Toro Limited Brexit Impact on Toro Limited (3978C)

27 Juin 2016 - 6:00PM

UK Regulatory

TIDMTORO

RNS Number : 3978C

Toro Limited

27 June 2016

Toro Limited

27 June 2016

Brexit impact on Toro Limited

The Portfolio Manager would like to share their first thoughts

with Toro Limited ("Toro" or the "Company") investors as to the

impact of the "Brexit" vote on the European ABS market and

performance of the Toro portfolio, as well as the potential

consequences of Brexit on the strategy.

Initial impact on the European ABS market and Toro

performance

Following an initial sharp sell-off in risky assets, the

European credit market rebounded as Friday morning progressed

(iTraxx Xover retraced 50bps from the intra-day wide levels of

450bps). The European ABS market was rather calm and orderly with

decent buying inquiries across the spectrum initially and no forced

sellers in sight. Indeed, bottom fishers emerged and bids across

the stack improved to clear on the following levels: UK

non-conforming senior RMBS at a discount margin of 210bps (+50bps),

BBB CLO 2.0 tranches traded at a discount margin of 475bps (+75bps)

and Spanish high beta senior RMBS at a discount margin of 475bps

(+100bps) just to name a few.

Therefore, benchmarking Toro's positions to these levels and

extrapolating for other sectors, we would expect the Company's

exposure to Public ABS to be marked down by 3% (gross estimate

subject to revisions). Public ABS represented 61.7% of the NAV as

at 31 May 2016.

On the Private Asset Backed Finance strategy, exposure to CLO

warehouse will also be marginally marked down although offers on

leveraged loans in performing high quality credits remained at or

above par as there were few forced sellers and ample cash positions

within recently printed CLOs.

Toro's large cash position (22%), low leverage ratio (78%) and

hedging policy reflected a defensive positioning that we have been

advocating for months, ahead of this binary event. Such mitigating

factors are likely to offset the mark-to-market losses and Toro's

NAV is expected to be marginally down month-to-date (-1% to

0%).

Consequences of Brexit on the strategy

Clearly, the capacity of the Portfolio Manager to assess the

impact of Brexit is limited until a post-Brexit trajectory is

agreed by the UK and the EU or at least proposed by the incoming

Prime Minister. There is a lot of uncertainty ahead, but also some

offsetting factors such as policy responses from central banks and

political bodies in the UK and abroad that would dampen expected

market volatility.

Brexit is likely to harm the UK economy first as both

investments and consumption wane. A mild recession could be

accompanied by falling real estate prices, increasing arrears and

default rates affecting directly UK consumer ABS transactions.

Exposure to UK assets in Toro (especially non-conforming and

buy-to-let RMBS) was reduced significantly in Q1 2016. The

Portfolio Manager has stress tested the remaining 6.5% of UK RMBS

exposure and expects no losses under such a scenario. Indirect

exposure to UK corporate through the CLOs is 2.2% and benefits from

limited exposure to domestic consumer risk.

The overall European economy is also expected to be impacted

and, although the current short term outlook remains benign and

technically supported by the ECB's accommodative stance, the UK

referendum could trigger further political instability in the EU.

Therefore, the Portfolio Manager expects to continue to manage

actively tail risk hedges. Both mortgage loan origination in Europe

and Leveraged loans CLO formation are also likely to slowdown,

potentially delaying the implementation of the origination

strategy.

The increase degree of risk aversion in the market is also

likely to last, as uncertainty from a Brexit should remain in place

for an extended period of time given the complexity and duration of

the process. A calm and opportunistic approach to investment, made

possible by Toro's capital structure, should create better entry

points both on liquid and illiquid assets as markets adjust to the

new reality.

Enquiries:

Kirstie McLaren

Chenavari Investment Managers

Email: tlir@chenavari.com

Telephone: +44 207 259 3600

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUBUVRNSANUAR

(END) Dow Jones Newswires

June 27, 2016 12:00 ET (16:00 GMT)

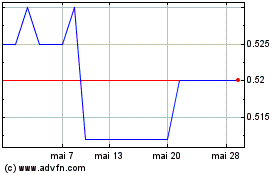

Chenavari Toro Income (LSE:TORO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

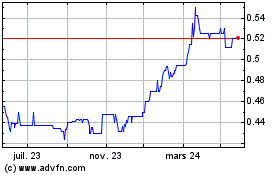

Chenavari Toro Income (LSE:TORO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024