false

0001800637

0001800637

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 14, 2024

AGRIFY CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-39946 |

|

30-0943453 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2468 Industrial Row Dr.

Troy, MI |

|

48084 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (617) 896-5243

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AGFY |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial

Conditions.

On November 14, 2024, Agrify Corporation (the

“Company”) issued a press release announcing financial results for the quarter ended September 30, 2024. A copy of the release

is attached as Exhibit 99.1.

The information furnished pursuant to this

Item 2.02, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise

subject to the liability of that section. This information will not be deemed to be incorporated by reference into any filing under the

Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates them by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AGRIFY CORPORATION |

| |

|

|

| Date: November 14, 2024 |

By: |

/s/ Benjamin Kovler |

| |

|

Benjamin Kovler |

| |

|

Chairman and Interim Chief Executive Officer |

2

Exhibit 99.1

Agrify Corporation Announces Results for Third

Quarter 2024

TROY, Michigan, November 14, 2024 - Agrify Corporation

(Nasdaq:AGFY) (“Agrify” or the “Company”), a leading provider of branded innovative solutions for the cannabis

and hemp industries, today announced financial results for the quarter ended September 30, 2024.

Third Quarter 2024 Financial Results Summary

| ● | Revenue was $1.9 million for

the third quarter of 2024 |

| ● | Gross profit was $0.2

million for the third quarter of 2024 |

| ● | Net loss for the third quarter

of 2024 was $18.6 million, primarily attributed to a $15 million change in fair value of warrant liabilities |

| ● | As of November 14, 2024, Agrify

has approximately 1.5 million shares of common stock outstanding and 6.3 million warrants |

Recent Developments

| ● | Secured new convertible note

financing of up to $20 million with an initial draw of $10 million from Green Thumb Industries on November 5, 2024 |

| ● | Ben Kovler was appointed Chairman and Interim CEO on November 5,

2024 |

| ● | Announced intent to acquire

the Señorita brand of hemp-derived THC drinks (HDT) on November 12, 2024 |

“Today really is Day One at Agrify,”

said Chairman and Interim CEO Ben Kovler. “The hemp and cannabis industries are evolving fast and Agrify’s fortified balance

sheet is ready to move on opportunities. We have a deep understanding of the consumer and plan to leverage that strength today to

build Agrify’s value for tomorrow. With that in mind, we made our first strategic decision this week when we signed a non-binding

letter of intent to acquire the Señorita brand of HDT beverages. While challenges in the industry remain, we are excited about the

innovative aspects of this sector and see lots of opportunity ahead.”

About Agrify (Nasdaq:AGFY)

Agrify Corporation (“Agrify” or the

“Company”) is a developer of branded innovative solutions for the cannabis and hemp industries in extraction, cultivation

and more. Agrify’s proprietary micro-environment-controlled Vertical Farming Units (VFUs) enable cultivators to produce the highest

quality products with unmatched consistency, yield, and return on investment at scale. Agrify’s comprehensive extraction product

line, which includes hydrocarbon, ethanol, solventless, post-processing, and lab equipment, empowers producers to maximize the quantity

and quality of extract required for premium concentrates. For more information, please visit Agrify at http://www.agrify.com.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 concerning Agrify and other matters. All statements contained

in this press release that do not relate to matters of historical fact should be considered forward-looking statements including, without

limitation, statements regarding future financial results, potential growth opportunities, the ability to consummate the Señorita

transaction on a timely basis or at all, and Agrify’s ability to deliver solutions and services. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,” “should,” “expects,” ”plans,”

“anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. The forward-looking statements in this press release are only predictions. We have based

these forward-looking statements largely on our current expectations and projections about future events and financial trends that we

believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks,

uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from

any future results, performance or achievements expressed or implied by the forward-looking statements. You should carefully consider

the risks and uncertainties that affect our business, including those described in our filings with the Securities and Exchange Commission

(“SEC”), including under the caption “Risk Factors” in our Annual Report on Form 10-K filed for the year ended

December 31, 2023 with the SEC, which can be obtained on the SEC website at www.sec.gov. These forward-looking statements speak only as

of the date of this communication. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking

statements, whether as a result of any new information, future events or otherwise. You are advised, however, to consult any further disclosures

we make on related subjects in our public announcements and filings with the SEC.

Contact

Agrify Investor Relations

IR@agrify.com

(857) 256-8110

Agrify Corporation

Highlights from Unaudited Condensed Consolidated Statements of Operations

For the Three and Nine Months Ended September 30, 2024 and

2023

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30,

2024 | | |

September 30,

2023 | | |

September 30,

2024 | | |

September 30,

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,934 | | |

$ | 3,139 | | |

$ | 7,526 | | |

$ | 14,009 | |

| Cost of Goods Sold | |

| (1,709 | ) | |

| (2,165 | ) | |

| (6,009 | ) | |

| (11,447 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 225 | | |

| 974 | | |

| 1,517 | | |

| 2,562 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, General, and Administrative | |

| 3,890 | | |

| 5,552 | | |

| 3,405 | | |

| 20,068 | |

| Total Expenses | |

| 3,890 | | |

| 5,552 | | |

| 3,405 | | |

| 20,068 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss From Operations | |

| (3,665 | ) | |

| (4,578 | ) | |

| (1,888 | ) | |

| (17,506 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense), net | |

| (14,948 | ) | |

| 2,849 | | |

| (15,333 | ) | |

| (158 | ) |

| Interest Expense, net | |

| (38 | ) | |

| (363 | ) | |

| (166 | ) | |

| (1,562 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other Income (Expense) | |

| (14,986 | ) | |

| 2,486 | | |

| (15,499 | ) | |

| (1,720 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Before Non-Controlling Interest | |

| (18,651 | ) | |

| (2,092 | ) | |

| (17,387 | ) | |

| (19,226 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Attributable To Non-Controlling Interest | |

| — | | |

| — | | |

| — | | |

| 2 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Attributable To Agrify Corporation | |

$ | (18,651 | ) | |

$ | (2,092 | ) | |

$ | (17,387 | ) | |

$ | (19,224 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss per share - basic and diluted (1) | |

$ | (17.31 | ) | |

$ | (19.02 | ) | |

$ | (16.82 | ) | |

$ | (202.21 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding - basic and diluted | |

| 1,077,780 | | |

| 109,983 | | |

| 1,033,582 | | |

| 95,068 | |

| (1) | Periods presented have been adjusted to retroactively reflect

the 1-for-20 reverse stock split on July 5, 2023, and for the 1-for-15 reverse stock split on October 8, 2024. Additional information

regarding the reverse stock splits may be found in Note 1 – Overview, Basis of Presentation,

and Significant Accounting Policies, included in the notes to the consolidated financial statements |

Agrify Corporation

Highlights from the Unaudited Condensed Consolidated Balance Sheet

(Amounts Expressed in Thousands of United States Dollars)

| | |

September 30, | |

| | |

2024 | |

| | |

(Unaudited) | |

| Cash and Cash Equivalents | |

$ | 263 | |

| Inventory, Net | |

| 18,085 | |

| Other Current Assets | |

| 2,422 | |

| Loans Receivable, Net of Current Portion | |

| 9,903 | |

| Property and Equipment, Net | |

| 6,596 | |

| Operating Lease Right-of-Use Assets | |

| 1,573 | |

| Other Long-term Assets | |

| 110 | |

| Total Assets | |

$ | 38,952 | |

| Total Current Liabilities | |

$ | 27,766 | |

| Related Party Debt, Net of Current Portion | |

| 4,360 | |

| Operating Lease Liabilities, Net of Current Portion | |

| 1,090 | |

| Other long-Term Liabilities | |

| 279 | |

| Total Equity | |

| 5,457 | |

| Total Liabilities and Equity | |

$ | 38,952 | |

4

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

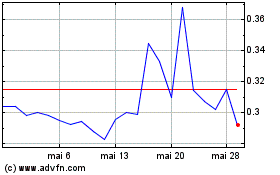

Agrify (NASDAQ:AGFY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Agrify (NASDAQ:AGFY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024