RenaissanceRe Shares Hit 52-Week High - Analyst Blog

18 Mars 2013 - 12:40PM

Zacks

On Mar 15, 2013, shares of RenaissanceRe Holdings

Ltd. (RNR) hit a 52-week high of $91.10. After dismal

performances in the last two quarters, the company had managed to

post solid fourth-quarter 2012 results with an earnings surprise of

70.3%. This property & casualty insurer witnessed positive

earnings surprises in 2 of 4 quarters of 2012, with an average beat

of 14.6%.

On Feb 20, 2013, the board of directors of RenaissanceRe approved a

3.7% increase in the quarterly dividend to 28 cents per share from

27 cents paid earlier. This marks the 18th consecutive year of

dividend increase. In addition, the board of directors approved an

increase in RenaissanceRe's stock repurchase program, bringing the

total current authorization to $500 million.

In addition, RenaissanceRe created a new special purpose insurance

vehicle – Upsilon Reinsurance II Ltd., thereby increasing its

reinsurance capacity to cater to the global retrocessional

reinsurance market.

On Feb 6, RenaissanceRe reported fourth-quarter 2012 operating

income of 65 cents per share, up 28 cents from the Zacks Consensus

Estimate. Improved premiums aided the bottom line.

RenaissanceRe posted total revenue of $348.4 million, up 67% year

over year from $208.5 million in the fourth quarter of 2011. Total

revenue also surpassed the Zacks Consensus Estimate of $307

million.

Valuation for RenaissanceRe looks attractive. The shares are

trading at a 17.7% discount to the peer group average on a forward

price-to-earnings basis and at only 1.9% premium to the peer group

on a price-to-book basis. Return on equity is 129.5% above the peer

group average. The one-year return for the stock came in at 22.4%,

much above S&P 500’s return of 11.2%.

Over the long-term, the company faces headwinds such as declining

investment income, high competition and weather-related risks in

the catastrophe insurance and reinsurance business. Nevertheless,

strategic divestitures, efficient capital deployment via repurchase

and dividend hikes and continued focus to enhance its operation

should help RenaissanceRe deliver solid numbers going forward. The

long-term expected earnings growth rate for this stock is

9.5%.

RenaissanceRe presently carries a Zacks Rank #3 (Hold). Property

and casualty insurers like XL Group plc (XL),

Cincinnati Financial Corp. (CINF) and Arch

Capital Group Ltd. (ACGL), among others, carry a favorable

Zacks Rank #1 (Strong Buy).

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

RENAISSANCERE (RNR): Free Stock Analysis Report

XL GROUP PLC (XL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

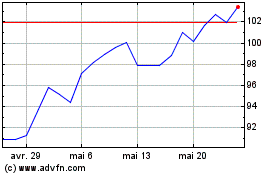

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024