TIDMWPM

RNS Number : 8621Y

Wheaton Precious Metals Corp.

10 May 2023

May 9, 2023

Vancouver, British Columbia

Wheaton Precious Metals Announces Renewal Of Its At-The-Market

Equity Program

Wheaton Precious Metals Corp. ("Wheaton" or the "Company")

announced today that the Company has renewed its at-the-market

equity program (the "ATM Program"). The ATM Program allows the

Company to issue up to US$300 million (or the equivalent in

Canadian dollars determined using the daily exchange rate posted by

the Bank of Canada on the date of sale) of common shares ("Common

Shares") from treasury to the public from time to time, at the

Company's discretion and subject to regulatory requirements. Any

Common Shares sold in the ATM Program will be sold (i) in ordinary

brokers' transactions on the NYSE or another US marketplace on

which the Common Shares are listed, quoted or otherwise trade, (ii)

ordinary brokers' transactions on the TSX, (iii) on another

Canadian marketplace on which the Common Shares are listed, quoted

or otherwise trade, or (iv) with respect to sales in the United

States, at the prevailing market price, a price related to the

prevailing market price or at negotiated prices. Since the Common

Shares will be distributed at the prevailing market prices at the

time of the sale or certain other prices, prices may vary among

purchasers and during the period of distribution.

Wheaton has not utilized the ATM Program since its inception in

April 2020 as a result of robust cash flows and access to debt.

Wheaton intends to use the net proceeds from the ATM Program, if

any, where needed for funding precious metals purchase agreements

("PMPAs") and/or other general corporate purposes, including the

repayment of indebtedness.

Sales of Common Shares through the ATM Program, if any, will be

made pursuant to the terms of an ATM equity offering sales

agreement dated May 9, 2023 (the "Sales Agreement") entered into

among the Company, BofA Merrill Lynch, BMO Capital Markets, RBC

Dominion Securities Inc., Scotiabank, CIBC Capital Markets, TD

Securities, National Bank Financial Markets, Eight Capital, Raymond

James Ltd. and Canaccord Genuity (the "Canadian Agents") and BofA

Securities, BMO Capital Markets, RBC Capital Markets, LLC, and

Scotiabank (the "U.S. Agents" and, together with the Canadian

Agents, the "Agents"). The ATM Program will be effective until the

date that all Common Shares available for issue under the ATM

Program have been issued or the ATM Program is terminated prior to

such date by the Company or the Agents.

Concurrent with the entering into of the Sales Agreement, the

Company's previously announced ATM equity offering sales agreement

dated April 16, 2020, as amended on May 12, 2021, was terminated.

No Common Shares were issued through the Company's previous

at-the-market equity program.

The ATM Program is being established pursuant to a prospectus

supplement dated May 9, 2023 (the "Canadian Prospectus Supplement")

to the Company's Canadian base shelf prospectus dated April 13,

2023 (the "Canadian Shelf Prospectus") filed with the securities

commissions in each of the provinces and territories of Canada and

pursuant to a prospectus supplement dated May 9, 2023 (the "U.S.

Prospectus Supplement") to the Company's U.S. base prospectus dated

April 13, 2023 (the "U.S. Base Prospectus") included in its

registration statement on Form F-10 (the "Registration Statement")

and filed with the U.S. Securities and Exchange Commission (the

"SEC"). The Sales Agreement, Canadian Prospectus Supplement and

Canadian Shelf Prospectus may be downloaded from SEDAR at

www.sedar.com , and the Sales Agreement, the U.S. Prospectus

Supplement, the U.S. Base Prospectus and the Registration Statement

are accessible via EDGAR on the SEC website at www.sec.gov .

Alternatively, any of the following agents participating in the ATM

Program will arrange to send you these documents if you request it

by contacting, in Canada:

BofA Merrill Lynch by mail at 181 Bay Street, Suite 400,

Toronto, Ontario M5J2V8 Canada, by email at

Dg.can_dcm@bankofamerica.com or by telephone at 416-369-7400.

BMO Capital Markets by mail at Brampton Distribution Centre,

9195 Torbram Road, Brampton, Ontario, L6S 6H2, attn: The Data Group

of Companies, by email at torbramwarehouse@datagroup.ca or by

telephone at 905-791-3151 ext. 4312.

RBC Dominion Securities Inc. by mail at 180 Wellington Street

West, 8(th) Floor, Toronto, ON M5J 0C2, attn: Distribution Centre,

by email at Distribution.RBCDS@rbccm.com or by telephone at

416-842-5349.

Scotiabank by mail at 40 Temperance Street, 5th Floor, Toronto,

Ontario M5H 0B4, attn: Equity Capital Markets, by email at

equityprospectus@scotiabank.com or by telephone at

416-863-7704.

or in the United States:

BofA Securities by mail at 201 North Tryon, Charlotte, NC 28255,

Mail Code NC1-022-02-25, attn: Prospectus Department or by email at

dg.prospectus_requests@bofa.com .

BMO Capital Markets by mail at 151 West 42nd Street, New York,

NY 10036, attn: Equity Syndicate, by email at bmoprospectus@bmo.com

, or by telephone at 800-414-3627.

RBC Capital Markets, LLC by mail at 200 Vesey Street, 8th Floor,

New York, NY 10281-8098, attn: Equity Syndicate, by email at

equityprospectus@rbccm.com or by telephone at 877-822-4089.

Scotiabank by mail at 250 Vesey Street, 24th Floor, New York,

New York, 10281, attn: Equity Capital Markets, by email at

equityprospectus@scotiabank.com or by telephone at

212-225-6853.

This news release does not constitute an offer to sell or the

solicitation of an offer to buy the Common Shares, nor shall there

be any sale of the Common Shares in any jurisdiction in which such

an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

About Wheaton Precious Metals Corp.

Wheaton Precious Metals is the world's premier precious metals

streaming company with the

highest-quality portfolio of long-life, low-cost assets. Its

business model offers investors leverage to commodity prices and

exploration upside but with a much lower risk profile than a

traditional mining company. Wheaton delivers amongst the highest

cash operating margins in the mining industry, allowing it to pay a

competitive dividend and continue to grow through accretive

acquisitions. As a result, Wheaton has consistently outperformed

gold and silver, as well as other mining investments. Wheaton is

committed to strong ESG practices and giving back to the

communities where Wheaton and its mining partners operate. Wheaton

creates sustainable value through streaming.

CAUTIONARY NOTE REGARDING FORWARD LOOKING-STATEMENTS

This press release contains "forward-looking statements" within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and "forward-looking information" within the

meaning of applicable Canadian securities legislation concerning

the offer and sale of Common Shares under the ATM Program,

including the timing and amounts thereof, and the use of any

proceeds from the ATM Program. These forward-looking statements are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of Wheaton to be materially different from those

expressed or implied by such forward-looking statements including

but not limited to the risks discussed in the section entitled

"Description of the Business - Risk Factors" in Wheaton's Annual

Information Form available on SEDAR at www.sedar.com , and in

Wheaton's Form 40-F for the year ended December 31, 2022 filed on

the SEC's EDGAR system available at www.sec.gov (the

"Disclosure").

These forward-looking statements are based on assumptions

management currently believes to be reasonable, including (without

limitation): that there will be no material adverse change in the

market price of commodities, that Wheaton's mining operations (the

"Mining Operations") will continue to operate and the mining

projects will be completed in accordance with public statements and

achieve their stated production estimates, that the mineral reserve

and mineral resource estimates from Mining Operations (including

reserve conversion rates) are accurate, that each party will

satisfy their obligations in accordance with Wheaton's PMPAs, that

Wheaton will continue to be able to fund or obtain funding for

outstanding commitments, that Wheaton will be able to source and

obtain accretive PMPAs, that neither Wheaton nor the Mining

Operations will suffer significant impacts as a result of an

epidemic (including the COVID-19 virus pandemic), that any outbreak

or threat of an outbreak of a virus or other contagions or epidemic

disease will be adequately responded to locally, nationally,

regionally and internationally, without such response requiring any

prolonged closure of the Mining Operations or having other material

adverse effects on the Company and counterparties to its PMPAs,

that the trading of the Common Shares will not be adversely

affected by the differences in liquidity, settlement and clearing

systems as a result of multiple listings of the Common Shares on

the LSE, the TSX and the NYSE, that the trading of the Common

Shares will not be suspended, that the sale of Common Shares under

the ATM Program, if any, will not have a significant impact on the

market price of the Company's common shares and that the net

proceeds of sales of Common Shares, if any will be used as

anticipated, that expectations regarding the resolution of legal

and tax matters will be achieved (including ongoing audits by the

Canada Revenue Agency ("CRA") involving the Company), that Wheaton

has properly considered the interpretation and application of

Canadian tax law to its structure and operations, that Wheaton has

filed its tax returns and paid applicable taxes in compliance with

Canadian tax law, that Wheaton's application of the CRA tax

settlement for years subsequent to 2010 is accurate (including the

Company's assessment that there will be no material change in the

Company's facts or change in

law or jurisprudence), that Wheaton will remain in compliance

with the requirements of applicable securities law and stock

exchange listing rules in respect of the Common Shares, and such

other assumptions and factors as set out in the Disclosure. There

can be no assurance that forward-looking statements will prove to

be accurate and even if events or results described in the

forward-looking statements are realized or substantially realized,

there can be no assurance that they will have the expected

consequences to, or effects on, Wheaton. Readers should not place

undue reliance on forward-looking statements and are cautioned that

actual outcomes may vary. The forward-looking statements included

herein are for the purpose of providing readers with information to

assist them in understanding Wheaton's expected financial and

operational performance and may not be appropriate for other

purposes. Any forward looking statement speaks only as of the date

on which it is made, reflects Wheaton's management's current

beliefs based on current information and will not be updated except

in accordance with applicable securities laws. Although Wheaton has

attempted to identify important factors that could cause actual

results, level of activity, performance or achievements to differ

materially from those contained in forward--looking statements,

there may be other factors that cause results, level of activity,

performance or achievements not to be as anticipated, estimated or

intended.

For further information, please contact:

Patrick Drouin or Emma Murray

Wheaton Precious Metals Corp.

Tel: 1-844-288-9878

Email: info@wheatonpm.com

Website: www.wheatonpm.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAESNEAPDEAA

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

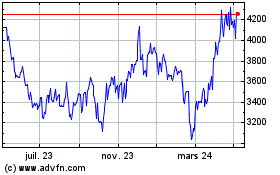

Wheaton Precious Metals (LSE:WPM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

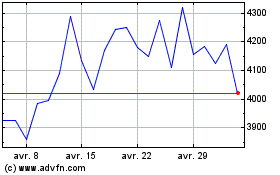

Wheaton Precious Metals (LSE:WPM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024