New Copper Offtake Secured with Trafigura for Baita Plai

13 Mars 2024 - 8:00AM

UK Regulatory

New Copper Offtake Secured with Trafigura for Baita Plai

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

13 March 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

New Copper Offtake Secured with Trafigura

for Baita Plai

Vast Resources plc, the AIM-listed mining

company, is pleased to announce that it has secured a new exclusive

offtake agreement with Trafigura Group Pte (‘Trafigura’) for all

copper concentrate (‘the New Offtake’) produced at the Company’s

100% owned Baita Plai Polymetallic Mine in Romania (‘Baita Plai’).

The New Offtake builds on Vast’s existing relationship with

Trafigura, which is one of the world’s leading independent

commodity trading and logistics companies, following the exclusive

offtake agreement signed with Trafigura in October 2022 relating to

the Takob Mine in Tajikistan.

The New Offtake agreement, which will be in

place until June 2025, will replace the existing copper concentrate

offtake agreement. The New Offtake agreement pricing terms are in

accordance with market practice, with adjustments for the grade of

material delivered, and at a small discount to the LME cash

settlement quotation averaged over an agreed period for copper,

silver and gold to ensure competitive pricing.

Copper concentrate production is ramping up at

Baita Plai with dry metric tonnes increasing by 24% from Q4 2022 to

Q4 2023. In addition, as previously reported, the Company is

currently working to accelerate development of the underground

decline access ramp at Baita Plai, which is expected to

substantially increase productivity through reduced underground

haulage times and also provide faster access to high grade ore at

depth. As a result, the Company expects the overall grade of

concentrate produced at Baita Plai to increase, and for there to be

a reduction in grade variability which will align with the

Company’s offtake objectives with Trafigura.

The Board would also like to advise shareholders

that discussions regarding the terms and conditions of the

extension of the loans to A&T Investments SARL and Mercuria

Energy Trading SA beyond the current effective repayment date of 29

February 2024 are continuing, and the Company will update the

market once finalised.

Andrew Prelea, Chief Executive Officer

at Vast Resources PLC, commented:

“Vast has been developing a relationship

with Trafigura, one of the world’s leading independent commodity

trading and logistics companies, since early 2022 and we are

delighted to report this new exclusive offtake over our producing

asset in Romania. The terms of the offtake ensure that Vast will

benefit from the widely forecast price increase over the coming

months and into 2025 as global supply struggles to meet demand,

with UBS going as far as to say that ‘a copper supply crunch is

unavoidable’. As a Company in production, which continues to ramp

up with limited additional capex required, Vast is in a solid

position to capitalise on these market dynamics through its new

offtake with Trafigura.”

About

Trafigura

Trafigura is a leading commodities group, owned by its employees

and founded 30 years ago. At the heart of global supply, Trafigura

connects vital resources to power and build the world. It deploys

infrastructure, market expertise and a worldwide logistics network

to move oil and petroleum products, metals and minerals, gas and

power from where they are produced to where they are needed,

forming strong relationships that make supply chains more

efficient, secure and sustainable. Trafigura invests in renewable

energy projects and technologies to facilitate the transition to a

low-carbon economy, including through H2Energy Europe and joint

venture Nala Renewables.

The Trafigura Group also comprises industrial

assets and operating businesses including multi-metals producer

Nyrstar, fuel storage and distribution company Puma Energy, and the

Impala Terminals joint venture. The Group employs over 12,000

people and is active in 156 countries.

Visit: www.trafigura.com

Market Abuse Regulation (MAR)

Disclosure

Certain information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018 (“UK MAR”) until the release

of this announcement.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced. Vast has also been contractually appointed

to manage and develop the Aprelevka Gold Mines located along the

Tien Shan Belt that extends through Central Asia, currently

producing approximately 11,600 oz of gold and 116,000 oz of silver

per annum. It is the intention to increase production closer to

historical peak production of 27,000 oz gold and 250,000 oz silver.

Vast will be entitled to a 4.9% effective interest in the mines

with the option to acquire equity in the future.

The Company retains a continued presence in

Zimbabwe in respect of the Historic claims.

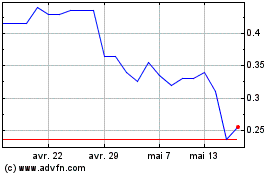

Vast Resources (LSE:VAST)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Vast Resources (LSE:VAST)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024