TIDMTPT

RNS Number : 3876V

Topps Tiles PLC

05 April 2023

5 April 2023

Topps Tiles Plc

First Half Trading Update

Topps Tiles Plc ("Topps Group", or the "Group"), the UK's

leading tile specialist, announces a trading update for the 26-week

period ended 1 April 2023.

Group

The Topps Group has developed and diversified over recent years

and now operates across three distinct business areas: Topps Tiles

is the clear market leader in the UK, serving trade customers and

homeowners in the domestic market through an omni-channel model

incorporating specialist product expertise and world-class customer

service; our high-growth Online Pure Play businesses (Pro Tiler

Tools and Tile Warehouse) are specifically focused on the digital

space; and our Parkside brand focuses on B2B sales in the

commercial market.

Having reported record years for revenue in both 2021 and 2022,

the Group delivered a record period in the first half, with

revenues of GBP130.5 million(1) , GBP11.3 million or 9.5% higher

than the prior year. Approximately GBP9.0m(1) of revenue growth

related to the acquisition of Pro Tiler Tools and the launch of

Tile Warehouse in 2022.

Omnichannel - Topps Tiles

Following a strong first quarter, Topps Tiles continued to

deliver good sales growth in Q2, with like-for-like sales(2) being

3.5% higher year on year, from one fewer trading day in the

quarter. Like-for-like sales over the first half were up 4.3%, and

Topps Tiles delivered first half revenue of GBP115.8 million(1) , a

record for the business as a standalone brand. Sales per store in

the first half were 30% higher than in the pre-pandemic period of

FY19, including the benefit of transferring sales from closed

stores as we successfully rationalised our store estate, as well as

underlying sales growth.

Customer satisfaction scores improved further during the first

half, against the world class levels reported last year, and the

business increased its mix of sales to trade customers to 59% (H1

FY22: 58%). Trade customers are key as they provide high levels of

repeat custom and an important link to homeowners, through

recommendation and direct sales.

Whilst gross profit has been rising in recent years following

strong sales growth, gross margin percentage has trended down as a

result of cost inflation, the growing trade customer mix, product

mix and strategic decisions to invest in our customer value

proposition. In the first half, gross margins in Topps Tiles were

lower year on year, however margins improved over the course of the

period as we passed through cost price rises, and as supply chain

pressures have started to moderate or reverse. As a result of these

factors, we expect to see gross margins increase sequentially in

the second half.

Online Pure Play - Pro Tiler Tools and Tile Warehouse

The growth of our Online Pure Play businesses, led by Pro Tiler

Tools, has been very strong. In the first half of this year, Online

Pure Play delivered revenues of GBP10.1 million(1) (H1 FY22: Group

consolidated revenue of GBP1.1 million). Pro Tiler Tools continued

its exceptional growth in the first half and Tile Warehouse

delivered modest sales but is also an important source of future

growth in the medium term.

Commercial - Parkside

Parkside's revenue in the first half was GBP4.6 million(1) ,

down 9.3% year on year, reflecting project delays and lower

business confidence as a result of the wider market sentiment. We

are implementing various business improvement programmes, including

a new CRM system which will support further growth in the business

as the commercial market begins to recover from the pandemic

period.

Summary

The Group's strong revenue performance in the first half

reflects the strength of our brands, the execution of our strategy

and encouraging domestic market conditions. Our continued growth

gives us confidence that we will deliver our market share goal of

'1 in 5 by 2025'(3) ahead of schedule.

The business remains strongly cash generative, with the balance

sheet, cash flows and profitability remaining in line with our

expectations.

As announced in the 2022 full year results, we expect Group

profitability in the current financial year to be weighted towards

the second half. The expected weighting reflects: a significant

year on year increase in our gas expense with the majority of the

increase experienced in the first half due to higher energy usage

over the winter; a normalised holiday pay accrual, with a debit in

the first half of c GBP0.7 million and a credit in the second half

of c. GBP0.7 million; growth of the newer businesses over the

course of the year; and a further easing in cost of goods inflation

as the year progresses, which has already been seen towards the end

of the first half.

Rob Parker, CEO, said: "Our performance across the first half

has been good, with a record period for Group revenues, supported

by like-for-like sales growth in Topps Tiles of 4.3% and an

excellent post-acquisition performance from Pro Tiler Tools.

"The economic outlook remains uncertain but early signs of

easing supply chain pressures, allied to the Group's strong balance

sheet, world class customer service, specialist expertise and

growth strategy give us confidence in our ability to drive value

for all stakeholders over the medium term."

(1) All revenue numbers are stated before accounting adjustments

including revenue recognition and customer returns provisions which

will be included in the Interim Results. Group revenue includes

GBP10.1 million of sales from Pro Tiler Tools and Tile Warehouse in

FY23 compared to GBP1.1 million of sales recognised in in the

Group's consolidated accounts for H1 FY22.

(2) Topps Tiles like-for-like sales is defined as online sales

and sales from Topps Tiles stores that have been trading for more

than 52 weeks.

(3) Refers to Topps' goal of accounting for GBP1 in every GBP5

spent on tiles and associated products in the UK by 2025, thereby

increasing its market share to 20% from approximately 17% in 2019.

In the 52 weeks ended 1 October 2022 the Group's market share

increased to 19.0% (2021: 17.6%)

For further information please contact:

Topps Tiles Plc

Rob Parker, CEO

Stephen Hopson, CFO 0116 282 8000

Citigate Dewe Rogerson

Kevin Smith

Ellen Wilton 020 7638 9571

Notes to Editors

Topps Tiles Plc is the UK's largest specialist supplier of tiles

and associated products, targeting the UK domestic refurbishment

and commercial markets and serving homeowners, trade customers,

architects, designers and contractors from 304 nationwide Topps

Tiles stores, three commercial showrooms and six websites:

www.toppstiles.co.uk , www.parkside.co.uk , www.protilertools.co.uk

, www.northantstools.co.uk , www.premiumtiletrim.co.uk and

www.tilewarehouse.co.uk .

Since opening its first store in 1963, Topps has maintained a

simple operating philosophy -- inspiring customers with unrivalled

product choice and providing exceptional levels of customer

service. For further information on the Group, please visit

http://www.toppstilesplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDSIXGDGXS

(END) Dow Jones Newswires

April 05, 2023 02:00 ET (06:00 GMT)

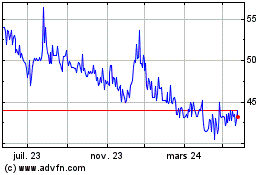

Topps Tiles (LSE:TPT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

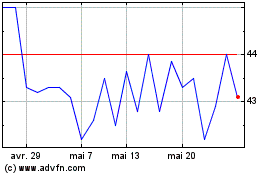

Topps Tiles (LSE:TPT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025