ACV (Nasdaq: ACVA), a leading digital automotive marketplace and

data services partner for dealers and commercial clients, today

reported results for its fourth quarter and full-year ended

December 31, 2024.

“We are very pleased with our fourth quarter results, with

revenue and Adjusted EBITDA above the high-end of our guidance

range, along with continued margin expansion. ACV's leading market

position resulted in additional share gains and strong revenue

growth in the quarter. Our expanding suite of dealer solutions

gained further market traction and we executed on initiatives to

support our commercial wholesale strategy,” said George Chamoun,

CEO of ACV.

“Turning to our 2025 outlook, while the dealer wholesale market

is expected to be approximately flat year-over-year, we believe ACV

remains well positioned to deliver sustainable market share gains,

strong revenue growth and margin expansion, as our business model

continues to scale," concluded Chamoun.

Fourth Quarter 2024 Highlights

- Revenue of $160 million, an increase

of 35% year over year

- Marketplace and Service Revenue of

$143 million, an increase of 38% year over year

- Marketplace GMV of $2.3 billion, an

increase of 22% year over year

- Marketplace Units of 183,497, an

increase of 27% year over year

- GAAP net income (loss) of ($26)

million, compared to GAAP net income (loss) of ($23) million in the

fourth quarter of 2023

- Non-GAAP net income (loss) of ($1)

million, compared to non-GAAP net income (loss) of ($6) million in

the fourth quarter of 2023

- Adjusted EBITDA of $6 million,

compared to Adjusted EBITDA of ($5) million in the fourth quarter

of 2023

Full-Year 2024 Highlights

- Revenue of $637 million, an increase

of 32% year over year

- Marketplace and Service Revenue of

$573 million, an increase of 36% year over year

- Marketplace GMV of $9.5 billion, an

increase of 7% year over year

- Marketplace units of 743,008, an

increase of 24% year over year

- Adjusted EBITDA of $28 million,

compared to Adjusted EBITDA of ($18) million in 2023

First Quarter and Full-Year 2025 Guidance

Based on information as of today, ACV is providing the following

guidance:

- First Quarter of 2025:

- Total revenue of $180 million to

$185 million, an increase of 24% to 27% year over year

- GAAP net income (loss) of ($21)

million to ($19) million

- Non-GAAP net income of $3 million to

$5 million

- Adjusted EBITDA of $9 million to $11

million, an increase of 110% to 158% year over year

- Full-Year 2025:

- Total revenue of $765 million to

$785 million, an increase of 20% to 23% year over year

- GAAP net income (loss) of ($62)

million to ($52) million

- Non-GAAP net income of $32 million

to $42 million

- Adjusted EBITDA of $65 million to

$75 million, an increase of 131% to 167% year over year

Our financial guidance includes the following assumptions:

- The dealer wholesale market is

expected to be approximately flat year over year in 2025.

- Conversion rates and wholesale price

depreciation expected to follow normal seasonal patterns.

- 2025 revenue growth is expected to

outpace Non-GAAP Operating Expense growth (excluding Cost of

Revenue and Depreciation and Amortization) by approximately 500

basis points.

- First quarter non-GAAP net income

guidance excludes approximately $19 million of stock-based

compensation expense and approximately $3 million of intangible

amortization.

- Full-year non-GAAP net income

guidance excludes approximately $76 million of stock-based

compensation expense and $10 million of intangible

amortization.

ACV’s Fourth Quarter Results Conference

Call

ACV will host a conference call and live webcast today, February

19, 2025, at 5:00 p.m. ET to discuss the financial results. To

access the live conference call participants are invited to dial

877-704-4453 (international callers please dial 1-201-389-0920)

approximately 10 minutes prior to the start of the call. A live

webcast and replay of the call will be available on the Company’s

investor relations website at https://investors.acvauto.com/.

Participants are encouraged to join the webcast unless asking a

question.

2025 Analyst Day

ACV will host an analyst meeting on March 11, 2025. The event

location is Convene at 530 Fifth Avenue in midtown Manhattan. The

program will begin at 1:00 p.m. ET and conclude at 4:00 p.m. ET,

followed by a reception with ACV’s management team. To register for

the event, please send an email to ACVAuctionsIR@icrinc.com.

About ACV Auctions

ACV is on a mission to transform the automotive industry by

building the most trusted and efficient digital marketplace and

data solutions for sourcing, selling and managing used vehicles

with transparency and comprehensive insights that were once

unimaginable. ACV offerings include ACV Auctions, ACV

Transportation, ACV Capital, ACV MAX, True360, and ClearCar.

For more information about ACV, visit www.acvauto.com.

Information About Non-GAAP Financial

Measures

ACV provides supplemental non-GAAP financial measures to its

financial results. We use these non-GAAP financial measures, and we

believe that they assist our investors to make period-to-period

comparisons of our operating performance because they provide a

view of our operating results without items that are not, in our

view, indicative of our operating results. These non-GAAP financial

measures should not be construed as an alternative to GAAP results

as the items excluded from the non-GAAP financial measures often

have a material impact on our operating results, certain of those

items are recurring, and others often recur. Management uses, and

investors should consider, our non-GAAP financial measures only in

conjunction with our GAAP results.

Non-GAAP Financial Measures

Adjusted EBITDA is a financial measure that is not presented in

accordance with GAAP. We believe that Adjusted EBITDA, when taken

together with our financial results presented in accordance with

GAAP, provides meaningful supplemental information regarding our

operating performance and facilitates internal comparisons of our

historical operating performance on a more consistent basis by

excluding certain items that may not be indicative of our business,

results of operations or outlook. In particular, we believe that

the use of Adjusted EBITDA is helpful to our investors as it is a

measure used by management in assessing the health of our business,

determining incentive compensation and evaluating our operating

performance, as well as for internal planning and forecasting

purposes.

We define Adjusted EBITDA as net loss, adjusted to exclude:

depreciation and amortization; stock-based compensation expense;

interest (income) expense; provision for income taxes; and other

one-time non-recurring items, when applicable, such as

acquisition-related and restructuring expenses.

Adjusted EBITDA is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not

be considered in isolation or as a substitute for financial

information presented in accordance with GAAP. Some of these

limitations include that (1) it does not properly reflect capital

commitments to be paid in the future; (2) although depreciation and

amortization are non-cash charges, the underlying assets may need

to be replaced and Adjusted EBITDA does not reflect these capital

expenditures; (3) it does not consider the impact of stock-based

compensation expense, (4) it does not reflect other non-operating

income and expenses, including interest income and expense, (5) it

does not consider the impact of any contingent consideration

liability valuation adjustments, (6) it does not reflect tax

payments that may represent a reduction in cash available to us,

and (7) it does not reflect other one-time, non-recurring items,

when applicable, such as acquisition-related and restructuring

expenses. In addition, our use of Adjusted EBITDA may not be

comparable to similarly titled measures of other companies because

they may not calculate Adjusted EBITDA in the same manner, limiting

its usefulness as a comparative measure. Because of these

limitations, when evaluating our performance, you should consider

Adjusted EBITDA alongside other financial measures, including our

net loss and other results stated in accordance with GAAP.

Non-GAAP net income (loss), a financial measure that is not

presented in accordance with GAAP, provides investors with

additional useful information to measure operating performance and

current and future liquidity when taken together with our financial

results presented in accordance with GAAP. By providing this

information, we believe management and the users of the financial

statements are better able to understand the financial results of

what we consider to be our continuing operations.

We define non-GAAP net income (loss) as net income (loss),

adjusted to exclude: stock-based compensation expense, amortization

of acquired intangible assets, and other one-time, non-recurring

items, when applicable, such as acquisition-related and

restructuring expenses.

In the calculation of non-GAAP net income (loss), we exclude

stock-based compensation expense because of varying available

valuation methodologies, subjective assumptions and the variety of

equity instruments that can impact our non-cash expense. We believe

that providing non-GAAP financial measures that exclude stock-based

compensation expense allows for more meaningful comparisons between

our operating results from period to period.

We exclude amortization of acquired intangible assets from the

calculation of non-GAAP net income (loss). We believe that

excluding the impact of amortization of acquired intangible assets

allows for more meaningful comparisons between operating results

from period to period as the underlying intangible assets are

valued at the time of acquisition and are amortized over several

years after the acquisition.

We exclude contingent consideration liability valuation

adjustments associated with the purchase consideration of

transactions accounted for as business combinations. We also

exclude certain other one-time, non-recurring items, when

applicable, such as acquisition-related and restructuring expenses,

because we do not consider such amounts to be part of our ongoing

operations nor are they comparable to prior period nor predictive

of future results.

Non-GAAP net income (loss) is presented for supplemental

informational purposes only, has limitations as an analytical tool

and should not be considered in isolation or as a substitute for

financial information presented in accordance with GAAP. Some of

these limitations include that: (1) it does not consider the impact

of stock-based compensation expense; (2) although amortization is a

non-cash charge, the underlying assets may need to be replaced and

non-GAAP net income (loss) does not reflect these capital

expenditures; (3) it does not consider the impact of any contingent

consideration liability valuation adjustments; and (4) it does not

consider the impact of other one-time charges, such as

acquisition-related and restructuring expenses, which could be

material to the results of our operations. In addition, our use of

non-GAAP net income (loss) may not be comparable to similarly

titled measures of other companies because they may not calculate

non-GAAP net income (loss) in the same manner, limiting its

usefulness as a comparative measure. Because of these limitations,

when evaluating our performance, you should consider non-GAAP net

income (loss) alongside other financial measures, including our net

loss other results stated in accordance with GAAP.

Information About Operating and Financial

Metrics

We regularly monitor the following operating and financial

metrics in order to measure our current performance and estimate

our future performance. Our key operating and financial metrics may

be calculated in a manner different than similar business metrics

used by other companies.

Operating and Financial Metrics

Marketplace GMV - Marketplace GMV is primarily

driven by the volume and dollar value of Marketplace Unit

transactions. We believe that Marketplace GMV acts as an indicator

of our success, signaling satisfaction of dealers and buyers, and

the health, scale, and growth of our business. We define

Marketplace GMV as the total dollar value of vehicles transacted

within the applicable period, excluding any auction and ancillary

fees.

Marketplace Units - Marketplace Units is a key

indicator of our potential for growth in Marketplace GMV and

revenue. It demonstrates the overall engagement of our customers

and our market share of wholesale transactions in the United

States. We define Marketplace Units as the number of vehicles

transacted within the applicable period. Marketplace Units

transacted includes any vehicle that successfully reaches sold

status, even if the auction is subsequently unwound, meaning the

buyer or seller does not complete the transaction. These instances

have been immaterial to date. Marketplace Units excludes vehicles

that were inspected by ACV, but not sold. Marketplace Units have

generally increased over time as we have expanded our territory

coverage, added new dealer partners and increased our share of

wholesale transactions from existing customers.

Forward-Looking Statements

This presentation contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, including statements concerning

our financial guidance for the fourth quarter of 2024 and the full

year of 2024. In some cases, you can identify forward-looking

statements because they contain words such as “anticipate,”

“believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “will” or “would” or the negative of

these words or other similar terms or expressions. You should not

rely on forward-looking statements as predictions of future

events.

The forward-looking statements contained in this presentation

are based on ACV’s current assumptions, expectations and beliefs

and are subject to substantial risks, uncertainties and changes in

circumstances that may cause ACV’s actual results, performance or

achievements to differ materially from those expressed or implied

in any forward-looking statement. These risks and uncertainties

include, but are not limited to: (1) our history of operating

losses; (2) our limited operating history; (3) our ability to

effectively manage our growth; (4) our ability to grow the number

of participants on our marketplace platform; (5) general market,

political, economic, and business conditions; (6) our ability to

acquire new customers and successfully retain existing customers;

(7) our ability to effectively develop and expand our sales and

marketing capabilities; (8) our ability to successfully launch new

products and services; (9) breaches in our security measures,

unauthorized access to our marketplace platform, our data, or our

customers’ or other users’ personal data; (10) risk of

interruptions or performance problems associated with our products

and platform capabilities; (11) our ability to adapt and respond to

rapidly changing technology or customer needs; (12) our ability to

compete effectively with existing competitors and new market

entrants; (13) our ability to comply or remain in compliance with

laws and regulations that currently apply or become applicable to

our business in the United States and other jurisdictions where we

elect to do business; (14) the impact that economic conditions

could have on our or our customers’ businesses, financial condition

and results of operations; and (15) the impact of such economic

conditions in the wholesale dealer market included in our guidance

for the first quarter of 2025 and full year 2025, and the related

impact on the performance of our marketplace and our operating

expenses, stock-based compensation expense and intangible

amortization. These and other risks and uncertainties are more

fully described in our filings with the Securities and Exchange

Commission (“SEC”), including in the section entitled “Risk

Factors” in our Form 10-K for the year ended December 31, 2024,

filed with the SEC on February 19, 2025. Additional information

will be made available in other filings and reports that we may

file from time to time with the SEC. New risks emerge from time to

time. It is not possible for our management to predict all risks,

nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, we cannot guarantee future results,

levels of activity, performance, achievements, or events and

circumstances reflected in the forward-looking statements will

occur. The forward-looking statements made in this presentation

relate only to events as of the date on which the statements are

made. We undertake no obligation to update any forward-looking

statements made in this presentation to reflect events or

circumstances after the date of this presentation or to reflect new

information or the occurrence of unanticipated events, except as

required by law.

Investor Contact: Tim

Foxtfox@acvauctions.com

Media Contact: Maura

Dugganmduggan@acvauctions.com

|

ACV AUCTIONS INC.CONSOLIDATED STATEMENTS

OF OPERATIONS(Unaudited)(in

thousands, except per share data) |

|

|

| |

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

| Marketplace and service

revenue |

$ |

143,123 |

|

|

$ |

103,767 |

|

|

$ |

572,971 |

|

|

$ |

422,527 |

|

| Customer assurance

revenue |

|

16,391 |

|

|

|

14,610 |

|

|

|

64,185 |

|

|

|

58,707 |

|

|

Total revenue |

|

159,514 |

|

|

|

118,377 |

|

|

|

637,156 |

|

|

|

481,234 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Marketplace and service cost of revenue (excluding depreciation

& amortization) |

|

61,200 |

|

|

|

46,975 |

|

|

|

248,210 |

|

|

|

192,707 |

|

|

Customer assurance cost of revenue (excluding depreciation &

amortization) |

|

14,683 |

|

|

|

13,666 |

|

|

|

56,231 |

|

|

|

51,747 |

|

|

Operations and technology |

|

42,398 |

|

|

|

34,779 |

|

|

|

162,700 |

|

|

|

140,959 |

|

|

Selling, general, and administrative |

|

56,697 |

|

|

|

42,821 |

|

|

|

217,435 |

|

|

|

166,510 |

|

|

Depreciation and amortization |

|

10,334 |

|

|

|

6,902 |

|

|

|

36,685 |

|

|

|

18,988 |

|

|

Total operating expenses |

|

185,312 |

|

|

|

145,143 |

|

|

|

721,261 |

|

|

|

570,911 |

|

|

Loss from operations |

|

(25,798 |

) |

|

|

(26,766 |

) |

|

|

(84,105 |

) |

|

|

(89,677 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest income |

|

1,927 |

|

|

|

4,002 |

|

|

|

9,337 |

|

|

|

16,507 |

|

|

Interest expense |

|

(2,026 |

) |

|

|

(360 |

) |

|

|

(4,244 |

) |

|

|

(1,565 |

) |

|

Total other income (expense) |

|

(99 |

) |

|

|

3,642 |

|

|

|

5,093 |

|

|

|

14,942 |

|

|

Loss before income taxes |

|

(25,897 |

) |

|

|

(23,124 |

) |

|

|

(79,012 |

) |

|

|

(74,735 |

) |

| (Benefit from)

provision for income taxes |

|

240 |

|

|

|

117 |

|

|

|

688 |

|

|

|

526 |

|

|

Net loss |

$ |

(26,137 |

) |

|

$ |

(23,241 |

) |

|

$ |

(79,700 |

) |

|

$ |

(75,261 |

) |

|

Weighted-average shares - basic and diluted |

|

166,484,713 |

|

|

|

161,174,469 |

|

|

|

164,850,699 |

|

|

|

159,952,813 |

|

|

Net loss per share - basic and diluted |

$ |

(0.16 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.48 |

) |

|

$ |

(0.47 |

) |

|

|

|

ACV AUCTIONS INC.CONSOLIDATED BALANCE

SHEETS(Unaudited)(in thousands,

except share data) |

|

|

|

|

December 31,2024 |

|

December 31,2023 |

| Assets |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

224,065 |

|

|

$ |

182,571 |

|

| Marketable securities |

|

46,036 |

|

|

|

228,761 |

|

| Trade receivables (net of

allowance of $6,372 and $2,868) |

|

168,770 |

|

|

|

164,009 |

|

| Finance receivables (net of

allowance of $4,191 and $3,428) |

|

139,045 |

|

|

|

119,034 |

|

| Other current assets |

|

15,281 |

|

|

|

12,524 |

|

|

Total current assets |

|

593,197 |

|

|

|

706,899 |

|

| Property and equipment (net of

accumulated depreciation of $5,227 and $4,462) |

|

7,625 |

|

|

|

4,918 |

|

| Goodwill |

|

180,478 |

|

|

|

103,379 |

|

| Acquired intangible assets

(net of amortization of $28,972 and $17,534) |

|

90,816 |

|

|

|

34,192 |

|

| Internal-use software costs

(net of amortization of $38,499 and $17,059) |

|

68,571 |

|

|

|

55,771 |

|

| Other assets |

|

43,462 |

|

|

|

17,765 |

|

|

Total assets |

$ |

984,149 |

|

|

$ |

922,924 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current

Liabilities: |

|

|

|

| Accounts payable |

$ |

345,605 |

|

|

$ |

305,845 |

|

| Accrued payroll |

|

16,725 |

|

|

|

12,245 |

|

| Accrued other liabilities |

|

18,836 |

|

|

|

15,851 |

|

|

Total current liabilities |

|

381,166 |

|

|

|

333,941 |

|

| Long-term debt |

|

123,000 |

|

|

|

115,000 |

|

| Other long-term

liabilities |

|

39,979 |

|

|

|

17,455 |

|

|

Total liabilities |

|

544,145 |

|

|

|

466,396 |

|

| Commitments and

Contingencies |

|

|

|

| Stockholders'

Equity: |

|

|

|

| Preferred Stock |

|

— |

|

|

|

— |

|

| Common Stock - Class A |

|

168 |

|

|

|

139 |

|

| Common Stock - Class B |

|

- |

|

|

|

23 |

|

| Additional paid-in

capital |

|

944,891 |

|

|

|

880,510 |

|

| Accumulated deficit |

|

(502,315 |

) |

|

|

(422,615 |

) |

| Accumulated other

comprehensive loss |

|

(2,740 |

) |

|

|

(1,529 |

) |

|

Total stockholders' equity |

|

440,004 |

|

|

|

456,528 |

|

|

Total liabilities and stockholders' equity |

$ |

984,149 |

|

|

$ |

922,924 |

|

|

|

|

ACV AUCTIONS INC.CONSOLIDATED STATEMENTS

OF CASH FLOWS(Unaudited)(in

thousands) |

|

|

| |

Year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash Flows from

Operating Activities |

|

|

|

|

Net income (loss) |

$ |

(79,700 |

) |

|

$ |

(75,261 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

36,808 |

|

|

|

19,285 |

|

|

Stock-based compensation expense, net of amounts capitalized |

|

68,010 |

|

|

|

49,648 |

|

|

Provision for bad debt |

|

9,989 |

|

|

|

10,923 |

|

|

Other non-cash, net |

|

741 |

|

|

|

(1,464 |

) |

|

Changes in operating assets and liabilities, net of effects from

purchases of businesses: |

|

|

|

|

Trade receivables |

|

17,466 |

|

|

|

14,406 |

|

|

Other operating assets |

|

(424 |

) |

|

|

(310 |

) |

|

Accounts payable |

|

16,167 |

|

|

|

(34,612 |

) |

|

Other operating liabilities |

|

(3,660 |

) |

|

|

(500 |

) |

|

Net cash provided by (used in) operating

activities |

|

65,397 |

|

|

|

(17,885 |

) |

| Cash Flows from

Investing Activities |

|

|

|

|

Net increase in finance receivables |

|

(22,005 |

) |

|

|

(45,273 |

) |

|

Purchases of property and equipment |

|

(4,539 |

) |

|

|

(2,330 |

) |

|

Proceeds from sale of real estate |

|

14,083 |

|

|

|

— |

|

|

Capitalization of software costs |

|

(29,702 |

) |

|

|

(25,840 |

) |

|

Purchases of marketable securities |

|

(35,979 |

) |

|

|

(146,032 |

) |

|

Maturities and redemptions of marketable securities |

|

88,664 |

|

|

|

135,724 |

|

|

Sales of marketable securities |

|

130,090 |

|

|

|

2,402 |

|

|

Acquisition of businesses (net of cash acquired) |

|

(156,475 |

) |

|

|

(29,623 |

) |

|

Net cash provided by (used in) investing

activities |

|

(15,863 |

) |

|

|

(110,972 |

) |

|

Cash Flows from Financing Activities |

|

|

|

|

Proceeds from long term debt |

|

491,500 |

|

|

|

420,000 |

|

|

Payments towards long term debt |

|

(483,500 |

) |

|

|

(380,500 |

) |

|

Proceeds from exercise of stock options |

|

9,436 |

|

|

|

4,265 |

|

|

Payments for debt issuance and other financing costs |

|

(2,023 |

) |

|

|

— |

|

|

Payment of RSU tax withholdings in exchange for common shares

surrendered by RSU holders |

|

(27,131 |

) |

|

|

(16,025 |

) |

|

Proceeds from employee stock purchase plan |

|

3,910 |

|

|

|

3,062 |

|

|

Other financing activities |

|

(66 |

) |

|

|

(169 |

) |

|

Net cash provided by (used in) financing

activities |

|

(7,874 |

) |

|

|

30,633 |

|

|

Effect of exchange rate changes on cash, cash equivalents,

and restricted cash |

|

(166 |

) |

|

|

43 |

|

|

Net increase (decrease) in cash, cash equivalents, and

restricted cash |

|

41,494 |

|

|

|

(98,181 |

) |

| Cash, cash

equivalents, and restricted cash, beginning of period |

|

182,571 |

|

|

|

280,752 |

|

| Cash, cash

equivalents, and restricted cash, end of period |

$ |

224,065 |

|

|

$ |

182,571 |

|

| |

|

|

|

The following table presents a reconciliation of non-GAAP net

income (loss) to net income (loss), the most directly comparable

financial measure stated in accordance with GAAP, for the periods

presented:

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss) |

$ |

(26,137 |

) |

|

$ |

(23,241 |

) |

|

$ |

(79,700 |

) |

|

$ |

(75,261 |

) |

| Stock-based compensation |

|

19,955 |

|

|

|

13,386 |

|

|

|

68,010 |

|

|

|

49,648 |

|

| Amortization of acquired

intangible assets |

|

3,071 |

|

|

|

1,729 |

|

|

|

11,687 |

|

|

|

5,471 |

|

| Amortization of capitalized

stock based compensation |

|

1,520 |

|

|

|

802 |

|

|

|

4,675 |

|

|

|

1,836 |

|

| Acquisition-related costs |

|

446 |

|

|

|

626 |

|

|

|

3,966 |

|

|

|

1,237 |

|

| Litigation-related costs

(1) |

|

— |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

| Other |

|

— |

|

|

|

678 |

|

|

|

783 |

|

|

|

1,056 |

|

| Non-GAAP Net income

(loss) |

$ |

(1,145 |

) |

|

$ |

(6,020 |

) |

|

$ |

10,974 |

|

|

$ |

(16,013 |

) |

| |

|

|

|

|

|

|

|

|

(1) Litigation-related costs are related to an anti-competition

case which we do not consider to be representative of our

underlying operating performance |

|

|

|

|

|

|

|

|

|

|

The following table presents a reconciliation of Adjusted EBITDA

to net income (loss), the most directly comparable financial

measure stated in accordance with GAAP, for the periods

presented:

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted EBITDA

Reconciliation |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(26,137 |

) |

|

$ |

(23,241 |

) |

|

$ |

(79,700 |

) |

|

$ |

(75,261 |

) |

| Depreciation and

amortization |

|

10,356 |

|

|

|

6,878 |

|

|

|

36,807 |

|

|

|

19,285 |

|

| Stock-based compensation |

|

19,955 |

|

|

|

13,386 |

|

|

|

68,010 |

|

|

|

49,648 |

|

| Interest (income) expense |

|

99 |

|

|

|

(3,642 |

) |

|

|

(5,093 |

) |

|

|

(14,942 |

) |

| Provision for income

taxes |

|

240 |

|

|

|

117 |

|

|

|

688 |

|

|

|

526 |

|

| Acquisition-related costs |

|

446 |

|

|

|

626 |

|

|

|

3,966 |

|

|

|

1,237 |

|

| Litigation-related costs

(1) |

|

— |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

| Other |

|

658 |

|

|

|

516 |

|

|

|

1,905 |

|

|

|

1,298 |

|

| Adjusted EBITDA |

$ |

5,617 |

|

|

$ |

(5,360 |

) |

|

$ |

28,136 |

|

|

$ |

(18,209 |

) |

| |

|

|

|

|

|

|

|

|

(1) Litigation-related costs are related to an anti-competition

case which we do not consider to be representative of our

underlying operating performance |

|

|

|

|

|

|

|

|

|

|

The following table presents a reconciliation of non-GAAP net

income (loss) to GAAP net income (loss), the most directly

comparable financial measure stated in accordance with GAAP, for

the periods presented (in millions):

| |

Three Months Ended March 31, 2025 |

|

Year ended December 31, 2025 |

|

| Non-GAAP net income (loss) to

net income (loss) guidance Reconciliation |

|

|

|

|

| Net income (loss) |

($21) - ($19) |

|

($62) - ($52) |

|

| Non-GAAP Adjustments: |

|

|

|

|

|

Stock-based compensation |

$ |

19 |

|

$ |

76 |

|

| Intangible amortization |

$ |

3 |

|

$ |

10 |

|

| Amortization of capitalized

stock-based compensation |

$ |

2 |

|

$ |

8 |

|

| Non-GAAP net income

(loss) |

$3 - $5 |

|

$32 - $42 |

|

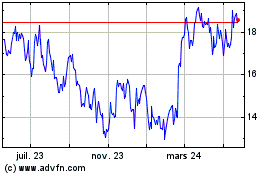

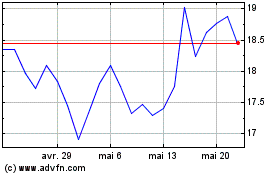

ACV Auctions (NASDAQ:ACVA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ACV Auctions (NASDAQ:ACVA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025