AXIS Capital Hits 52-Week High - Analyst Blog

20 Mars 2013 - 1:03PM

Zacks

On Mar 19, 2013, shares of AXIS Capital Holdings

Limited (AXS) hit a 52-week high of $41.84. Previously,

the company had reported solid fourth-quarter results with an

earnings surprise of 64.9%. This property & casualty insurer

witnessed positive earnings surprises in two of four quarters of

2012, with an average beat of 26.6%.

On Feb 4, AXIS Capital reported fourth-quarter 2012 operating loss

of 23 cents per share, narrower than the Zacks Consensus Estimate

of a loss of $1.18 per share. Total revenue grossed $975.5 billion

in the quarter, improving 3.1% from the year-ago quarter. The top

line comfortably surpassed the Zacks Consensus Estimate of $928

million.

AXIS Capital also continues to benefit from rate increases. The

company noted an improved pricing scenario in the insurance market

place extending across classes and geographies, and expects the

momentum to continue. Looking forward, AXIS Capital expects gross

premiums written to increase in 2013, given favorable pricing

momentum sustains in the primary insurance market.

AXIS Capital has a $750 million share buyback program under its

authorization. Further, the approval of a dividend hike of 4% to 25

cents per share in Dec 2012 marked the 9th consecutive year of

dividend increase.

The absence of any major catastrophe events in the first nine

months of 2012 was beneficial to the underwriting results of the

company. However, the occurrence of Hurricane Sandy in the fourth

quarter altered the picture. Though its exposure to cat loss weighs

on the results, prudent underwriting practices managed to limit the

adverse effect. Nevertheless, AXIS Capital enjoyed underwriting

income of $263.1 million for full year 2012, reversing the year-ago

loss. The combined ratio improved 1610 basis points to 112.2% in

2012.

Valuation for AXIS Capital looks attractive. The shares are trading

at a discount to the peer group average, both on a price-to-book

basis (9.3% discount to peer group average) and forward

price-to-earnings basis (27.7% discount to peer group average),

with return on equity remaining 8.2% above the peer group average.

The 1-year return from the stock is 28.5%, much above S&P’s

return of 10.3%.

We believe that the conservative underwriting practices will help

the company remain well capitalized. New business generation and

platform expansion will also aid AXIS fuel its top-line growth. The

overall long-term expected sales and earnings growth rate for this

stock is 8.2% and 8.5%, respectively.

AXIS Capital presently carries a Zacks Rank # 2 (Buy). Property and

casualty insurers like XL Group plc (XL),

Cincinnati Financial Corp. (CINF) and Arch

Capital Group Ltd. (ACGL), among others, carry a favorable

Zacks Rank # 1 (Strong Buy) and appear impressive.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

XL GROUP PLC (XL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

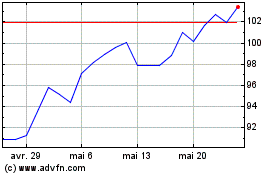

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024