- ------------- -------------

Share capital 6,152 5,990 6,140

Share premium account 5,942 5,893 5,893

Capital redemption reserve 3,896 3,896 3,896

Cumulative translation

adjustment 505 1,490 751

Share based payments

reserve 203 342 390

Retained earnings (2,901) (6,030) (6,735)

---------- ------------- -------------

Total equity 13,797 11,581 10,335

---------- ------------- -------------

Group cashflow statement

for the six months ended 31 March 2014

Six months ended Year ended

31 March 30 September

2014 2013 2013

(Restated**) (Restated**)

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Profit for the period from continuing

operating activities 5,390 3,282 8,786

Amortisation of intangible assets 750 250 500

Depreciation 1,185 513 1,288

Profit on sale of property, plant and

equipment (143) (27) (110)

Decrease in inventories 79 192 6,466

(Increase)/decrease in receivables (18,337) 9,949 2,093

Increase/(decrease) in payables 19,471 (10,047) 1,936

Current service cost in respect of defined

benefit pension scheme 29 26 53

Cash contribution to defined benefit

schemes (1,473) (1,433) (2,946)

(Credit)/expense in respect of share

options (187) 53 101

Finance income (74) (18) (25)

Finance costs and expense 210 343 320

Interest paid (149) (193) (362)

Income taxes paid (236) - (429)

Income tax expense 1,490 1,062 1,787

Net cash inflow from continuing operating

activities 8,005 3,952 19,458

Net cash outflow from discontinued operating

activities (18) (105) (220)

---------- ------------- -------------

Net cash inflow from operating activities 7,987 3,847 19,238

---------- ------------- -------------

Investing activities

Interest received 74 18 25

Proceeds on disposal of property, plant

and equipment 188 40 1,854

Purchases of property, plant and equipment (600) (52) (705)

Acquisition of subsidiaries net of cash

acquired - - (9,384)

Net cash (outflow)/inflow from investing

activities (338) 6 (8,210)

---------- ------------- -------------

Financing activities

Dividends paid (1,538) (1,258) (1,917)

Issue of Ordinary Shares 61 - 150

Loan repayments (2,500) (2,500) (5,000)

Repayment of obligations under finance

leases (892) (338) (958)

---------- ------------- -------------

Net cash outflow from financing activities (4,869) (4,096) (7,725)

---------- ------------- -------------

Net increase/(decrease) in continuing

cash and cash equivalents 2,798 (138) 3,523

Net decrease in discontinued cash and

cash equivalents (18) (105) (220)

---------- ------------- -------------

Net increase/(decrease) in cash and cash

equivalents 2,780 (243) 3,303

Cash and cash equivalents at the beginning

of the period 5,348 2,040 2,040

Effect of foreign exchange rate changes (5) 15 5

Cash and cash equivalents at the end

of the period 8,123 1,812 5,348

---------- ------------- -------------

Bank balances and cash 8,123 1,812 5,348

---------- ------------- -------------

NOTES TO THE ACCOUNTS

Note 1 - Basis of preparation

(a) The consolidated interim financial report for the six months

ended 31 March 2014 and the equivalent period in 2013 have not been

audited or reviewed by the Group's auditor. They do not comprise

statutory accounts within the meaning of Section 435 of the

Companies Act 2006. They have been prepared under the historical

cost convention and on a going concern basis in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union. This interim financial report does not comply

with IAS34 "Interim Financial Reporting", which is not currently

required to be applied for AIM companies. This interim report was

approved by the Directors on 20 May 2014.

(b) The accounts for the year ended 30 September 2013 were

prepared under IFRS and have been delivered to the Registrar of

Companies. The report of the auditor on those accounts was

unqualified, did not contain an emphasis of matter paragraph and

did not contain any statement under Section 498(2) or (3) of the

Companies Act 2006. In this report, the comparative figures for the

year ended 30 September 2013 have been audited. The comparative

figures for the period ended 31 March 2013 are unaudited.

(c) For the year ending 30 September 2014, there are no new

accounting standards, which have been adopted by the EU, applied

and implemented for this interim financial report.

For this interim financial report however, the amended IAS 19

(2011) applies for accounting periods beginning on or after 1

January 2013 which impacts the Group's 2014 results. The 2013

comparative results have been amended to reflect this change in

accounting policy which is required by changes to the standard. The

principal adjustments are:

- Pension scheme administration costs are now reported within

central administration costs (March 2013: GBP263,000, September

2013: GBP400,000). Previously these costs were reported within the

total of contributions paid to the scheme by the employer and as a

deduction from the expected return on assets.

- Expected return on assets is replaced by interest on the

assets calculated using the IAS 19 discount rate. This reduces the

interest charge for the year ended 30 September 2013 by GBP274,000

from a GBP232,000 charge to a GBP42,000 credit.

** indicates where adjustments to previously reported results

have been made as a consequence of implementing IAS 19 (2011).

(d) The Directors are satisfied that the Group has adequate

resources to continue in operational existence for the foreseeable

future.

This interim statement is being sent to all shareholders and is

also available upon request from the Company Secretary, Renew

Holdings plc, Yew Trees, Main Street North, Aberford, West

Yorkshire LS25 3AA, or via the website www.renewholdings.com.

Note 2 - Segmental analysis

Operating segments have been identified based on the internal

reporting information provided to the Group's Chief Operating

Decision Maker. From such information, Engineering Services and

Specialist Building have been determined to represent operating

segments.

Six months ended Year ended

31 March 30 September

2014 2013 2013

Unaudited Unaudited Audited

Revenue is analysed as follows: GBP000 GBP000 GBP000

Engineering Services 169,190 110,372 232,371

Specialist Building 56,605 42,039 102,521

Inter segment revenue - - (246)

---------------------------- -------------------------------- --------------

Segment revenue 225,795 152,411 334,646

Central activities - - 3

---------------------------- -------------------------------- --------------

Group revenue before exceptional

items 225,795 152,411 334,649

Exceptional revenue - - 15,412

---------------------------- -------------------------------- --------------

Group revenue from continuing

operations 225,795 152,411 350,061

---------------------------- -------------------------------- --------------

Six months ended

31 March

Before

exceptional Exceptional

items items

and and Year Ended

Before

amortisation Amortisation amortisation amortisation

of intangible of intangible of intangible of intangible

assets assets assets assets 30 September

2014 2014 2014 2013* 2013 2013 2013

(Restated**) (Restated**) (Restated**)

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Analysis of

operating

profit

Engineering

Services 7,764 (750) 7,014 4,645 10,646 (500) 10,146

Specialist

Building 1,005 - 1,005 994 2,083 (3,539) (1,456)

-------------- -------------- ------------ -------------- --------------- --------------- --------------

Segment

operating

profit 8,769 (750) 8,019 5,639 12,729 (4,039) 8,690

Central

activities (1,003) - (1,003) (970) (1,897) 4,075 2,178

-------------- -------------- ------------ -------------- --------------- --------------- --------------

Operating

profit 7,766 (750) 7,016 4,669 10,832 36 10,868

Net

financing

expense (136) - (136) (325) (295) - (295)

-------------- -------------- ------------ -------------- --------------- --------------- --------------

Profit

before

income tax 7,630 (750) 6,880 4,344 10,537 36 10,573

-------------- -------------- ------------ -------------- --------------- --------------- --------------

*Operating profit for the six months ended 31 March 2013 is

after charging GBP250,000 of amortisation cost. There were no

exceptional items reported in the six months ended 31 March

2013.

Note 3 - Exceptional items and amortisation of intangible

assets

Six months ended Year ended

31 March 30 September

2014 2013 2013

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Redundancy and restructuring

costs - - 272

Provision against amounts

recoverable on

old building contracts - - 2,767

Costs related to exceptional

storm damage on a building

contract - - 500

Lewis acquisition costs - - 196

Profit arising from sale

of land - - (9,190)

Write down of land stock

in the USA - - 4,919

Total gains arising from

exceptional items - - (536)

Amortisation of intangible

assets 750 250 500

---------- ------------------ -------------

750 250 (36)

---------- ------------------ -------------

Amortisation of intangible assets relates to the acquisition

of:

Amalgamated Construction

Ltd 250 250 500

Lewis Civil Engineering 500 - -

Ltd

---------- ------------------ -------------

750 250 500

---------- ------------------ -------------

Note 4 - Income tax expense

Six months ended Year ended

31 March 30 September

2014 2013 2013

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Current tax:

UK corporation tax on profits

for the period (1,258) (668) (858)

Adjustments in respect of previous

periods - - 10

---------- ---------- -------------

Total current tax (1,258) (668) (848)

Deferred tax (232) (394) (982)

---------- ---------- -------------

Income tax expense (1,490) (1,062) (1,830)

Deferred tax in respect of discontinued

operation - - 43

---------- ---------- -------------

Income tax in respect of continuing

activities (1,490) (1,062) (1,787)

---------- ---------- -------------

Note 5 - Earnings per share

Six months ended 31 March Year ended 30 September

2014 2013 2013

(Restated**) (Restated**)

Unaudited Unaudited Audited

Earnings EPS DEPS Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence GBP000 Pence Pence

Earnings

before

exceptional

items

and

amortisation 5,952 9.80 9.66 3,469 5.79 5.54 8,759 14.60 14.45

Exceptional

items

and

amortisation (562) (0.93) (0.91) (187) (0.31) (0.30) 27 0.04 0.04

---------- ----------- ------- --------- --------------- --------- ----- --------- --------------- -------

Basic earnings

per share -

continuing

operations 5,390 8.87 8.75 3,282 5.48 5.24 8,786 14.64 14.49

Loss for the

period from

discontinued

operation (18) (0.03) (0.03) (105) (0.18) (0.16) (315) (0.52) (0.52)

---------- ----------- ------- --------- --------------- --------- ----- --------- --------------- -------

Basic earnings

per share 5,372 8.84 8.72 3,177 5.30 5.08 8,471 14.12 13.97

---------- ----------- ------- --------- --------------- --------- ----- --------- --------------- -------

Weighted

average

number of

shares 60,766 61,594 59,899 62,593 59,998 60,624

----------- ------- --------------- --------- --------------- -------

The dilutive effect of share options is to increase the number

of shares by 828,000 (March 2013: 2,694,000; September 2013:

626,000) and reduce the basic earnings per share by 0.12p (March

2013: 0.22p; September 2013: 0.15p). On 3 February 2014 114,280 new

Ordinary shares of 10p each were issued following the exercise of

share options bringing the total number in issue to 61,517,948.

Note 6 - Dividends

The proposed interim dividend is 1.50p per share (2013: 1.10p).

This will be paid out of the Company's available distributable

reserves to shareholders on the register on 6 June 2014, payable on

7 July 2014. In accordance with IAS 1, dividends are recorded only

when paid and are shown as a movement in equity rather than as a

charge in the income statement.

Note 7 - Acquisition of subsidiary

On 29 April 2014 the Company announced that it had agreed to

acquire the entire issued share capital of Clarke Telecom Limited

("Clarke"), an engineering services business focused in the

wireless telecoms infrastructure market, for a cash consideration

of GBP17m. GBP11.9m of the total consideration was paid on 28 April

2014 and a further GBP5.1m will be paid at the end of May 2014. The

acquisition was funded from the Group's cash resources and a four

year loan of GBP12m provided by HSBC Bank plc. Further information

on the acquisition will be included in the annual report and

accounts for the year ending 30 September 2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFAFIUFLSELI

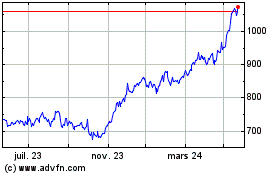

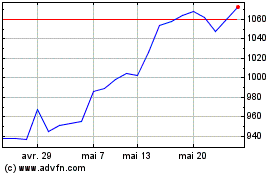

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024