TIDMSTS

RNS Number : 7053W

STS Global Income & Growth Trust

14 December 2023

To: RNS

From: STS Global Income & Growth Trust plc

LEI: 549300UZ1Y7PPQYJGE19

Date: 14 December 2023

Half-year financial report

Six months to 30 September 2023

FINANCIAL HIGHLIGHTS

Total return ^ Six months ended Six months ended

(including reinvested dividends) 30 September 30 September 2022

2023

% %

------------------------------------ ------------------ -------------------

Net asset value per share 0.7 (2.7)

Lipper Global - Equity Global

Income Index 0.5 (5.9)

Share price 3.2 (1.4)

------------------------------------ ------------------ -------------------

Key data As at As at

30 September 31 March 2023

2023

--------------------------- --------------- ---------------

Net asset value per share

(cum income) 220.09p 220.37p

Net asset value per share

(ex income) 216.67p 218.37p

Share price 219.00p 214.00p

Discount (0.49%) (2.89%)

Net assets GBP206,657,000 GBP219,235,000

--------------------------- --------------- ---------------

Income Six months ended Six months ended

30 September 30 September 2022

2023

-------------------- ----------------- -------------------

Revenue per share 3.31p 3.43p

Dividend per share 3.05p 2.90p

-------------------- ----------------- -------------------

^ For details of all Alternative Performance Measures refer to

the half-year report.

INTERIM MANAGEMENT REPORT

Chairman's statement

Introduction

For the six-month period to 30 September 2023 the net asset

value total return for your Company was +0.7%, in line with the

+0.5% total return from the benchmark, the Lipper Global - Equity

Global Income Index.

There was a slight narrowing of the discount to net asset value

at which the share price traded over the period from 2.9% to 0.5%

which resulted in a share price total return of +3.2%.

Equity and more recently bond markets around the world have

faced a challenging background, during the period under review.

Short term interest rates continued to rise. The debate has moved

on from how high would rates go, to how long rates will remain at

current levels - suggesting that we are close to or at the peak in

the current rate cycle. In the US, in particular, stubbornly

resilient growth in the economy is forcing the Federal Reserve to

signal a 'higher for longer' stance on rates, as the strength of

demand continues to present inflationary pressures on the economy.

By contrast, in the UK and Europe where growth is weaker the rate

of inflation appears to have peaked, but the rate of decline is

disappointing and likewise leading to rates predicted to remain at

current levels for some time.

Financial markets have also had to cope with an increasingly

uncertain geopolitical backdrop, due to the ongoing conflicts in

Ukraine and the Middle East.

Consequently, the low nominal returns detailed above are no

surprise and equity markets have struggled to generate consistent

positive returns in the face of economic and political

uncertainty.

More recently, bond markets in the US and UK have seen yields

rise to in excess of 5% - comfortably the highest level since 2008.

The medium term implication of such rises in yields are seen in

higher financing cost for companies and financial investors

(including venture capital and private equity funds). After a

prolonged period of (what can now be described as) abnormally low

rates, it remains to be seen how markets adapt to a return to what

was normality ahead of the financial crash in 2007/08.

Revenue and earnings

Total revenue for the period was GBP4.0m and Revenue earnings

per share were 3.31p. These earnings are lower than the previous

comparable period. As discussed in the statement last year,

movements in GBP/US$ exchange rate can have an impact on the level

of revenue earned in sterling terms. The average GBP/US$ rate in

this first half has been 1.259 compared with 1.217 in the previous

comparable period.

Underlying dividends declared by your Company's investments have

been encouraging and this is a sound indicator of the quality of

the companies which the Manager has chosen to invest in.

A first quarterly dividend of 1.525p per share was paid to

shareholders on 27 October 2023. This represented a 5.2% increase

on the equivalent payment in 2022. The Board's policy is to declare

three equal dividends for the first three quarterly payments and

consider the fourth quarterly dividend once clarity on earnings for

the full year is available around the time of the year end.

Proposed merger with Troy Income & Growth Trust plc

On 28 November 2023 it was announced that agreement had been

reached between the Boards of your Company and Troy Income &

Growth Trust plc ('TIGT') for a proposed combination of STS with

the assets of TIGT. This combination is subject to approval by the

shareholders of both companies, and you will receive documents in

respect of this transaction in February 2024.

Your Board considers the proposed merger to be an excellent

opportunity for your Company and shareholders will benefit from an

increase in scale allowing the enlarged STS to spread its fixed

costs over a larger asset base. It has been agreed that the

management fee charged on the enlarged company will be reduced to

0.55% of shareholders' funds up to GBP250m and 0.50% above GBP250m

(currently the fee is 0.65% of shareholders' funds). Troy is also

making a significant cost contribution in the form of an 18-months

fee waiver on the assets transferred from TIGT to the Company.

It is expected that the transaction will be complete by your

Company's year end on 31 March 2024. When transferred, the assets

of TIGT will be invested in line with the current STS portfolio and

there will be no change to the investment process, philosophy or

personnel managing the portfolio.

Discount Management

Your Board has adopted and implements a formal discount control

mechanism, with the objective of ensuring that the share price

consistently trades close to net asset value per share. Shares are

bought in or sold, at the appropriate times, to manage this

objective. During the period under review, 5,585,197 shares were

purchased at an average discount of 1.9%.

The consistent application of the discount control mechanism

should mean that, over the long term, the net asset per share total

return and the share price total return should be very similar.

However, it is possible that, in the short term, these respective

returns can deviate due to small movements in the discount/premium,

particularly in periods of low nominal returns.

Borrowing facilities

Your Company entered into new borrowing agreements in the period

as the seven year term of the previous agreement expired in

September. A new three year revolving credit facility ('RCF') was

agreed with The Royal Bank of Scotland International for GBP20m

with an additional GBP5m being available, should it be considered

necessary.

Outlook

At the core of your Manager's philosophy is the preservation of

capital and the objective of delivering above average returns with

below average volatility. In particular, the Manager seeks to

provide some protection from significant drawdowns in weaker

markets. The political and economic background around the world

might suggest that higher bond yields and rising political tension

may be a precursor to a period in which equity markets find it hard

to make consistent progress.

In such periods, your Manager's process and consistent

application of their philosophy should stand your Company in a

relatively strong position. Your portfolio consists of a group of

carefully chosen companies that have high and defendable operating

margins, pricing power and in particular strong balance sheets

supported by robust free cash flow.

These attributes should stand the Company in good stead in the

current uncertain world.

John Evans

Chairman

13 December 2023

Manager's review

After a bright start to the year, broader world equity markets

have been meandering over the summer. The MSCI Equal Weighted Net

Total Return Index, used to reduce the distortion of the highly

concentrated MSCI World Index and associated AI excitement,

returned 0.12% in sterling terms over the six month period under

review. The benchmark for the Company did slightly better at 0.5%

and the Company share price better still.

The strongest contributor to performance during the half-year

was Domino's Pizza ('Domino's'). In July the company benefited from

the appointment of a new CEO and strong results. The new CEO,

Andrew Rennie, is a known quantity having been regarded as a

potential leader for the business as early as 2019. Andrew has a

long experience in Domino's Pizza Enterprises in Australia, and we

have no doubt that he is the right person for the role. Meanwhile,

the company continues to grow sales at a healthy pace, supported by

better execution and the collaboration with Just Eat. During

September we started reducing our position in Domino's as the

valuation improved. We currently have a 2.1% position.

Admiral Group ('Admiral') was strong following a positive update

at the half year results. UK car insurers have had a torrid 18

months as high claims inflation combined with record low insurance

premiums following the pandemic have led to a squeeze on

underwriting profits. This has led to competitors such as Direct

Line and Sabre Insurance issuing multiple profit warnings. As it

has done numerous times over its 20+ year history, Admiral executed

exceptionally through this market cycle, raising rates ahead of

peers in the face of rising claims costs, allowing it to protect

profits. In its most recent results, Admiral claimed it has reached

pre-pandemic levels of profitability on policies written in 2023.

As the wider market scrambles to belatedly raise rates, Admiral

should continue to take market share.

Novartis also made a decent contribution, rising strongly in

September following a lacklustre period. This may be explained by

the fact that the company was preparing to spin-off its generic

drug company, named Sandoz. The Company received shares in this

business, which we then sold, favouring the remaining, now more

focussed company which other investors also appear to have

preferred.

ADP appreciated over this time. As investors worry about a

potential spike in unemployment following the Federal Reserve's

tightening cycle, the company was penalised by the market at the

beginning of the year. However, we argue that the pendulum has

swung too far to the pessimistic side and ADP regained some ground.

As the economic horizon darkens, it is useful to remind ourselves

that these companies are less sensitive to unemployment than the

market believes. The company remains a core long term

investment.

Nintendo is a business which is benefitting from the positively

received launch of several games including The Legend of Zelda:

Tears of the Kingdom and Super Mario Bros. Wonder. This is helping

to underpin profitability while investors wait for the release of a

replacement to the current Switch console. This will be called

Switch Pro and is likely to be launched in 2024. We continue to

believe the company is good value and are excited about the value

of the company's timeless intellectual property and the prospect of

a new hardware cycle in the coming years.

The single biggest detractor was the Link REIT. Investors are

not unreasonably concerned about the effect of the rapid increase

in interest rates on this sector and company. Having been

recapitalised and with underlying exposure to defensive assets we

believe this company is well placed to buy distressed assets as

others seek to reduce debt levels. If interest rates are close to

reaching a peak, as we believe, the shares should perform better in

the coming months.

Next was Diageo, reflecting worries over a potential slowdown in

the US as sales data continues to be soft. Additionally, with a new

CEO (Debra Crew) and an investor day planned for mid-November,

there is a degree of uncertainty around strategy. However, the

first set of results from the new CEO in August was robust. While

there is some weakness in the US, the underlying spirits category

continues to take market share, Diageo remains uniquely positioned

to capture its fair share of growth.

Also within the consumer staples sector, Hershey declined after

years of strong performance. The company has had tremendous success

in increasing prices during 2022 without any significant effect on

volumes. The ability to raise prices to cover inflation is a

testament to the dominant market position of this company as well

as the strength of the brand. As we lap those strong price

increases, sales growth is slowing, and volumes are starting to

turn negative. There have also been some concerns that a new

category of weight-loss drugs may diminish the demand for this

popular but sugary product. We view these concerns as over-stated

given the length of time that such an eventuality becomes

impactful, even if the concerns prove credible.

British American Tobacco was also weak as it was impacted by

ever-present regulatory concerns, as well as softness in demand for

combustibles in the US. This fear was confirmed at the recent

results whereby the company lowered medium term guidance. Further,

and consistent with the company's stated aim to be smoke-free by

2035, the value of the brands in the US acquired from Reynolds in

2016 are to be written down to zero over 30 years. This led to

further share price weakness. We continue to believe the shares

offer exceptional value for what remains a highly cash generative

company. We also note that the brand write down is a non-cash item

that does not impact profitability and therefore the company's

ability to continue to fund its dividend for many years to

come.

Finally, the most recent purchase in the portfolio, Texas

Instruments, lost ground. We established an initial investment in

this business in October 2022 at an attractive valuation. Cognizant

of the inherent cyclicality of the end markets for this business,

which include industrial, automotive and personal electronics, we

allocated 2% of the Company to this holding. The quality of the

business warrants a more substantial investment, in time.

Outlook

While equity markets have lacked direction, government bond

markets have been on the move. Over this period the US 10-year

yield has risen from 3.47% to 4.57%. This updraft may be a result

of several factors, including the influence of other major bond

markets, notably Japan, concerns over large-scale upcoming issuance

and, most likely, a belief that growth is proving impervious to

higher interest rates. Whatever the cause, it represents a

significant change in the relative price of government bonds to

equities. 4.57%, when compared to an historic earnings yield for

the S&P 500 of 4.80%, implies a further compression of the

equity risk premium.

Perhaps more striking has been the move in inflation- linked

bonds. Again, over the same period, the yield on US 30-year US

Treasury Inflation Protected Securities has risen from 1.40% to

2.30%. At the same time, the 30-year break-even inflation rate has

remained remarkably stable at close to the Federal Reserve's

inflation target of 2% (2.40% as at 30 September 2023). At least

according

to markets, this is not about increasing inflation expectations.

It is a function of an expansion in real yields driven by the rise

in the nominal interest rate.

At the same time, not only have equities continued to trade

towards the upper end of historical valuation measures (the US CAPE

remains at 29.3x) but credit spreads have been tightening.

It would seem to us that although a higher cost of capital has

been reflected in government bond markets, it has yet to be for

risk assets. Time will tell how this apparent contradiction

resolves itself - as the effect of the change in interest rates

gradually works its way through the economy, this may change to the

benefit of our quality focussed, conservatively managed

Company.

James Harries

13 December 2023

Statement of Directors' responsibilities

A review of the half year and the outlook for the Company can be

found in the Chairman's statement and Manager's review above.

Risk and mitigation

The Company's business model is longstanding and resilient to

most of the short-term uncertainties that it faces, which the Board

believes are effectively mitigated by its internal controls and the

oversight of the Manager, as described in the latest annual report.

The principal and emerging risks and uncertainties are therefore

largely longer-term and driven by the inherent uncertainties of

investing in global equity markets. The Board believes that it is

able to respond to these longer-term risks and uncertainties with

effective mitigation so that both the potential impact and the

likelihood of these seriously affecting shareholders' interests are

materially reduced.

Risks are regularly monitored at Board meetings and the Board's

planned mitigation measures are described in the latest annual

report. The Board maintains a risk register and also carries out a

risk review as part of its annual strategy meeting.

A detailed explanation of the principal risks and uncertainties

facing the Company and how the Board manages them can be found in

the 2023 annual report, which can be found on the Company's website

www.stsplc .co .uk . In the view of the Board, these principal

risks and uncertainties at the year end remain. The Board continue

to work with the agents and advisers to the Company to manage these

risks. The risks identified are as applicable to the remaining six

months of the year as they were to the six months under review.

Going concern status

The Company's business activities, together with the factors

likely to affect its future development, performance and position,

are continually monitored by the Board.

The financial position of the Company as at 30 September 2023 is

shown on the unaudited statement of financial position . The

unaudited statement of cash flow of the Company is set out

below.

The Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern. The Company's assets

consist primarily of a diverse portfolio of listed equity shares

which, in most circumstances, are realisable within a very short

timescale. The Directors are mindful of the principal risks

disclosed above. They have reviewed revenue forecasts and the

financial position of the Company. They believe that the Company

has adequate financial resources and a suitably liquid investment

portfolio to continue its operational existence for the foreseeable

future and for at least one year from the date of signing of these

financial statements. Accordingly, the Directors consider it

appropriate to continue to adopt the going concern basis in

preparing these financial statements.

Related party transactions

During the first six months of the year, no transactions with

related parties have taken place which have materially affected the

financial position or performance of the Company. There have been

no material changes in any related party transaction described in

the annual report for the year ended 31 March 2023.

Directors' responsibility statement

The Directors are responsible for preparing the half yearly

financial report in accordance with applicable law and regulations.

The Directors confirm that, to the best of their knowledge:

-- the financial statements have been prepared in accordance

with United Kingdom Generally Accepted Accounting Practice, in

particular with Financial Reporting Standard 104 "Interim Financial

Reporting" and with the Statement of Recommended Practice

"Financial Statements of Investment Trust Companies and Venture

Capital Trusts" issued by the AIC in July 2022;

-- the interim management report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months

of the financial year and description of principal risks and

uncertainties for the remaining six months of the year); and

-- the interim management report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and charges

therein).

By order of the Board

John Evans, Chairman

13 December 2023

Portfolio Summary

Portfolio distribution as at 30 September 2023

By region (excluding As at 30 September As at 31 March

cash) 2023 2023

% %

--------------------- ------------------- --------------

North America 52.8 52.9

Europe 41.4 41.0

Asia 5.8 6.1

100.0 100.0

--------------------- ------------------- --------------

By sector (excluding As at 30 September As at 31 March

cash) 2023 2023

% %

----------------------- ------------------- --------------

Consumer staples 38.2 39.9

Industrials 16.2 6.2

Healthcare 14.1 12.9

Information technology 10.6 20.2

Financials 8.1 6.7

Consumer discretionary 7.0 7.1

Communication services 3.5 3.1

Real estate 2.3 3.9

100.0 100.0

----------------------- ------------------- --------------

By asset class

(including cash and As at 30 September As at 31 March

borrowings) 2023 2023

% %

--------------------- -------------------- ----------------

Equities 106.6 106.5

Cash 1.1 0.7

Borrowings (7.7) (7.2)

--------------------- -------------------- ----------------

100.0 100.0

--------------------- -------------------- ----------------

Ten Largest holdings 30 September 30 September 31 March 31 March

2023 2023 2023 2023

Market value % of total Market value % of total

GBP000 portfolio GBP000 portfolio

--------------------- ------------ ------------ ------------ ----------

Paychex 11,891 5.4 12,274 5.3

Unilever 11,491 5.2 12,081 5.2

Reckitt Benckiser 11,448 5.2 11,824 5.1

British American

Tobacco 11,295 5.1 13,070 5.6

PepsiCo 11,054 5.0 11,984 5.1

CME Group 11,039 5.0 9,934 4.2

Philip Morris 9,830 4.5 10,402 4.4

Novartis 9,784 4.5 9,235 3.9

ADP 9,737 4.4 9,294 4.0

Relx 8,885 4.0 9,002 3.8

--------------------- ------------ ------------ ------------ ----------

Unaudited Statement of Comprehensive Income

Six months to Six months to

30 September 2023 30 September 2022

Note Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------- ----- -------- -------- -------- -------- -------- --------

Net losses on investments 5 - (1,204) (1,204) - (7,283) (7,283)

Net currency (losses)/gains (22) (66) (88) 24 (1,946) (1,922)

Income 3 4,034 - 4,034 4,269 266 4,535

Investment management

fee (247) (459) (706) (266) (494) (760)

Other expenses (287) - (287) (295) - (295)

----------------------------- ----- -------- -------- -------- -------- -------- --------

Net return before

finance costs and taxation 3,478 (1,729) 1,749 3,732 (9,457) (5,725)

Finance costs (83) (153) (236) (85) (158) (243)

----------------------------- ----- -------- -------- -------- -------- -------- --------

Net return on ordinary

activities before taxation 3,395 (1,882) 1,513 3,647 (9,615) (5,968)

Taxation 4 (192) - (192) (215) - (215)

----------------------------- ----- -------- -------- -------- -------- -------- --------

Net return attributable

to ordinary shareholders 3,203 (1,882) 1,321 3,432 (9,615) (6,183)

----------------------------- ----- -------- -------- -------- -------- -------- --------

Net return per ordinary

share 2 3.31p (1.94p) 1.37p 3.43p (9.61p) (6.18p)

----------------------------- ----- -------- -------- -------- -------- -------- --------

(Audited)

Year to 31 March 2023

Revenue Capital Total

Note GBP000 GBP000 GBP000

---------------------------- ---- ------- -------- -------

Net losses on investments 5 - (8,800) (8,800)

Net currency losses (4) (869) (873)

Income 3 8,238 266 8,504

Investment management

fee (531) (985) (1,516)

Other expenses (625) - (625)

---------------------------- ---- ------- -------- -------

Net return before

finance costs and taxation 7,078 (10,388) (3,310)

Finance costs (171) (318) (489)

---------------------------- ---- ------- -------- -------

Net return on ordinary

activities before taxation 6,907 (10,706) (3,799)

Taxation 4 (566) - (566)

---------------------------- ---- ------- -------- -------

Net return attributable

to ordinary shareholders 6,341 (10,706) (4,365)

---------------------------- ---- ------- -------- -------

Net return per ordinary

share 2 6.34p (10.70p) (4.36p)

---------------------------- ---- ------- -------- -------

The total columns of this statement are the profit and loss

accounts of the company.

The revenue and capital items are presented in accordance with

the Association of Investment Companies ('AIC') Statement of

Recommended Practice ('SORP 2022').

All revenue and capital items in the above statement derive from

continuing operations.

No operations were acquired or discontinued during the

period.

Unaudited Statement of Financial Position

(Audited)

As at As at As at

30 September 30 September 31 March 2023

2023 2022

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Fixed assets

Investments at fair value

through profit or loss 5 219,848 235,338 234,362

--------- --------- ---------

Current assets

Trade and other receivables 1,260 3,415 1,113

Cash and cash equivalents 2,210 4,414 1,570

----------------------------- ----- --------- --------- --------- --------- --------- ---------

3,470 7,829 2,683

Current liabilities

Bank loans 6 (15,855) (16,878) (15,795)

Trade payables (806) (2,848) (572)

Dividend payable - - (1,443)

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Total current liabilities (16,661) (19,726) (17,810)

Net current liabilities (13,191) (11,897) (15,127)

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Total net assets 206,657 223,441 219,235

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Capital and reserves

Called up share capital 8 1,223 1,223 1,223

Capital redemption reserve 78 78 78

Share premium account 31,808 31,571 31,808

Special distributable

reserve 58,813 72,837 70,924

Capital reserve 110,023 112,996 111,905

Revenue reserve 4,712 4,736 3,297

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Total shareholders'

funds 206,657 223,441 219,235

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Net asset value per

ordinary share 2 220.09p 222.86p 220.37p

----------------------------- ----- --------- --------- --------- --------- --------- ---------

Unaudited Statement of Changes in Equity

For the period Called Capital Share Special

ended 30 September up share redemption premium distributable Capital Revenue

2023 capital reserve account reserve* reserve* reserve* Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ---------- ------------ --------- --------------- ----------- ----------- ---------

As at 1 April

2023 1,223 78 31,808 70,924 111,905 3,297 219,235

Net return attributable

to shareholders** - - - - (1,882) 3,203 1,321

Shares bought

back into treasury - - - (12,111) - - (12,111)

Dividends paid - - - - - (1,788) (1,788)

As at 30 September

2023 1,223 78 31,808 58,813 110,023 4,712 206,657

------------------------- ---------- ------------ --------- --------------- ----------- ----------- ---------

For the period Called Capital Share Special

ended 30 September up share redemption premium distributable Capital Revenue

2022 capital reserve account reserve* reserve* reserve* Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ---------- ------------ --------- --------------- ----------- ----------- ---------

As at 1 April

2022 1,223 78 30,762 71,925 122,611 3,058 229,657

Net return attributable

to shareholders** - - - - (9,615) 3,432 (6,183)

Shares issued

from treasury - - 809 1,906 - - 2,715

Shares bought

back into treasury - - - (994) - - (994)

Dividends paid - - - - - (1,754) (1,754)

As at 30 September

2022 1,223 78 31,571 72,837 112,996 4,736 223,441

------------------------- ---------- ------------ --------- --------------- ----------- ----------- ---------

For the year

ended 31 March

2023 Share

(Audited) premium Capital Revenue

Called Capital Special

up share redemption distributable

capital reserve account reserve* reserve* reserve* Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ---------- ------------ --------- --------------- ---------- ----------- --------

As at 1 April

2022 1,223 78 30,762 71,925 122,611 3,058 229,657

Net return attributable

to shareholders** - - - - (10,706) 6,341 (4,365)

Shares issued

from treasury - - 1,046 2,585 - - 3,631

Shares bought

back into treasury - - - (3,586) - - (3,586)

Dividends paid - - - - - (6,102) (6,102)

As at 31 March

2023 1,223 78 31,808 70,924 111,905 3,297 219,235

------------------------- ---------- ------------ --------- --------------- ---------- ----------- --------

*These reserves are distributable with the exception of the

unrealised portion of the capital reserve (GBP25,529,000; 31 March

2023: GBP27,700,000; 30 September 2022: GBP25,784,000), which is

non-distributable.

**The company does not have any other income or expenses that

are not included in the 'Net return attributable to shareholders'

as disclosed in the condensed statement of comprehensive income

above, and therefore this is also the 'Total comprehensive income'

for the period.

Unaudited Statement of Cash Flow

(Audited)

Six months to Six months to Year to

30 September 30 September 2022 31 March 2023

2023

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------- ---- -------- -------- --------- -------- -------- -------

Cashflows from operating

activities

Net return on ordinary

activities before taxation 1,513 (5,968) (3,799)

Adjustments for:

Losses on investments 5 1,204 7,283 8,800

Finance costs 236 243 489

Exchange movement on

bank borrowings 7 60 1,877 794

Purchases of investments* (2,851) (7,401) (22,917)

Sales of investments* 16,106 9,312 24,316

Dividend income 3 (4,029) (4,533) (8,496)

Other income 3 (5) (2) (8)

Dividend income received 3,950 4,615 8,523

Other income received 5 2 8

Decrease/(increase)

in receivables 15 14 (5)

(Decrease)/increase

in payables (97) (12) 70

Overseas withholding

tax deducted (161) (240) (612)

14,433 11,158 10,962

---------------------------- ---- -------- -------- --------- -------- -------- -------

Net cash flows from

operating activities 15,946 5,190 7,163

---------------------------- ---- -------- -------- --------- -------- -------- -------

Cash flows from financing

activities

Repurchase of ordinary

share capital (11,786) (994) (3,586)

Issue of ordinary share

capital from treasury - 2,715 3,631

Equity dividends paid

from revenue (3,231) (3,122) (6,027)

Interest and fees paid

on borrowings (289) (240) (476)

---------------------------- ---- -------- -------- --------- -------- -------- -------

Net cash flows from

financing activities (15,306) (1,641) (6,458)

---------------------------- ---- -------- -------- --------- -------- -------- -------

Net increase in cash

and cash equivalents 640 3,549 705

Cash and cash equivalents

at the start of the

period 1,570 865 865

---------------------------- ---- -------- -------- --------- -------- -------- -------

Cash and cash equivalents

at the end of the period 7 2,210 4,414 1,570

---------------------------- ---- -------- -------- --------- -------- -------- -------

*Receipts from the sale of, and payments to acquire investment

securities, have been classified as components of cash flows from

operating activities because they form part of the company's

dealing operations.

Notes to the Financial Statements

Note 1: Accounting policies

For the period ended 30 September 2023 (and the year ended 31

March 2023), the company is applying The Financial Reporting

Standard applicable in the UK and Republic of Ireland ('FRS 102'),

which forms part of Generally Accepted Accounting Practice ('UK

GAAP') issued by the Financial Reporting Council ('FRC') in

2015.

These condensed financial statements have been prepared on a

going concern basis in accordance with the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, FRS 102 the

Financial Reporting Standard applicable in the UK and Republic of

Ireland, FRS 104 Interim Financial Reporting, and the Statement of

Recommended Practice "Financial Statements of Investment Trust

Companies and Venture Capital Trusts" ('SORP') issued by the AIC in

July 2022.

The accounting policies applied for the condensed set of

financial statements are set out in the Company's annual report for

the year ended 31 March 2023.

Note 2: Returns and net asset value

(Audited)

Six months Six months to Year to

to 30 September 31 March

30 September 2022 2023

2023

--------------------------- --------------- ---------------- ------------

Returns per share

Revenue return (GBP000) 3,203 3,432 6,341

Capital return (GBP000) (1,882) (9,615) (10,706)

--------------------------- --------------- ---------------- ------------

Total (GBP000) 1,321 (6,183) (4,365)

--------------------------- --------------- ---------------- ------------

Weighted average number

of ordinary shares

in issue 96,715,825 100,054,419 100,005,571

Revenue return per

ordinary share 3.31p 3.43p 6.34p

Capital return per

ordinary share (1.94p) (9.61p) (10.70p)

--------------------------- --------------- ---------------- ------------

Total return per ordinary

share 1.37p (6.18p) (4.36p)

--------------------------- --------------- ---------------- ------------

Net asset value per

share

Net assets attributable

to shareholders (GBP000) 206,657 223,441 219,235

Number of shares in

issue at period end 93,898,378 100,260,575 99,483,575

Net asset value per

share 220.09p 222.86p 220.37p

--------------------------- --------------- ---------------- ------------

Note 3: Income

Six months Six months to Year to

to 30 September 31 March

30 September 2022 2023

2023 GBP000 GBP000

GBP000

------------------------- --------------- ---------------- -----------

From listed investments

UK - equities 1,968 1,932 2,973

Overseas - equities 2,061 2,335 5,257

------------------------- --------------- ---------------- -----------

4,029 4,267 8,230

------------------------- --------------- ---------------- -----------

Other income

Deposit interest 5 2 8

4,034 4,269 8,238

------------------------- --------------- ---------------- -----------

During the six months to 30 September 2023 the Company did not

receive any special dividends which were treated as capital (30

September 2022 and year to 31 March 2023: special dividends of

GBP266,000 received from Admiral Group, which were treated as

capital).

Note 4: Taxation

(Audited)

Six months Six months to Year to

to 30 September 31 March

30 September 2022 2023

2023 GBP000 GBP000

GBP000

Irrecoverable overseas

withholding tax 192 215 566

------------------------ --------------- ---------------- ----------

Note 5: Investments at fair value through profit or loss

(Audited)

As at As at As at

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

----------------------- --------------- --------------- ----------

Opening book cost 206,662 209,480 209,480

Opening investment

holding gains 27,700 35,081 35,081

----------------------- --------------- --------------- ----------

Opening market value 234,362 244,561 244,561

----------------------- --------------- --------------- ----------

Acquisitions at cost 2,851 9,769 22,917

Disposal proceeds

received (16,161) (11,709) (24,316)

Losses on investments (1,204) (7,283) (8,800)

----------------------- --------------- --------------- ----------

Closing market value

of investments 219,848 235,338 234,362

----------------------- --------------- --------------- ----------

Closing book cost 194,319 209,554 206,662

Closing investment

holding gains 25,529 25,784 27,700

----------------------- --------------- --------------- ----------

Closing market value 219,848 235,338 234,362

----------------------- --------------- --------------- ----------

The company received GBP16,161,000 (six months ended 30

September 2022: GBP11,709,000; year ended 31 March 2023:

GBP24,316,000) from investments sold in the six months ended 30

September 2023. The average book cost of these investments when

they were purchased was GBP15,194,000 (six months ended 30

September 2022: GBP9,695,000; year ended 31 March 2023:

GBP25,735,000). These investments have been revalued over time and

until they were sold any unrealised gains/losses were included in

the fair value of investments.

Transaction costs

During the period, expenses were incurred in acquiring or

disposing of investments classified as fair value though profit or

loss. These have been expensed through capital and are included

within losses on investments in the statement of comprehensive

income. The total costs were as follows:

Six months (Audited)

to Six months to Year to

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

-------------- -------------- -------------- ----------

Acquisitions 4 43 68

Disposals 6 4 11

-------------- -------------- -------------- ----------

10 47 79

-------------- -------------- -------------- ----------

Note 6: Bank loans

(Audited)

As at As at As at

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

--------------------------- --------------- --------------- ----------

Bank borrowings repayable

within one year 15,855 16,878 15,795

15,855 16,878 15,795

--------------------------- --------------- --------------- ----------

During the period, the Company arranged a new GBP20m

multi-currency revolving credit facility with The Royal Bank of

Scotland International Limited, which expires on 19 September 2026.

As at 30 September 2023 GBP15,855,000 was drawn down until 19

December 2023. The amount has been drawn in the same currency split

as borrowed under the previous term loan facility at 30 September

2022 and 31 March 2023 - GBP1,500,000; EUR4,500,000; and

US$12,750,000.

Interest is payable at the aggregate of the compounded Risk Free

Rate ("RFR") for the relevant currency and loan period, plus a

margin of 1.55%, totalling 6.74%, 5.24% and 6.85% on the GBP, EUR

and USD balances respectively (30 September 2022 and 31 March 2023:

interest was charged at a fixed rate of 2.1408%, 1.4175% and

3.1925% on the GBP, EUR and USD balances respectively).

Note 7: Analysis of net debt

(Audited)

As at As at

31 March Exchange 30 September

2023 Cash flow movements 2023

GBP000 GBP000 GBP000 GBP000

----------------- ---------- ---------- ----------- ---------------

Cash at bank 1,570 640 - 2,210

Bank borrowings (15,795) - (60) (15,855)

(14,225) 640 (60) (13,645)

----------------- ---------- ---------- ----------- ---------------

Note 8: Called up share capital

(Audited)

As at As at As at

30 September 30 September 31 March

2023 2022 2023

No. of shares No. of shares No. of shares

-------------------- ---------------- ---------------- ---------------

Ordinary shares of

1p

Shares in issue 93,898,378 100,260,575 99,483,575

Held in treasury 28,400,770 22,038,573 22,815,573

-------------------- ---------------- ---------------- ---------------

122,299,148 122,299,148 122,299,148

-------------------- ---------------- ---------------- ---------------

During the six months ended 30 September 2023 there were

5,585,197 shares bought back into treasury at a cost of

GBP12,111,000 (six months ended 30 September 2022: 429,500 shares

bought back into treasury at a cost of GBP994,000; year ended 31

March 2023: 1,616,500 shares bought back into treasury at a cost of

GBP3,586,000).

During the six months ended 30 September 2023 no shares were

issued from treasury (six months ended 30 September 2022: 1,165,000

shares were issued from treasury for net proceeds of GBP2,715,000;

year ended 31 March 2023: 1,575,000 shares were issued from

treasury for net proceeds of GBP3,631,000).

No shares were purchased for cancellation or cancelled from

treasury in the current or prior periods.

Note 9: Fair value hierarchy

Under FRS 102, the company is required to classify fair value

measurements using a fair value hierarchy that reflects the

significance of the inputs used in making the measurements. The

fair value hierarchy shall have the following levels:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- Level 2: other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayments, credit

risk, etc); or

- Level 3: significant unobservable input (including the

company's own assumptions in determining the fair value of

investments).

The financial assets measured at fair value through profit and

loss are grouped into the fair value hierarchy as follows:

(Audited)

As at As at As at

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

-------------------------- --------------- --------------- ----------

Financial assets at

fair value through

profit or loss - Quoted

equities

Level 1 219,848 235,338 234,362

Level 2 - - -

Level 3 - - -

-------------------------- --------------- --------------- ----------

219,848 235,338 234,362

-------------------------- --------------- --------------- ----------

There have been no transfers between levels 1, 2, or 3 during

the period (period to 30 September 2022 and year to 31 March 2023:

nil).

Note 10: Interim financial report

The financial information contained in this half-yearly

financial report does not constitute statutory accounts as defined

in s434 - 6 of the Companies Act 2006. The financial information

for the six months ended 30 September 2023 and 30 September 2022

has not been audited or reviewed.

The information for the year ended 31 March 2023 has been

extracted from the latest published audited financial statements

which have been filed with the Registrar of Companies. The report

of the auditors on those accounts contained no qualification or

statement under s498 (2), (3) or (4) of the Companies Act 2006.

A copy of the half-year report can shortly be downloaded at

www.stsplc.co.uk .

Enquiries:

Juniper Partners Limited

Company Secretary

Email: companysecretary@stsplc.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRBDDDXBDGXX

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

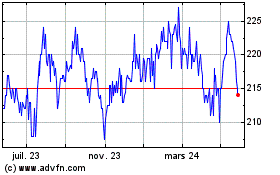

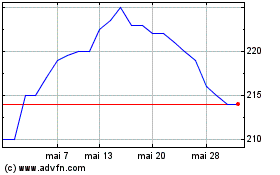

Sts Global Income & Growth (LSE:STS)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Sts Global Income & Growth (LSE:STS)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024