The transaction will enable further expansion

into the middle-market property and casualty segment.

Arch Insurance North America (Arch Insurance), part of Arch

Capital Group Ltd. (Nasdaq: ACGL) (Arch), today announces it has

entered into a master transaction agreement to acquire the U.S.

MidCorp and Entertainment insurance businesses, including select

specialty insurance programs, from Allianz Global Corporate &

Specialty SE (AGCS) for a $450 million cash consideration to

Allianz. Arch estimates its capital requirement to support the

business will be approximately $1.4 billion.

The businesses being acquired are written by Fireman’s Fund

Insurance Company and its subsidiaries and collectively totaled

$1.7 billion of gross premium written in 2023. Approximately 500

individuals supporting the business, including underwriting, claims

and other professional staff, are expected to become Arch Insurance

employees as part of the transaction.

“The acquisition of the MidCorp business meaningfully expands

our presence in the U.S. middle market, a targeted growth area for

Arch,” said Matt Shulman, CEO for Arch Insurance North America.

“This transaction will enhance our distribution relationships,

broaden our product suite and expand our ability to participate in

these underwriting-intensive middle-market lines. We are also

excited to add a market-leading Entertainment business that

complements Arch Insurance’s existing portfolio of specialty

products.”

“We are proud of our employees who have served our U.S. MidCorp

and Entertainment clients and brokers over the years,” said Tracy

Ryan, AGCS Chief Executive Officer for North America and member of

AGCS’s Board of Management. “We are confident that they will be a

strong addition to Arch, ensuring continuity for our partners.”

Arch Insurance currently provides a wide range of property,

casualty and specialty insurance options across market segments and

wrote approximately $5.8 billion of gross premium in North America

in 2023. This transaction builds upon Arch Insurance’s North

America business that has delivered double-digit topline growth for

five consecutive years.

“Combining this platform, broad set of client relationships and

talented employee-base with Arch’s capabilities creates an

attractive middle-market business that should further establish

Arch Insurance as a market leader in the specialty insurance

space,” said Nicolas Papadopoulo, CEO for Arch Worldwide Insurance

Group. “We take pride in our client-focused, inclusive culture and

look forward to incorporating the experience and expertise of our

new colleagues as we continue to raise the bar and fulfill our

brand promise of Pursuing Better Together.”

This transaction is expected to close in the second half of 2024

and is subject to regulatory approvals.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are

acting as financial advisors to Arch, and Willkie Farr &

Gallagher LLP is serving as the Company’s legal advisor.

An Arch slide presentation regarding the master transaction

agreement and the related transactions described will be posted to

the Presentations section of our website,

https://ir.archgroup.com/news-events-presentations/presentations/default.aspx.

About Arch Insurance North America

Arch Insurance North America, part of Arch Capital Group Ltd.,

includes Arch’s insurance operations in the United States and

Canada. Business in the U.S. is written by Arch Insurance Company,

Arch Specialty Insurance Company, Arch Property & Casualty

Insurance Company and Arch Indemnity Insurance Company. Business in

Canada is written by Arch Insurance Canada Ltd.

About Arch Capital Group Ltd.

Arch Capital Group Ltd. (Nasdaq: ACGL) is a publicly listed

Bermuda exempted company with approximately $21.1 billion in

capital at Dec. 31, 2023. Arch, which is part of the S&P 500

Index, provides insurance, reinsurance and mortgage insurance on a

worldwide basis through its wholly owned subsidiaries.

About Allianz Commercial

Allianz Commercial is the center of expertise and global line of

Allianz Group for insuring mid-sized businesses, large enterprises

and specialist risks. Among our customers are the world’s largest

consumer brands, financial institutions and industry players, the

global aviation and shipping industry as well as family-owned and

medium enterprises which are the backbone of the economy. We also

cover unique risks such as offshore wind parks, infrastructure

projects or Hollywood film productions. Powered by the employees,

financial strength, and network of the world’s #1 insurance brand,

we work together to help our customers prepare for what’s ahead:

They trust us in providing a wide range of traditional and

alternative risk transfer solutions, outstanding risk consulting

and Multinational services as well as seamless claims handling.

Allianz Commercial brings together the large corporate insurance

business of Allianz Global Corporate & Specialty (AGCS) and the

commercial insurance business of national Allianz Property &

Casualty entities serving mid-sized companies. We are present in

over 200 countries and territories either through our own teams or

the Allianz Group network and partners. In 2023, the integrated

business of Allianz Commercial generated around €18 billion in

gross premium globally. https://commercial.allianz.com/

Cautionary Note Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a

"safe harbor" for forward−looking statements. This release or any

other written or oral statements made by or on behalf of Arch

Capital Group Ltd. and its subsidiaries may include forward−looking

statements, which reflect the Company’s current views with respect

to future events and financial performance. All statements other

than statements of historical fact included in or incorporated by

reference in this release are forward−looking statements.

Forward−looking statements can generally be identified by the

use of forward−looking terminology such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe" or "continue" or

their negative or variations or similar terminology.

Forward−looking statements involve the Company’s current assessment

of risks and uncertainties. Actual events and results may differ

materially from those expressed or implied in these statements. A

non-exclusive list of the important factors that could cause actual

results to differ materially from those in such forward-looking

statements includes the following: adverse general economic and

market conditions; increased competition; pricing and policy term

trends; fluctuations in the actions of rating agencies and the

Company’s ability to maintain and improve its ratings; investment

performance; the loss of key personnel; the adequacy of the

Company’s loss reserves, severity and/or frequency of losses,

greater than expected loss ratios and adverse development on claim

and/or claim expense liabilities; greater frequency or severity of

unpredictable natural and man-made catastrophic events, including

pandemics such as COVID-19; the impact of acts of terrorism and

acts of war; changes in regulations and/or tax laws in the United

States or elsewhere; ability to successfully integrate, establish

and maintain operating procedures as well as integrate the

businesses the Company has acquired or may acquire into the

existing operations; changes in accounting principles or policies;

material differences between actual and expected assessments for

guaranty funds and mandatory pooling arrangements; availability and

cost to the Company of reinsurance to manage our gross and net

exposures; the failure of others to meet their obligations to the

Company; an incident, disruption in operations or other cyber event

caused by cyber attacks, the use of artificial intelligence

technologies or other technology on the Company’s systems or those

of the Company’s business partners and service providers, which

could negatively impact the Company’s business and/or expose the

Company to litigation; and other factors identified in our filings

with the U.S. Securities and Exchange Commission (SEC).

The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with

other cautionary statements that are included herein or elsewhere.

All subsequent written and oral forward−looking statements

attributable to us or persons acting on the Company’s behalf are

expressly qualified in their entirety by these cautionary

statements. The Company undertakes no obligation to publicly update

or revise any forward−looking statement, whether as a result of new

information, future events or otherwise.

Source — Arch Capital Group Ltd. Tag —

arch-corporate-insurance

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240405551743/en/

Arch Media Contact: Greg Hare Arch Capital Services LLC

ghare@archgroup.com

Stephanie Perez Arch Capital Services LLC

stperez@archgroup.com

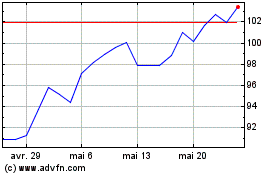

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025