Arch Capital Group Ltd. (NASDAQ: ACGL) reports that net income

available to common shareholders for the 2008 second quarter was

$192.3 million, or $2.92 per share, compared to $199.4 million, or

$2.65 per share, for the 2007 second quarter, and $381.7 million,

or $5.71 per share, for the six months ended June 30, 2008,

compared to $397.9 million, or $5.24 per share, for the 2007

period. The Company also reported after-tax operating income

available to common shareholders of $185.4 million, or $2.82 per

share, for the 2008 second quarter, compared to $205.6 million, or

$2.73 per share, for the 2007 second quarter, and $387.4 million,

or $5.79 per share, for the six months ended June 30, 2008,

compared to $410.4 million, or $5.40 per share, for the 2007

period. All earnings per share amounts discussed in this release

are on a diluted basis. The Company�s book value per common share,

including the net effect of share repurchases, increased to $57.49

at June 30, 2008 from $56.92 per share at March 31, 2008. The

Company�s after-tax operating income available to common

shareholders represented a 20.5% annualized return on average

common equity for the 2008 second quarter, compared to 24.1% for

the 2007 second quarter, and 21.3% for the six months ended June

30, 2008, compared to 24.7% for the 2007 period. After-tax

operating income available to common shareholders, a non-GAAP

measure, is defined as net income available to common shareholders,

excluding net realized gains or losses, equity in net income or

loss of investment funds accounted for using the equity method and

net foreign exchange gains or losses, net of income taxes. See page

7 for a further discussion of after-tax operating income available

to common shareholders and Regulation G. The following table

summarizes the Company�s underwriting results: � Three Months Ended

� Six Months Ended June 30, June 30, (U.S. dollars in thousands)

2008 � 2007 2008 � 2007 � Gross premiums written $ 886,926 $

1,102,210 $ 1,940,078 $ 2,312,824 Net premiums written 686,118

757,895 1,497,460 1,629,640 Net premiums earned 705,675 751,412

1,413,909 1,496,905 Underwriting income 91,405 120,295 189,776

244,893 � Combined ratio 87.1 % 84.1 % 86.6 % 83.9 % The following

table summarizes, on an after-tax basis, the Company�s consolidated

financial data, including a reconciliation of after-tax operating

income available to common shareholders to net income available to

common shareholders and related diluted per share results: � Three

Months Ended � Six Months Ended June 30, June 30, (U.S. dollars in

thousands, except per share data) 2008 � 2007 2008 � 2007 �

After-tax operating income available to common shareholders $

185,375 $ 205,626 $ 387,358 $ 410,356 Net realized (losses) gains,

net of tax (12,868 ) (2,791 ) 20,268 (2,005 ) Equity in net income

(loss) of investment funds accounted for using the equity method,

net of tax 19,583 3,376 (2,730 ) 6,018 Net foreign exchange gains

(losses), net of tax � 192 � � (6,817 ) � (23,192 ) � (16,424 ) Net

income available to common shareholders $ 192,282 � $ 199,394 � $

381,704 � $ 397,945 � � Diluted per common share results: After-tax

operating income available to common shareholders $ 2.82 $ 2.73 $

5.79 $ 5.40 Net realized (losses) gains, net of tax (0.20 ) (0.04 )

0.30 (0.03 ) Equity in net income (loss) of investment funds

accounted for using the equity method, net of tax 0.30 0.05 (0.04 )

0.08 Net foreign exchange gains (losses), net of tax � 0.00 � �

(0.09 ) � (0.34 ) � (0.21 ) Net income available to common

shareholders $ 2.92 � $ 2.65 � $ 5.71 � $ 5.24 � � Weighted average

common shares and common share equivalents outstanding � diluted

65,748,119 75,254,846 66,886,972 75,947,858 The combined ratio

represents a measure of underwriting profitability, excluding

investment income, and is the sum of the loss ratio and expense

ratio. A combined ratio under 100% represents an underwriting

profit and a combined ratio over 100% represents an underwriting

loss. The combined ratio of the Company�s insurance and reinsurance

subsidiaries consisted of a loss ratio of 57.3% and an underwriting

expense ratio of 29.8% for the 2008 second quarter, compared to a

loss ratio of 56.6% and an underwriting expense ratio of 27.5% for

the 2007 second quarter. The combined ratio of the Company�s

insurance and reinsurance subsidiaries consisted of a loss ratio of

57.2% and an underwriting expense ratio of 29.4% for the six months

ended June 30, 2008, compared to a loss ratio of 56.5% and an

underwriting expense ratio of 27.4% for the 2007 period. The loss

ratio of 57.3% for the 2008 second quarter was comprised of 43.4

points of paid losses, 8.3 points related to reserves for reported

losses and 5.6 points related to incurred but not reported

reserves. In establishing the reserves for losses and loss

adjustment expenses, the Company has made various assumptions

relating to the pricing of its reinsurance contracts and insurance

policies and also has considered available historical industry

experience and current industry conditions. The Company�s reserving

method to date has been, to a large extent, the expected loss

method, which is commonly applied when limited loss experience

exists. Any estimates and assumptions made as part of the reserving

process could prove to be inaccurate due to several factors,

including the fact that relatively limited historical information

has been reported to the Company through June 30, 2008. For a

discussion of underwriting activities and a review of the Company�s

results by operating segment, see �Segment Information� in the

Supplemental Financial Information section of this release. Net

investment income for the 2008 second quarter was $117.1 million,

compared to $113.9 million for the 2007 second quarter, and $239.3

million for the six months ended June 30, 2008, compared to $224.0

million for the 2007 period. The increase in net investment income

in the 2008 second quarter primarily resulted from a higher level

of average invested assets in the 2008 second quarter. The pre-tax

investment income yield was 4.80% for the 2008 second quarter,

compared to 4.94% for the 2007 second quarter. During the 2008

second quarter, the fair value of the Company�s investment

portfolio, which mainly consists of high quality fixed income

securities, decreased by $141.2 million, on a pre-tax basis. The

decline in value was primarily attributable to interest-rate

movements as the average credit quality rating remained at �AA+� at

June 30, 2008 and the portfolio�s average effective duration

remained relatively constant at 3.36 years at June 30, 2008,

compared to 3.50 years at March 31, 2008. The Company�s investment

portfolio includes certain funds that invest in fixed maturity

securities which, due to the ownership structure of the funds, are

accounted for by the Company using the equity method. In applying

the equity method, these investments are initially recorded at cost

and are subsequently adjusted based on the Company�s proportionate

share of the net income or loss of the funds (which include changes

in the market value of the underlying securities in the funds).

This method of accounting is different from the way the Company

accounts for its other fixed maturity securities. Investment funds

accounted for using the equity method totaled $351.9 million at

June 30, 2008, compared to $294.4 million at March 31, 2008 and

$236.0 million at December 31, 2007. For the 2008 second quarter,

the effective tax rates on income before income taxes and pre-tax

operating income were 2.6% and 2.5%, respectively, compared to 2.8%

and 3.0% for the 2007 second quarter. For the six months ended June

30, 2008, the effective tax rates on income before income taxes and

pre-tax operating income were 3.2% and 2.5%, respectively, compared

to 3.4% and 3.9% for the 2007 period. The Company�s effective tax

rates may fluctuate from period to period based on the relative mix

of income reported by jurisdiction primarily due to the varying tax

rates in each jurisdiction. The Company�s quarterly tax provision

is adjusted to reflect changes in its expected annual effective tax

rates, if any. A significant portion of the Company�s

catastrophe-exposed property business is written by a Bermuda-based

subsidiary. As a result, generally, the Company�s effective tax

rate is likely to be favorably affected in periods that have a low

level of catastrophic losses incurred and adversely impacted in

periods with significant catastrophic claims activity. The Company

currently expects that its annual effective tax rate on pre-tax

operating income available to common shareholders for the year

ended December 31, 2008 will be in the range of 2.0% to 4.0%. In

addition, the Company�s Bermuda-based reinsurer incurs federal

excise taxes for premiums assumed on U.S. risks. Such expenses are

included in the Company�s acquisition expenses. Net foreign

exchange gains for the 2008 second quarter of $0.3 million

consisted of net unrealized gains of $1.1 million and net realized

losses of $0.8 million, compared to net foreign exchange losses for

the 2007 second quarter of $6.5 million which consisted of net

unrealized losses of $5.9 million and net realized losses of $0.6

million. Net foreign exchange losses for the six months ended June

30, 2008 of $23.3 million consisted of net unrealized losses of

$21.2 million and net realized losses of $2.1 million, compared to

net foreign exchange losses for the 2007 period of $16.2 million

which consisted of net unrealized losses of $23.1 million and net

realized gains of $6.9 million. Net unrealized foreign exchange

gains or losses result from the effects of revaluing the Company�s

net insurance liabilities required to be settled in foreign

currencies at each balance sheet date. The Company holds

investments in foreign currencies which are intended to mitigate

its exposure to foreign currency fluctuations in its net insurance

liabilities. However, changes in the value of such investments due

to foreign currency rate movements are reflected as a direct

increase or decrease to shareholders� equity and are not included

in the statement of income. Diluted weighted average common shares

and common share equivalents outstanding, used in the calculation

of after-tax operating income and net income per common share, were

65.7 million for the 2008 second quarter, compared to 75.3 million

for the 2007 second quarter, and 66.9 million for the six months

ended June 30, 2008, compared to 75.9 million for the 2007 period.

The lower level of weighted average shares outstanding in the 2008

periods was primarily due to the impact of share repurchases as

discussed below. The board of directors of ACGL has authorized the

investment of up to $1.5 billion in ACGL�s common shares through a

share repurchase program. Repurchases under the program may be

effected from time to time in open market or privately negotiated

transactions through February 2010. During the 2008 second quarter,

ACGL repurchased approximately 2.9 million common shares under the

share repurchase program for an aggregate purchase price of $199.9

million. Since the inception of the share repurchase program

through June 30, 2008, ACGL has repurchased approximately 13.4

million common shares for an aggregate purchase price of $926.8

million. As a result of the share repurchase transactions to date,

book value per common share was reduced by $2.09 per share at June

30, 2008, compared to $1.45 at December 31, 2007, while weighted

average shares outstanding for the 2008 second quarter and six

months ended June 30, 2008 were reduced by 11.9 million and 10.6

million shares, respectively, compared to 1.8 million shares and

1.0 million shares for the 2007 second quarter and six months ended

June 30, 2007, respectively. From July 1, 2008 to July 22, 2008,

the Company purchased approximately 1.7 million common shares for

an aggregate purchase price of $112.7 million. The timing and

amount of the repurchase transactions under this program will

depend on a variety of factors, including market conditions and

corporate and regulatory considerations. For additional information

on the Company�s share repurchase program, refer to the

supplemental financial information portion of this release. In May

2008, the Company invested $100.0 million in Gulf Reinsurance

Limited (�Gulf Re�), a newly formed reinsurer based in the Dubai

International Financial Centre, as part of the Company�s joint

venture agreement with Gulf Investment Corporation GSC (�GIC�).

Under the agreement, each of the Company and GIC owns 50% of Gulf

Re, which has commenced writing property and casualty reinsurance.

The Company funded this investment by drawing on its existing

credit facility, which expires in August 2011, with interest

calculated based on 1 month, 3 month or 6 month LIBOR rates plus

27.5 basis points. At June 30, 2008, the Company�s capital of $4.29

billion consisted of $300.0 million of senior notes, representing

7.0% of the total, $100.0 million of revolving credit agreement

borrowings, representing 2.3% of the total, $325.0 million of

preferred shares, representing 7.6% of the total, and common

shareholders� equity of $3.56 billion, representing the balance. At

December 31, 2007, the Company�s capital of $4.34 billion consisted

of $300.0 million of senior notes, representing 6.9% of the total,

$325.0 million of preferred shares, representing 7.5% of the total,

and common shareholders� equity of $3.71 billion, representing the

balance. The decrease in capital during 2008 was primarily

attributable to share repurchase activity and an after-tax decrease

in the fair value of our investment portfolio, partially offset by

net income and borrowings during the period. The Company will hold

a conference call for investors and analysts at 11:00 a.m. Eastern

Time on Friday, July 25, 2008. A live webcast of this call will be

available via the Media-Earnings Webcasts section of the Company's

website at http://www.archcapgroup.bm and will be archived on the

website from 1:00 p.m. Eastern Time on July 25 through midnight

Eastern Time on August 25, 2008. A telephone replay of the

conference call also will be available beginning on July 25 at 1:00

p.m. Eastern Time until August 1, 2008 at midnight Eastern Time. To

access the replay, domestic callers should dial 888-286-8010

(passcode 63520973), and international callers should dial

617-801-6888 (passcode 63520973). Arch Capital Group Ltd., a

Bermuda-based company with approximately $4.3 billion in capital at

June 30, 2008, provides insurance and reinsurance on a worldwide

basis through its wholly owned subsidiaries. Cautionary Note

Regarding Forward-Looking Statements The Private Securities

Litigation Reform Act of 1995 (�PLSRA�) provides a �safe harbor�

for forward-looking statements. This release or any other written

or oral statements made by or on behalf of the Company may include

forward-looking statements, which reflect the Company�s current

views with respect to future events and financial performance. All

statements other than statements of historical fact included in or

incorporated by reference in this release are forward-looking

statements. Forward-looking statements, for purposes of the PLSRA

or otherwise, can generally be identified by the use of

forward-looking terminology such as �may,� �will,� �expect,�

�intend,� �estimate,� �anticipate,� �believe� or �continue� and

similar statements of a future or forward-looking nature or their

negative or variations or similar terminology. Forward-looking

statements involve the Company�s current assessment of risks and

uncertainties. Actual events and results may differ materially from

those expressed or implied in these statements. Important factors

that could cause actual events or results to differ materially from

those indicated in such statements are discussed below and

elsewhere in this release and in the Company�s periodic reports

filed with the Securities and Exchange Commission (the �SEC�), and

include: the Company�s ability to successfully implement its

business strategy during �soft� as well as �hard� markets;

acceptance of the Company�s business strategy, security and

financial condition by rating agencies and regulators, as well as

by brokers and its insureds and reinsureds; the Company�s ability

to maintain or improve its ratings, which may be affected by its

ability to raise additional equity or debt financings, by ratings

agencies� existing or new policies and practices, as well as other

factors described herein; general economic and market conditions

(including inflation, interest rates, foreign currency exchange

rates and prevailing credit terms) and conditions specific to the

reinsurance and insurance markets in which the Company operates;

competition, including increased competition, on the basis of

pricing, capacity, coverage terms or other factors; the Company�s

ability to successfully integrate, establish and maintain operating

procedures (including the implementation of improved computerized

systems and programs to replace and support manual systems) to

effectively support its underwriting initiatives and to develop

accurate actuarial data; the loss of key personnel; the integration

of businesses the Company has acquired or may acquire into its

existing operations; accuracy of those estimates and judgments

utilized in the preparation of the Company�s financial statements,

including those related to revenue recognition, insurance and other

reserves, reinsurance recoverables, investment valuations,

intangible assets, bad debts, income taxes, contingencies and

litigation, and any determination to use the deposit method of

accounting, which for a relatively new insurance and reinsurance

company, like the Company, are even more difficult to make than

those made in a mature company since relatively limited historical

information has been reported to the Company through June 30, 2008;

greater than expected loss ratios on business written by the

Company and adverse development on claim and/or claim expense

liabilities related to business written by its insurance and

reinsurance subsidiaries; severity and/or frequency of losses;

claims for natural or man-made catastrophic events in the Company�s

insurance or reinsurance business could cause large losses and

substantial volatility in its results of operations; acts of

terrorism, political unrest and other hostilities or other

unforecasted and unpredictable events; losses relating to aviation

business and business produced by a certain managing underwriting

agency for which the Company may be liable to the purchaser of its

prior reinsurance business or to others in connection with the

May�5, 2000 asset sale described in the Company�s periodic reports

filed with the SEC; availability to the Company of reinsurance to

manage its gross and net exposures and the cost of such

reinsurance; the failure of reinsurers, managing general agents,

third party administrators or others to meet their obligations to

the Company; the timing of loss payments being faster or the

receipt of reinsurance recoverables being slower than anticipated

by the Company; the Company�s investment performance; material

differences between actual and expected assessments for guaranty

funds and mandatory pooling arrangements; changes in accounting

principles or policies or in the Company�s application of such

accounting principles or policies; changes in the political

environment of certain countries in which the Company operates or

underwrites business; statutory or regulatory developments,

including as to tax policy and matters and insurance and other

regulatory matters such as the adoption of proposed legislation

that would affect Bermuda-headquartered companies and/or

Bermuda-based insurers or reinsurers and/or changes in regulations

or tax laws applicable to the Company, its subsidiaries, brokers or

customers; and the other matters set forth under Item 1A �Risk

Factors�, Item 7 �Management�s Discussion and Analysis of Financial

Condition and Results of Operations� and other sections of the

Company�s Annual Report on Form 10-K, as well as the other factors

set forth in the Company�s other documents on file with the SEC,

and management�s response to any of the aforementioned factors. In

addition, other general factors could affect the Company�s results,

including�developments in the world�s financial and capital markets

and its access to such markets. All subsequent written and oral

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these cautionary statements. The foregoing review of important

factors should not be construed as exhaustive and should be read in

conjunction with other cautionary statements that are included

herein or elsewhere. The Company undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise. Comment on

Regulation G Throughout this release, the Company presents its

operations in the way it believes will be the most meaningful and

useful to investors, analysts, rating agencies and others who use

the Company�s financial information in evaluating the performance

of the Company. This presentation includes the use of after-tax

operating income available to common shareholders, which is defined

as net income available to common shareholders, excluding net

realized gains or losses, equity in net income or loss of

investment funds accounted for using the equity method and net

foreign exchange gains or losses, net of income taxes. The

presentation of after-tax operating income available to common

shareholders is a �non-GAAP financial measure� as defined in

Regulation G. The reconciliation of such measure to net income

available to common shareholders (the most directly comparable GAAP

financial measure) in accordance with Regulation G is included on

page 2 of this release. The Company believes that net realized

gains or losses, equity in net income or loss of investment funds

accounted for using the equity method and net foreign exchange

gains or losses in any particular period are not indicative of the

performance of, or trends in, the Company�s business performance.

Although net realized gains or losses, equity in net income or loss

of investment funds accounted for using the equity method and net

foreign exchange gains or losses are an integral part of the

Company�s operations, the decision to realize investment gains or

losses, the recognition of equity in net income or loss of

investment funds accounted for using the equity method and the

recognition of foreign exchange gains or losses are independent of

the insurance underwriting process and result, in large part, from

general economic and financial market conditions. Furthermore,

certain users of the Company�s financial information believe that,

for many companies, the timing of the realization of investment

gains or losses is largely opportunistic, and, under applicable

GAAP accounting, losses on the Company�s investments can be

realized as the result of other-than-temporary declines in value

without actual realization. The use of the equity method on certain

of the Company�s investments in certain funds that invest in fixed

maturity securities is driven by the ownership structure of such

funds (either limited partnerships or limited liability companies).

In applying the equity method, these investments are initially

recorded at cost and are subsequently adjusted based on the

Company�s proportionate share of the net income or loss of the

funds (which include changes in the market value of the underlying

securities in the funds). This method of accounting is different

from the way the Company accounts for its other fixed maturity

securities and the timing of the recognition of equity in net

income or loss of investment funds accounted for using the equity

method may differ from gains or losses in the future upon sale or

maturity of such investments. Due to these reasons, the Company

excludes net realized gains or losses, equity in net income or loss

of investment funds accounted for using the equity method and net

foreign exchange gains or losses from the calculation of after-tax

operating income available to common shareholders. The Company

believes that showing net income available to common shareholders

exclusive of the items referred to above reflects the underlying

fundamentals of the Company�s business since the Company evaluates

the performance of and manages its business to produce an

underwriting profit. In addition to presenting net income available

to common shareholders, the Company believes that this presentation

enables investors and other users of the Company�s financial

information to analyze the Company�s performance in a manner

similar to how the Company�s management analyzes performance. The

Company also believes that this measure follows industry practice

and, therefore, allows the users of the Company�s financial

information to compare the Company�s performance with its industry

peer group. The Company believes that the equity analysts and

certain rating agencies which follow the Company and the insurance

industry as a whole generally exclude these items from their

analyses for the same reasons. ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES SUPPLEMENTAL FINANCIAL INFORMATION � Book Value Per

Common Share and Share Repurchases � � June 30, � December 31,

(U.S. dollars in thousands, except share data) 2008 2007 �

Calculation of book value per common share: Total shareholders�

equity $ 3,886,233 $ 4,035,811 Less preferred shareholders� equity

� (325,000 ) � (325,000 ) Common shareholders� equity $ 3,561,233 $

3,710,811 Common shares outstanding (1) � 61,943,100 � � 67,318,466

� Book value per common share $ 57.49 � $ 55.12 � � Three Months

Ended � Six Months Ended � Cumulative June 30, June 30, June 30,

(U.S. dollars in thousands, except share data) 2008 � 2007 2008 �

2007 2008 � Effect of share repurchases: Aggregate purchase price

of shares repurchased $ 199,910 $ 210,498 $ 389,753 $ 254,973 $

926,819 Shares repurchased � 2,871,859 � � 2,955,875 � � 5,621,768

� � 3,638,642 � � 13,390,807 � Average price per share repurchased

$ 69.61 $ 71.21 $ 69.33 $ 70.07 $ 69.21 � Estimated dilutive impact

on ending book value per common share (2) � ($0.54 ) � ($0.95 ) �

($0.99 ) � ($1.10 ) � ($2.09 ) Estimated net accretive impact on

diluted earnings per share (3) $ 0.30 � $ 0.04 � $ 0.56 � $ 0.10 �

(1) Excludes the effects of 5,609,458 and 5,486,033 stock options

and 435,704 and 116,453 restricted stock units outstanding at June

30, 2008 and December 31, 2007, respectively. (2) As the average

price per share repurchased during the periods exceeded the book

value per common share at June 30, 2008 and December 31, 2007, the

repurchase of shares during the periods reduced book value per

common share in the periods presented. (3) The estimated impact on

diluted earnings per share was calculated comparing reported

results versus (i) net income per share plus an estimate of lost

net investment income on the share repurchases divided by (ii)

weighted average diluted shares outstanding excluding the weighted

average impact of share repurchases. The repurchase of shares was

accretive to diluted earnings per share in the periods presented.

Annualized Operating Return on Average Common Equity � � Three

Months Ended � Six Months Ended June 30, June 30, (U.S. dollars in

thousands) 2008 � 2007 2008 � 2007 � After-tax operating income

available to common shareholders $ 185,375 $ 205,626 $ 387,358 $

410,356 Annualized operating income available to common

shareholders 741,500 822,504 774,716 820,712 � Beginning common

shareholders� equity $ 3,679,544 $ 3,458,348 $ 3,710,811 $

3,265,619 Ending common shareholders� equity � 3,561,233 � �

3,379,067 � � 3,561,233 � � 3,379,067 � Average common

shareholders� equity $ 3,620,389 � $ 3,418,708 � $ 3,636,022 � $

3,322,343 � � Annualized operating return on average common equity

20.5 % 24.1 % 21.3 % 24.7 % Selected Information on Losses and Loss

Adjustment Expenses � � Three Months Ended � Six Months Ended June

30, June 30, (U.S. dollars in thousands) 2008 � 2007 2008 � 2007 �

Components of losses and loss adjustment expenses Paid losses and

loss adjustment expenses $ 306,604 $ 258,505 $ 556,104 $ 532,873

Increase in unpaid losses and loss adjustment expenses � 98,021 � �

167,158 � � 252,938 � � 312,851 � Total losses and loss adjustment

expenses $ 404,625 � $ 425,663 � $ 809,042 � $ 845,724 � �

Estimated net (favorable) adverse development in prior year loss

reserves, net of related adjustments Net impact on underwriting

results: Insurance ($19,498 ) $ 3,922 ($25,108 ) $ 6,848

Reinsurance � (35,575 ) � (36,076 ) � (86,625 ) � (82,303 ) Total �

($55,073 ) � ($32,154 ) � ($111,733 ) � ($75,455 ) � Impact on

losses and loss adjustment expenses: Insurance ($23,263 ) $ 3,252

($29,039 ) $ 2,353 Reinsurance � (39,034 ) � (38,583 ) � (90,120 )

� (85,337 ) Total � ($62,297 ) � ($35,331 ) � ($119,159 ) �

($82,984 ) � Impact on acquisition expenses: Insurance $ 3,765 $

670 $ 3,931 $ 4,495 Reinsurance � 3,459 � � 2,507 � � 3,495 � �

3,034 � Total $ 7,224 � $ 3,177 � $ 7,426 � $ 7,529 � � Impact on

combined ratio: Insurance (4.7 %) 0.9 % (3.0 %) 0.8 % Reinsurance

(12.3 %) (11.3 %) (15.0 %) (12.7 %) Total (7.8 %) (4.3 %) (7.9 %)

(5.0 %) � Impact on loss ratio: Insurance (5.6 %) 0.8 % (3.5 %) 0.3

% Reinsurance (13.5 %) (12.1 %) (15.6 %) (13.1 %) Total (8.8 %)

(4.7 %) (8.4 %) (5.5 %) � Impact on acquisition expense ratio:

Insurance 0.9 % 0.1 % 0.5 % 0.5 % Reinsurance 1.2 % 0.8 % 0.6 % 0.4

% Total 1.0 % 0.4 % 0.5 % 0.5 % � Estimated net losses incurred

from current period catastrophic events (1) Insurance $ 6,950 � $

27,250 � Reinsurance � 16,780 � � 12,100 � � 22,554 � � 27,858 �

Total $ 23,730 � $ 12,100 � $ 49,804 � $ 27,858 � � Impact on loss

ratio: Insurance 1.7 % � 3.3 % � Reinsurance 5.8 % 3.8 % 3.9 % 4.3

% Total 3.4 % 1.6 % 3.5 % 1.9 % (1) Equals estimated losses from

catastrophic events occurring in the current accident year, net of

reinsurance and reinstatement premiums. Amounts shown for the

insurance segment are for named catastrophic events only. Amounts

shown for the reinsurance segment include (i) named events with

over $5 million of losses incurred by its Bermuda operations and

(ii) all catastrophe losses incurred by its U.S. operations.

Investment Information � � Three Months Ended � Six Months Ended

June 30, June 30, (U.S. dollars in thousands) 2008 � 2007 2008 �

2007 � Net investment income: Total $ 117,120 $ 113,923 $ 239,313 $

223,970 Per share $ 1.78 $ 1.51 $ 3.58 $ 2.95 � Pre-tax investment

income yield (at amortized cost) 4.80 % 4.94 % 4.84 % 4.90 %

After-tax investment income yield (at amortized cost) 4.68 % 4.78 %

4.72 % 4.74 % � Cash flow from operations $ 256,263 $ 273,872 $

590,808 $ 677,003 � June 30, � December 31, (U.S. dollars in

thousands) 2008 2007 � Investable assets: Fixed maturities

available for sale, at fair value $ 7,746,296 $ 7,137,998 Fixed

maturities pledged under securities lending agreements, at fair

value (1) � 890,822 � � 1,462,826 � Total fixed maturities

8,637,118 8,600,824 Short-term investments available for sale, at

fair value 645,587 699,036 Short-term investments pledged under

securities lending agreements, at fair value (1) � 219 Cash 246,544

239,915 Other investments (2) Mutual funds 228,466 286,146

Privately held securities and other 67,172 67,548 Investment funds

accounted for using the equity method (3) 351,879 235,975

Investment in joint venture 100,000 � Securities transactions

entered into but not settled at the balance sheet date � (10,845 )

� (5,796 ) Total investable assets (1) $ 10,265,921 � $ 10,123,867

� � Fixed income portfolio (1): Average effective duration (in

years) 3.36 3.29 Average credit quality AA+ AA+ Imbedded book yield

(before investment expenses) 4.96% 5.03% (1) In securities lending

transactions, the Company receives collateral in excess of the fair

value of the fixed maturities and short-term investments pledged

under securities lending agreements. For purposes of this table,

the Company has excluded the collateral received at June 30, 2008

and December 31, 2007 of $918.2 million and $1.5 billion,

respectively, which is reflected as �short-term investment of funds

received under securities lending agreements, at fair value� and

included the $890.8 million and $1.46 billion, respectively, of

�fixed maturities and short-term investments pledged under

securities lending agreements, at fair value.� (2) Other

investments include (i) mutual funds which invest in fixed maturity

securities and international equity index funds; and (ii) privately

held securities and other which include the Company�s investment in

Aeolus LP and other privately held securities. (3) The Company�s

investment portfolio includes certain funds that invest in fixed

maturity securities which, due to the ownership structure of the

funds, are accounted for by the Company using the equity method. In

applying the equity method, these investments are initially

recorded at cost and are subsequently adjusted based on the

Company�s proportionate share of the net income or loss of the

funds (which include changes in the market value of the underlying

securities in the funds). Changes in the carrying value of such

investments are recorded as �Equity in net income (loss) of

investment funds accounted for using the equity method� rather than

as an unrealized gain or loss component of accumulated other

comprehensive income in shareholders� equity as are changes in the

carrying value of the Company�s other fixed income investments.

Investment Information (continued) The following table summarizes

the Company�s fixed maturities and fixed maturities pledged under

securities lending agreements: (U.S. dollars in thousands) �

Estimated Fair Value � Gross Unrealized Gains � Gross Unrealized

Losses � Amortized Cost � June 30, 2008: Corporate bonds $

2,318,198 $ 42,801 ($70,098 ) $ 2,345,495 Mortgage backed

securities 1,532,524 13,235 (48,999 ) 1,568,288 Commercial mortgage

backed securities 1,277,512 9,761 (5,481 ) 1,273,232 Asset backed

securities 1,100,914 8,190 (7,505 ) 1,100,229 Municipal bonds

1,066,325 5,905 (7,825 ) 1,068,245 U.S. government and government

agencies 937,496 10,839 (7,055 ) 933,712 Non-U.S. government

securities � 404,149 � 23,205 (10,097 ) � 391,041 Total $ 8,637,118

$ 113,936 ($157,060 ) $ 8,680,242 � December 31, 2007: Corporate

bonds $ 2,452,527 $ 40,296 ($10,994 ) $ 2,423,225 Mortgage backed

securities 1,234,596 14,211 (4,087 ) 1,224,472 Commercial mortgage

backed securities 1,315,680 17,339 (558 ) 1,298,899 Asset backed

securities 1,008,030 9,508 (4,030 ) 1,002,552 Municipal bonds

990,325 13,213 (195 ) 977,307 U.S. government and government

agencies 1,165,423 21,598 (447 ) 1,144,272 Non-U.S. government

securities � 434,243 � 28,032 (3,056 ) � 409,267 Total $ 8,600,824

$ 144,197 ($23,367 ) $ 8,479,994 The following table provides

information on the Company�s asset backed securities (�ABS�) at

June 30, 2008: � � � � Estimated Fair Value (U.S. dollars in

thousands) Par Value Average Credit Quality Effective Duration

Total � % of Class � % of Investable Assets � Sector: Autos $

277,941 AAA 1.22 $ 278,820 25.3 2.7 Credit cards 558,667 AAA 2.33

561,463 51.0 5.5 Rate reduction bonds 126,506 AAA 2.28 128,618 11.7

1.3 Other � 96,460 AAA 1.28 � 96,245 8.8 � 0.9 $ 1,059,574 AAA 1.94

$ 1,065,146 96.8 10.4 � Home equity (1) $ 23,694 AAA 0.01 $ 20,391

1.9 0.2 17,432 AA 0.03 11,821 1.1 0.1 2,625 A 0.02 1,181 0.1 0.0

2,400 BBB 0.01 249 0.0 0.0 8,493 B 0.01 1,593 0.1 0.0 � 3,611 CCC

0.01 � 533 0.0 0.0 $ 58,255 AA+ 0.02 $ 35,768 3.2 0.3 � � � � Total

ABS $ 1,117,829 AAA 1.84 $ 1,100,914 100.0 10.7 (1) The Company�s

investment portfolio included $71.4 million par in sub-prime

securities at June 30, 2008, with an estimated fair value of $45.9

million, an average credit quality of AA+ and an effective duration

of 0.01 years. Such amounts were primarily in the home equity

sector with the balance in other ABS, MBS and CMBS sectors.

Investment Information (continued) The following table provides

information on the Company�s mortgage backed securities (�MBS�) and

commercial mortgage backed securities (�CMBS�) at June 30, 2008: �

� � � Estimated Fair Value (U.S. dollars in thousands) Issuance

Year Par Value Average Credit Quality Total � % of Asset Class � %

of Investable Assets � MBS: Agency MBS � $ 1,015,604 AAA $

1,012,626 66.1 9.9 � Prime non-agency MBS 2002 $ 7,876 AAA $ 7,609

0.5 0.1 2003 25,245 AAA 24,223 1.6 0.2 2004 88,440 AAA 84,110 5.5

0.8 2005 125,570 AAA 108,397 7.1 1.1 2006 139,207 AAA 124,220 8.1

1.2 2007 153,632 AAA 137,401 8.9 1.3 2008 � 35,746 � AAA � 33,938

2.2 0.3 $ 575,716 AAA $ 519,898 33.9 5.0 � � � � Total MBS $

1,591,320 � AAA $ 1,532,524 100.0 14.9 � CMBS: Agency CMBS (1) � $

1,294,169 Gov�t $ 505,453 39.6 4.9 � Non-agency CMBS 1998 $ 3,400

AAA $ 3,580 0.3 0.0 1999 113,120 AAA 116,426 9.1 1.1 2000 129,064

AAA 133,356 10.4 1.3 2001 105,508 AAA 107,682 8.4 1.1 2002 80,857

AAA 79,999 6.3 0.8 2003 105,410 AAA 101,447 7.9 1.0 2004 77,747 AAA

76,526 6.0 0.8 2005 78,602 AAA 75,033 5.9 0.7 2006 36,979 AAA

35,619 2.8 0.3 2007 � 44,375 � AAA � 42,391 3.3 0.4 $ 775,062 AAA $

772,059 60.4 7.5 � � � � Total CMBS $ 2,069,231 � AAA $ 1,277,512

100.0 12.4 � Additional Statistics: Prime Non- Agency MBS

Non-Agency CMBS (2) Weighted average loan age (months) 32 73

Weighted average life (months) (3) 68 42 Weighted average

loan-to-value % (4) 66.0 % 58.0 % Total delinquencies (5) 4.4 % 0.8

% Current credit support % (6) 11.7 % 26 % (1) Includes

approximately $834.4 million par of �interest-only� securities with

an estimated fair value of $49.2 million. (2) Loans defeased with

government/agency obligations represented approximately 23% of the

collateral underlying the Company�s non-agency CMBS holdings. (3)

The weighted average life for MBS is based on the interest rates in

effect at June 30, 2008. The weighted average life for non-agency

CMBS reflects the average life of the collateral underlying the

Company�s non-agency CMBS holdings. (4) The range of loan-to-values

on MBS is 40% to 93% while the range of loan-to-values on CMBS is

44% to 72%. (5) Total delinquencies for MBS includes 60 days and

over while CMBS includes 30 days and over. (6) Current credit

support % represents the percentage for a collateralized mortgage

obligation (�CMO�) or CMBS class/tranche from other subordinate

classes in the same CMO or CMBS deal. ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (U.S. dollars in

thousands, except share data) � � (Unaudited) � (Unaudited) Three

Months Ended Six Months Ended June 30, June 30, 2008 � 2007 2008 �

2007 Revenues Net premiums written $ 686,118 $ 757,895 $ 1,497,460

$ 1,629,640 Decrease (increase) in unearned premiums � 19,557 � �

(6,483 ) � (83,551 ) � (132,735 ) Net premiums earned 705,675

751,412 1,413,909 1,496,905 Net investment income 117,120 113,923

239,313 223,970 Net realized (losses) gains (12,669 ) (3,757 )

23,306 (4,738 ) Fee income 1,238 2,091 2,306 4,060 Equity in net

income (loss) of investment funds accounted for using the equity

method 19,583 3,376 (2,730 ) 6,018 Other income � 4,968 � � 265 � �

9,004 � � 869 � Total revenues � 835,915 � � 867,310 � � 1,685,108

� � 1,727,084 � � Expenses Losses and loss adjustment expenses

404,625 425,663 809,042 845,724 Acquisition expenses 119,226

117,277 233,865 237,405 Other operating expenses 102,578 100,505

199,765 191,318 Interest expense 5,788 5,523 11,312 11,046 Net

foreign exchange (gains) losses � (298 ) � 6,450 � � 23,289 � �

16,192 � Total expenses � 631,919 � � 655,418 � � 1,277,273 � �

1,301,685 � � Income before income taxes 203,996 211,892 407,835

425,399 � Income tax expense � 5,253 � � 6,037 � � 13,209 � �

14,532 � � Net income 198,743 205,855 394,626 410,867 � Preferred

dividends � 6,461 � � 6,461 � � 12,922 � � 12,922 � � Net income

available to common shareholders $ 192,282 � $ 199,394 � $ 381,704

� $ 397,945 � � Net income per common share Basic $ 3.05 $ 2.75 $

5.95 $ 5.44 Diluted $ 2.92 $ 2.65 $ 5.71 $ 5.24 � Weighted average

common shares and common share equivalents outstanding Basic

62,995,550 72,494,823 64,145,533 73,209,439 Diluted 65,748,119

75,254,846 66,886,972 75,947,858 ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (U.S. dollars in

thousands, except share data) � (Unaudited) � June 30, December 31,

2008 2007 Assets Investments: Fixed maturities available for sale,

at fair value (amortized cost: 2008, $7,787,994; 2007, $7,037,272)

$ 7,746,296 $ 7,137,998 Short-term investments available for sale,

at fair value (amortized cost: 2008, $644,156; 2007, $700,262)

645,587 699,036 Short-term investment of funds received under

securities lending agreements, at fair value 918,207 1,503,723

Other investments (cost: 2008, $281,243; 2007, $323,950) 295,638

353,694 Investment funds accounted for using the equity method

351,879 235,975 Investment in joint venture � 100,000 � � � Total

investments 10,057,607 9,930,426 � Cash 246,544 239,915 Accrued

investment income 76,313 73,862 Fixed maturities and short-term

investments pledged under securities lending agreements, at fair

value 890,822 1,463,045 Premiums receivable 859,261 729,628 Unpaid

losses and loss adjustment expenses recoverable 1,586,201 1,609,619

Paid losses and loss adjustment expenses recoverable 113,439

132,289 Prepaid reinsurance premiums 364,226 480,462 Deferred

income tax assets, net 66,944 57,051 Deferred acquisition costs,

net 319,732 290,059 Receivable for securities sold 1,053,379 17,359

Other assets � 647,034 � � 600,552 Total Assets $ 16,281,502 � $

15,624,267 � Liabilities Reserve for losses and loss adjustment

expenses $ 7,349,083 $ 7,092,452 Unearned premiums 1,735,371

1,765,881 Reinsurance balances payable 254,830 301,309 Senior notes

300,000 300,000 Revolving credit agreement borrowings 100,000 �

Securities lending payable 918,207 1,503,723 Payable for securities

purchased 1,064,224 23,155 Other liabilities � 673,554 � � 601,936

Total Liabilities � 12,395,269 � � 11,588,456 � Commitments and

Contingencies � Shareholders� Equity Non-cumulative preferred

shares ($0.01 par value, 50,000,000 shares authorized) - Series A

(issued: 2008 and 2007, 8,000,000) 80 80 - Series B (issued: 2008

and 2007, 5,000,000) 50 50 Common shares ($0.01 par value,

200,000,000 shares authorized, issued: 2008, 61,943,100; 2007,

67,318,466) 619 673 Additional paid-in capital 1,089,636 1,451,667

Retained earnings 2,809,821 2,428,117 Accumulated other

comprehensive (loss) income, net of deferred income tax � (13,973 )

� 155,224 Total Shareholders� Equity � 3,886,233 � � 4,035,811

Total Liabilities and Shareholders� Equity $ 16,281,502 � $

15,624,267 ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CHANGES IN SHAREHOLDERS� EQUITY (U.S. dollars in

thousands) � � (Unaudited) Six Months Ended June 30, 2008 � 2007

Non-Cumulative Preferred Shares Balance at beginning and end of

period $ 130 $ 130 � Common Shares Balance at beginning of year 673

743 Common shares issued, net 2 6 Purchases of common shares under

share repurchase program � (56 ) � (36 ) Balance at end of period �

619 � � 713 � � Additional Paid-in Capital Balance at beginning of

year 1,451,667 1,944,304 Common shares issued 3,511 405 Exercise of

stock options 9,073 13,373 Common shares retired (391,776 )

(257,162 ) Amortization of share-based compensation 17,511 14,457

Other � (350 ) � 918 � Balance at end of period � 1,089,636 � �

1,716,295 � � Retained Earnings Balance at beginning of year

2,428,117 1,593,907 Adjustment to adopt SFAS No. 155, �Accounting

for Certain Hybrid Financial Instruments�an amendment of FASB

Statements No. 133 and 140� � � � � 2,111 � Balance at beginning of

year, as adjusted 2,428,117 1,596,018 Dividends declared on

preferred shares (12,922 ) (12,922 ) Net income � 394,626 � �

410,867 � Balance at end of period � 2,809,821 � � 1,993,963 � �

Accumulated Other Comprehensive Income (Loss) Balance at beginning

of year 155,224 51,535 Adjustment to adopt SFAS No. 155,

�Accounting for Certain Hybrid Financial Instruments�an amendment

of FASB Statements No. 133 and 140� � � � � (2,111 ) Balance at

beginning of year, as adjusted 155,224 49,424 Change in unrealized

appreciation (decline) in value of investments, net of deferred

income tax (169,023 ) (67,513 ) Foreign currency translation

adjustments, net of deferred income tax � (174 ) � 11,055 � Balance

at end of period � (13,973 ) � (7,034 ) � Total Shareholders�

Equity $ 3,886,233 � $ 3,704,067 � ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (U.S.

dollars in thousands) � � (Unaudited) Six Months Ended June 30,

2008 � 2007 Comprehensive Income Net income $ 394,626 $ 410,867

Other comprehensive income (loss), net of deferred income tax

Unrealized decline in value of investments: Unrealized holding

losses arising during period (127,124 ) (72,486 ) Reclassification

of net realized (gains) losses, net of income taxes, included in

net income (41,899 ) 4,973 Foreign currency translation adjustments

� (174 ) � 11,055 � Other comprehensive loss � (169,197 ) � (56,458

) Comprehensive Income $ 225,429 � $ 354,409 � ARCH CAPITAL GROUP

LTD. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (U.S.

dollars in thousands) � � (Unaudited) Six Months Ended June 30,

2008 � 2007 Operating Activities Net income $ 394,626 $ 410,867

Adjustments to reconcile net income to net cash provided by

operating activities: Net realized (gains) losses (20,087 ) 4,854

Equity in net (income) loss of investment funds accounted for using

the equity method and other income (6,009 ) (6,887 ) Share-based

compensation 17,511 14,457 Changes in: Reserve for losses and loss

adjustment expenses, net of unpaid losses and loss adjustment

expenses recoverable 278,357 324,793 Unearned premiums, net of

prepaid reinsurance premiums 85,364 135,525 Premiums receivable

(126,518 ) (290,437 ) Deferred acquisition costs, net (29,810 )

(18,702 ) Reinsurance balances payable (47,774 ) 79,254 Other

liabilities 48,281 1,737 Other items, net � (3,133 ) � 21,542 � Net

Cash Provided By Operating Activities � 590,808 � � 677,003 � �

Investing Activities Purchases of fixed maturity investments

(7,510,262 ) (8,933,304 ) Proceeds from sales of fixed maturity

investments 7,044,479 8,407,340 Proceeds from redemptions and

maturities of fixed maturity investments 317,369 305,847 Purchases

of other investments (187,652 ) (185,357 ) Proceeds from sales of

other investments 89,324 62,309 Investment in joint venture

(100,000 ) � Net sales (purchases) of short-term investments 60,739

(141,217 ) Change in investment of securities lending collateral

585,516 (223,583 ) Purchases of furniture, equipment and other �

(4,984 ) � (8,998 ) Net Cash Provided By (Used For) Investing

Activities � 294,529 � � (716,963 ) � Financing Activities

Purchases of common shares under share repurchase program (389,753

) (254,973 ) Proceeds from common shares issued, net 8,050 7,427

Revolving credit agreement borrowings 100,000 � Change in

securities lending collateral (585,516 ) 223,583 Excess tax

benefits from share-based compensation 1,276 3,965 Preferred

dividends paid � (12,922 ) � (12,922 ) Net Cash Used For Financing

Activities � (878,865 ) � (32,920 ) � Effects of exchange rate

changes on foreign currency cash � 157 � � 1,006 � � Increase

(decrease) in cash 6,629 (71,874 ) Cash beginning of year � 239,915

� � 317,017 � Cash end of period $ 246,544 � $ 245,143 � � Income

taxes paid, net $ 5,233 � $ 1,881 � Interest paid $ 11,025 � $

11,025 � ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES SEGMENT

INFORMATION The Company classifies its businesses into two

underwriting segments � insurance and reinsurance � and corporate

and other (non-underwriting). The Company�s insurance and

reinsurance operating segments each have segment managers who are

responsible for the overall profitability of their respective

segments and who are directly accountable to the Company�s chief

operating decision makers, the President and Chief Executive

Officer of ACGL and the Chief Financial Officer of ACGL. The chief

operating decision makers do not assess performance, measure return

on equity or make resource allocation decisions on a line of

business basis. The Company determined its reportable operating

segments using the management approach described in SFAS No. 131,

�Disclosures About Segments of an Enterprise and Related

Information.� Management measures segment performance based on

underwriting income or loss. The Company does not manage its assets

by segment and, accordingly, investment income is not allocated to

each underwriting segment. In addition, other revenue and expense

items are not evaluated by segment. The accounting policies of the

segments are the same as those used for the preparation of the

Company�s consolidated financial statements. Inter-segment

insurance business is allocated to the segment accountable for the

underwriting results. The insurance segment consists of the

Company�s insurance underwriting subsidiaries which primarily write

on both an admitted and non-admitted basis. The insurance segment

consists of nine specialty product lines: casualty; construction

and national accounts; executive assurance; healthcare;

professional liability; programs; property, marine and aviation;

surety; and other (consisting of collateral protection business,

excess workers� compensation and employers� liability business and

travel and accident business). The reinsurance segment consists of

the Company�s reinsurance underwriting subsidiaries. The

reinsurance segment generally seeks to write significant lines on

specialty property and casualty reinsurance treaties. Classes of

business include: casualty; marine and aviation; other specialty;

property catastrophe; property excluding property catastrophe

(losses on a single risk, both excess of loss and pro rata); and

other (consisting of non-traditional and casualty clash business).

Corporate and other (non-underwriting) includes net investment

income, other fee income, net of related expenses, other income

(loss), other expenses incurred by the Company, interest expense,

net realized gains or losses, equity in net income (loss) of

investment funds accounted for using the equity method, net foreign

exchange gains or losses and income taxes. In addition, results for

corporate and other include dividends on the Company�s

non-cumulative preferred shares. The following tables set forth

underwriting income or loss by segment, together with a

reconciliation of underwriting income to net income available to

common shareholders: � Three Months Ended June 30, 2008 (U.S.

dollars in thousands) Insurance � Reinsurance � Total � Gross

premiums written (1) $ 621,663 $ 273,318 $ 886,926 Net premiums

written 421,501 264,617 686,118 � Net premiums earned $ 416,585 $

289,090 $ 705,675 Fee income 880 358 1,238 Losses and loss

adjustment expenses (262,633 ) (141,992 ) (404,625 ) Acquisition

expenses (55,400 ) (63,826 ) (119,226 ) Other operating expenses �

(71,566 ) � (20,091 ) � (91,657 ) Underwriting income $ 27,866 � $

63,539 � 91,405 � Net investment income 117,120 Net realized losses

(12,669 ) Equity in net income (loss) of investment funds accounted

for using the equity method 19,583 Other income 4,968 Other

expenses (10,921 ) Interest expense (5,788 ) Net foreign exchange

gains � 298 � Income before income taxes 203,996 Income tax expense

� (5,253 ) � Net income 198,743 Preferred dividends � (6,461 ) Net

income available to common shareholders $ 192,282 � � Underwriting

Ratios Loss ratio 63.0 % 49.1 % 57.3 % Acquisition expense ratio

(2) 13.1 % 22.1 % 16.8 % Other operating expense ratio � 17.2 % �

6.9 % � 13.0 % Combined ratio � 93.3 % � 78.1 % � 87.1 % (1)

Certain amounts included in the gross premiums written of each

segment are related to intersegment transactions and are included

in the gross premiums written of each segment. Accordingly, the sum

of gross premiums written for each segment does not agree to the

total gross premiums written as shown in the table above due to the

elimination of intersegment transactions in the total. (2) The

acquisition expense ratio is adjusted to include certain fee

income. � Three Months Ended June 30, 2007 (U.S. dollars in

thousands) Insurance � Reinsurance � Total � Gross premiums written

(1) $ 684,725 $ 427,348 $ 1,102,210 Net premiums written 451,828

306,067 757,895 � Net premiums earned $ 432,560 $ 318,852 $ 751,412

Fee income 1,276 815 2,091 Losses and loss adjustment expenses

(272,658 ) (153,005 ) (425,663 ) Acquisition expenses (47,532 )

(69,745 ) (117,277 ) Other operating expenses � (70,269 ) � (19,999

) � (90,268 ) Underwriting income $ 43,377 � $ 76,918 � 120,295 �

Net investment income 113,923 Net realized losses (3,757 ) Equity

in net income (loss) of investment funds accounted for using the

equity method 3,376 Other income 265 Other expenses (10,237 )

Interest expense (5,523 ) Net foreign exchange losses � (6,450 )

Income before income taxes 211,892 Income tax expense � (6,037 ) �

Net income 205,855 Preferred dividends � (6,461 ) Net income

available to common shareholders $ 199,394 � � Underwriting Ratios

Loss ratio 63.0 % 48.0 % 56.6 % Acquisition expense ratio (2) 10.8

% 21.9 % 15.5 % Other operating expense ratio � 16.2 % � 6.3 % �

12.0 % Combined ratio � 90.0 % � 76.2 % � 84.1 % (1) Certain

amounts included in the gross premiums written of each segment are

related to intersegment transactions and are included in the gross

premiums written of each segment. Accordingly, the sum of gross

premiums written for each segment does not agree to the total gross

premiums written as shown in the table above due to the elimination

of intersegment transactions in the total. (2) The acquisition

expense ratio is adjusted to include certain fee income. � Six

Months Ended June 30, 2008 (U.S. dollars in thousands) Insurance �

Reinsurance � Total � Gross premiums written (1) $ 1,248,011 $

707,145 $ 1,940,078 Net premiums written 824,265 673,195 1,497,460

� Net premiums earned $ 835,685 $ 578,224 $ 1,413,909 Fee income

1,762 544 2,306 Losses and loss adjustment expenses (549,936 )

(259,106 ) (809,042 ) Acquisition expenses (107,289 ) (126,576 )

(233,865 ) Other operating expenses � (145,203 ) � (38,329 ) �

(183,532 ) Underwriting income $ 35,019 � $ 154,757 � 189,776 � Net

investment income 239,313 Net realized gains 23,306 Equity in net

income (loss) of investment funds accounted for using the equity

method (2,730 ) Other income 9,004 Other expenses (16,233 )

Interest expense (11,312 ) Net foreign exchange losses � (23,289 )

Income before income taxes 407,835 Income tax expense � (13,209 ) �

Net income 394,626 Preferred dividends � (12,922 ) Net income

available to common shareholders $ 381,704 � � Underwriting Ratios

Loss ratio 65.8 % 44.8 % 57.2 % Acquisition expense ratio (2) 12.6

% 21.9 % 16.4 % Other operating expense ratio � 17.4 % � 6.6 % �

13.0 % Combined ratio � 95.8 % � 73.3 % � 86.6 % (1) Certain

amounts included in the gross premiums written of each segment are

related to intersegment transactions and are included in the gross

premiums written of each segment. Accordingly, the sum of gross

premiums written for each segment does not agree to the total gross

premiums written as shown in the table above due to the elimination

of intersegment transactions in the total. (2) The acquisition

expense ratio is adjusted to include certain fee income. � Six

Months Ended June 30, 2007 (U.S. dollars in thousands) Insurance �

Reinsurance � Total � Gross premiums written (1) $ 1,345,935 $

986,002 2,312,824 Net premiums written 880,172 749,468 1,629,640 �

Net premiums earned $ 846,407 $ 650,498 $ 1,496,905 Fee income

2,701 1,359 4,060 Losses and loss adjustment expenses (531,980 )

(313,744 ) (845,724 ) Acquisition expenses (94,227 ) (143,178 )

(237,405 ) Other operating expenses � (139,163 ) � (33,780 ) �

(172,943 ) Underwriting income $ 83,738 � $ 161,155 � 244,893 � Net

investment income 223,970 Net realized losses (4,738 ) Equity in

net income (loss) of investment funds accounted for using the

equity method 6,018 Other income 869 Other expenses (18,375 )

Interest expense (11,046 ) Net foreign exchange losses � (16,192 )

Income before income taxes 425,399 Income tax expense � (14,532 ) �

Net income 410,867 Preferred dividends � (12,922 ) Net income

available to common shareholders $ 397,945 � � Underwriting Ratios

Loss ratio 62.9 % 48.2 % 56.5 % Acquisition expense ratio (2) 10.9

% 22.0 % 15.8 % Other operating expense ratio � 16.4 % � 5.2 % �

11.6 % Combined ratio � 90.2 % � 75.4 % � 83.9 % (1) Certain

amounts included in the gross premiums written of each segment are

related to intersegment transactions and are included in the gross

premiums written of each segment. Accordingly, the sum of gross

premiums written for each segment does not agree to the total gross

premiums written as shown in the table above due to the elimination

of intersegment transactions in the total. (2) The acquisition

expense ratio is adjusted to include certain fee income. The

following tables set forth the insurance segment�s net premiums

written and earned by major line of business, together with net

premiums written by client location: � Three Months Ended June 30,

2008 � 2007 INSURANCE SEGMENT (U.S. dollars in thousands) Amount �

% of Total Amount � % of Total � Net premiums written Property,

marine and aviation $ 90,569 21.5 $ 104,705 23.2 Programs 73,202

17.3 59,154 13.1 Construction and national accounts 65,752 15.6

55,514 12.3 Professional liability 63,583 15.1 64,584 14.3

Executive assurance 43,740 10.4 47,904 10.6 Casualty 30,266 7.2

57,240 12.6 Healthcare 11,027 2.6 12,383 2.7 Surety 10,206 2.4

12,968 2.9 Other (1) � 33,156 7.9 � 37,376 8.3 Total $ 421,501

100.0 $ 451,828 100.0 � Net premiums earned Property, marine and

aviation $ 84,472 20.3 $ 92,387 21.4 Programs 62,085 14.9 57,036

13.2 Construction and national accounts 58,166 14.0 50,965 11.8

Professional liability 66,200 15.9 65,804 15.2 Executive assurance

44,496 10.7 47,408 11.0 Casualty 37,650 9.0 52,570 12.1 Healthcare

13,137 3.1 17,107 3.9 Surety 12,057 2.9 16,597 3.8 Other (1) �

38,322 9.2 � 32,686 7.6 Total $ 416,585 100.0 $ 432,560 100.0 � Net

premiums written by client location United States $ 330,154 78.3 $

361,733 80.1 Europe 56,657 13.5 60,968 13.5 Other � 34,690 8.2 �

29,127 6.4 Total $ 421,501 100.0 $ 451,828 100.0 � Net premiums

written by underwriting location United States $ 318,227 75.5 $

341,456 75.6 Europe 79,854 18.9 83,730 18.5 Other � 23,420 5.6 �

26,642 5.9 Total $ 421,501 100.0 $ 451,828 100.0 (1) Includes

excess workers� compensation and employers� liability business and

travel and accident business. � Six Months Ended June 30, 2008 �

2007 INSURANCE SEGMENT (U.S. dollars in thousands) Amount � % of

Total Amount � % of Total � Net premiums written Property, marine

and aviation $ 188,731 22.9 $ 189,568 21.5 Programs 127,785 15.5

117,477 13.3 Construction and national accounts 126,963 15.4

115,997 13.2 Professional liability 117,664 14.3 122,939 14.0

Executive assurance 85,909 10.4 91,995 10.4 Casualty 57,884 7.0

100,331 11.4 Healthcare 22,024 2.7 33,913 3.9 Surety 21,073 2.6

31,715 3.6 Other (1) � 76,232 9.2 � 76,237 8.7 Total $ 824,265

100.0 $ 880,172 100.0 � Net premiums earned Property, marine and

aviation $ 169,464 20.3 $ 174,191 20.6 Programs 119,072 14.2

113,245 13.4 Construction and national accounts 115,281 13.8 98,940

11.7 Professional liability 135,010 16.2 133,688 15.8 Executive

assurance 88,904 10.6 92,786 10.9 Casualty 79,422 9.5 104,112 12.3

Healthcare 26,582 3.2 36,951 4.4 Surety 25,556 3.1 35,726 4.2 Other

(1) � 76,394 9.1 � 56,768 6.7 Total $ 835,685 100.0 $ 846,407 100.0

� Net premiums written by client location United States $ 609,409

73.9 $ 681,738 77.5 Europe 142,957 17.4 135,903 15.4 Other � 71,899

8.7 � 62,531 7.1 Total $ 824,265 100.0 $ 880,172 100.0 � Net

premiums written by underwriting location United States $ 605,436

73.4 $ 673,014 76.5 Europe 181,865 22.1 165,746 18.8 Other � 36,964

4.5 � 41,412 4.7 Total $ 824,265 100.0 $ 880,172 100.0 (1) Includes

excess workers� compensation and employers� liability business and

travel and accident business. The following tables set forth the

reinsurance segment�s net premiums written and earned by major line

of business and type of business, together with net premiums

written by client location: � Three Months Ended June 30, 2008 �

2007 REINSURANCE SEGMENT (U.S. dollars in thousands) Amount � % of

Total Amount � % of Total � Net premiums written Casualty (1) $

86,974 32.9 $ 110,108 36.0 Property excluding property catastrophe

(2) 85,748 32.4 69,351 22.7 Property catastrophe 52,797 19.9 77,514

25.3 Other specialty 20,693 7.8 27,971 9.1 Marine and aviation

17,975 6.8 19,812 6.5 Other � 430 0.2 � 1,311 0.4 Total $ 264,617

100.0 $ 306,067 100.0 � Net premiums earned Casualty (1) $ 106,199

36.8 $ 131,114 41.1 Property excluding property catastrophe (2)

67,445 23.3 64,734 20.3 Property catastrophe 51,496 17.8 38,152

12.0 Other specialty 36,058 12.5 52,582 16.5 Marine and aviation

26,946 9.3 30,021 9.4 Other � 946 0.3 � 2,249 0.7 Total $ 289,090

100.0 $ 318,852 100.0 � Net premiums written Pro rata $ 168,025

63.5 $ 184,972 60.4 Excess of loss � 96,592 36.5 � 121,095 39.6

Total $ 264,617 100.0 $ 306,067 100.0 � Net premiums earned Pro

rata $ 195,070 67.5 $ 228,815 71.8 Excess of loss � 94,020 32.5 �

90,037 28.2 Total $ 289,090 100.0 $ 318,852 100.0 � Net premiums

written by client location United States $ 153,106 57.9 $ 206,456

67.5 Europe 58,372 22.1 37,710 12.3 Bermuda 40,784 15.4 47,851 15.6

Other � 12,355 4.6 � 14,050 4.6 Total $ 264,617 100.0 $ 306,067

100.0 � Net premiums written by underwriting location Bermuda $

160,228 60.6 $ 205,138 67.0 United States 92,629 35.0 99,515 32.5

Other � 11,760 4.4 � 1,414 0.5 Total $ 264,617 100.0 $ 306,067

100.0 (1) Includes professional liability, executive assurance and

healthcare business. (2) Includes facultative business. � Six

Months Ended June 30, 2008 � 2007 REINSURANCE SEGMENT (U.S. dollars

in thousands) Amount � % of Total Amount � % of Total � Net

premiums written Casualty (1) $ 192,961 28.7 $ 254,582 34.0

Property excluding property catastrophe (2) 181,670 27.0 164,297

21.9 Property catastrophe 159,021 23.6 158,173 21.1 Other specialty

96,373 14.3 101,967 13.6 Marine and aviation 40,139 6.0 63,527 8.5

Other � 3,031 0.4 � 6,922 0.9 Total $ 673,195 100.0 $ 749,468 100.0

� Net premiums earned Casualty (1) $ 213,847 37.0 $ 271,556 41.7

Property excluding property catastrophe (2) 130,786 22.6 137,776

21.2 Property catastrophe 101,777 17.6 72,842 11.2 Other specialty

74,542 12.9 104,624 16.1 Marine and aviation 54,377 9.4 56,643 8.7

Other � 2,895 0.5 � 7,057 1.1 Total $ 578,224 100.0 $ 650,498 100.0

� Net premiums written Pro rata $ 383,444 57.0 $ 448,787 59.9

Excess of loss � 289,751 43.0 � 300,681 40.1 Total $ 673,195 100.0

$ 749,468 100.0 � Net premiums earned Pro rata $ 387,146 67.0 $

471,254 72.4 Excess of loss � 191,078 33.0 � 179,244 27.6 Total $

578,224 100.0 $ 650,498 100.0 � Net premiums written by client

location United States $ 370,285 55.0 $ 460,447 61.4 Europe 202,292

30.1 162,048 21.6 Bermuda 74,844 11.1 98,692 13.2 Other � 25,774

3.8 � 28,281 3.8 Total $ 673,195 100.0 $ 749,468 100.0 � Net

premiums written by underwriting location Bermuda $ 380,897 56.6 $

457,166 61.0 United States 247,109 36.7 279,877 37.3 Other � 45,189

6.7 � 12,425 1.7 Total $ 673,195 100.0 $ 749,468 100.0 (1) Includes

professional liability, executive assurance and healthcare

business. (2) Includes facultative business. Discussion of 2008

Second Quarter Performance � Insurance Segment � � Three Months

Ended June 30, (U.S. dollars in thousands) 2008 � 2007 � Gross

premiums written $ 621,663 $ 684,725 Net premiums written 421,501

451,828 Net premiums earned 416,585 432,560 Underwriting income

27,866 43,377 � Loss ratio 63.0 % 63.0 % Acquisition expense ratio

13.1 % 10.8 % Other operating expense ratio � 17.2 % � 16.2 %

Combined ratio � 93.3 % � 90.0 % Gross premiums written by the

insurance segment in the 2008 second quarter were 9.2% lower than

in the 2007 second quarter, while net premiums written were 6.7%

lower as the insurance segment maintained underwriting discipline

in response to the current market environment. Net premiums earned

by the insurance segment in the 2008 second quarter were 3.7% lower

than in the 2007 second quarter, and reflect changes in net

premiums written over the previous five quarters, including the mix

and type of business written. The loss ratio for the insurance

segment was 63.0% in the 2008 and 2007 second quarters. The 2008

second quarter loss ratio also reflected a 5.6 point reduction

related to estimated net favorable development in prior year loss

reserves, compared to 0.8 points of estimated net adverse

development in prior year loss reserves in the 2007 second quarter.

The estimated net favorable development in the 2008 second quarter

was primarily in medium-tail and longer-tail lines and resulted

from better than expected claims emergence. The insurance segment�s

loss ratio in the 2008 second quarter also reflected an increase in

expected loss ratios across a number of lines of business primarily

due to rate changes and changes in the mix of business. In

addition, the 2008 second quarter included a higher level of large,

specific risk loss activity than the 2007 second quarter. The

insurance segment�s underwriting expense ratio was 30.3% in the

2008 second quarter, compared to 27.0% in the 2007 second quarter.

The acquisition expense ratio was 13.1% for the 2008 second

quarter, compared to 10.8% for the 2007 second quarter. The

acquisition expense ratio is influenced by, among other things, (1)

the amount of ceding commissions received from unaffiliated

reinsurers, (2) the amount of business written on a surplus lines

(non-admitted) basis and (3) mix of business. The higher

acquisition expense ratio in the 2008 second quarter primarily

resulted from changes in the form of reinsurance ceded and the mix

of business. In addition, the acquisition expense ratio for the

2008 second quarter included 0.9 points related to favorable prior

year loss development, compared to 0.1 points in the 2007 second

quarter. The insurance segment�s other operating expense ratio was

17.2% for the 2008 second quarter, compared to 16.2% in the 2007

second quarter. Operating expenses in the 2008 second quarter

included $1.6 million of costs related to the relocation of certain

of the insurance segment�s U.S. operations. Such actions were

undertaken as part of an expense management plan, which includes

office relocation, personnel and other expense saving initiatives,

the implementation of which began in response to market conditions.

Reinsurance Segment � � Three Months Ended June 30, (U.S. dollars

in thousands) 2008 � 2007 � Gross premiums written $ 273,318 $

427,348 Net premiums written 264,617 306,067 Net premiums earned

289,090 318,852 Underwriting income 63,539 76,918 � Loss ratio 49.1

% 48.0 % Acquisition expense ratio 22.1 % 21.9 % Other operating

expense ratio � 6.9 % � 6.3 % Combined ratio � 78.1 % � 76.2 %

Gross premiums written by the reinsurance segment in the 2008

second quarter were 36.0% lower than in the 2007 second quarter,

with reductions in all treaty lines of business. Commencing in

2006, the reinsurance segment�s Bermuda-based reinsurer, Arch Re

Bermuda, ceded certain lines of property and marine premiums

written under a quota share reinsurance treaty (the �Treaty�) to

Flatiron Re Ltd. Under the Treaty, Flatiron Re Ltd. assumed a 45%

quota share of certain lines of property and marine business

underwritten by Arch Re Bermuda for the 2006 and 2007 underwriting

years (the percentage ceded was increased from 45% to 70% of

covered business bound from June 28, 2006 until August 15, 2006

provided such business did not incept beyond September 30, 2006).

On December 31, 2007, the Treaty expired by its terms.�For its

January 1 renewals, Arch Re Bermuda adjusted its book of business

in light of the expiration of the Treaty. In addition, gross and

net premiums written for the 2007 second quarter included $64.0

million and $35.2 million, respectively, of property catastrophe

business on a contract written with a two-year term while the 2008

second quarter did not include such activity. Other reductions in

the reinsurance segment�s book of business resulted from continued

competition which led to non-renewals or lower shares written.

Ceded premiums written by the reinsurance segment were 3.2% of

gross premiums written for the 2008 second quarter, compared to

28.4% for the 2007 second quarter. In the 2008 second quarter, Arch

Re Bermuda ceded $7.0 million, or 2.6% of gross premiums written,

of certain lines of property and marine premiums written under the

Treaty to Flatiron Re Ltd., compared to $115.9 million, or 27.1%,

in the 2007 second quarter, with the lower level due to the

expiration of the Treaty. On an earned basis, Arch Re Bermuda ceded

$45.9 million to Flatiron Re Ltd. in the 2008 second quarter,

compared to $72.5 million in the 2007 second quarter. Commission

income from the Treaty (in excess of the reimbursement of direct

acquisition expenses) reduced the reinsurance segment�s acquisition

expense ratio by 2.3 points in the 2008 second quarter, compared to

3.1 points in the 2007 second quarter. At June 30, 2008, $65.6

million of premiums ceded to Flatiron Re Ltd. were unearned. The

attendant premiums earned, losses incurred and acquisition expenses

will primarily be reflected in the reinsurance segment�s results

during the balance of 2008. Net premiums written by the reinsurance

segment in the 2008 second quarter were 13.5% lower than in the

2007 second quarter, while net premiums earned in the 2008 second

quarter were 9.3% lower than in the 2007 second quarter. The

decrease in net premiums earned in the 2008 second quarter

primarily resulted from changes in net premiums written over the

previous five quarters, including the mix and type of business

written. The reinsurance segment�s loss ratio was 49.1% in the 2008

second quarter, compared to 48.0% for the 2007 second quarter. The

2008 second quarter loss ratio reflected approximately 5.8 points

of catastrophic activity, while the 2007 second quarter loss ratio

reflected approximately 3.8 points of catastrophic activity. The

loss ratio for the 2008 second quarter also reflected a 13.5 point

reduction related to estimated net favorable development in prior

year loss reserves, compared to a 12.1 point reduction in the 2007

second quarter. The estimated net favorable development in the 2008

second quarter was primarily in short-tail lines and resulted from

better than anticipated claims emergence. The reinsurance segment�s

loss ratio in the 2008 second quarter also reflected an increase in

expected loss ratios across a number of lines of business primarily

due to rate changes and changes in the mix of business. The

underwriting expense ratio for the reinsurance segment was 29.0% in

the 2008 second quarter, compared to 28.2% in the 2007 second

quarter. The acquisition expense ratio for the 2008 second quarter

was 22.1%, compared to 21.9% for the 2007 second quarter. The

acquisition expense ratio for the 2008 second quarter included 1.2

points related to favorable prior year loss development, compared

to 0.8 points in the 2007 second quarter. In addition, the

acquisition expense ratio is influenced by, among other things, the

mix and type of business written and earned and the level of ceding

commission income. The reinsurance segment�s other operating

expense ratio was 6.9% for the 2008 second quarter, compared to

6.3% for the 2007 second quarter. The higher ratio in the 2008

second quarter primarily resulted from a lower level of net

premiums earned.

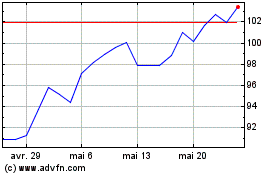

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024