TIDMWYN

RNS Number : 3915W

Wynnstay Group PLC

18 August 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN, NEW ZEALAND OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN WYNNSTAY GROUP PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION WHERE TO DO SO WOULD BREACH ANY

APPLICABLE LAW OR REGULATION. NEITHER THIS ANNOUNCEMENT NOR THE

FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON

IN CONNECTION WITH, ANY INVESTMENT DECISION IN RESPECT OF WYNNSTAY

GROUP PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018, AS AMED.

For immediate release

18 August 2022

Wynnstay Group plc

Result of Fundraise

Wynnstay Group plc (LSE: WYN) ("Wynnstay", the "Company") the

agricultural supplies group, is pleased to announce that, further

to the announcement on 17 August 2022 (the "Fundraise

Announcement"), the Company has conditionally raised approximately

GBP10.6 million (before expenses) pursuant to the Placing.

Under the Placing, 1,900,000 new ordinary shares have been

conditionally placed pursuant to the Placing at a price of 560

pence per Placing Share.

Shore Capital acted as sole bookrunner and sole broker in

connection with the Placing. The Placing was significantly

oversubscribed.

Capitalised terms used in this announcement (this

"Announcement") have the meanings given to them in the Fundraise

Announcement unless the context provides otherwise.

Admission and settlement

The Placing Shares, when issued, will represent approximately 9

per cent. of the Company's issued ordinary share capital as

enlarged by the Placing.

The Placing Shares, when issued, will be fully paid and will

rank pari passu in all respects with the existing ordinary

shares.

Applications have been made for the Placing Shares to be

admitted to trading on the AIM market for listed securities of

London Stock Exchange plc (together "Admission").

Settlement for the Placing Shares and Admission is expected to

take place on or before 8.00 a.m. on 22 August 2022.

Total voting rights

Following Admission, the Company will have a total of 22,299,355

ordinary shares in issue. With effect from Admission, this figure

may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company, under

the Disclosure Guidance and Transparency Rules of the FCA.

Enquiries:

Wynnstay Group plc Gareth Davies, Chief T: 01691 827

Executive 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178

Mahoney 6378

Shore Capital (Nomad Stephane Auton / John T: 020 7408

and Broker) More 4090

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

IMPORTANT NOTICES

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT IS DIRECTED ONLY AT PERSONS WHOSE

ORDINARY ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING, MANAGING

AND DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR THE

PURPOSES OF THEIR BUSINESS AND WHO HAVE PROFESSIONAL EXPERIENCE IN

MATTERS RELATING TO INVESTMENTS AND ARE: (1) IF IN A MEMBER STATE

OF THE EUROPEAN ECONOMIC AREA ("EEA"), QUALIFIED INVESTORS AS

DEFINED IN ARTICLE 2(e) OF REGULATION (EU) 2017/1129 (THE

"PROSPECTUS REGULATION"); ("EU QUALIFIED INVESTORS"); (2) IF IN THE

UNITED KINGDOM, QUALIFIED INVESTORS WHO (A) FALL WITHIN ARTICLE

19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL

PROMOTION) ORDER 2005, AS AMED (THE "ORDER") (INVESTMENT

PROFESSIONALS) OR (B) FALL WITHIN ARTICLE 49(2)(a) TO (d) (HIGH NET

WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.) OF THE ORDER

AND (3) ARE QUALIFIED INVESTORS WITHIN THE MEANING OF ARTICLE 2(e)

OF REGULATION (EU) 2017/1129 AS AMED, AS IT FORMS PART OF UK LAW AS

RETAINED EU LAW AS DEFINED IN, AND BY VIRTUE OF, THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (AS AMED) (THE "UK PROSPECTUS REGULATION")

("UK QUALIFIED INVESTORS") ; OR (4) PERSONS TO WHOM IT MAY

OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING

REFERRED TO AS "RELEVANT PERSONS").

THIS ANNOUNCEMENT AND THE INFORMATION IN IT MUST NOT BE ACTED ON

OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. PERSONS

DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS

LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH

THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THIS ANNOUNCEMENT

DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN WYNNSTAY GROUP PLC.

THE PLACING SHARES HAVE NOT BEEN AND WILL NOT BE REGISTERED

UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMED (THE

"SECURITIES ACT") OR UNDER THE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES, AND MAY NOT BE OFFERED,

SOLD OR TRANSFERRED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION

NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES

ACT. THE PLACING IS BEING MADE SOLELY OUTSIDE OF THE UNITED STATES

TO PERSONS IN OFFSHORE TRANSACTIONS (AS DEFINED IN REGULATION S

UNDER THE SECURITIES ACT "REGULATION S"). PERSONS RECEIVING THIS

ANNOUNCEMENT (INCLUDING CUSTODIANS, NOMINEES AND TRUSTEES) MUST NOT

FORWARD, DISTRIBUTE, MAIL OR OTHERWISE TRANSMIT IT IN OR INTO THE

UNITED STATES OR USE THE UNITED STATES MAILS, DIRECTLY OR

INDIRECTLY, IN CONNECTION WITH THE PLACING.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN, NEW ZEALAND OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

The distribution of this Announcement and/or the Placing and/or

issue of the Placing Shares in certain jurisdictions may be

restricted by law. No action has been taken by the Company, Shore

Capital or any of their respective affiliates, agents, directors,

officers or employees that would permit an offer of the Placing

Shares or possession or distribution of this Announcement or any

other offering or publicity material relating to such Placing

Shares in any jurisdiction where action for that purpose is

required. Persons into whose possession this Announcement comes are

required by the Company and Shore Capital to inform themselves

about and to observe any such restrictions.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States (including its territories and possessions, any state of the

United States and the District of Columbia (the "United States" or

the "US")), Australia, Canada, the Republic of South Africa, Japan

or New Zealand or any other jurisdiction in which the same would be

unlawful. No public offering of the Placing Shares is being made in

any such jurisdiction.

All offers of the Placing Shares will be made pursuant to an

exemption under the UK Prospectus Regulation and the EU Prospectus

Regulation from the requirement to produce a prospectus. In the

United Kingdom, this Announcement is being directed solely at

persons in circumstances in which section 21(1) of the Financial

Services and Markets Act 2000 (as amended) does not apply.

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States. The relevant clearances have not

been, nor will they be, obtained from the securities commission of

any province or territory of Canada, no prospectus has been lodged

with, or registered by, the Australian Securities and Investments

Commission or the Japanese Ministry of Finance; the relevant

clearances have not been, and will not be, obtained for the South

Africa Reserve Bank or any other applicable body in the Republic of

South Africa in relation to the Placing Shares and the Placing

Shares have not been, nor will they be, registered under or offered

in compliance with the securities laws of any state, province or

territory of Australia, Canada, the Republic of South Africa, Japan

or New Zealand. Accordingly, the Placing Shares may not (unless an

exemption under the relevant securities laws is applicable) be

offered, sold, resold or delivered, directly or indirectly, in or

into Australia, Canada, the Republic of South Africa, Japan or New

Zealand or any other jurisdiction outside the United Kingdom.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement to a jurisdiction outside of the United

Kingdom should seek appropriate advice before taking any

action.

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

affiliates operate, the effect of volatility in the equity, capital

and credit markets on the Company's profitability and ability to

access capital and credit, a decline in the Company's credit

ratings; the effect of operational risks; and the loss of key

personnel. As a result, the actual future financial condition,

performance and results of the Company may differ materially from

the plans, goals and expectations set forth in any forward-looking

statements. Any forward-looking statements made in this

Announcement by or on behalf of the Company speak only as of the

date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

Shore Capital and Corporate Limited, which is authorised and

regulated by the FCA in the United Kingdom and is acting

exclusively as sponsor, and Shore Capital Stockbrokers Limited is

acting exclusively as bookrunner, for the Company and no one else

in connection with the Proposed Acquisition and the Placing, and

Shore Capital will not be responsible to anyone (including any

Placees) other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

Proposed Acquisition or the Placing or any other matters referred

to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Shore Capital or by any of Shore

Capital's affiliates or agents as to, or in relation to, the

accuracy or completeness of this Announcement or any other written

or oral information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

No statement in this Announcement is intended to be a profit

forecast or estimate, and no statement in this Announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult an

independent financial adviser.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than the London

Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (i)

compatible with an end target market of (a) retail clients, as

defined in point (8) of Article 2 of the UK Prospectus Regulation

(EU) No 2017/565 as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018 ("EUWA"), (b) investors who

meet the criteria of professional clients as defined in Regulation

(EU) No 600/2014 as it forms part of domestic law by virtue of the

EUWA and (c) eligible counterparties as defined in the FCA Handbook

Conduct of Business Sourcebook ("COBS"); and (ii) eligible for

distribution through all distribution channels as are permitted by

EU Directive 2014/65/EU on markets in financial instruments, as

amended ("MiFID II") (the "UK Target Market Assessment").

Solely for the purposes of the product governance requirements

contained within: (a) MiFID II; (b) Articles 9 and 10 of Commission

Delegated Directive EU 2017/593 supplementing MiFID II; and (c)

local implementing measures (together, the "MiFID II Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the MiFID II Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of (a) retail investors, (b) investors who meet the

criteria of professional clients and (c) eligible counterparties,

each as defined in MiFID II; and (ii) eligible for distribution

through all distribution channels as are permitted by MiFID II (the

"EU Target Market Assessment" and, together with the UK Target

Market Assessment, the "Target Market Assessments").

Notwithstanding the Target Market Assessments, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessments are without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions to the

Placing. Furthermore, it is noted that, notwithstanding the Target

Market Assessments, Shore Capital will only procure investors who

meet the criteria of professional clients or eligible

counterparties.

For the avoidance of doubt, the Target Market Assessments do not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of COBS (for the purposes of the UK Target Market

Assessment) or MiFID II (for the purposes of the EU Target Market

Assessment); or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIMZGMRNNGGZZM

(END) Dow Jones Newswires

August 18, 2022 02:00 ET (06:00 GMT)

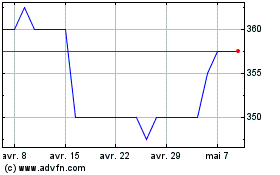

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024