Pregressive Reaches 52-Week High - Analyst Blog

03 Avril 2013 - 12:54PM

Zacks

On Apr 2, 2013, shares of Progressive

Corp. (PGR) hit a 52-week high of $25.68. The company

generated total of 39 cents in earnings in January and February,

with premiums increasing year over year in both the months.

Progressive’s operating earnings and premiums’ growth as well as

debt-to-total capital ratio in the first two months of this year

reflect overall constant improvement. Policies in force also

remained healthy. Progressive remains focused on maintaining a

healthy policy life expectancy, which is a significant measure to

retain customers.

Progressive delivered positive earnings surprise in two quarters of

2012. However, average surprise was a negative 4.85% due to poor

performance in the second quarter. Nevertheless, our proven model

shows that the property & casualty insurer is likely to beat

earnings in the first quarter of 2013 because it has a right

combination of a positive Earnings ESP (Read: Zacks Earnings ESP: A

Better Method) and a Zacks Rank #1 (Strong Buy). ESP or Expected

Surprise Prediction, which represents the difference between the

Most Accurate Estimate and the Zacks Consensus Estimate, is

+4.65%.

Progressive is scheduled to release its first-quarter 2013 earnings

results on Apr 10. The Zacks Consensus Estimate for the first

quarter is currently pegged at 43 cents, representing a

year-over-year increase of 1.3%.

Valuation for Progressive looks stretched. The shares are trading

at a considerable premium to the peer group average both on a

price-to-book basis and on a forward price-to-earnings basis.

Comparatively, return on equity is 29% higher than the peer group

average.

Progressive presently carries a Zacks Rank #1 (Strong Buy).

Property and casualty insurers like AXIS Capital Holdings

Ltd. (AXS), Montpelier Re Holdings Ltd.

(MRH) and Arch Capital Group Ltd. (ACGL), among

others, also carry a Zacks Rank #1 and appear impressive.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

MONTPELIER RE (MRH): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

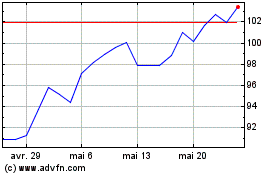

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024