UPDATE: Japan Quake, Tsunami Caused Up To $25Bln Insured Loss - Eqecat

16 Mars 2011 - 6:42PM

Dow Jones News

Disaster-modeling company Eqecat on Wednesday said insured

losses from Japan's earthquake and tsunami would be $12 billion to

$25 billion, an estimate whose high end is significantly lower than

an earlier prediction.

Eqecat said a portion of the costs in its estimate--$2 billion

to $4 billion--would be borne by the government's Japan Earthquake

Reinsurance Pool, which will reduce the total cost to private

insurers.

The massive earthquake, upgraded by seismologists this week to a

magnitude 9.0, toppled buildings and triggered a tsunami that swept

away cars, buildings and ships. The estimate from Eqecat includes

insured losses from the quake, the ensuing tsunami and fires, and

losses to cars and ships. Eqecat said it had reports of 90 large

commercial vessels and thousands of smaller vessels getting pushed

far inland by the tsunami.

The estimate also includes an estimated payout of $2 billion to

$3 billion by life insurers.

While the exact cost of the disaster won't be known for months,

estimates from catastrophe-risk modeling companies like Eqecat give

an early glimpse at the ultimate costs. A competing firm, AIR

Worldwide, estimated Sunday the quake caused insured property

losses of $15 billion to $35 billion. Its estimate didn't include

the effects of the tsunami.

While Eqecat's estimate is lower, the disaster could still

become the largest ever earthquake loss for the insurance industry.

The only quakes that rival it are the $15.3 billion earthquake in

Northridge, Calif., in 1995, and last month's temblor in

Christchurch, New Zealand, where insured costs are still being

tallied but could exceed $10 billion.

Industry analysts have been attempting to determine if losses

from the disaster would force the price of catastrophe insurance

higher around the globe. Insurers and reinsurers are already on the

hook for substantial claims tied to storms and flooding in

Australia and the Christchurch quake, and analysts said many

reinsurance companies will report first-quarter losses and may end

up losing money for all of 2011.

The world's largest reinsurers, Swiss Reinsurance Co. (RUKN.VX)

and Munich Re (MUV2.XE), said before last week's catastrophe they

had already largely exhausted their annual provision for natural

disasters.

If the Eqecat estimate proves true, prices may stop their

years-long decline, but some analysts and executives have said

losses would have to be substantially larger to cause prices to

rise.

Ratings firm Standard & Poor's said on Tuesday before the

release of the Eqecat estimate that it didn't expect to make

widespread ratings cuts against insurers "because much of the

industry is dealing with this disaster from a position of capital

strength." The company has downgraded its outlook on Japanese

property insurers to negative from stable.

However large the insured loss, the economic damage of the quake

is sure to be much larger. Earthquake coverage is far from

universal in Japan, and many homes and businesses were uncovered.

Also, the government is ultimately responsible for liability costs

tied to the ongoing nuclear disaster.

Japan's Fire and Disaster Management Agency said Monday the

number of buildings completely or partially destroyed by the

earthquake had reached 75,000. But Eqecat, in a statement, warned

it was "an early tally."

-By Erik Holm, Dow Jones Newswires; 212-416-2892;

erik.holm@dowjones.com

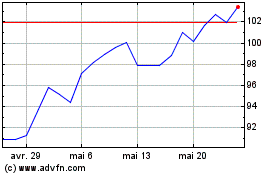

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024