TIDMVCT

RNS Number : 6371V

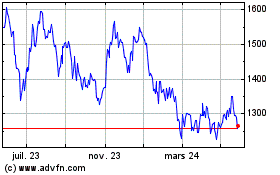

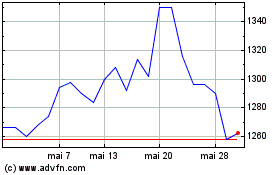

Victrex PLC

05 December 2023

5 December 2023

Victrex plc - Preliminary Results 2023

'PBT in-line & record Medical revenues'

*New mid-term growth targets*

Victrex plc is an innovative world leader in high performance

polymers, delivering sustainable products which enable

environmental and societal benefit. This announcement covers

preliminary results (audited) for the 12 months ended 30 September

2023.

FY 2023 FY 2022 % change % change

(reported) (constant

currency(1)

)

Group sales volume 3,598 tonnes 4,727 tonnes -24% N/A

------------- ------------- ------------ -------------

Group revenue GBP307.0m GBP341.0m -10% -13%

------------- ------------- ------------ -------------

Average selling GBP85.3/kg GBP72.1/kg +18% N/A

price (ASP)

------------- ------------- ------------ -------------

Gross profit GBP162.6m GBP174.5m -7% -10%

Gross margin 53.0% 51.2% +180bps N/A

------------- ------------- ------------ -------------

Underlying profit

before tax (PBT)(1) GBP80.0m GBP95.6m -16% -18%

------------- ------------- ------------ -------------

Reported PBT GBP72.5m GBP87.7m -17% -19%

------------- ------------- ------------ -------------

Underlying EPS(1) 77.7p 95.0p -18% N/A

------------- ------------- ------------ -------------

EPS 70.9p 87.6p -19% N/A

------------- ------------- ------------ -------------

Dividend per share 59.56p 59.56p flat N/A

------------- ------------- ------------ -------------

Highlights:

-- PBT in-line# after challenging year

- Underlying PBT in-line at GBP80.0m; reported PBT GBP72 .5 m

- FY 2023 volume down 24%; Group revenue down 10%

-- Significant weakness in Electronics, Energy & Industrial, VAR

-- Record Medical revenues +12% & broad-based growth; strong Aerospace performance

-- Robust cost discipline whilst prioritising Medical & innovation investment

-- Strong average selling prices; improved gross margin

- ASP up 18%, driven by price increases (& mix/FX)

- FY 2023 gross margin up 180bps, offset by lower asset utilisation

-- Well placed for macro-recovery, with new strategic growth targets

- Targeting mid-term revenue growth of 5-7% CAGR(##) based on core & new applications

- Upside potential to 8-10% CAGR driven by mega-programme commercialisation

- Targeting GBP25m-GBP35m of revenues from mega-programme portfolio in FY 2025

- Decarbonisation targets submitted to Science-based targets initiative (SBTi)

-- Mega-programmes prioritised to drive enhanced commercialisation

- Investment prioritised in streamlined portfolio: Aerospace, E-mobility, Knee, Magma, Trauma

- Key milestones delivered in pathways to GBP10m revenue:

-- E-mobility: GBP6m revenues, ahead of expectations & new customer collaborations

-- Trauma plates: growing demand & broader customer opportunities

-- Knee: clinical trial & top 5 OEM collaboration, 2-3 years to 1(st) sales

-- Aerospace: broader customer portfolio for composite parts & revenues growing

-- Magma: supporting TechnipFMC for Brazil scale up

-- Strong balance sheet & opportunity for cashflow improvement

- FY 2023 available cash(1) GBP30.1m (FY 2022: GBP66.0m) after major capex & higher inventory

- Well invested assets: new China facilities ready & UK facilities upgraded

- Inventory set to unwind from FY 2024 (FY 2023 inventory GBP134.5m vs FY 2022 GBP86.8m)

- Final dividend (###) maintained at 46.14p/share, reflecting confidence in future performance

(1) Alternative performance measures are defined in note 16

#in line with revised June 2023 guidance of GBP80m-GBP85m

underlying PBT

##revenue CAGR in 5 year period

###Proposed

Commenting on the Group's preliminary results, Jakob Sigurdsson,

Chief Executive of Victrex, said :

"After one of the most challenging years for the Chemical sector

and for Victrex, the Group delivered in line with guidance#. Strong

average selling prices, continued innovation, cost discipline and

well invested assets demonstrate the strength of our Polymer &

Parts strategy and business model. Record revenues in Medical -

with a new goal for Medical to double in five years and contribute

around one-third of revenues in less than 10 years - and growing

opportunities in China, with our new facilities ready to start up,

underpin our belief in the core and our mega-programmes.

Confidence in our strategy & new mid-term growth targets

"We have today set out new mid-term growth targets of 5-7% CAGR

for revenue, with an opportunity for 8-10% as our mega-programmes

further commercialise. PBT has the opportunity to grow faster than

revenue, as operating leverage improves and overhead investment

moderates. These targets reflect the opportunity from a

macro-economic recovery and industry indicators across Automotive,

Electronics and General Industrial, with the ability for our core

business to grow faster than the wider market through new and

differentiated applications. As our mega-programmes further

commercialise, we see additional upside potential. Investment is

now being prioritised around five key mega-programmes, offering

substantial opportunity across Aerospace, E-mobility, Knee, Magma

and Trauma. Several programmes are on the pathway to GBP10m

revenues and we are targeting GBP25m-GBP35m of revenues from the

mega-programme portfolio in FY 2025. With further long term upside

in the Medical programmes particularly, the total portfolio

opportunity remains broadly unchanged. Whilst Gears saw further

growth to GBP6m revenue, it is well down the adoption pathway and

enables us to prioritise investment elsewhere.

Further progress in mega-programme portfolio

"All of our mega-programmes met key technical or commercial

milestones during the year. Our E-mobility platform, focused on

electric vehicle applications, saw the strongest growth, ahead of

expectations with GBP6m revenues, new customer collaborations and

increasing penetration in major car brands.

"In Medical, we saw strong progress in Trauma and commercial

revenue building towards GBP1m. In Knee, our collaboration with a

top 5 Knee company in Aesculap (B Braun), and our partner Maxx in

the clinical trial, as well as engagement with major customers,

offers the potential for a commercial PEEK Knee in 2-3 years.

Outlook - a slow start but well placed for recovery &

growth

"The Group is expecting good progress in revenue and PBT for FY

2024, subject to an improving macro-economic outlook. Volumes have

the potential for double-digit growth although, at this early

stage, we have yet to see signs of a macro recovery, with a slow

start to our typically seasonally weak Q1. Consequently, growth is

expected to be second half weighted, which is consistent with some

end-market indicators pointing to improvement during 2024. Demand

continues to be soft in Electronics, Energy & Industrial and

VAR. Automotive and Aerospace remain positive, with Medical also

expected to deliver full year growth.

"Input costs are tracking lower year-on-year, although the

potential for energy volatility remains. Within operating

overheads, we expect only limited increases, despite wage inflation

and bonus accrual. However, the effect of lower asset utilisation

and start-up costs in China will have some effect on our cost of

manufacture and gross margin. In relation to currency, whilst spot

rates imply a headwind, our hedging will offset this impact to

PBT.

"Overall, the Group is well placed for recovery and growth. With

a strong and diversified core business, increasing

commercialisation in our mega-programmes, well invested assets and

incremental capacity, and the opportunity for cashflow improvement,

our investment proposition remains strong."

About Victrex:

Victrex is an innovative world leader in high performance

polymer solutions, focused on the strategic markets of automotive,

aerospace, energy & industrial, electronics and medical. Every

day, millions of people use products and applications which contain

our sustainable materials - from smartphones, aeroplanes and cars

to energy production and medical devices. With over 40 years'

experience, we develop world leading solutions in PEEK and PAEK

based polymers, semi-finished and finished parts which shape future

performance for our customers and our markets, enable environmental

and societal benefits, and drive value for our shareholders. Find

out more at www.victrexplc.com

A presentation for investors and analysts will be held at 9.

00am (UK time) this morning via a dial-in facility, which can be

accessed by registering on the following link:

https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=5475738&linkSecurityString=e8f40c1d8

The presentation will be available to download from 8.30am (GMT)

today on Victrex's website at www.victrexplc.com under the

Investors/Reports & Presentations section.

Victrex plc:

Andrew Hanson, Director of Investor Relations,

Corporate Communications & ESG +44 (0) 7809 595831

Ian Melling, Chief Financial Officer +44 (0) 1253 897700

Jakob Sigurdsson, Chief Executive +44 (0) 1253 897700

Preliminary results statement for the 12 months ended 30

September 2023

'PBT in-line & record Medical revenues'

*New mid-term growth targets*

Operating review

Volume and revenue down, despite record Medical performance

With a continuing challenging trading environment during the

second half, full year Group sales volume of 3,598 tonnes was 24%

down on the prior year (FY 2022: 4,727 tonnes). In line with

similar declines seen across the Chemical sector, the Group

delivered full-year revenue of GBP307.0m, which was down 10% (FY

2022: GBP341.0m). In constant currency(1) Group revenue was 13%

down on the prior year.

H2 2023 volume and revenue

Trading in the final quarter (Q4) remained similar to Q3,

resulting in a H2 2023 sales volume of 1,657 tonnes (H2 2022: 2,463

tonnes), with H2 2023 revenue of GBP144.8m down 20% (H2 2022

revenue: GBP180.9m). With the weaker macro-economic environment

impacting several end-markets, our FY 2023 result was achieved

through a combination of a strong focus on pricing and cost

discipline, including minimising discretionary spend and deferral

of certain recruitment. Investment was sustained in our priority

areas of Medical and innovation to support differentiated

applications or mega-programme commercialisation.

Divisional performance

Despite weakness across several end-markets in our Sustainable

Solutions (formerly Industrial) area, primarily Electronics, Energy

& Industrial and our Value Added Resellers (VAR) area, we saw a

good performance in Aerospace, with volumes up 20% as build rates

increase, together with new application growth. VAR was the weakest

area, with volumes down 39%, driven by destocking and weak demand.

Whilst Automotive volume was stable (and up in revenue terms), we

note that 2024 market indicators support the opportunity for

growth, with car sales set to increase by 1-3% (S&P November

2023). Revenue in Sustainable Solutions was down 14% at GBP241.8m

(FY 2022: GBP282.7m).

Medical revenues of GBP65.2m were a record and increased by 12%

compared to the prior year (FY 2022: GBP58.3m), driven by broad

based application growth. Across our core business of Spine,

Arthroscopy and Cranio Maxillo-Facial (CMF), we continue to see

good growth opportunities, with support from increasing penetration

in Cardio, Orthopaedics and Drug Delivery. Our Non-Spine area

represents the most significant growth opportunity, as PEEK's inert

nature and strong biocompatibility drives increased application

usage. Revenues in Medical are now 46% Spine and 54% Non-Spine.

Growth was broad based by region, with Asia driving the highest

revenue growth of 31%.

Strong ASP driven by pricing & sales mix

FY 2023 saw good progress in recovering the significant energy

and raw material inflation seen over the past two years. Average

selling prices (ASPs) increased by 18% to GBP85.3/kg, driven by

price increases, sales mix and currency. The overwhelming majority

of price increases were achieved via structural price

increases.

For FY 2024, we anticipate average selling prices will remain

comfortably in excess of GBP80/kg. This reflects some expected

recovery in end-markets within Sustainable Solutions, which will

result in a slightly less favourable sales mix.

Core business application pipeline

Despite a challenging macro-economic environment, we continue to

build our core business growth pipeline, to support PEEK's use in a

range of applications, driven by its lightweighting, durability,

chemical and heat resistance, or other properties.

Mature Annualised Revenues (MAR), which reflect the pipeline of

incremental opportunities in the core business, was robust at

GBP300m (FY 2022: GBP294m). This number assumes all targets are

converted. Automotive and Medical opportunities showed the highest

year on year growth, reflecting the increasing range of

applications within these end-markets.

Sales from new products increased to 7%

Our measure of Sales from new products revenue increased to 7%

of Group revenue for FY 2023 (FY 2022: 6%). From FY 2023, sales

from new products was based on new products and grades, including

some mega-programmes, introduced over the past seven years, rather

than from FY 2014. Recent examples of new product grades included

in this definition being our Victrex XPI(TM) polymer for E-mobility

and Victrex PC101(TM), a medical grade for use in drug delivery

devices.

Going forward, our priority will be on measuring our newly

introduced goal of mega-programme portfolio revenues.

Mega-programme highlights: investment prioritised &

streamlined portfolio

With several programmes on their journey towards GBP10m revenue

per annum (Aerospace, E-mobility, Magma and Trauma), we have chosen

to prioritise investment in five key programmes to enhance

strategic progress. This also ensures that we measure appropriate

investment, resource and capability in order to improve our

returns.

PEEK Gears continues to see good growth and opportunities in ICE

and EV platforms, but as the focus is now on progressing adoption,

it will no longer be defined as a mega-programme and will be

overseen as part of our core business, as we prioritise investment

in E-mobility and elsewhere. PEEK Gears delivered growth to GBP6m

revenue this year, vs over GBP4m in FY 2022. Having successfully

seeded the market, it also reflects that the route to market is via

both parts manufacture and polymer resin based sales, where a third

party manufacturer would build the final component, based on

Victrex design, development and know-how. As a result, there has

been no significant change in the overall portfolio value, with

several mega-programmes offering revenue potential of significantly

more than GBP50m per year (e.g. Knee).

Key highlights in our mega-programme portfolio include:

Our E-mobility mega-programme platform is based on specific

electric vehicle applications and drove the most growth of all

mega-programmes during the year, with business wins specifically

focused on wire coating and other applications. This programme

delivered revenue of GBP6m this year, with better than expected

progress as our materials supported major car brands. This

mega-programme includes Victrex XPI (TM) grade, which enables

coatings of tightly wound electric wires for existing and primarily

next generation high-voltage vehicles (800 volt batteries and

applications), where higher performance is required. Compared to

previous enamel coatings, VICTREX XPI(TM) is extruded onto the

copper and requires less energy in the process, supporting

sustainability goals. With penetration in battery applications and

elsewhere in electric vehicles, we assess the future potential PEEK

content per electric vehicle as over 200g (average content in

existing internal combustion engine car approximately 10g today).

We are collaborating with multiple customers, and signed a

strategic collaboration agreement with Well Ascent, a major wire

coating manufacturer, supplying into European, Asian and US car

manufacturers, including existing Chinese models. Continued growth

in E-mobility is expected during FY 2024, with the potential for

GBP10m revenue within two years.

In our Magma composite pipe programme for the energy industry,

we saw close collaboration with TechnipFMC and a team from the

end-customer in Brazil, including detailed technical and commercial

meetings hosted at our UK facilities. The primary focus is

supporting TechnipFMC to accelerate the significant opportunities

for thermoplastic composite pipe in deepwater oil & gas fields

in Brazil, with light-weighting, durability, a reduced carbon

footprint for installation and ease of manufacturing being key

parts of the proposition. Multiple field opportunities are being

targeted in Brazil, requiring alternative solutions to existing

performance issues with metal-based pipes. PEEK based Hybrid

Flexible Pipe (HFP) is seen by TechnipFMC as the most cost

effective riser solution, with TechnipFMC constructing a new pipe

extrusion facility in Brazil, incorporating Victrex's pipe

extrusion know-how. We continue to await outcomes on existing bids

by TechnipFMC, utilising this technology, which offers the

potential for a step up in volume from 2025. This programme offers

good mid-term potential towards GBP10m annual revenues with the

next key milestone being bid outcomes.

In Trauma, we saw a significant step up in demand post FDA

approval and launch, with revenues building towards GBP1m this

year, and further expected growth in the coming years. This was

primarily driven by our partnership with In2Bones (part of CONMED)

and other customers for PEEK composite Trauma plates, supporting

fracture fixation, including in foot and ankle plates. Over 3,000

Victrex manufactured trauma plates were supplied for implants.

Studies show an enhanced union rate using PEEK composites rather

than titanium based plates . Victrex manufactures the PEEK

composite based trauma plates in-house, or via our partner, Paragon

Medical, who will toll manufacture in China, supporting a growing

customer base in the US, Asia and globally. This programme has the

potential for double-digit revenues within the next two to three

years.

In our Aerospace Composites programme, which combines the

programmes for smaller composite parts, larger structural parts and

interior applications, we are advancing qualifications with OEMs,

including Airbus and Boeing, and tier companies as thermoplastic

composites based on PEEK are validated and qualified. Major

structural parts include for wings, engine housing and fuselage.

The potential PEEK content per plane is at least 10-times current

levels, with large scale demonstrator parts being exhibited and

advancing through qualification programmes. We have also broadened

the number of customers we are working with as part of this

programme, beyond the Airbus Clean Sky 2 programme, reflecting the

significant opportunity for light-weight and easily processed PEEK

composite materials. In both structural and smaller composite based

parts, our AE (TM) 250 composite tape is integral to these

opportunities. Smaller composite parts currently being used on

aircraft include for use in seat pans and door brackets. Revenue

for these programmes in FY 2023 was nearly GBP3m, with the

potential opportunity to GBP10m in the next two to three years and

good long-term prospects.

In our PEEK Knee programme, we saw particularly strong progress.

We are working with Maxx Orthopaedics, our partner in the clinical

trial across Belgium, India and Italy, as well as Aesculap (part of

B Braun), a top 5 global knee company. We also have interest in the

progress of PEEK Knee from other top 10 organisations. 46 patients

to date have been implanted with a PEEK Knee, with no remedial

intervention required. Ten patients have also passed the two year

stage with no intervention, which is particularly encouraging. Both

of these companies, supported by our Medical business, are focusing

on the route to early commercialisation. Our offering has also

expanded beyond a cemented PEEK Knee implant, to include cementless

and tibia options, which enables us to offer a broader suite of

customer solutions. The next milestone is targeted as commencing a

US clinical trial during FY 2024. PEEK Knee would be an alternative

to existing surgeries, which primarily use metal (cobalt chrome).

Early assessment suggests the opportunity of first sales within two

to three years, subject to the appropriate regulatory pathway. PEEK

Knee remains the largest of our mega-programme opportunities by

annual revenue potential.

Innovation investment

Our new innovation investment during FY 2023 was primarily

supporting our Medical Acceleration programme. This includes an

investment in our New Product Development (NPD) Centre in Leeds,

UK, to support new roles and capability. R&D investment was

higher this year at GBP18.6m (FY 2022: GBP15.7m) representing 6% of

revenues on a full year basis, with the higher percentage

reflecting incremental investment and lower revenues. Our total

R&D investment in dedicated sustainable products or programmes

as a proportion of total R&D investment increased to 40% (FY

2022: 35%). This metric has been updated from prior disclosures,

which measured project-based, non-labour R&D spend in

sustainable programmes (92% for FY 2023 vs 89% for FY 2022), rather

than total R&D spend. A level of 40% of total R&D

investment in dedicated sustainable products or programmes

underlines our focus in this area.

Financial review

Gross profit down 7%

Gross profit was down 7% at GBP162.6m (FY 2022: GBP174.5m),

primarily driven by lower sales. Energy costs eased, yet raw

materials remained relatively high. We also incurred some

under-absorbed fixed costs (totalling approximately GBP3m) as a

result of lower production volumes compared to FY 2022 (production

volumes 9% lower). For FY 2024, we anticipate some modest benefit

from lower input costs, offset by start-up and under-utilised asset

costs in China (including costs moving from overheads to COGs), as

well as depreciation and lower asset utilisation (UK and China), as

we start to gradually unwind inventory from its high level.

Gross margin slightly ahead

Full year Group gross margin of 53.0% was 180 basis points (bps)

ahead of FY 2022 (FY 2022: 51.2%), supported by improved pricing

and a favourable sales mix. Second half Group gross margin of 52.4%

was slightly below the first half, impacted by lower asset

utilisation and the corresponding impact on under absorbed fixed

costs. The impact from losses on forward hedging contracts was also

higher than the prior year.

We remain focused on a mid-to-high fifty percent gross margin

level over the medium term, whilst noting that sales mix, asset

utilisation and the expected increase in parts contribution to

revenue will play a key role over the coming years. For FY 2024, we

anticipate Group gross margin will be slightly lower than the prior

year, reflecting start up costs in China and lower asset

utilisation as we start to unwind inventory over the next two

years. Currency also impacts gross margin.

Gains & losses on foreign currency net hedging

Fair value gains and losses on foreign currency contracts in FY

2023 were a loss of GBP7.6m (FY 2022: loss of GBP2.8m), largely

from contracts where the deal rate obtained in advance was

unfavourable to the average exchange rate prevailing at the date of

the related hedged transactions, following the devaluation of

Sterling from mid H2 2022. The corresponding spot rate benefit is

largely seen in the revenue line.

Currency tailwind in FY 2023

FY 2023 saw a currency tailwind of approximately GBP3m at profit

before tax (PBT) level, with most of this coming in the first half,

prior to Sterling recovering. At this early stage, spot rates show

currency for FY 2024 is tracking as a modest headwind. This is

prior to the impact of hedging, with gains and losses on foreign

currency net of hedging tracking as a small gain. We are mindful of

unhedged currencies - predominantly in Asia - which are set to

increase in importance as we see growth in China and other parts of

Asia over the coming years. Recent devaluation in these currencies

has contributed to the spot rate headwind in FY 2024.

Our hedging policy is kept under review, for duration of

hedging, level of cover and specific currencies. It requires that

at least 80% of our US Dollar and Euro forecast cash flow exposure

is hedged for the first six months, then at least 75% for the

second six months of any twelve-month period.

Operating overheads (1) up 5%; H2 overheads down 14%

Operating overheads(1) , which excludes exceptional items of

GBP7.5m, increased to GBP81.9m (FY 2022: GBP78.1m) driven primarily

by higher innovation spend (R&D is now separately disclosed on

the face of the income statement), with targeted R&D investment

commencing last year, primarily to support Medical acceleration. We

also saw wage inflation, including targeted cost of living payments

to support global employees at certain grades.

We also incurred costs to support the commercial ramp up for our

new China PEEK facilities. This facility will underpin further

commercial growth in this region over the coming years, driven by

new polymer grades to meet existing and new demand. Following

commissioning and production of first PEEK, we will start to ramp

up and support revenues in early 2024.

Pleasingly, second half operating overheads were down 14%

compared to H1 2023 (and down 9% vs H2 2022), which reflects strong

cost discipline and the impact of no accrual for bonus, as profits

fell.

Going forward, our intention is to ensure investment remains

targeted and to deliver an appropriate return. Operating overheads

are therefore expected to show only limited increases for FY 2024,

including the effect of wage inflation and bonus accrual.

Underlying PBT down on weaker trading environment

Underlying PBT of GBP80.0m was in-line with our revised guidance

and down 16% on the prior year (FY 2022: GBP95.6m).

Reported PBT reduced by 17% to GBP72.5m (FY 2022: GBP87.7m).

This reflects exceptional items of GBP7.5m (FY 2022: GBP7.9m),

representing the cost of implementing a new ERP software system,

the majority of which has been incurred. The implementation will be

substantially completed during 2024.

Earnings per share down 19%

Basic earnings per share (EPS) of 70.9p was 19% down on the

prior year (FY 2022: 87.6p per share), reflecting the decline in

PBT. Underlying EPS was down 18% at 77.7p (FY 2022: 95.0p).

Taxation

Victrex continued to benefit from the reduced tax rate on

profits taxed under the UK Government's Patent Box scheme, which

incentivises innovation and consequently highly skilled Research

& Development jobs within the UK. Net taxation paid was GBP2.0m

(FY 2022: tax paid of GBP10.6m), with the effective tax rate of

15.9% (FY 2022: 13.9%), being slightly higher due to the increase

in UK corporation tax and a lower proportion of profits being

eligible for the patent box rate. Our mid-term guidance for an

effective tax rate has slightly increased to approximately 13%-17%

primarily reflecting the increase in the UK Corporation tax rate

from 19% to 25% from 1 April 2023. We continue to monitor global

taxation developments.

Strong balance sheet

With a range of global customers across our end-markets,

customers recognise and value our strong balance sheet, and our

ability to invest and support security of supply. Net assets at 30

September 2023 totalled GBP501.0m (FY 2022: GBP490.6m).

Return on capital employed (ROCE) and return on sales (ROS) are

focus areas for the Group. After a period of investment in people,

capability and assets, we have the opportunity to improve operating

leverage. Return on sales is a specific KPI we are seeking to

improve, having reduced to 26% in FY 2023 (FY 2022: 28%).

Inventory higher due to softer demand; opportunity for

unwind

For FY 2023, we were required to rebuild raw material

inventories to safety stock levels, to support security of supply

for customers. Several raw materials had run below or close to

safety stock levels during the pandemic, with supply chains

impacted. During the year, we also built inventory to reflect

planned engineering work in H1 2024, which is required as part of

our UK Asset Improvement programme and asset shutdowns.

With the weaker trading environment persisting during the second

half, total closing inventory was higher than expectations at

GBP134.5m (FY 2022: GBP86.8m), which also includes the impact of

higher energy and raw material costs. Upon completion of our UK

Asset Improvement programme in early 2024, we have the opportunity

to start unwinding inventory over the next 1-2 years.

First PEEK in China; commercial ramp-up in FY 2024

With commissioning concluding, including the successful

production of first PEEK prior to commercial start-up, we will be

ramping up commercial production from early 2024. The China

facility, PVYX, will enable us to broaden our portfolio of PEEK

grades, including a new Elementary type 2 PEEK grade, as well as

target a number of key end-markets, particularly Automotive,

Electronics and VAR. Close collaboration with customers continues,

in support of their own growth plans in China. We also invested in

some additional capability within China to support customers, for

example in compounding. With a strong sales and supply chain team,

our technical centre in Shanghai, and our new manufacturing assets,

we are underpinning our future growth.

Capital expenditure set to reduce

Growth investment remains the priority, with cash capital

investment during the year of GBP38.5m (FY 2022: GBP45.5m), of

which a significant proportion was to support our China

manufacturing investments. A large proportion of the China

investment was funded through utilisation of the Group's China

banking facilities.

Other investments included our UK Asset Improvement programme

(we anticipate this will be approximately GBP15m in total, with

most spend already completed and a further GBP5m in FY 2024). This

UK investment will support increased capacity due to batch sizes

and faster cycle times, offering a total nameplate capacity in

excess of 8,000 tonnes (approximately 1,000 tonnes of additional

capacity gained from this investment). This supports growth for the

years ahead and is particularly key in engagement with major OEMs

for high volume opportunities in Aerospace, Automotive and the

Magma programme.

After conclusion of these investments, we see a limited need for

sizeable polymer capacity in the medium term, which will drive

lower capital expenditure. Overall capital expenditure for FY 2024

is expected to be approximately GBP30m-GBP35m, or 8-10% of

revenues. Over the medium term, this will include increased ESG

related capital investment in our manufacturing facilities, to

support decarbonisation. Current ESG related capital expenditure

remains relatively small and is primarily for our Continuous

Improvement (CI) activities. Our increased capacity is expected to

enhance asset efficiency.

Cashflow

Cash generated from operations was GBP42.9m (FY 2022: GBP90.7m),

giving an operating cash conversion(1) of 18% (FY 2022: 49%). This

was driven by the weaker trading environment and increased

inventory. We expect to see an improvement on operating cash

conversion in FY 2024.

Cash and other financial assets at 30 September 2023 was

GBP33.5m (FY 2022: GBP68.8m). This lower cash position reflects

weaker demand and capital expenditure. It also includes GBP3.4m

ring-fenced in our China subsidiaries (FY 2022: GBP2.8m) and other

financial assets of GBP0.1m, representing cash which was held in

deposit accounts greater than three months in duration (FY 2022:

GBP10.1m). With utilisation of the Group's China bank facilities -

put in place for the period of investment in new China

manufacturing assets - borrowings (current and non-current) at 30

September 2023 were GBP39.7m (FY 2022: GBP22.5m).

In Bond 3D, which is making good progress in porous PEEK spinal

cages for medical, with regulatory approval planned in FY 2024, we

committed a further GBP2.9m in convertible loan notes during the

year. This takes the total carrying value of assets in Bond 3D to

GBP18.8m (FY 2022: GBP17.0m). Further investment is required to

complete the development phase and fund through to cash break-even,

with the Bond board targeting new investors during 2024.

In February 2023 we paid the 2022 full year final dividend of

46.14p/share at a cash cost of GBP40.1m and in July 2023 paid the

interim dividend of 13.42p/share at a cash cost of GBP11.7m. After

the year end, the Group renewed its UK banking facilities,

increasing the level of facilities to GBP60m (GBP40m committed and

GBP20m accordion) to reflect higher inventory and provide support

against the current weaker trading environment. The facility

expires in October 2026.

Dividends

Despite the weaker trading environment during the year, the

Board is proposing to maintain the final dividend at 46.14p/share

(FY 2022: 46.14p/share), which reflects the Group being well placed

for a macro-economic recovery. Underlying dividend cover (1) was

1.3x (FY 2022: 1.6x). The Group intends to grow the regular

dividend in line with earnings growth once dividend cover returns

closer to 2x.

Capital allocation; share buybacks a consideration, alongside

special dividends

Whilst growth investment remains the focus for the Group, we

note the income attractions of Victrex, with a cash generative

business model. We continue to review a number of potential

investment opportunities, particularly in Medical as we see

significant opportunities to enhance our portfolio. Following

engagement with shareholders during the year, share buybacks are

now included as an option for future shareholder returns, alongside

special dividends, within our capital allocation policy. Reflecting

the liquidity of Victrex shares, any future buyback programme is

likely to require a lower cash level than that required for special

dividends. Current cash resources would not support a sufficient

buyback programme at this time, although we note the prospect of

improving cashflows as capital expenditure reduces and inventory

levels come down.

Sustainability

Victrex's Sustainability credentials are strong as part of our

'People, Planet and Products' agenda. During the year we saw

sustainable product revenues increase to 55%(2) (FY 2022: 48%). At

the end of FY 2023, we concluded our SBTi submission, aligning our

goals with Science Based Targets across scope 1, 2 and 3 and a

range of decarbonisation options available for us. Post review and

validation by SBTi, we expect to communicate exact reduction

targets during FY 2024, which will be equivalent to an annualised

reduction of approximately 4% to 2050.

FY 2024: Sustainable Solutions & Medical

Following the retirement of our Chief Commercial Officer, Martin

Court, we are further enhancing our focus on delivering growth

through the creation of our Sustainable Solutions (formerly

Industrial) and Medical business areas for FY 2024 onwards. These

will be led by Managing Directors Michael Koch and John Devine

respectively. The re-positioning of Industrial to Sustainable

Solutions has been driven by how we are increasingly demonstrating

the technical, environmental or societal benefits our products

bring to customers.

Mid-term growth targets

Our new mid-term core growth targets 5-7% CAGR on revenue in the

five year period of our strategic plan. This is broadly in line

with our performance on sales volume since 2015 (excluding Consumer

Electronics). These targets reflect the opportunity from a

macro-economic recovery in our core business, with the ability to

grow faster than the wider market through new and differentiated

applications, including growth in China. As our mega-programmes

further increase their commercialisation - whilst noting growth

rates will be influenced by the timing of milestones achieved and

the adoption pathway - we see upside potential towards double-digit

growth (8-10%) . With improved operating leverage and more modest

investment expected, PBT has the opportunity to grow faster than

revenue.

We are also targeting GBP25m-GBP35m of revenues from

mega-programmes in FY 2025 (current mega-programme revenues of

GBP11m, which excludes GBP6m of Gears revenue).

Outlook - a slow start but well placed for recovery &

growth

The Group is expecting good progress in revenue and PBT for FY

2024, subject to an improving macro-economic outlook. Volumes have

the potential for double-digit growth although, at this early

stage, we have yet to see signs of a macro recovery, with a slow

start to our typically seasonally weak Q1. Consequently, growth is

expected to be second half weighted, which is consistent with some

end-market indicators pointing to improvement during 2024. Demand

continues to be soft in Electronics, Energy & Industrial and

VAR. Automotive and Aerospace remain positive, with Medical also

expected to deliver full year growth.

Input costs are tracking lower year-on-year, although there

remains the potential for energy volatility. Within operating

overheads, we expect only limited increases, despite wage inflation

and bonus accrual. However, the effect of lower asset utilisation

and start-up costs in China will have some effect on our cost of

manufacture and gross margin. In relation to currency, whilst spot

rates imply a headwind, our hedging will offset this impact to

PBT.

Overall, the Group is well placed for recovery and growth. With

a strong and diversified core business, increasing

commercialisation in our mega-programmes, well invested assets and

incremental capacity, and the opportunity for cashflow improvement,

our investment proposition remains strong.

Jakob Sigurdsson

Chief Executive, 5 December 2023

(1) Alternative performance measures are defined in note 16

(2) Other internal metrics are defined below

DIVISIONAL REVIEW

Sustainable Solutions (formerly Industrial)

12 Months 12

Months

Ended Ended %

30 Sep 30 Sep % Change

2023 2022 Change (constant

GBPm GBPm (reported) currency)

-------------- ---------- -------- ----------- ----------

Revenue 241.8 282.7 -14% -17%

Gross profit 110.5 124.8 -11% -14%

-------------- ---------- -------- ----------- ----------

Victrex's divisional performance is reported through Sustainable

Solutions (formerly Industrial) and Medical. The Group continues to

provide an end-market based summary of our performance and growth

opportunities. Within Sustainable Solutions end-markets, we have

the Energy & Industrial, Value Added Resellers (VAR), Transport

(Automotive & Aerospace) and Electronics.

A summary of all the mega-programmes and the strong progress

made during the year, is covered earlier in this report.

Weaker end markets driving revenue down 14%

The Sustainable Solutions division saw revenue of GBP241.8m (FY

2022: GBP282.7m), down 14% on the prior year, with a decline across

Electronics, Energy & Industrial and VAR, as these end markets

remain weak. Revenue in constant currency was down 17%. With

improved pricing and a more favourable sales mix, gross margin was

up by 160bps to 45.7% (FY 2022: 44.1%).

Energy & Industrial

Energy & Industrial sees our materials used in a range of

energy applications where Victrex(TM) PEEK has a long-standing

track record of durability and performance benefit in many

demanding Oil & Gas applications. Sales volume of 639 tonnes,

was down 23% on the prior year (FY 2022: 830 tonnes), reflecting

the weaker performance across this area, which is currently a

challenging end-market. Industrial (which makes up more than half

of this segment) is driven by global activity levels and capital

goods equipment, which was weaker during the period.

Elsewhere in the new energy space, we continue to assess

applications in Hydrogen, where PEEK's inert nature and durability

could have a strong play. In Wind, we have gained business on wind

energy applications supporting durability in harsh environments.

Energy volumes overall were down 19%.

Value Added Resellers (VAR)

Victrex has significant business through VAR, much of which is

specified by end users. End market alignment, whilst difficult to

fully track, supports a similar alignment to our Sustainable

Solutions end-markets, with the exception of Aerospace, where sales

volumes are largely direct to OEMs or tier suppliers. VAR is often

a good barometer of the general health of the supply chain, with

VAR customers processing high volumes of PEEK into stock shapes, or

compounds.

After a strong period of growth and a strong comparative, VAR

saw a particularly challenging year, leading to a 39% decline in

VAR volumes, to 1,304 tonnes (FY 2022: 2,122 tonnes). Destocking

was a key contributor in VAR volumes falling significantly this

year, as supply chains adjusted to weaker demand, continuing the

volatility in order patterns seen since the start of the pandemic.

Although visibility remains low, we are well placed for when the

global economic environment improves, with VAR typically seeing a

strong bounce back as demand improves and restocking commences.

Transport (Automotive & Aerospace)

Our Transport area builds on both legacy applications and new

applications with the use of composites or new innovative materials

in aircraft and electric vehicles. We continue to have a strong

alignment to the CO2 reduction megatrend, with our materials

offering lightweighting, durability, comfort, dielectric properties

and heat resistance. As well as long standing core business within

Automotive & Aerospace across a range of application areas, we

also made good progress in our Transport related mega-programmes of

E-mobility and Aerospace Composites.

Overall Transport sales volume was up 4% to 950 tonnes (FY 2022:

913 tonnes), with Aerospace up 20% and Automotive flat (Automotive

revenue up 9%).

Automotive

In Automotive, supply chains continue to impact growth, although

we note market indicators support a return to modest car production

growth in 2024, with S&P forecasting a 1-3% increase in car

production (S&P October 2023). Core applications include

braking systems, bushings & bearings and transmission

equipment, with increasing opportunities and new business wins in

electric vehicles, supporting a growing E-mobility business.

Translation across internal combustion engine (ICE) to electric

vehicles (EVs) remains a net benefit opportunity, with current PEEK

content averaging around 10g per car. Our assessment of the EV

opportunity is now for a long term potential of over 200g per

electric vehicle, with several application areas.

We also gained some new gear business in the e-bike market

during the year, which is expected to grow.

Aerospace

Aerospace volumes were up 20%, reflecting the benefit of plane

build increasing during the year and new application growth.

Application growth includes in Aptiv(TM) film and also our AE(TM)

250 PEEK grade (and use as composite tape). Emerging areas of

business include the potential from PEEK's inert characteristics

within fuel systems, including sustainable fuels. Our

mega-programmes in Aerospace were consolidated into one programme

of Aerospace Composites to simplify and focus resources. Aerospace

Composites supports smaller and larger structural parts for Airbus,

Boeing and tier companies, with qualifications well advanced,

existing parts on planes and larger demonstrator parts being

exhibited by major customers, ahead of commercial adoption.

FY 2023 also saw applications with COMAC start to yield growing

revenue. Whilst relatively small at this stage (based on plane

build of approximately two planes per month) we note the planned

ramp up of production over the coming years.

The mid-term outlook for Aerospace is good. We continue to

consider future plane build forecasts, with our assessment that

over 53 million tonnes of CO2 could be saved over the next 15 years

if all new single aisle planes were produced with over 50% PEEK

composite content.

Electronics

2023 was a tough year for the global Semiconductor market and

Consumer Electronics. Volumes into Semiconductor typically make up

close to half of our Electronics exposure. Total Electronics

volumes were down 23% at 513 tonnes (FY 2022: 662 tonnes), though

we note industry forecasts suggesting an improvement in 2024 for

Semiconductor of 11.8% (WSTS October 2023).

Victrex has historic business in this end market, for core

applications like CMP rings (for Semiconductor), as well as new

applications utilising PEEK, including for Semiconductor, 5G, cloud

computing and other extended application areas. Our Aptiv (TM) film

business and small space acoustic applications remain well

positioned, though consumer devices was an area significantly

impacted by the global downturn.

Home appliances has been an area of growth in recent years and

our impeller application business in high-end brands continues to

offer good growth opportunities. These applications, with lighter

materials and enhanced durability, also offer the opportunity for

improved energy efficiency.

Regional trends

With a more challenging global macro-economic environment,

regional performance in Europe and North America was adversely

affected, with North America being the most impacted.

Overall by region. Europe was down 25%, at 1,903 tonnes (FY

2022: 2,554 tonnes), driven by declines in Energy & Industrial

and VAR primarily. North America was down 32% at 650 tonnes (FY

2022: 952 tonnes), principally driven by Energy & Industrial.

Asia-Pacific was down 14% at 1,045 tonnes (FY 2022: 1,221 tonnes),

as we saw declines in Electronics and VAR.

Medical

12 Months 12

Months

Ended Ended %

30 Sep 30 Sep % Change

2023 2022 Change (constant

GBPm GBPm (reported) currency)

-------------- ---------- -------- ----------- ----------

Revenue 65.2 58.3 +12% +7%

Gross profit 52.1 49.7 +5% +2%

-------------- ---------- -------- ----------- ----------

Our strategy of Polymer & Parts also includes a goal of

increasing the proportion of Medical revenues for the Group, above

one-third of revenues by 2032 from a baseline year of FY 2022 (FY

2023 had Medical share of Group revenue at 21% vs FY 2022 at 17% of

Group revenue). As a high value segment, this end market is seeing

a broader range of opportunities to meet patient and surgeon

requirements, as PEEK's performance supports improved patient

outcomes. To date, over 15 million patients have PEEK implanted

devices.

Medical saw a record performance in FY 2023, driven by further

recovery of elective surgeries post pandemic, and new application

growth. Revenue in Medical was up 12% at GBP65.2m (FY 2022:

GBP58.3m). In constant currency, Medical revenue was up 7%.

Gross profit was GBP52.1m (FY 2022: GBP49.7m) and gross margin

was slightly lower at 79.9% (FY 2022: 85.2%) primarily reflecting

sales mix and the higher growth in non-Spine. We continue to see

faster growth in non-Spine as we purposely target emerging or

developing application areas in Cardio, Drug Delivery and Active

Implantables. Geographically, Asia-Pacific revenues were up 31%

year on year, with Medical revenues in the US up 4% and Europe up

9%.

Progress on the Medical mega-programmes is covered in the

operating review.

Medical strategy

Our Medical aspirations are for our solutions to treat a patient

every 15-20 seconds by 2027 (from approximately 25-30 seconds now)

and the Group is prioritising targeted investment in Medical,

including a New Product Development Centre of Excellence in Leeds,

UK, which opened during the year. This facility will support

customer scale up in Trauma and Knee, aligned to major medical

device companies, as well as working closely with academia. It was

one of the key overhead investment items in FY 2023, as we build

additional capability and skills in this area, with approximately

25 new roles initially.

Our Medical manufacturing capability is already strong in

driving innovation for our parts businesses. As we focus on scale

up, we have established a manufacturing partner for Trauma plates,

Paragon Medical (Paragon), in China, whilst retaining the design

and development know-how. Paragon, who are contracted by many of

the major global medical device companies, will help us to meet the

initial excess demand. Our customer base is growing in this area,

with additional development agreements now in place.

Spine and non-Spine

Non-Spine offers the highest growth area for our core business

over the medium term. Several application areas have seen good

growth, including Arthroscopy and Cranio Maxillo-Facial (CMF). CMF

also offers us an opportunity through 3D printed parts, with new

product grades introduced in this area, driving growth of 38% this

year.

Our current revenue split shows 46% of segmental revenue from

Spine and 54% non-Spine. Next generation Spine products will be key

in maintaining PEEK's position in this segment, including the

opportunity for Porous PEEK, where a spinal cage can support

bone-in growth as well as bone-on growth. A US 510k submission is

targeted during FY 2024. Whilst we continue to innovate and develop

new products for Spine, partly through our associate investment in

Bond 3D, usage of 3D printed titanium cages continues, largely in

the US. PEEK within Spinal fusion remains strong in Asia and

Europe. In China, we are mindful of both the opportunities and

risks from the emerging volume-based procurement (VBP) approach,

The first VBP cycle for Spine occurred during FY 2023 with the

cycle for some other applications expected during FY 2024 . Our

premium and differentiated PEEK-OPTIMA(TM) HA Enhanced product

(POHAE) - to drive next generation Spine procedures - is one part

of our strategy, alongside the introduction of Porous PEEK, to grow

our Medical business, with annualised revenues being approximately

GBP2m and good opportunities globally, and in Asia

particularly.

Other non-Spine applications include Cardio. More than 250,000

patients have now benefited from PEEK being used in heart pumps,

containing implantable grade PEEK. We also introduced a new

pharmaceutical grade, PC-101, for use in drug delivery devices and

pharmaceutical contact.

Other internal metrics:

In addition to the Alternative performance measures defined in

note 17 there are a number of other internal metrics, which are

used by the Board in evaluating performance, and are referenced in

this report, but do not meet the definition for an APM. The

measures are as follows:

- Sales from New Products as a percentage of Group sales is used

by the Board to measure the success of driving adoption of the new

product pipeline. It measures Group sales generated from certain

mega-programmes, new differentiated polymers and other pipeline

products that were not sold in the prior seven years as a

percentage of total Group sales. This metric has been updated in FY

2023 with the prior year's metric, based on new products not sold

before FY 2014.

- Sustainable revenues as a % of total revenues is calculated as

the % of revenue earned from sustainable products, which are

defined as those which offer a quantifiable environmental or

societal benefit. These are primarily in automotive and aerospace

(supporting CO2 reduction) but also in energy and industrial and

electronics (e.g. wind energy applications, or those which support

energy efficiency) and medical, supporting better patient

outcomes.

Consolidated Income Statement

Year ended Year ended

30 September 30 September

2023 2022

Note GBPm GBPm

------------------------------------------- ------- -------- --------------

Revenue 4 307.0 341.0

Losses on foreign currency

net hedging (7.6) (2.8)

Cost of sales (136.8) (163.7)

------------------------------------------- ------- -------- --------------

Gross profit 4 162.6 174.5

Sales, marketing and administrative

expenses (70.8) (70.3)

Research and development expenses (18.6) (15.7)

------------------------------------------- ------- -------- --------------

Operating profit before exceptional

items 80.7 96.4

Exceptional items 5 (7.5) (7.9)

------------------------------------------- ------- -------- --------------

Operating profit 73.2 88.5

Financial income 1.3 0.5

Finance costs (0.7) (0.3)

Share of loss of associate (1.3) (1.0)

Profit before tax and exceptional

items 80.0 95.6

Exceptional items 5 (7.5) (7.9)

------------------------------------------- ------- -------- --------------

Profit before tax 72.5 87.7

Income tax expense 6 (11.5) (12.2)

Profit for the period 61.0 75.5

Profit/(loss) for the period attributable

to:

Owners of the Company 61.7 76.2

Non-controlling interests (0.7) (0.7)

Earnings per share

Basic 7 70.9p 87.6p

Diluted 7 70.5p 87.3p

------------------------------------------- ------- -------- --------------

Dividends (pence per share)

Interim 13.42 13.42

Final 46.14 46.14

59.56 59.56

------------------------------------------- ------- -------- --------------

A final dividend in respect of FY 2023 of 46.14p per ordinary

share has been recommended by the Directors for approval at the

Annual General Meeting on 9 February 2024.

Consolidated Statement of Comprehensive Income

Year ended Year ended

30 September 30 September

2023 2022

GBPm GBPm

-------------------------------------- -------------- --------------

Profit for the period 61.0 75.5

--------------------------------------- -------------- --------------

Items that will not be reclassified

to profit or loss

Defined benefit pension schemes'

actuarial (losses)/gains (6.9) 0.2

Income tax on items that will

not be reclassified to profit

or loss 1.4 (0.1)

(5.5) 0.1

Items that may be subsequently

reclassified to profit or

loss

Currency translation differences

for foreign operations (10.0) 11.1

Effective portion of changes in

fair value of cash flow hedges 10.0 (19.7)

Net change in fair value of cash

flow hedges

transferred to profit or loss 7.6 2.8

Income tax on items that may be

reclassified to profit or loss (3.4) 3.2

4.2 (2.6)

Total other comprehensive expense

for the period (1.3) (2.5)

--------------------------------------- -------------- --------------

Total comprehensive income for

the period 59.7 73.0

Total comprehensive income/(expense)

for the period attributable to:

Owners of the Company 60.4 73.7

Non-controlling interests (0.7) (0.7)

--------------------------------------- -------------- --------------

Consolidated Balance Sheet

30 September 30 September

2023 2022

Note GBPm GBPm

----------------------------------------- ------ --------------- ---------------

Assets

Non-current assets

Property, plant and equipment 351.2 347.2

Intangible assets 18.7 20.2

Investment in associated undertakings 8 9.1 10.4

Financial assets held at fair value

through profit and loss 9 13.2 10.1

Financial assets at amortised cost 0.6 -

Deferred tax assets 5.6 7.2

Retirement benefit asset 9.7 14.9

----------------------------------------- ------ --------------- ---------------

408.1 410.0

----------------------------------------- ------ --------------- ---------------

Current assets

Inventories 134.5 86.8

Current income tax assets 1.3 7.9

Trade and other receivables 47.2 68.1

Derivative financial instruments 11 2.0 -

Other financial assets 12 0.1 10.1

Cash and cash equivalents 33.4 58.7

218.5 231.6

----------------------------------------- ------ --------------- ---------------

Total assets 626.6 641.6

----------------------------------------- ------ --------------- ---------------

Liabilities

Non-current liabilities

Deferred tax liabilities (34.0) (34.3)

Borrowings 10 (34.5) (21.6)

Long term lease liabilities (8.9) (7.8)

Retirement benefit obligations (2.5) (2.7)

(79.9) (66.4)

----------------------------------------- ------ --------------- ---------------

Current liabilities

Derivative financial instruments 11 (1.8) (19.9)

Borrowings 10 (5.2) (0.9)

Current income tax liabilities (3.0) (2.3)

Trade and other payables (34.1) (59.7)

Current lease liabilities (1.6) (1.8)

----------------------------------------- ------ --------------- ---------------

(45.7) (84.6)

----------------------------------------- ------ --------------- ---------------

Total liabilities (125.6) (151.0)

----------------------------------------- ------ --------------- ---------------

Net assets 501.0 490.6

----------------------------------------- ------ --------------- ---------------

Equity

Share capital 0.9 0.9

Share premium 61.9 61.5

Translation reserve 2.8 12.8

Hedging reserve 0.6 (13.6)

Retained earnings 432.8 427.2

----------------------------------------- ------ --------------- ---------------

Equity attributable to owners of the

Company 499.0 488.8

Non-controlling Interest 13 2.0 1.8

----------------------------------------- ------ --------------- ---------------

Total equity 501.0 490.6

------------------------------------------ ---------------------- ---------------

Consolidated Cash Flow Statement

Year ended Year ended

30 September 30 September

2023 2022

Note GBPm GBPm

------------------------------------------- ------- ------- --------------

Cash flows from operating activities

Cash generated from operations 15 42.9 90.7

Interest received 1.0 0.3

Interest paid (0.2) (0.4)

Net income tax paid (2.0) (10.6)

------------------------------------------- ---------------- --------------

Net cash flow generated from

operating activities 41.7 80.0

------------------------------------------- ---------------- --------------

Cash flows from investing activities

Acquisition of property, plant

and equipment and intangible

assets (38.5) (45.5)

Withdrawal of cash invested for

greater than three months 10.0 27.4

Proceeds from disposal of financial

asset held at fair value through

profit and loss - 4.2

Other loans granted (0.9) -

Loan to associated undertakings (2.9) (2.3)

Net cash flow used in investing

activities (32.3) (16.2)

------------------------------------------- ---------------- --------------

Cash flows from financing activities

Proceeds from issue of ordinary shares

exercised under option 0.4 0.4

Repayment of lease liabilities (2.1) (2.1)

Transactions with non-controlling 2.6 -

interests

Bank borrowings received 19.0 14.5

Bank borrowings repaid (0.9) -

Interest on bank borrowings paid (0.9) -

Dividends paid (51.8) (95.2)

------------------------------------------- ---------------- --------------

Net cash flow used in financing

activities (33.7) (82.4)

------------------------------------------- ---------------- --------------

Net decrease in cash and cash equivalents (24.3) (18.6)

Effect of exchange rate fluctuations

on cash held (1.0) 2.4

Cash and cash equivalents at

beginning of period 58.7 74.9

------------------------------------------- ---------------- --------------

Cash and cash equivalents at

end of period 33.4 58.7

------------------------------------------- ---------------- --------------

Consolidated Statement of Changes in Equity

Share Share Translation Hedging Retained Total Non-controlling

capital premium reserve reserve earnings attributable interest Total

to owners

of parent

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Equity at 1

October

2022 0.9 61.5 12.8 (13.6) 427.2 488.8 1.8 490.6

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Total

comprehensive

income for the

period

Profit for the

period

attributable to

the

parent - - - - 61.7 61.7 - 61.7

Loss for the

period

attributable to

non-controlling

interest - - - - - - (0.7) (0.7)

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Other

comprehensive

(expense)/income

Currency

translation

differences for

foreign

operations - - (10.0) - - (10.0) - (10.0)

Effective portion

of

changes in fair

value

of cash flow

hedges - - - 10.0 - 10.0 - 10.0

Net change in

fair value

of cash flow

hedges

transferred to

profit

or loss - - - 7.6 - 7.6 - 7.6

Defined benefit

pension

schemes'

actuarial losses - - - - (6.9) (6.9) - (6.9)

Tax on other

comprehensive

(expense)/income - - - (3.4) 1.4 (2.0) - (2.0)

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Total other

comprehensive

(expense)/income

for

the period - - (10.0) 14.2 (5.5) (1.3) - (1.3)

Total

comprehensive

(expense)/income

for

the period - - (10.0) 14.2 56.2 60.4 (0.7) 59.7

Contributions by

and

distributions to

owners

of the Company

Adjustment

arising from

additional

investment

by

non-controlling

interest - - - - - - 0.9 0.9

Share options

exercised - 0.4 - - - 0.4 - 0.4

Equity-settled

share-based

payment

transactions - - - - 1.1 1.1 - 1.1

Tax on

equity-settled

share-based

payment

transactions 0.1 0.1 - 0.1

Dividends to

shareholders - - - - (51.8) (51.8) - (51.8)

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Equity at 30

September

2023 0.9 61.9 2.8 0.6 432.8 499.0 2.0 501.0

------------------ --------- --------- ------------ --------- ---------- ------------- ---------------- --------

Share Share Translation Hedging Retained Total Non-controlling

capital premium reserve reserve earnings attributable interest Total

to owners

of parent

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Equity at 1

October

2021 0.9 61.1 1.7 0.1 445.4 509.2 2.5 511.7

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Total

comprehensive

income for the

year

Profit for the

year

attributable to

the

parent - - - - 76.2 76.2 - 76.2

Loss for the year

attributable

to

non-controlling

interest - - - - - - (0.7) (0.7)

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Other

comprehensive

income/(expense)

Currency

translation

differences for

foreign

operations - - 11.1 - - 11.1 - 11.1

Effective portion

of

changes in fair

value

of cash flow

hedges - - - (19.7) - (19.7) - (19.7)

Net change in

fair value

of cash flow

hedges

transferred to

profit

or loss - - - 2.8 - 2.8 - 2.8

Defined benefit

pension

schemes'

actuarial gains - - - - 0.2 0.2 - 0.2

Tax on other

comprehensive

income/(expense) - - - 3.2 (0.1) 3.1 - 3.1

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Total other

comprehensive

income/(expense)

for

the year - - 11.1 (13.7) 0.1 (2.5) - (2.5)

Total

comprehensive

income/(expense)

for

the year - - 11.1 (13.7) 76.3 73.7 (0.7) 73.0

Contributions by

and

distributions to

owners

of the Company

Share options

exercised - 0.4 - - - 0.4 - 0.4

Equity-settled

share-based

payment

transactions - - - - 1.8 1.8 - 1.8

Tax on

equity-settled

share-based

payment

transactions - - - - (1.1) (1.1) - (1.1)

Dividends to

shareholders - - - - (95.2) (95.2) - (95.2)

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Equity at 30

September

2022 0.9 61.5 12.8 (13.6) 427.2 488.8 1.8 490.6

------------------ -------- --------- ------------ --------- --------- ------------- ---------------- --------

Notes to the Financial Report

1. Reporting entity

Victrex plc (the 'Company') is a public company, which is

limited by shares and is listed on the London Stock Exchange. This

Company is incorporated and domiciled in the United Kingdom. The

address of its registered office is Victrex Technology Centre,

Hillhouse International, Thornton Cleveleys, Lancashire FY5 4QD,

United Kingdom.

The consolidated financial statements of the Company for the

year ended 30 September 2023 comprise the Company and its

subsidiaries (together referred to as the 'Group').

The consolidated financial statements were approved for issue by

the Board of Directors on 5 December 2023.

2. Basis of preparation

Both the consolidated and Company financial statements have been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006 and in

accordance with UK-adopted International Accounting Standards. The

financial statements have been prepared under the historical cost

basis except for derivative financial instruments, defined benefit

pension scheme assets and financial assets held at fair value

through profit and loss, which are measured at their fair

value.

The Group's business activities, together with factors likely to

affect its future development, performance and position, are set

out in the FY 2023 Annual Report. In addition, note 16 (financial

risk management) in the financial statements of the FY 2023 Annual

Report details the Group's exposure to a variety of financial

risks, including currency and credit risk.

The financial information set out in this document does not

constitute the Group's statutory financial statements for the years

ended 30 September 2023 or 2022 but is derived from those financial

statements. Statutory financial statements for the year ended 30

September 2023 and 30 September 2022 have been reported on by the

auditors who issued an unqualified opinion and did not draw

attention to any matters by way of emphasis without qualifying

their report and did not contain statements under s498(2) or

s498(3) of the Companies Act 2006 in respect of both years in the

auditors' reports for FY 2023 and FY 2022. Statutory accounts for

the year ended 30 September 2022 have been filed with the Registrar

of Companies. The statutory accounts for the year ended 30

September 2023, will be delivered to the Registrar of Companies

within the Companies House accounts filing guidance. A separate

announcement will be made when the FY 2023 Annual Report is made

available on the Company's website in January 2024.

Climate change

In preparing the financial statements of the Group an assessment

of the impact of climate change has been made in line with the

requirements of the Task Force on Climate-Related Financial

Disclosures ("TCFD") and with specific consideration of the

disclosures made in the Sustainability report starting on page 42

of the FY 2023 Annual Report. This has specifically incorporated

the impact of the physical risks of climate change, transitional

risks including the potential impact of government and regulatory

actions as well as the Group's stated Net Zero targets. The

potential impact has been considered in the following areas:

- the key areas of judgement and estimation

- the expected useful lives of property, plant and equipment

- those areas which rely on future forecasts which have the

potential to be impacted by climate change:

o carrying value of non-current assets

o going concern

o viability

- the recoverability of deferred taxation assets

- the recoverability of inventory and trade receivables

The Directors recognise the inherent uncertainty in predicting

the impact of climate change and the actions which regulators and

governments, both domestic and overseas, will take in order to

achieve their various targets. However from the work undertaken to

date, outlined in the Sustainability report, the Directors have

reached the overall conclusion that there has been no material

impact on the financial statements for the current year from the

potential impact of climate change.

The Group's analysis on the impact of climate change continues

to evolve as more clarity on timings and targets emerges, with

Victrex committed to reducing its carbon impact towards Net Zero

across all scopes by 2050.

Use of Judgements and estimation uncertainty

The Group uses estimates and assumptions in applying the

critical accounting policies to value balances and transactions

recorded in the financial statements. The estimates and assumptions

that, if revised, would have a significant risk of a material

impact on the valuation of assets and liabilities within the next

financial year are retirement benefits, the valuation of inventory,

the carrying value of the investment in associate and fair value of

convertible loan notes held in Bond 3D High Performance Technology

BV ("Bond") . The latter two were disclosed as "Other areas of

judgement and sources of estimation uncertainty" in FY 2022 Annual

Report. At 31 March 2023 the directors reassessed this resulting in

the reclassification to "critical judgement and key source of

estimation uncertainty". This conclusion was reached in the

knowledge that further investment was required to support Bond

through to net cash generation, the economic environment had

tightened the financing market for early-stage businesses, there

were delays to the delivery of the key milestones and current

funding was only sufficient to sustain Bond through to mid-FY 2024.

The directors therefore concluded there was an increased risk of a

material change to the carrying values of both the investment in

associate and convertible loans in the next 12 months.

Going Concern

The Directors have performed a robust going concern assessment

including a detailed review of the business' 24-month rolling

forecast and consideration of the principal risks faced by the

Group and the Company, as detailed on pages 32 to 38 of the FY 2023

Annual Report. This assessment has paid particular attention to

current trading results and the impact of the current global

economic challenges on the aforementioned forecasts.

The Group maintains a strong balance sheet providing assurance

to key stakeholders, including customers, suppliers and employees.

The combined cash and other financial assets balance at 30

September 2023 was GBP33.5m, having reduced from GBP68.8m at 30

September 2022 following payment of the regular dividends of

GBP40.1m in February 2023 and GBP11.7m in June 2023 and a strategic

increase in the level of inventory held. Of the GBP33.5m, GBP3.4m

is held in the Group's subsidiaries in China for the sole purpose

of funding the construction of our new manufacturing facilities. Of

the remaining GBP30.1m, approximately 70% is held in the UK, on

instant access, where the company incurs the majority of its

expenditure. The Group has drawn debt of GBP31.6m in its Chinese

subsidiaries (with a total facility of c.GBP34.2m available until

December 2026) and has unutilised UK banking facilities, renewed

and extended in October 2023, of GBP60m through to October 2026, of

which GBP40m is committed and immediately available and GBP20m is

available subject to lender approval.

The 24-month forecast is derived from the company's Integrated

Business Planning ("IBP") process which runs monthly. Each area of

the business provides forecasts which consider a number of external

data sources, triangulating with customer conversations, trends in

market and country indices as well forward-looking industry

forecasts. For example, forecast aircraft build rates from the two

major manufacturers for Aerospace, rig count and purchasing manager

indices for E&I, World Semiconductor Trade Statistics

semiconductor market forecasts for Electronics and Needham and

IQVIA forecasts for Medical procedures.

The assessment of going concern included conducting scenario

analysis on the aforementioned forecast which, given current