New Sage study reveals IT channel partners embrace advisory roles to boost SMB digital agility

27 Juin 2024 - 3:00PM

A new study from Sage, the leader in accounting, financial, HR, and

payroll technology for small and mid-sized businesses (SMBs),

reveals the evolving role of technology channel and reseller

partners in the U.S. and Canada. The study indicates a shift from

point solutions providers and integrators to strategic advisors for

SMBs, unlocking significant growth opportunities and paving the way

for greater digital agility.

The report, ‘Small and medium-sized business demand for

digital advisory services fuels IT channel growth’,

surveyed 2,800 technology channel decision-makers globally,

including in the U.S. and Canada, to better understand the key

drivers impacting the IT channel and reseller market today.

The research highlights that the majority of technology

resellers in the U.S. (59%) and Canada (52%) have shifted their

focus toward providing strategic advice and services, aiming to

improve SMBs’ ability to swiftly adapt to market shifts, new

technological breakthroughs and evolving customer demands.

The report found that almost three-quarters of SMBs in the U.S.

(73%) and Canada (74%) see investing in digital agility as a high

priority, believing it will drive business growth (30%), followed

by enhance competitiveness in the U.S. (25%), and increase

efficiency in Canada (26%).

"These findings mark a significant shift within the channel

industry. The move toward more personalized solutions and stronger

customer relationships is revolutionizing our support for SMBs,”

says Sippora Veen, VP Global Partner Marketing at

Sage. “With the adoption of advanced technologies like AI,

and a commitment to building skills, we are better positioned to

help SMBs face challenges and thrive in the digital era. This

collaboration is essential for fostering innovation and mutual

growth."

Key findings include:

- Shift to Advisory

Roles: U.S. and Canadian channel leaders are split on what

is driving the shift to advisory roles with U.S. leaders citing the

use of technology and data analytics for personalized solutions

(59%), increased competition in the market requiring

differentiation and value-added services (57%) and desire to build

stronger customer relationships (55%). In Canada, leaders

attribute the shift to the need to keep up with shifting customer

demands (56%) and building stronger customer relationships

(53%).

- Digital Agility of

SMBs: Almost two-thirds of Canadian SMBs (64%) and half of

SMBs (51%) in the U.S. are recognized as 'fairly digitally agile'

by channel leaders, highlighting their quick adoption of

technologies that enhance efficiency and customer experience.

However, only 39% of U.S. and 28% of Canadian partners feel SMBs

are adequately prepared for future disruptions. Continuous

investment in digital tools and training, supported by channel

partners, is essential for maximizing the benefits of a

digital-first approach.

- Challenges in Driving

Digital Agility: The report identifies the main obstacle

preventing channel partners from effectively supporting SMBs as the

complexity of technology and integration processes. In the U.S.,

channel partners face significant challenges in providing advisory

services, primarily due to keeping up with evolving technology and

balancing priorities (both at 48%), along with SMB resistance to

advisory services (45%). Similarly, in Canada, nearly half of the

channel partners (47%) cite the complexity of technology and

integration processes as the top hindrance to supporting SMBs'

digital agility journey.

- Adoption of Innovative

Technologies: The majority of U.S. channel partners are

focused on driving the adoption of innovative technologies (59%),

while 52% of Canadian resellers are prioritizing offering strategic

advice and solutions. This is to ensure that SMBs not only access

but effectively utilize technology to enhance responsiveness and

competitive edge in a rapidly changing market.

- Critical

Technologies: Channel leaders in both Canada (62%) and the

U.S. (56%) believe cybersecurity solutions are the most

instrumental in fostering digital agility. AI and automation

followed closely, with 58% in Canada and 56% in the U.S. finding

these as the second most critical technologies. Focusing on these

areas can enhance SMB efficiency, and security.

“Having spent over 25 years in the channel, I have observed a

shift within the SMB market propelled by the need for growth,

competitiveness, and efficiency. More SMBs are now prioritizing

digital agility to remain competitive and resilient in a constantly

evolving business environment,” says Susan

Vincent, Managing Director, Baker Tilly and Sage Partner.

“As channel leaders, we must shift towards a consultative approach

to support our customers and help them activate the latest

technologies with ease. It's time to adapt and stand out.”

Sage's research underscores the importance of deepening

collaboration between IT resellers and SMBs to fully harness new

technologies and enhance resilience against market changes. By

focusing on areas like cybersecurity, digital transformation, and

operational efficiency, IT resellers can boost their growth while

helping SMBs successfully navigate these challenges.

"Digital agility is the new currency for SMBs, and channel

partners play a critical role in enabling businesses to leverage

innovative solutions that optimize operations, improve efficiency,

and enhance profitability. With technology evolving so quickly,

it's crucial for us to stay ahead of the curve and adopt the

correct tools as soon as possible,” says

Robert Colelli, Managing Principal, Operations, Cresa

Toronto. “AI and cybersecurity are key in driving our

digital agility and we rely on our IT suppliers to help us identify

and deploy the right solutions that are tailored and adaptable to

our growth strategy. With their support and invaluable advice, we

can navigate the challenges of digital transformation much easier

and increase our ability to pivot as necessary in a challenging

economic landscape.”

About Sage

Sage exists to knock down barriers so everyone can thrive,

starting with the millions of small and medium-sized businesses

served by us, our partners and accountants. Customers trust our

finance, HR and payroll software to make work and money flow. By

digitizing business processes and relationships with customers,

suppliers, employees, banks and governments, our digital network

connects SMBs, removing friction and delivering insights. Knocking

down barriers also means we use our time, technology and experience

to tackle digital inequality, economic inequality and the climate

crisis.

Summary of methodology

The research questioned 2,800 decision makers in the tech

industry whose company resells tech and IT supplies/services for

various businesses in Canada, France, Germany, Portugal, South

Africa, Spain, the United Kingdom and United States. The interviews

were conducted in April and May 2024.

This online survey was conducted by market research company

OnePoll, in accordance with the Market Research Society's code of

conduct.

Media ContactJordan

Kerchevaljordan.kercheval@sage.com

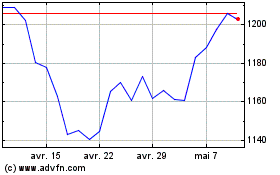

Sage (LSE:SGE)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Sage (LSE:SGE)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024