Arch Capital Posts Strong 1Q Earnings - Analyst Blog

01 Mai 2013 - 9:16AM

Zacks

Arch Capital Group

Limited (ACGL) reported first quarter 2013 net operating

earnings of $1.17 per share, surpassing the Zacks Consensus

Estimate of 97 cents per share. Results also outpaced the year-ago

earnings of 82 cents per share.

Including net realized gains of 41 cents, net impairment losses

recognized in earnings of 2 cents, equity in net income of

investment funds accounted for using the equity method of 10 cents

and net foreign exchange gains of 19 cents, Arch Capital reported

net income of $1.85 per share in the first quarter, up 62.3% year

over year.

Quarterly Operational Update

Total revenues of Arch Capital for the reported quarter increased

9.2% year over year to $890.1 million primarily due to higher

premiums earned (up 10.7% year over year) and net realized gains

(up 32.2% year over year). Results also surpassed the Zacks

Consensus Estimate of $852 million.

Net premiums written were $952.8 million, up 10.3% year over

year.

Net investment income declined 11.6% year over year to $65.7

million mainly due to lower income from fixed maturities (down

15.6% year over year) and higher investment expenses (up 29.7% year

over year)

Total expenses of Arch Capital during the quarter were $628.8

million, down 3.1% year over year. Lower interest expense (down

21.6% year over year) and foreign exchange gains of $24.3 million

that rebounded from a year-ago loss of $20.7 million led to the

improvement.

Underwriting income increased 73.2% year over year to $116.4

million during the reported quarter.

Combined ratio was 84.6% showing an improvement of 550 basis points

from 90.1% in the year-ago quarter.

Quarterly Segment Update

Insurance: Net premiums earned increased 0.7% year

over year to $445 million.

Underwriting income during the quarter was $14.95 million,

rebounding from a loss of $8.1 million in the year-ago quarter.

Combined ratio improved 510 basis points year over year to

96.7%.

Reinsurance: Net premiums earned increased 29%

year over year to $307.8 million.

Underwriting income increased 34.7% year over year to $101.4

million during the reported quarter.

Combined ratio improved 130 basis points year over year to

67.1%.

Share Repurchase Update

During the quarter Arch Capital repurchased 0.9 million shares for

approximately $41 million at an average share price of $44.01 per

share. The company is currently left with $728.9 million under its

authorization.

Financial Position

Total investments of Arch Capital increased 2.2% from 2012 end

level to $12.97 billion. As of Mar 31, 2013, total assets of the

company were $18.8 billion, up 5.3% from $17.8 billion from year

end 2012.

Cash flow from operations increased 42.1% year over year to $205.7

million in the first quarter.

As of Mar 31, 2013, shareholders’ equity increased 3.2% from $5.2

billion at year end 2012 to $5.3 billion. The debt-to-capital ratio

of Arch Capital as of Mar 31, 2013 was 5.3% compared to 5.5% as of

Dec 31, 2012.

Book value per share was $37.66 at Mar 31, 2013 representing a 4.1%

increase over $36.19 at Dec 31, 2012.

Return on equity (ROE) for the first quarter of 2013 was 12.9%, up

250 basis points from 10.4% in the year-ago quarter.

Investment Update

Arch Capital’s investment portfolio consists of high quality fixed

income securities with an average credit quality of “AA–/Aa2”.

The average effective duration of Arch Capital’s investment

portfolio as of Mar 31, 2013 was 2.94 years as compared to 3.06

years at year-end 2012.

During the reported quarter, total return on Arch Capital’s

investment portfolio, excluding the effects of foreign exchange was

1.01%, down 59 basis points from 1.60% at year end 2012.

Performance of Other Insurers

Progressive Corp.’s (PGR) earnings per share for

the first quarter of 2013 were 51 cents, surging nearly 21% from 42

cents in the year-ago quarter. Results outpaced the Zacks Consensus

Estimate of 44 cents. Net income shot up 20% from the first quarter

of 2012 to $308.6 million in the quarter.

AXIS Capital Holdings Limited (AXS) reported

first-quarter 2013 net operating income of $1.92 per share, which

breezed past the Zacks Consensus Estimate of $1.19. Earnings surged

79% year over year. Net operating income of $227 million improved

nearly 70% year over year.

Montpelier Re Holdings Ltd. (MRH) reported

first-quarter 2013 operating income of $1.18 per share, better than

the Zacks Consensus Estimate of 89 cents. However, earnings were

4.1% lower than $1.23 per share in the year-ago quarter.

Zacks Rank

Arch Capital currently carries Zacks Rank #2 (Buy).

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

MONTPELIER RE (MRH): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

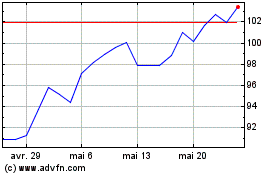

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024