TIDMVCAP

RNS Number : 3359L

Vector Capital PLC

05 September 2023

5 September 2023

Vector Capital plc

("Vector Capital", "Company" or "Group")

Half Year Results for the period ended 30 June 2023

Vector Capital Plc (AIM: VCAP), a commercial lending group that

offers secured loans primarily to businesses located in England and

Wales, is pleased to announce its interim results for the six

months ended 30 June 2023.

Highlights

-- Revenue for the period GBP2.9m (H1 2022: GBP3.0m) reflecting

a prudent approach to new lending.

-- Profit before tax GBP1.3m (H1 2022: GBP1.6m) reflecting

an increase in the doubtful debt reserve of GBP167,000

and an inflationary effect on overheads.

-- Loan book at 30 June 2023 GBP48.8m (December 2022:

GBP53.2m), as a result of net redemptions during the

period.

-- Interim dividend of 1.00p per share (2022: 1.00p),

recognising a resilient performance in challenging

market conditions.

Operational Highlights

-- Increase in wholesale banking facilities from GBP40m

-- to GBP45m during the period.

Extended and more flexible facilities to allow greater

capacity for loans secured on second charges.

-- Continued investment in the technology platform to improve

operational resilience and efficiency.

-- Further engagement in staff training and development.

-- Best practice ESG policies in place to support responsible

lending and encourage sustainability across the business.

Agam Jain, CEO of Vector Capital, commented: "We are very

pleased to report a robust set of interim results. The trading

climate for the first six months of this year has been set by the

backdrop of historic base rate rises from 0.10% in March 2020 to 5%

in June 2023, and now 5.25 %. For those borrowers experiencing

difficulty, our approach is to be flexible and supportive where we

believe that the circumstances justify this methodology.

Our strategy this year has been to seek to maintain higher

liquidity, with a correspondingly lower loan book and reduced

wholesale borrowings. To the extent that we lend our own capital we

can now earn a much higher return than previously. We have a strong

capital base which provides the Board with a high level of

confidence that we can weather continued or increased economic

headwinds.

Our pipeline is healthy with a steady stream of enquiries from

our Broker network allowing us to pick and choose the deals that

suit us."

Enquiries

Vector Capital Plc

Robin Stevens (Chairman) c/o IFC Advisory

Agam Jain (CEO)

WH Ireland Limited 020 7220 1666

Hugh Morgan, Chris Hardie, Darshan Patel

IFC Advisory Limited 020 3934 6630

Graham Herring, Florence Chandler, Zach Cohen

Notes to Editors

Vector Capital Plc provides secured, business-to-business loans

to SMEs based principally in England and Wales. Loans are typically

secured by a first legal charge against real estate. The Group's

customers typically borrow for general working capital purposes,

bridging ahead of refinancing, land development and property

acquisition. The loans provided by the Group are typically for

renewable 12-month terms with fixed interest rates.

Chairman's Statement

I am pleased to present our 2023 Interim Results for the six

months ended 30 June 2023, which report consolidated pre-tax

profits of GBP1,274,000 (2022 GBP1,556,000), and to propose an

interim dividend of 1.00 pence per share payable on 29 September

2023 (2022 1.00 pence).

The results for the first half of the year should be seen in the

light of the combined effects of the well-publicised headwinds in

the UK economy, as borrowers struggle with continuingly rising

interest rates, inflationary pressure on input prices and falling

property prices; almost the perfect storm for any sector. Against

this challenging backdrop, the Group's results show considerable

resilience and reflect our strong capital base, our selective and

cautious lending policy, our proven loan management systems and the

experience of the executive management team. The reduction in the

Group's loan book to GBP48.8m from GBP53.2m during the period from

31 December 2022, was to be expected where the terms of trade of

many SME borrowers are being squeezed. While these conditions

prevail, our aim is to maximise the return to shareholders on our

capital base. Our overall aim remains to create a leading market

presence in the provision of secured loans to the SME sector, which

our strong capital position in these challenging conditions may

well accelerate as other lenders trading on the margins

struggle.

During the period we extended and deepened our wholesale banking

facilities such that we can now utilise up to GBP45 million (31

December 2022 GBP40 million) from these sources, of which GBP2.5

million can be applied to loans secured by second charges, thus

providing scope for additional and in some cases higher-margin

lending as opportunities arise and market conditions improve. We

are also selectively developing our co-lending relationships, and

the Company's parent company, Vector Holdings Limited has increased

its loan to the Company from GBP3 million to GBP4 million.

Despite the uncertainties in the immediate economic outlook in

the UK and the likely continuing relatively high interest rates

through to 2025, we remain determined to build on the Group's

strong business foundations, to maximise returns from our existing

capital base and to build the loan book utilising the debt

facilities described above.

We are increasingly aware of our environmental, social and

governance responsibilities to shareholders and other stakeholders

and we are following what we believe to be market best practice and

developing procedures to address these important issues. Details of

our ESG policies and procedures, aimed principally at responsible

lending and encouraging sustainability and avoidance of waste in

all we do, are set out on the Company's website

www.vectorcapital.co.uk.

The Group's half year results are based on the continued hard

work of the executive team, to whom considerable thanks is due, the

quality of the underlying operational systems and the robustness of

the business model. Thanks, are also due to my fellow Board members

and our business partners.

We believe that our team has the skills and experience to adapt

to the challenges presented by the UK economic conditions and to

continue to build the business by capitalising on the opportunities

that are expected to arise through the rest of 2023 and beyond.

Robin Stevens

Chairman

4 September 2023

Chief Executive's Statement

Background

The trading climate for the first six months of this year has

been set by the backdrop of historic base rate rises from 0.10% in

March 2020 to 5% in June 2023, and now to 5,25%, the highest rate

since April 2008. For the mortgage sector, these are circumstances

not experienced by many lenders or borrowers. The tool used by the

Bank of England to control inflation has hit some of our borrowing

customers extremely hard. Our principal market consists of

borrowers that take loans to refurbish or develop land and

property.

Our borrowers have been faced with multiple issues of rising

building material costs and long lead times since 2022. This has

led to cost overruns and delays. On top of this, they are now faced

with substantial interest rate rises. This has a negative bearing

on project viability and the ability of some borrowers to

re-finance their developments.

Stressed Loans

For those borrowers experiencing difficulty, our approach is to

be flexible and supportive where we believe that the circumstances

justify this approach. We do this by agreeing to re-schedule

monthly payments and capital repayments. Where we are not satisfied

with the financial viability of a borrowers' loan, we work with the

borrowers to give time for them to sell or re-finance and, if

necessary, appoint an LPA Receiver to sell the property. Bearing in

mind the circumstances prevailing this year, the number of receiver

appointments has increased over previous years.

Our expectation is that we will recover our full capital in

almost all cases and also the fees and accrued interest in most

cases, albeit with consequent delays of 4-12 months. In accordance

with our normal policy, we have made provision for estimated

doubtful debts with the results for the period and the impact on

our results is within the margins we had stress tested. It should

be stressed that we have not written off any debts in the current

period under review but are taking a prudent view due to the

macro-economic environment. We have a strong capital base which

provides the Board with a high level of confidence that we can

weather continued or increased economic headwinds.

Excellent Interim Results

Against these adverse market conditions, I am very pleased to

report that Vector has delivered an excellent set of results and we

expect to continue to pay attractive dividends.

The unaudited profit before tax for the period was GBP1.3m on a

revenue of GBP2.9m (GBP1.6m and GBP3.0m, respectively, 30 June

2022).

At 30 June 2023 the loan book was GBP48.8m (31 December 2022,

GBP53.2m), and the consolidated net assets were GBP25.4m (31

December 2022, GBP25.1m).

We are fortunate to have a very strong capital base that allows

us the flexibility and security to capitalise on the market

opportunities that still exist in these challenging times.

We will propose an interim dividend of 1.00 pence per share

payable on 29 September 2023 (2022 1.0 pence.

Loan Book KPIs

HY 2023 % FY 2022 %

Residential 27,234,055 55.80% 30,351,346 57.02%

Commercial 11,681,461 23.93% 11,643,949 21.87%

-------------------- -------- --------------------- --------

Land & Development 5,050,619 10.35% 4,681,424 8.79%

-------------------- -------- --------------------- --------

Mixed 3,937,194 8.07% 4,707,648 8.84%

-------------------- -------- --------------------- --------

2nd charge 492,023 1.01% 1,545,273 2.90%

-------------------- -------- --------------------- --------

Other 415,000 0.85% 300,000 0.56%

-------------------- -------- --------------------- --------

48,810,352 100.00% 53,229,641 100.00%

-------- --------------------- --------

The loans we have issued to the various market segments that we

serve remain broadly similar.

The average rate achieved during the period was 10.18% p.a.

(June 2022, 11.69% p.a.)

The average loan size was GBP474,000 spread over 103 live loans.

(June 2022, GBP532,000)

Security held at 30 June 2023 was estimated at GBP84m giving an

average LTV of 58.10% (June 2022, 59.41%).

The loan balances are stated net of provisions of GBP367,000 at

30 June 2023 (December 2022, GBP200,000)

Operational review

Our strategy this year has been to seek to maintain higher

liquidity, with a correspondingly lower loan book and reduced

wholesale borrowings. To the extent that we lend our own capital we

can now earn a much higher return than previously.

Our pipeline is healthy with a steady stream of enquiries from

our Broker network allowing us to pick and choose the deals that

suit us.

Our wholesale banking rates have inevitably increased. However,

the rates are still viable for us to continue to drawdown against

the facilities. Our facilities are currently GBP45m and we do not

need to seek a further increase this year.

The existing operational team is extremely efficient and

provides a fast response time to brokers and borrowers alike. We

remain lean and have not needed to increase the head count in the

period.

Outlook

Vector is in a healthy financial position with a strong capital

base and we remain keen to return to a growth path when market

conditions allow. However, we still remain cautious and will wait

to see the impact on our market when the base rates stabilise.

There is strong demand for our loans, we have good support from our

lenders, and we remain excited about capitalising on the

opportunities ahead, albeit selectively.

Agam Jain

Chief Executive Officer

4 September 2023

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Revenue 3 2,851 2,980 5,928

Cost of sales (156) (289) (429)

-------------- -------------- -------------

Gross profit 2,695 2,691 5,499

Administrative expenses (532) (307) (911)

Operating profit 2,163 2,384 4,588

Finance income - - 3

Finance costs (889) (828) (1,782)

-------------- -------------- -------------

Profit on ordinary activities

before taxation 1,274 1,556 2,809

-------------- -------------- -------------

Income tax expense 4 (305) (296) (534)

-------------- -------------- -------------

Profit after taxation 969 1,260 2,275

Other comprehensive income - - -

-------------- -------------- -------------

Total comprehensive income attributable

to the shareholders of the Company 969 1,260 2,275

============== ============== =============

Pro - forma basic and diluted

earnings per share

attributable to the owners

of the Company (pence) 9 2.14 2.79 5.03

============== ============== =============

Condensed Consolidated Statements of Financial Position

For the six months ended 30 June 2023

Notes 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Non-Current assets

Property, plant and equipment 5 1 2 1

1 2 1

-------------- -------------- ------------

Current assets

Trade and other receivables 6 49,422 52,223 53,997

Cash and bank balances 479 737 688

49,901 52,960 54,685

-------------- -------------- ------------

Total Assets 49,902 52,962 54,686

============== ============== ============

Current liabilities

Trade and other payables 7 20,230 28,140 25,800

Income tax payable 307 296 240

20,537 28,436 26,040

-------------- -------------- ------------

Non-Current liabilities

Trade and other payables 7 4,000 - 3,558

Total Liabilities 24,537 28,436 29,598

-------------- -------------- ------------

Equity

Share capital 8 226 226 226

Share premium 20,876 20,876 20,876

Group reorganisation reserve 188 188 188

Retained earnings 4,075 3,236 3,798

25,365 24,526 25,088

-------------- -------------- ------------

Total Equity and Liabilities 49,902 52,962 54,686

============== ============== ============

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Share Share Group reorganisation Retained Total equity

capital premium reserve profits

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2022 226 20,876 188 2,659 23,949

Profit for the six months

ended 30 June 2022 - - - 1,260 1,260

Dividends paid - - - (683) (683)

Balance at 30 June 2022 226 20,876 188 3,236 24,526

Profit for the six months

ended 31 December 2022 - - - 1,015 1,015

Dividends paid - - - (453) (453)

Balance at 31 December

2022 226 20,876 188 3,798 25,088

Profit for the six months

ended 30 June 2023 - - - 969 969

Dividends paid - - - (692) (692)

Balance at 30 June 2023 226 20,876 188 4,075 25,365

-------- -------- -------------------- -------- ------------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

Six Months Six Months Year ended

ended 30 ended 30 31 December

June June

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Cash flow from operating

activities

Profit for the period before

taxation 1,274 1,556 2,809

Adjustment for :

Interest expense 889 828 1,782

Depreciation - 1 1

Finance income - - (3)

Tax paid (238) (289) (581)

------------ ------------ -------------

Operating cash flows before

movements in working capital 1,925 2,096 4,008

(Increase)/decrease in trade

and other receivables 4,575 (5,658) (7,432)

Increase/(decrease) in trade

and other payables (5,131) 4,283 5,499

------------ ------------ -------------

Cash generated from operating

activities 1,369 721 2,075

Interest paid (889) (828) (1,782)

Net cash generated from/(absorbed

in) operating activities 480 (107) 293

------------ ------------ -------------

Cash flows (for)/from investing

activities

Finance income - - 3

Net cash generated from investing

activities - - 3

------------ ------------ -------------

Cash flows ( for )/ from

financing activities

Amounts introduced by directors 3 - 1

Equity dividends paid (692) (683) (1,136)

Net cash (absorbed in)/generated

from financing activities (689) (683) 1,135

------------ ------------ -------------

Net (decrease) in cash &

cash equivalents (209) (790) (839)

Cash and equivalent at beginning

of period 688 1,527 1,527

Cash and equivalent at end

of period 479 737 688

============ ============ =============

Notes to the Interim Financial Statements

For the six months ended 30 June 2023

1 . Basis of Preparation

The interim consolidated financial statements of Vector Capital

Plc (the "Company") are unaudited condensed financial statements

for the six months ended 30 June 2023. These include unaudited

comparatives for the six months ended 30 June 2022 together with

audited comparatives for the year ended 31 December 2022. The

financial information for the six months ended 30 June 2022 does

not constitute statutory financial statements within the meaning of

section 434 of the Companies Act 2006. A copy of the audited

financial statements for the year ended 31 December 2022 is

available on the Company's website. The auditor's opinion on those

financial statements was unqualified and did not draw attention to

any matters by way of an emphasis of matter paragraph. These

interim condensed financial statements have been prepared on the

basis of the accounting policies expected to apply for the

financial year to 31 December 2023 based on the recognition and

measurement principles of United Kingdom adopted International

Financial Reporting Standards (IFRS), in accordance with the

provisions of the Companies Act 2006, applicable to companies

reporting under IFRS.

The financial statements have been prepared under the historical

cost convention. The Group's presentation and functional currency

is Sterling (GBP). The interim financial statements do not include

all of the information required for full annual financial

statements and do not comply with all the disclosures in IAS 34

'Interim Financial Reporting' and should be read in conjunction

with the Group's annual financial statements to 31 December 2022.

Accordingly, whilst the interim statements have been prepared in

accordance with IFRS, they cannot be construed as being in full

compliance with IFRS. The preparation of financial statements in

conformity with United Kingdom adopted International Financial

Reporting Standards (IFRS) requires the use of certain critical

accounting estimates. It also requires management to exercise its

judgement in the process of applying the Group's accounting

policies. The accounting policies adopted are consistent with those

followed in the preparation of the Group's annual financial

statements for the year ended 31 December 2022.

2. General information

The condensed consolidated financial information comprises the

financial information of the Company, Vector Asset Finance Ltd and

Vector Business Finance Ltd (the Group ).

The principal activities of the entities in the Group are as

follows : -

Name of company Country of incorporation Principal activities

------------------------- ------------------------- ---------------------

Vector Capital Plc England and Wales Holding company

Vector Business Finance England and Wales Commercial lending

Ltd

Vector Asset Finance Ltd England and Wales Commercial lending

There have been no significant changes in these activities

during the relevant financial periods .

3. Segmental reporting

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the chief operating decision maker (which

takes the form of the Board of Directors) as defined in IFRS 8, in

order to allocate resources to the segment and to assess its

performance.

Based on management information there is one operating segment.

Revenues are reviewed based on the services provided.

No customer has accounted for more than 10 % of total revenue

during the periods presented .

4. Income Tax expense

The tax charge on profits assessable has been calculated at the

rates of tax prevailing, based on existing legislation,

interpretation and practices in respect thereof.

5. Property, plant and equipment

Fixture, fittings and equipment

---------------------------------------------

30 Jun 30 Jun 31 Dec

23 22 22

(Unaudited (Unaudited)GBP'000 (Audited`)

GBP'000 GBP'000

Cost

Brought forward 5 5 5

Additions - - -

Disposals - - -

Carried forward 5 5 5

----------- ------------------- -----------

Accumulated depreciation

Brought forward 4 2 2

Depreciation - 1 2

----------- ------------------- -----------

Carried forward 4 3 4

----------- ------------------- -----------

NBV c/fwd 1 2 1

----------- ------------------- -----------

NBV b / fwd 1 3 3

----------- ------------------- -----------

6. Trade and other receivables

30 Jun 23 30 Jun 22 31 Dec 22

(Unaudited) (Unaudited) (Audited)

Current GBP'000 GBP'000 GBP'000

Trade receivables 48,810 51,604 51,709

Prepayments and accrued income 612 619 768

Total 49,422 52,223 52,477

-------------- -------------- ------------

Non-Current

Trade receivables - - 1,520

49,422 52,223 53,997

-------------- -------------- ------------

At 30 June 2023 48% of trade receivables were held by third

party secure funding via the block discounting facility (30 Jun 22:

54%, 31 Dec 22: 72%).

Trade receivables due after more than 1 year is not considered

material and therefore not reflected separately on the Balance

Sheet.

7 . Trade and other payables

30 Jun 23 30 Jun 22 31 Dec 22

(Unaudited) (Unaudited) (Audited)

Current GBP'000 GBP'000 GBP'000

Trade payable 38 31 11

Amounts owed to parent company - 3,000 -

Other payables 20,082 25,070 25,556

Accruals and deferred income 110 39 233

Total 20,230 28,140 25,800

-------------- -------------- ------------

Non-Current

Amounts owed to parent company 4,000 - 3,000

Other creditors - - 558

-------------- -------------- ------------

4,000 - 3,558

-------------- -------------- ------------

Other payables includes loan finance of GBP20,069k (30 Jun 22:

GBP24,882k, 31 Dec 22: GBP26,100k) which is secured against

associated loans assigned by way of block discounting.

8. Called up share capital

30 Jun 23 30 Jun 22 31 Dec 22

Authorised Nominal value (Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

45,244,385 Ordinary GBP0.005 226 226 226

9. Basic and diluted earnings per share

The calculation of earnings per share is based on the following

earnings and number of shares .

30 Jun 30 Jun 31 Dec

23 22 22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Total comprehensive income for

the period, used in the calculation

of total basic and diluted profit

per share 969 1,260 2,275

Weighted average number of ordinary

shares for the purpose of basic

and diluted profit per share 45,244,385 45,244,385 45,244,385

Earnings per share

Basic and diluted earnings per

share (pence) 2.14 2.79 5.03

10 . Significant related party transactions

The Group owed GBP4 million to its parent company, Vector

Holdings Ltd (30 Jun 22 GBP3 million, 31 Dec 22: GBP3 million).

During the period the Company paid interest totalling GBP97k to

Vector Holdings Ltd in relation to the balance owed as per the loan

agreement (30 Jun 22: GBP75k, 31 Dec 22: GBP150k).

During the period the Company paid GBP520k in dividends to

Vector Holdings Ltd (30 Jun 22: GBP513k, 31 Dec 22: GBP853k).

11 . Subsequent events

There were no significant subsequent events which warranted

disclosure.

12 . Half Year Report

A copy of this interim report, as well as the annual statutory

accounts to 31 December 2022 are available on the Company's website

at www.vectorcapital.co.uk/investors/corporate-documents

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCSGGDGXS

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

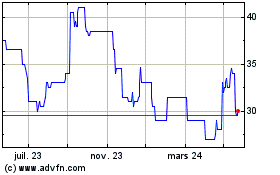

Vector Capital (LSE:VCAP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

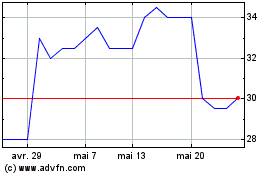

Vector Capital (LSE:VCAP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025