TIDMWATR

RNS Number : 0951P

Water Intelligence PLC

07 February 2023

2022 Full Year Trading Update

and

Acquisition of Nashville Franchise

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence" or

the "Group"), a leading multinational provider of precision,

minimally-invasive leak detection and remediation solutions for

both potable and non-potable water, is pleased to provide a trading

update and operational highlights for the year ended 31 December

2022 and also to announce the strategic acquisition by its American

Leak Detection subsidiary of its Nashville franchise.

The Group continues to perform strongly despite ongoing

macroeconomic uncertainty. Market demand for the Group's water leak

detection and repair solutions remains strong despite signs of

recessionary pressure going into 2023.

In terms of market capture, network sales (direct corporate

sales and indirect gross sales to third parties from which

franchise royalty is derived) grew approximately 10.5%, reaching

approximately $168 million (FY 2021: $152 million).

Franchise Acquisition / Subsequent Event

We are pleased to announce that the Group has reacquired its

Nashville, Tennessee franchise. The acquisition is pursuant to the

Group's growth strategy of creating regional hubs and adds further

corporate scale to operations in the Midwest, United States. The

cash consideration for the acquisition is $3.25 million based on a

2022 Adjusted Income Statement of $2.4 million in revenue and

$550,000 in profit before tax and includes the transfer of all

operating assets to the Group.

2022 Highlights

Financial Performance

v Group Revenue increased by 31% to $71.3 million (2021: $54.5

million)

American Leak Detection subsidiary

-- Franchise royalty declined 1% to $6.7 million (2021: $6.8

million) due to the franchise acquisitions in 2021 reducing the

pool of franchise royalty for 2022 (without these acquisitions

franchise royalty would have grown 8%)

-- Franchise Related Activities (Insurance Channel) grew 9% to

$10.6 million (2021: $9.8 million)

-- US Corporate locations sales grew 48% to $47.3 million (2021:

$31.9 million)

-- Same store sales grew 25% to $36.2 million (2021: $28.9 million)

-- Same store profits grew 14% to $6.2 million (2021: $5.4 million)

Water Intelligence International subsidiary

-- International corporate locations grew 9% to $6.7 million

(2021: $6.1 million)

v EBITDA Adjusted* grew 20% to $12.3 million (2021: $10.3

million)

o EBITDA grew 16% to $11.1 million (2021: $9.5 million)

v PBT Adjusted* grew 12% to $7.8 million (2021: $6.9

million)

o PBT declined 3% to $5.5 million (2021: $5.7 million) (due to

non-cash expenses especially related to Salesforce

implementation)

*EBITDA Adjusted and PBT Adjusted both adjusted for non-core

costs and non-cash expense of share-based payments; PBT Adjusted

also adjusted for non-cash expense of amortization. EBITDA and PBT

are adjusted to exclude the 2021 one-time gain of $1.9 million to

allow for like-for-like comparisons with 2021

Balance Sheet at 31 December 2022

-- Cash at $23 million

-- Cash net of bank debt at $6.2 million

-- Cash net of bank debt and deferred franchise acquisition

payments at $(6.4) million

-- Debt and acquisition payments all spread through 2027 at a

blended fixed rate of approximately 4.9% reflecting different

facilities

o Credit availability of $3 million for additional franchisee

reacquisitions under current bank credit facilities at a blended

fixed rate of approximately 5.5% and 5 year amortization

Corporate Development:

-- Expansion of Acquisition Credit Facilities ($17 million at a

blended fixed rate of approximately 5.5% through 2027)

-- Franchise Acquisitions: Fort Worth, Texas; Midland, Texas

-- Plumbing Acquisition: Fairfield, Connecticut

-- Sale of Franchise Territory: Central North Carolina

-- Salesforce and related web applications being developed and

implemented across all US locations (automates all aspects of

workflow: scheduling and delivery; marketing follow-up; e-commerce;

highest level of data security in Salesforce Cloud)

-- New Service Offerings developed and commercial in 2023:

Residential Pulse (sewer diagnostic tool) and Municipal LS1

(snapshot survey tool)

The Group will announce its audited full year results by early

June.

Commenting on the Group's performance, Executive Chairman, Dr.

Patrick DeSouza remarked:

"We are pleased that during 2022 our team successfully navigated

various challenges posed by short-run inflationary shocks and

subsequent rises in interest rates which are now raising concerns

over potential recessionary pressure. Despite this, our core

business remains strong and market demand for water infrastructure

solutions continues to grow.

We remain confident in our strategic growth plan. For 2022,

sales growth remained strong - both corporate and franchise; we

increased EBITDA by double digits while continuing to scale

operations through (i) investment in additional hiring and training

of technicians, (ii) implementation of Salesforce and related

applications and (iii) commercial launch of new service offerings.

The strength of our balance sheet enables us to continue to

reinvest in our growth plan. Further, we have credit availability

with the attractive fixed rates that we negotiated in the first

half of 2022 for future profitable franchise acquisitions.

We are very mindful that macroeconomic volatility remains a

challenge for 2023. We will be disciplined in managing expenses as

we remain acutely focused not just on revenue growth but also on

enhancing profit margins. Moreover, during the coming months, we

will also be coming to the end of our large upfront investment

spend for our Salesforce operating backbone and new service

offerings for customers, which will drive both cost efficiencies

and revenue growth going forward.

As we head into 2023, we are positioned to better meet growing

market demand with scalable operations and an ability to provide

our customers with added solutions for their water and wastewater

problems. With increasingly adverse climate conditions - whether

droughts, freezes or flooding - our customers need us more than

ever."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries:

Water Intelligence plc

Patrick DeSouza, Executive Chairman Tel: +1 203 654 5426

Maria McDonald, Director, Communications Tel: +1 415 272 2459

RBC Capital Markets - Joint Broker Tel: +44 (0) 207 653 4000

Rupert Walford

Daniel Saveski

WH Ireland Limited - NOMAD & Joint Broker Tel: +44 (0)207 220 1666

Hugh Morgan

James Bavister

Dowgate Capital Ltd - Joint Broker Tel: +44 (0)20 3903 7721

Stephen Norcross

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEADAKEAFDEAA

(END) Dow Jones Newswires

February 07, 2023 02:00 ET (07:00 GMT)

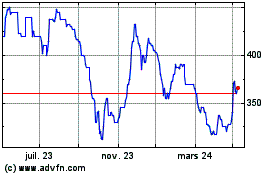

Water Intelligence (LSE:WATR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

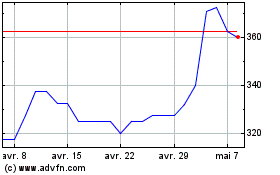

Water Intelligence (LSE:WATR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025