Platinum Upgraded to Strong Buy - Analyst Blog

11 Avril 2013 - 4:30PM

Zacks

On Apr 9, Zacks Investment Research

upgraded Platinum Underwriters Holdings Limited

(PTP) to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

Platinum Underwriters has been witnessed rising earnings estimates

since it reported solid fourth-quarter results. The company

delivered positive earnings surprises in 3 out of 4 quarters in

2012 with an average beat of 46.27%. The long-term expected

earnings growth rate for this stock is 8%.

Platinum Underwriters reported a net income of $327.2 million 2012,

rebounding from a loss of $224.1 million in 2011. In addition,

combined ratio also improved significantly in 2012. Results largely

benefited from strong reserve releases and realized gains as well

as moderate catastrophe losses.

The year-to-date return for the stock came in at 22.21%, way above

the S&P 500 return of 11.33%.

Platinum Underwriters continues to increase shareholders’ value

through dividend payouts and share repurchases. In 2012, the

company deployed $115.7 million to repurchase 3.1 million shares.

It also paid quarterly cash dividends of 8 cents in 2012.

Additionally, due to the absence of any significant catastrophe

event in the first quarter, the company’s underwriting performance

is expected to deliver better results.

Platinum Underwriters is scheduled to release its first-quarter

2013 earnings results on Apr 17. The Zacks Consensus Estimate for

the first quarter is currently pegged at $1.16 increasing 17.5%

over the last 60 days and reflecting a year-over-year improvement

of 30.71%.

Other Stocks to Consider

Other property and casualty insurers like Arch Capital

Group Ltd. (ACGL), Cincinnati Financial

Corporation (CINF) and AXIS Capital Holdings

Limited (AXS), carry a Zacks Rank #1 (Strong Buy) and are

worth noting.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

PLATINUM UNDRWT (PTP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

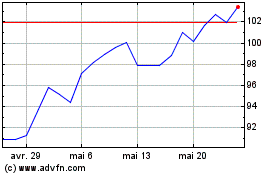

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024